The passage of the GENIUS Act 2025 marks a pivotal moment for the U. S. digital asset sector, introducing a comprehensive federal framework that reshapes how stablecoins are issued, managed, and integrated into mainstream commerce. For issuers, merchants, and compliance professionals alike, the law’s granular requirements and sweeping federal preemption signal both opportunity and operational challenge.

Who Can Issue Stablecoins? New Gatekeepers and Eligibility

At its core, the GENIUS Act limits who may issue payment stablecoins in the United States. Only subsidiaries of insured depository institutions, certain OCC-supervised nonbanks, and state-chartered entities meeting comparable oversight standards are permitted. Non-financial firms face an uphill climb: unless they secure unanimous approval from the Stablecoin Certification Review Committee (SCRC), they are expressly barred from issuing stablecoins.

This new gatekeeping function is designed to ensure that only entities with robust risk management capabilities and regulatory track records can participate. The intent is clear: reduce systemic risk, prevent under-collateralized issuers from entering the market, and create a level playing field for both legacy financial institutions and innovative fintechs. For more on issuer eligibility nuances, see our in-depth breakdown.

1: 1 Reserve Requirements, Transparency Becomes Law

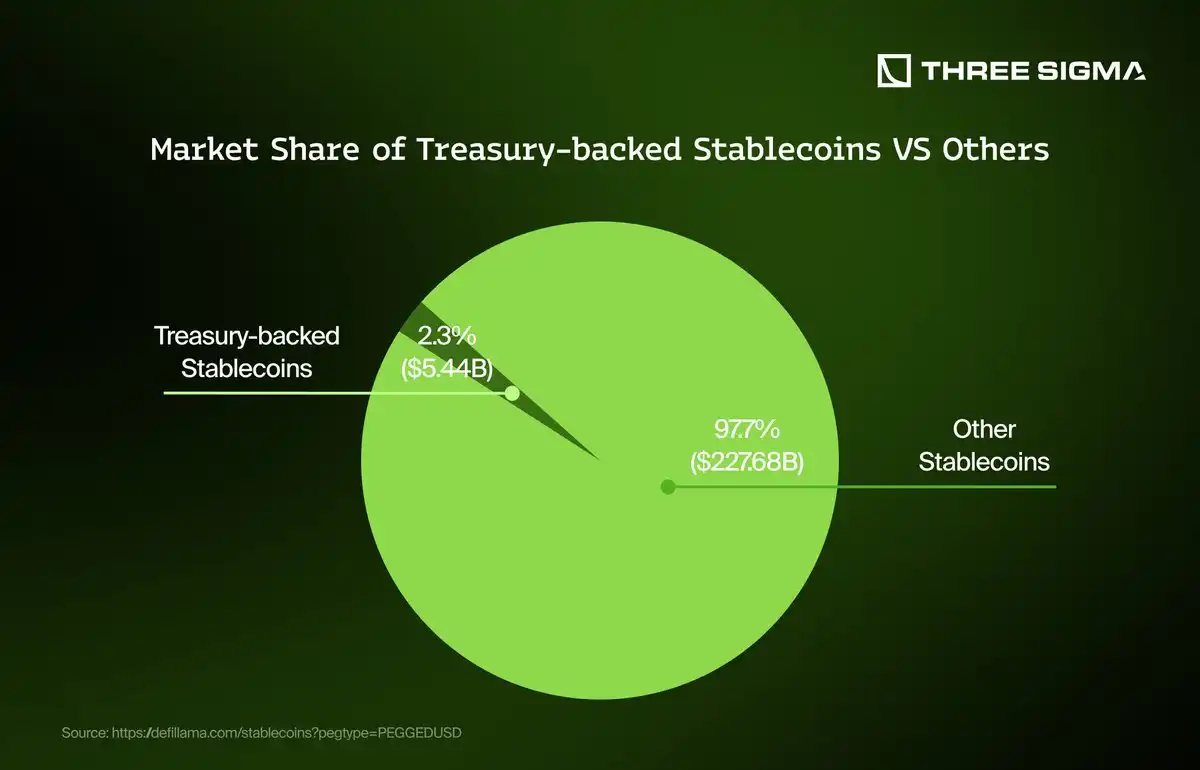

Perhaps the most consequential aspect for issuers is the requirement to maintain full 1: 1 reserves against all outstanding stablecoins. Permitted reserve assets are strictly defined, U. S. dollars held at insured banks, short-term Treasurys, or select money market funds. This eliminates ambiguity about backing assets that previously plagued some high-profile projects.

Monthly public disclosures are now mandatory, detailing both circulating supply and precise reserve composition. Larger issuers (over $50 billion) must also publish annual audited financial statements. These transparency measures aim to bolster market confidence while giving merchants and users clear visibility into what backs their digital dollars.

The Compliance Mandate, AML Programs and Reporting

The GENIUS Act designates all permitted stablecoin issuers as financial institutions under the Bank Secrecy Act (BSA). This brings a host of new obligations:

- Robust AML and Sanctions Programs: Issuers must implement anti-money laundering controls tailored to digital assets, overseen by a designated compliance officer.

- Regular Attestation and Audits: Monthly attestation of reserves is required; larger players face annual third-party audits.

- Civil and Criminal Penalties: Unlicensed issuance can trigger fines up to $100,000 per day plus potential criminal liability for knowing violations.

This shift not only raises the bar for internal controls but also aligns stablecoin oversight more closely with traditional banking standards, an intentional move to foster cross-sector trust.

Implications for Merchants, Trustworthy Payments with Clear Protections

The GENIUS Act’s framework isn’t just about issuer discipline; it directly impacts merchants looking to accept stablecoins at point-of-sale or online checkouts. By requiring full reserve backing and regular reporting from issuers, merchants gain assurance that accepted tokens are reliably redeemable at par value.

The law further prohibits interest payments on stablecoins, clearly distinguishing them from bank deposits, and mandates transparent redemption procedures. These features reduce ambiguity for businesses integrating digital payments into their workflows while enhancing consumer protection against counterparty risk.

If you’re preparing your team or business for these changes, or want deeper analysis on enforcement risks, explore our related coverage at GENIUS Act Explained.

For compliance teams, the GENIUS Act 2025 signals a new era of accountability and operational rigor. Risk officers and legal departments must now treat stablecoin programs with the same seriousness as traditional financial products. The law’s monthly public reporting requirements are not just a box-ticking exercise: they demand real-time reconciliation of circulating supply, reserve composition, and rapid response to discrepancies. For larger issuers, the annual audit requirement ratchets up pressure to maintain bulletproof documentation and internal controls year-round.

Top 5 Compliance Priorities for Stablecoin Issuers Under the GENIUS Act 2025

-

Obtain Proper Authorization as a Permitted Issuer: Only subsidiaries of insured depository institutions, OCC-supervised nonbanks, or state-chartered entities under comparable oversight may issue payment stablecoins. Non-financial firms require unanimous Stablecoin Certification Review Committee (SCRC) approval.

-

Maintain 1:1 Reserve Backing with Approved Assets: Issuers must fully back all outstanding stablecoins with reserves held in U.S. dollars, short-term Treasurys, or approved money market funds, ensuring liquidity and stability at all times.

-

Implement Robust AML and Sanctions Compliance Programs: Issuers are classified as financial institutions under the Bank Secrecy Act and must establish comprehensive anti-money laundering and sanctions compliance programs, including appointing a dedicated compliance officer.

-

Conduct Regular Reserve Disclosures and Financial Reporting: Monthly public disclosures of circulating stablecoins and reserve composition are mandatory. Issuers with over $50 billion in issuance must also publish annual audited financial statements.

-

Prepare for Regulatory Audits and Significant Penalties: Noncompliance can result in civil fines up to $100,000 per day and potential criminal charges for knowing violations, making rigorous internal controls and audit readiness essential.

Beyond internal compliance, external scrutiny will intensify. The Office of the Comptroller of the Currency (OCC), in coordination with other federal agencies, is expected to conduct periodic examinations and stress tests for permitted issuers. These reviews will likely focus on liquidity risk, operational resilience, and adherence to anti-money laundering (AML) protocols. Issuers operating at scale, those with more than $50 billion in circulation, will be under particular watch.

Enforcement mechanisms carry real weight: unlicensed or non-compliant issuance can trigger civil fines of up to $100,000 per day, alongside potential criminal charges for willful violations. This reflects a broader policy trend toward holding digital asset operators to traditional financial sector standards, and signaling that regulatory arbitrage is no longer tolerated in U. S. markets.

Federal Preemption and State Law: Uniformity or New Tensions?

One of the most debated features of the GENIUS Act is its federal preemption clause. By superseding state-by-state licensing regimes for permitted payment stablecoin issuers, Congress aims to create a uniform national standard, ending years of fragmented oversight that complicated multi-state operations.

This preemption brings clarity for institutions seeking nationwide market access but introduces new tensions with states that have developed advanced digital asset frameworks. Some state regulators argue that federal preemption may blunt local innovation or consumer protections tailored to regional risks. The coming months will reveal whether this balance holds or if further amendments are needed as adoption accelerates.

Looking Ahead: Strategic Considerations for Stakeholders

The GENIUS Act 2025 sets a high bar for transparency, capital integrity, and consumer protection, but it also opens doors for responsible innovation. Issuers must invest in robust compliance infrastructure from day one; merchants should review their onboarding processes to ensure partner tokens meet new eligibility criteria; compliance teams need proactive monitoring tools ready before regulatory audits begin.

Internationally active firms face an additional challenge: navigating cross-border payments while ensuring U. S. -issued stablecoins do not run afoul of foreign laws or sanctions regimes. As global regulatory harmonization remains elusive, expect ongoing tension between domestic requirements and international business models.

For those looking to go deeper on how these rules interact with existing frameworks or impact DeFi integrations, see our specialized analysis at GENIUS Act and DeFi.

Key Takeaways

- Stablecoin issuance is now gated by strict eligibility criteria and ongoing supervision.

- 1: 1 reserve backing and monthly transparency are non-negotiable pillars of compliance.

- Civil fines and criminal penalties make noncompliance an existential risk for issuers.

- Merchants benefit from greater payment certainty but must update acceptance policies accordingly.

- The balance between federal uniformity and state innovation will shape future amendments.

The GENIUS Act’s arrival marks a decisive shift toward mainstreaming stablecoins under clear regulatory guardrails, an inflection point that demands careful planning, strong governance, and continuous adaptation from all market participants.