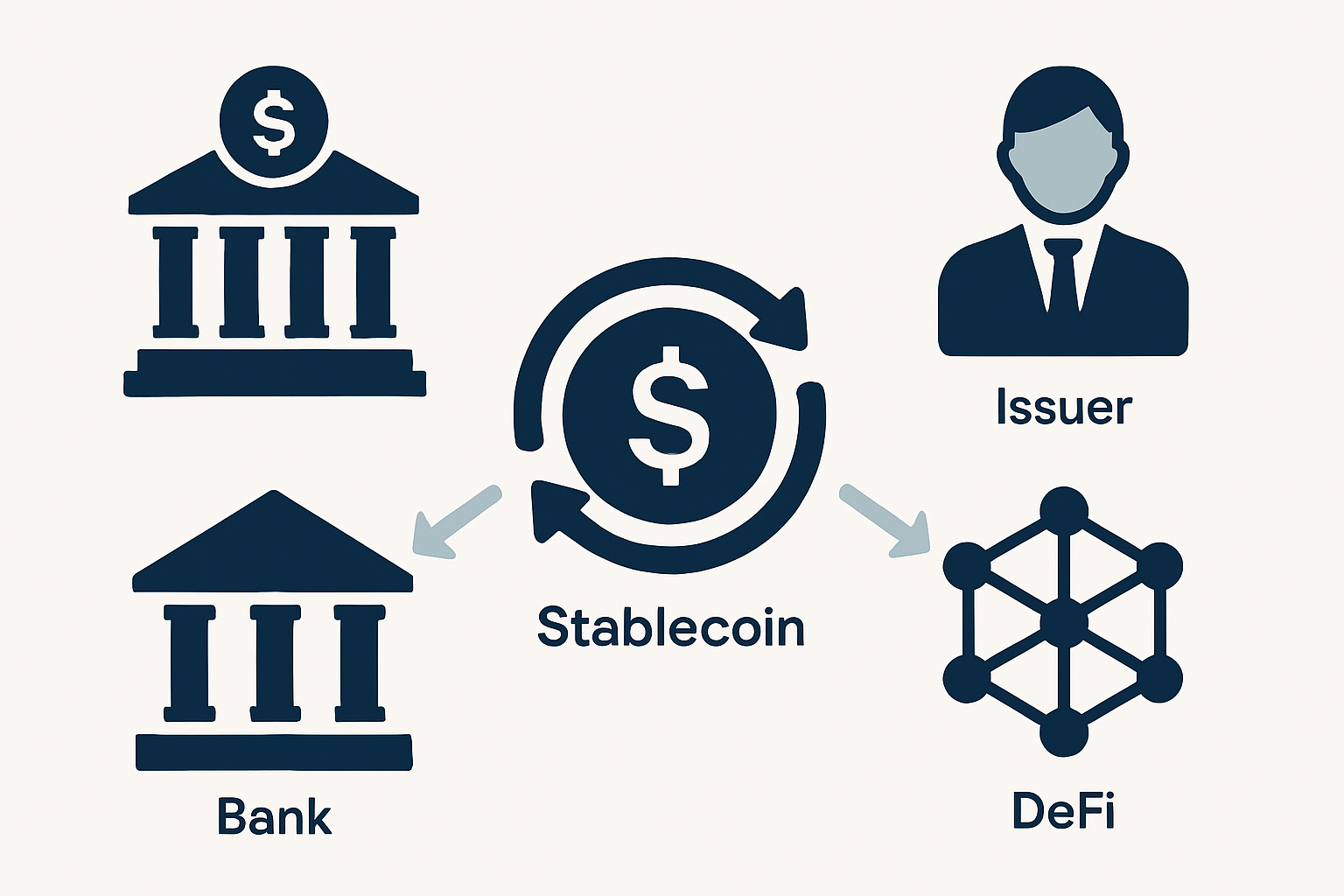

The GENIUS Act of 2025 marks a pivotal shift in the regulatory landscape for stablecoins in the United States, introducing a detailed compliance framework that directly impacts issuers, banks, and DeFi platforms. As stablecoins have become integral to both retail payments and decentralized finance, lawmakers have responded with sweeping new rules designed to foster innovation while mitigating systemic risk.

GENIUS Act 2025: Key Provisions Reshaping US Stablecoin Markets

At its core, the GENIUS Act creates a two-tier system for stablecoin issuer licensing in the US. Only entities that are federally chartered or approved by state authorities can issue payment stablecoins to US persons. This move ends the era of unregulated issuance and brings stablecoins under a regime of bank-like prudential oversight. Issuers must maintain 1: 1 backing with high-quality reserves, such as US dollars or short-term Treasuries, ensuring every token is fully collateralized at all times.

Operational restrictions are equally significant:

- No payment of interest or yield to holders, stablecoins are strictly transactional instruments under this law.

- Robust anti-money laundering (AML) and sanctions compliance programs are mandatory.

- Marketing practices face new scrutiny to prevent misleading claims about safety or returns.

This clarity has already driven a wave of institutional adoption and forced non-compliant issuers to adapt or exit the US market. For more on how these requirements affect day-to-day operations, see our detailed breakdown here.

Banks Enter the Arena: New Roles and Responsibilities

Banks now play a central role in the regulated stablecoin ecosystem. Under GENIUS, banks can issue their own stablecoins through subsidiaries and provide custodial services for both tokens and underlying reserves. However, these activities come with familiar strings attached, capital adequacy, liquidity management, and risk controls mirroring those required for traditional deposit-taking activities.

The result? Traditional financial institutions are leveraging their compliance infrastructure to enter digital assets more confidently. According to recent reports, several major banks have launched pilot programs for dollar-backed stablecoins since the law’s passage.

DeFi Platforms: Compliance as an Onramp for Institutional Capital

The greatest surprise since implementation has been DeFi’s rapid institutionalization. With clear federal guidelines on what constitutes a compliant stablecoin, DeFi protocols can now attract institutional liquidity without fear of legal uncertainty. In fact, some leading platforms report a staggering 300% increase in institutional capital flows since the Act took effect.

Top DeFi Protocols Benefiting from GENIUS Act-Compliant Stablecoins

-

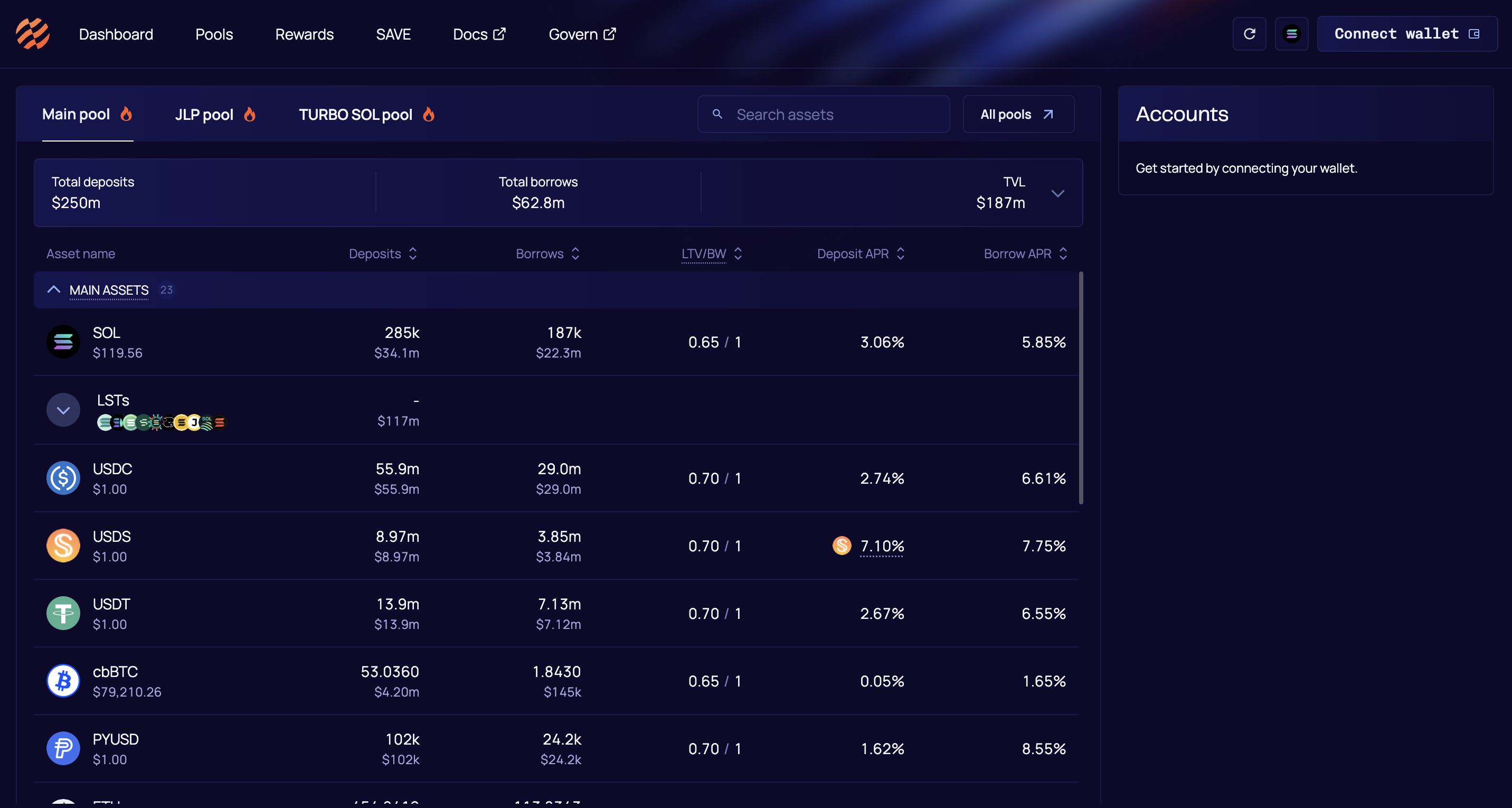

Aave – As a leading decentralized lending protocol, Aave has seen a surge in institutional liquidity and borrower confidence by integrating GENIUS Act-compliant stablecoins into its markets. Enhanced regulatory clarity has enabled Aave to attract more traditional finance participants.

-

Uniswap – The world’s largest decentralized exchange (DEX) now lists several GENIUS Act-approved stablecoins in its top trading pairs. This has boosted trading volumes and provided users with access to stable, regulated assets for swaps and liquidity pools.

-

Compound – With support for compliant stablecoins, Compound’s lending and borrowing markets have expanded, offering users greater security and transparency. The integration aligns with Compound’s focus on regulatory adherence and institutional adoption.

-

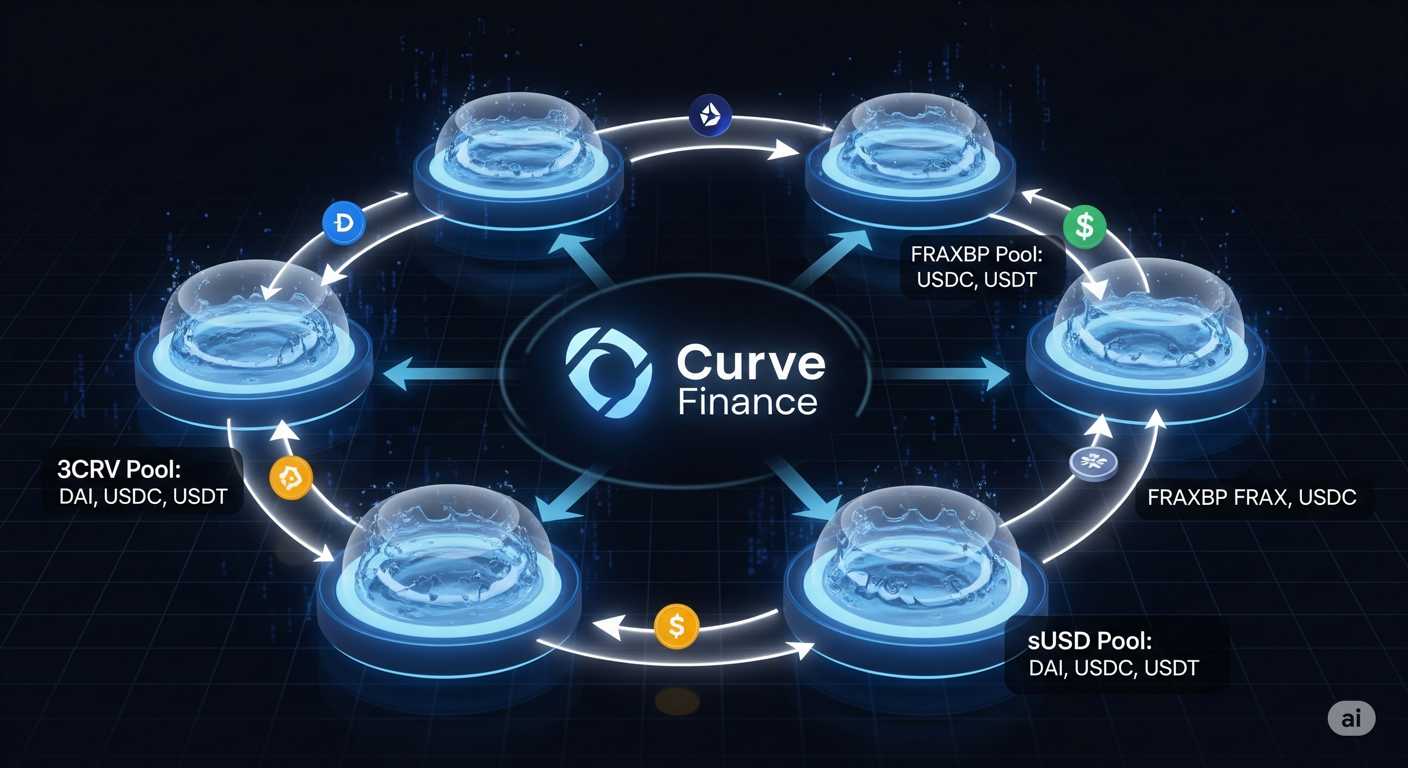

Curve Finance – Renowned for its stablecoin-focused automated market maker (AMM), Curve now features pools dominated by GENIUS Act-compliant stablecoins, providing deep liquidity and low slippage for users seeking regulated stable assets.

-

MakerDAO – As the issuer of the DAI stablecoin, MakerDAO has adapted its collateral framework to include GENIUS Act-compliant stablecoins. This move strengthens DAI’s stability and enhances its appeal to users prioritizing regulatory compliance.

This influx is not just about volume, it’s about quality. Compliant stablecoins serve as trusted collateral for lending pools, automated market makers (AMMs), and yield strategies that previously struggled with regulatory risk. The upshot is greater stability across DeFi markets and new opportunities for compliant innovation.

Federal Preemption and Competitive Dynamics Among Issuers

The GENIUS Act also introduces federal preemption over state-level licensing laws for permitted payment stablecoin issuers, a move designed to harmonize oversight nationwide. Only issuers with less than $10 billion in market capitalization may opt into certain state-based regimes; larger players must adhere strictly to federal standards. This distinction is reshaping competitive dynamics among both legacy fintechs and crypto-native firms seeking scale within regulatory bounds.

As the market digests these changes, participants are recalibrating their strategies. For smaller issuers, the choice between state and federal oversight is now a critical business decision, with compliance costs and operational flexibility weighed against national reach. Larger firms, meanwhile, are investing heavily in audit infrastructure and reserve transparency to meet the Act’s rigorous standards.

Federal preemption is also streamlining cross-border activity. Stablecoins issued under the U. S. framework can now be more easily recognized by foreign regulators, provided those jurisdictions maintain comparable regimes. This is expected to accelerate global integration of compliant dollar-backed tokens.

Audit and Reserve Transparency: Building Trust in Stablecoins

One of the most widely praised aspects of GENIUS Act 2025 stablecoin regulation is its emphasis on real-time auditing and reserve verification. Issuers must provide regular attestations from qualified third-party auditors, an unprecedented transparency requirement for digital assets in the U. S.

Key Audit and Reserve Reporting Rules Under GENIUS Act 2025

-

1:1 Reserve Backing Requirement: Issuers must maintain reserves equal to 100% of outstanding stablecoins, held in specified low-risk assets such as U.S. dollars and short-term U.S. Treasuries.

-

Monthly Public Reserve Reports: Issuers are required to publish monthly reserve attestations from independent auditors, detailing the composition and value of reserve assets.

-

Annual Independent Audits: All permitted payment stablecoin issuers must undergo annual audits by independent, registered public accounting firms, with results made available to the public.

-

Immediate Disclosure of Reserve Shortfalls: Any reserve deficiencies or breaches of the 1:1 ratio must be immediately disclosed to regulators and the public, ensuring transparency and consumer protection.

-

Standardized Reporting Format: Reserve and audit reports must follow a federally prescribed, standardized format to ensure consistency, comparability, and ease of oversight across all issuers.

This approach aims to restore trust after years of doubt around stablecoin backing and solvency. For users and institutional partners alike, knowing that every token is verifiably backed by high-quality liquid assets is a game-changer for adoption.

Opportunities and Ongoing Challenges

While the GENIUS Act provides much-needed clarity for US stablecoin compliance requirements, it also introduces new challenges. The prohibition on interest payments limits certain business models, pushing innovation toward utility-based features rather than yield-driven growth. DeFi protocols must now integrate compliance checks into their smart contracts, a technical hurdle, but one that opens doors to mainstream capital.

The law’s broad definition of “permitted payment stablecoin issuer” has sparked debate over whether non-bank fintechs can compete with legacy financial institutions on a level playing field. As regulatory interpretations evolve, we’ll likely see further guidance around eligibility criteria and ongoing obligations for all market participants.

What’s Next for US Stablecoin Regulation?

The GENIUS Act sets a new baseline for federal stablecoin oversight law, but regulatory evolution won’t stop here. Policymakers are already considering amendments to address algorithmic stablecoins and cross-chain interoperability risks not fully covered by the current text.

For legal professionals and industry builders alike, staying current is essential as rules shift from theory to practice. For more details on licensing pathways, reserve mandates, and ongoing audits under the new regime, visit our comprehensive resource on GENIUS Act licensing and audit rules.

“The real win isn’t just regulatory certainty, it’s unlocking the next wave of compliant financial innovation. ”