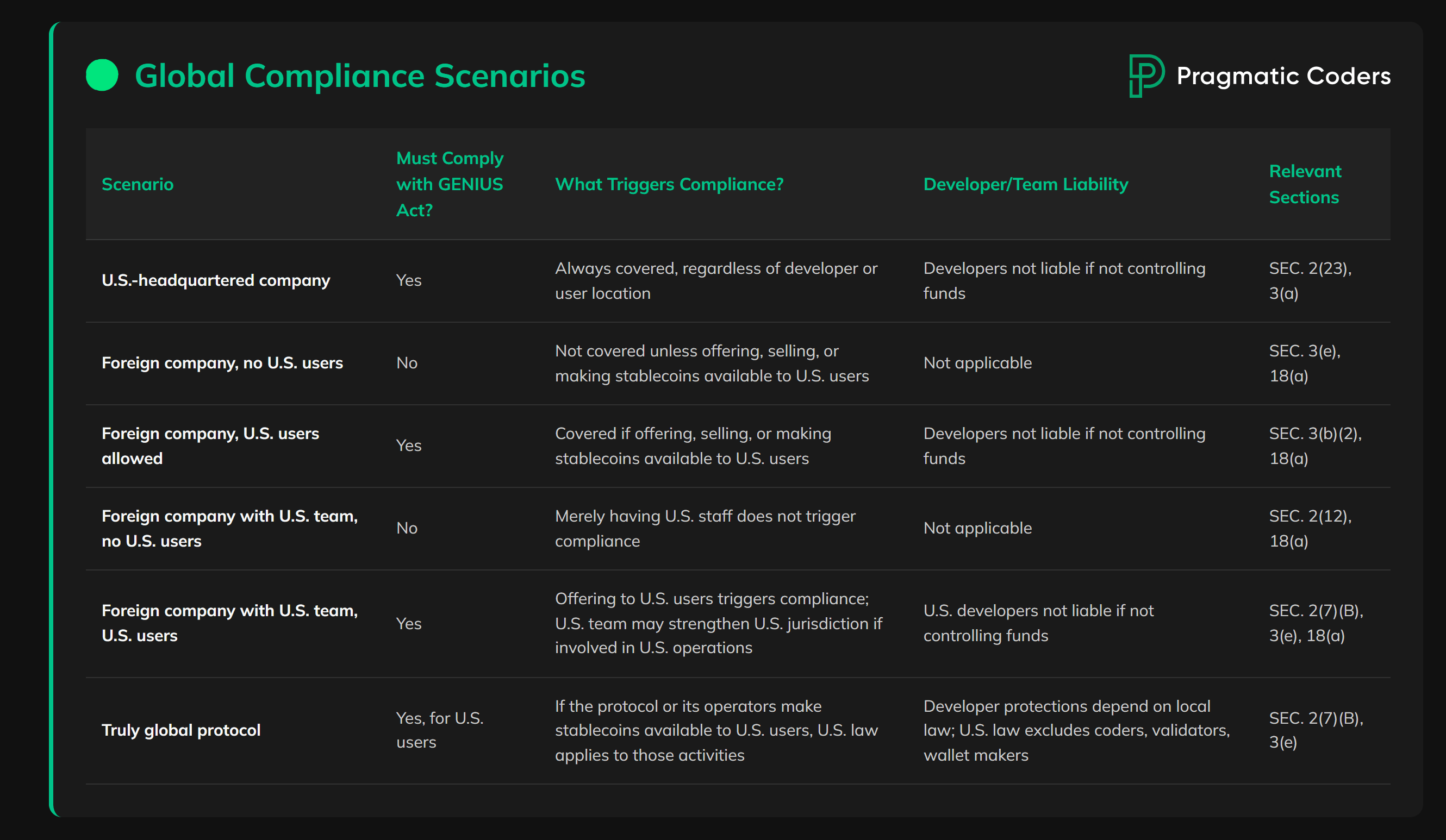

Stablecoin regulation in the United States entered a new era with the enactment of the GENIUS Act on July 18,2025. For legal professionals, digital asset service providers, and compliance officers, understanding the GENIUS Act stablecoin compliance landscape is now critical. The law’s sweeping requirements set a federal baseline for licensing, reserve management, anti-money laundering (AML) controls, and consumer protections, reshaping how U. S. stablecoin issuers operate in both domestic and cross-border markets.

Who Can Issue Stablecoins? Eligibility and Licensing Under the GENIUS Act

The GENIUS Act creates a tiered approach to stablecoin licensing USA. Only three categories of entities are permitted to issue payment stablecoins:

- Subsidiaries of Insured Depository Institutions (IDIs): Banks and credit unions insured by FDIC or NCUA that wish to issue stablecoins must do so through special-purpose subsidiaries.

- Nonbank Federal Issuers: Nonbank companies can apply to become “federal qualified payment stablecoin issuers” through the Office of the Comptroller of the Currency (OCC). Approval requires meeting capital, liquidity, governance, and risk standards similar to those expected of traditional financial institutions.

- State-Qualified Issuers: Nonbanks with less than $10 billion in outstanding stablecoins may opt for state licensing, if their state regime meets federal equivalency tests. Once they cross $10 billion in market cap, they must transition to federal oversight within 360 days.

This framework is designed to balance innovation with systemic risk mitigation. Unlicensed issuance is subject to severe penalties, up to $100,000 per day, and individuals knowingly participating in violations face personal liability.

Reserve Requirements: One-to-One Backing and Transparency

The core promise behind any payment stablecoin is its stability, and under the GENIUS Act, this promise is backed by explicit reserve mandates. Every issuer must maintain reserves equal to 100% of outstanding tokens in bankruptcy-remote accounts. Permissible assets include:

Permitted Reserve Assets Under the GENIUS Act

-

U.S. Dollar Cash and Coin: Stablecoin issuers must hold physical U.S. dollars and coins as part of their reserves, ensuring direct parity and immediate liquidity for redemption requests.

-

U.S. Treasury Bills: Short-term U.S. government securities (Treasury bills) are allowed as reserve assets, providing high liquidity and minimal credit risk.

-

Overnight Repurchase Agreements (Repos): Reserve assets may include overnight repos that are fully collateralized by U.S. government securities, offering secure short-term funding and liquidity.

-

Demand Deposits at Insured Depository Institutions: Funds held in demand deposit accounts at FDIC- or NCUA-insured banks or credit unions are permitted, ensuring safety and rapid access.

-

Shares of Registered Government Money Market Funds: Issuers can hold shares in SEC-registered government money market funds, which invest primarily in U.S. government securities and provide daily liquidity.

This approach aims to eliminate ambiguity over backing quality and enhance consumer confidence. Monthly public disclosures are mandatory; both CEO and CFO must certify these reports under penalty of law. For issuers with more than $50 billion outstanding, annual audited financial statements are also required, a significant upgrade from prior industry practices.

AML Obligations and Transaction Controls

The GENIUS Act brings all permitted stablecoin issuers squarely within Bank Secrecy Act (BSA) jurisdiction. This means robust Know Your Customer (KYC), risk-based transaction monitoring, suspicious activity reporting (SAR), and sanctions screening are now non-negotiable requirements for every issuer operating at scale in the U. S.

An additional operational safeguard: issuers must build technical capabilities to freeze or reject transactions that violate federal or state law, a major step toward aligning crypto compliance standards with those seen in mainstream payments infrastructure.

Consumer Protections: Marketing Rules and Redemption Rights

The consumer protection provisions are particularly noteworthy for both lawyers advising on product launches and marketing teams shaping go-to-market strategies. The law prohibits any implication that a stablecoin is government-backed or federally insured, marketing materials must avoid language that could mislead consumers about risk exposure or redemption guarantees.

Issuers also face an outright ban on paying interest or yield directly to holders, a move intended to distinguish payment-focused stablecoins from investment products subject to securities regulation. Redemption at par value is guaranteed by law; issuers must establish clear procedures for timely redemption requests.

Read more about 1: 1 backing requirements here

Compliance with the GENIUS Act is not a one-time event. The law establishes an ongoing obligation for stablecoin issuers to monitor their operational frameworks, update internal controls, and ensure that all disclosures and consumer communications remain accurate as market conditions evolve. Monthly reporting of reserve composition, certified at the executive level, will require close collaboration between legal, finance, and technology teams. For those crossing key thresholds (such as $10 billion or $50 billion in outstanding stablecoins), the transition to stricter federal oversight or annual audit requirements will likely demand significant investment in compliance infrastructure.

For nonbank issuers operating under state regimes, the Act’s equivalency test introduces new complexity. States must demonstrate that their regulatory frameworks are “substantially similar” to federal requirements, creating both opportunities for regulatory innovation and risks of fragmentation if standards diverge. Issuers should anticipate heightened scrutiny during examinations and be prepared for potential shifts in supervisory expectations as federal regulators issue further guidance.

Penalties, Enforcement, and Industry Impact

Unlicensed issuance remains one of the most significant compliance risks under the new regime. With civil penalties reaching up to $100,000 per day, and personal liability for executives who knowingly participate in violations, the GENIUS Act sets a high bar for accountability. Enforcement priorities are expected to focus initially on reserve sufficiency, marketing practices, and AML program effectiveness.

The exclusion of algorithmic stablecoins from the permitted issuer framework is another critical industry development. While not expressly banned, these projects fall outside federal protections and may face increased scrutiny from both regulators and counterparties. Market participants should carefully evaluate exposure to non-compliant tokens as part of their risk management processes.

Key Compliance Priorities for Stablecoin Issuers Post-GENIUS Act

-

Obtain Proper Licensing and Regulatory ApprovalIssuers must secure authorization as a federal qualified payment stablecoin issuer from the Office of the Comptroller of the Currency (OCC) or operate as a subsidiary of an insured depository institution (IDI). Nonbanks with under $10 billion in stablecoins may opt for state-level licensing if the state regime aligns with federal standards. Entities exceeding $10 billion must transition to federal oversight within 360 days.

-

Maintain Segregated, Bankruptcy-Remote ReservesIssuers are required to fully back all outstanding stablecoins with reserves held in segregated, bankruptcy-remote accounts. Permissible assets include U.S. dollars, Treasury bills, overnight repurchase agreements, demand deposits, and shares in registered government money market funds.

-

Implement Robust Reserve Transparency and ReportingMonthly public disclosures of reserve composition are mandatory, with certifications from the CEO and CFO. Issuers with over $50 billion in outstanding stablecoins must also publish annual audited financial statements.

-

Establish Comprehensive AML and Sanctions ProgramsStablecoin issuers are classified as financial institutions under the Bank Secrecy Act (BSA). They must implement customer identification (KYC), transaction monitoring, suspicious activity reporting, and sanctions screening, and have the technical ability to freeze or reject illicit transactions.

-

Adhere to Operational Restrictions and Consumer ProtectionsIssuers are prohibited from paying interest or yield to stablecoin holders, must not imply government backing in marketing, and are required to honor redemption at par value with clear, timely procedures.

-

Monitor and Meet Compliance DeadlinesThe GENIUS Act will take effect by the earlier of 18 months from enactment or 120 days after final rules are issued. Existing issuers and Digital Asset Service Providers (DASPs) have up to three years to comply, after which only permitted issuers may operate.

Strategic Takeaways for Legal and Compliance Teams

The GENIUS Act’s phased implementation gives issuers a window, up to 18 months or until final rules are published, to align operations with federal standards. Digital Asset Service Providers (DASPs) have three years to transition exclusively to payment stablecoins issued by authorized entities, but early preparation will be crucial as regulators clarify expectations around technical controls, reporting formats, and cross-border activities.

For legal professionals advising clients or managing internal risk assessments, focus areas should include:

- Gap analysis against new licensing and reserve requirements

- Reviewing consumer-facing materials for compliance with marketing restrictions

- Testing AML/KYC systems for alignment with BSA mandates

- Scenario planning for potential state-to-federal supervisory transitions

The GENIUS Act marks a decisive shift toward institutional-grade regulation in U. S. digital asset markets. Those who invest early in robust compliance architecture are likely to gain both regulatory confidence and long-term market access.