The GENIUS Act of 2025 marks a pivotal shift in GENIUS Act stablecoin regulation, imposing rigorous US Treasury requirements on reserves, KYC, and issuer oversight to fortify payment stablecoins against systemic risks. As issuers scramble to align with this federal framework, the stakes could not be higher: full compliance unlocks innovation, while lapses invite enforcement actions that could cripple operations.

Reserve Backbone: 1: 1 Backing and Permitted Assets

At the core of the GENIUS Act lies an ironclad mandate for stablecoin issuers to hold reserves matching outstanding payment stablecoins on a 1: 1 basis. This provision targets the vulnerabilities exposed in past depegs, ensuring redemption at par value even amid market turbulence. Permitted assets form a conservative palette, prioritizing liquidity and safety over yield-chasing gambits.

GENIUS Act Reserve Assets

-

U.S. currency and coins: Physical cash for 1:1 backing.

-

Balances at Federal Reserve Banks: Direct Fed account holdings.

-

Demand deposits at insured depository institutions: Funds in FDIC-insured banks.

-

Treasury bills, notes, or bonds (≤93 days maturity): Short-term U.S. government securities.

-

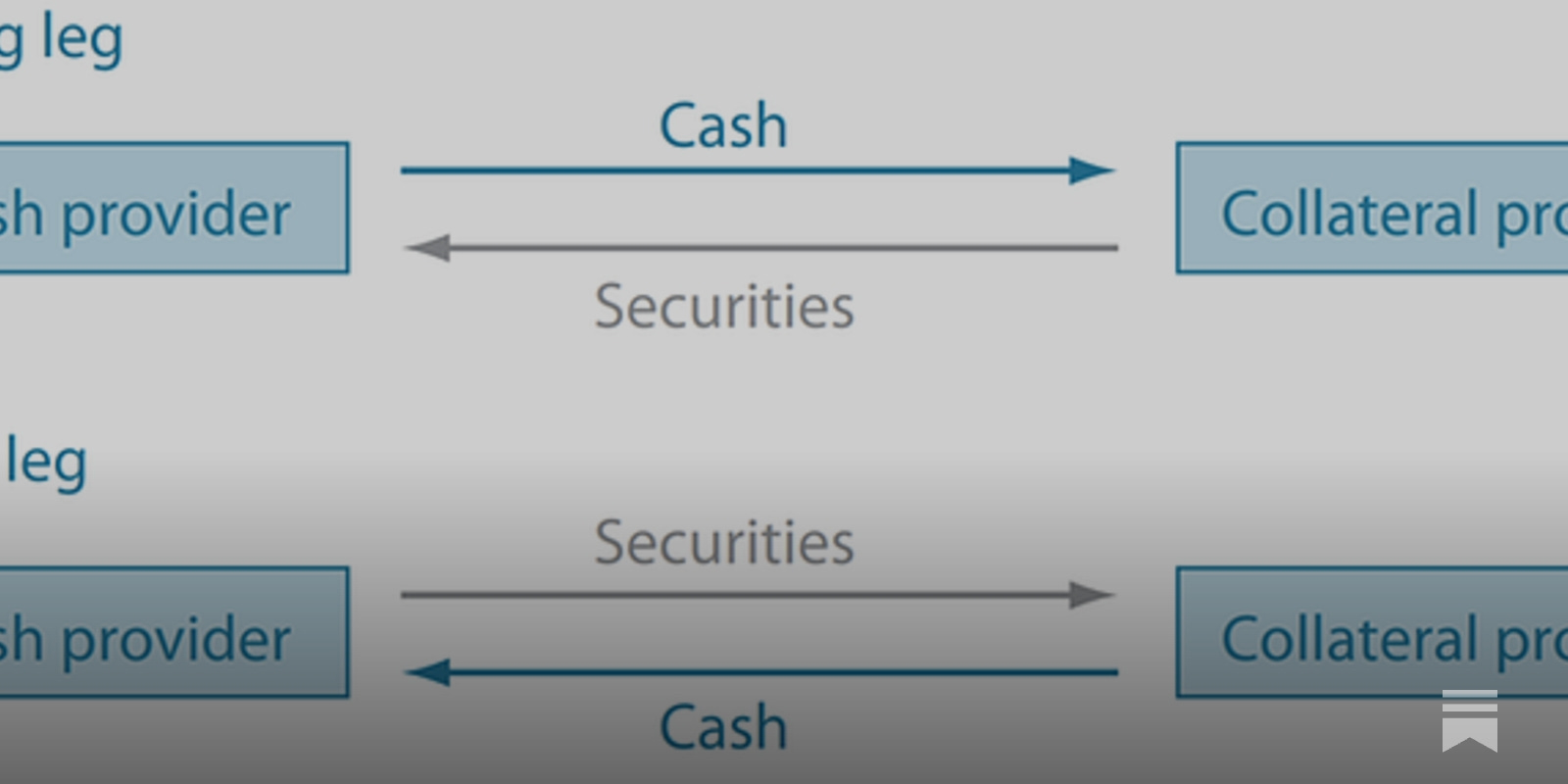

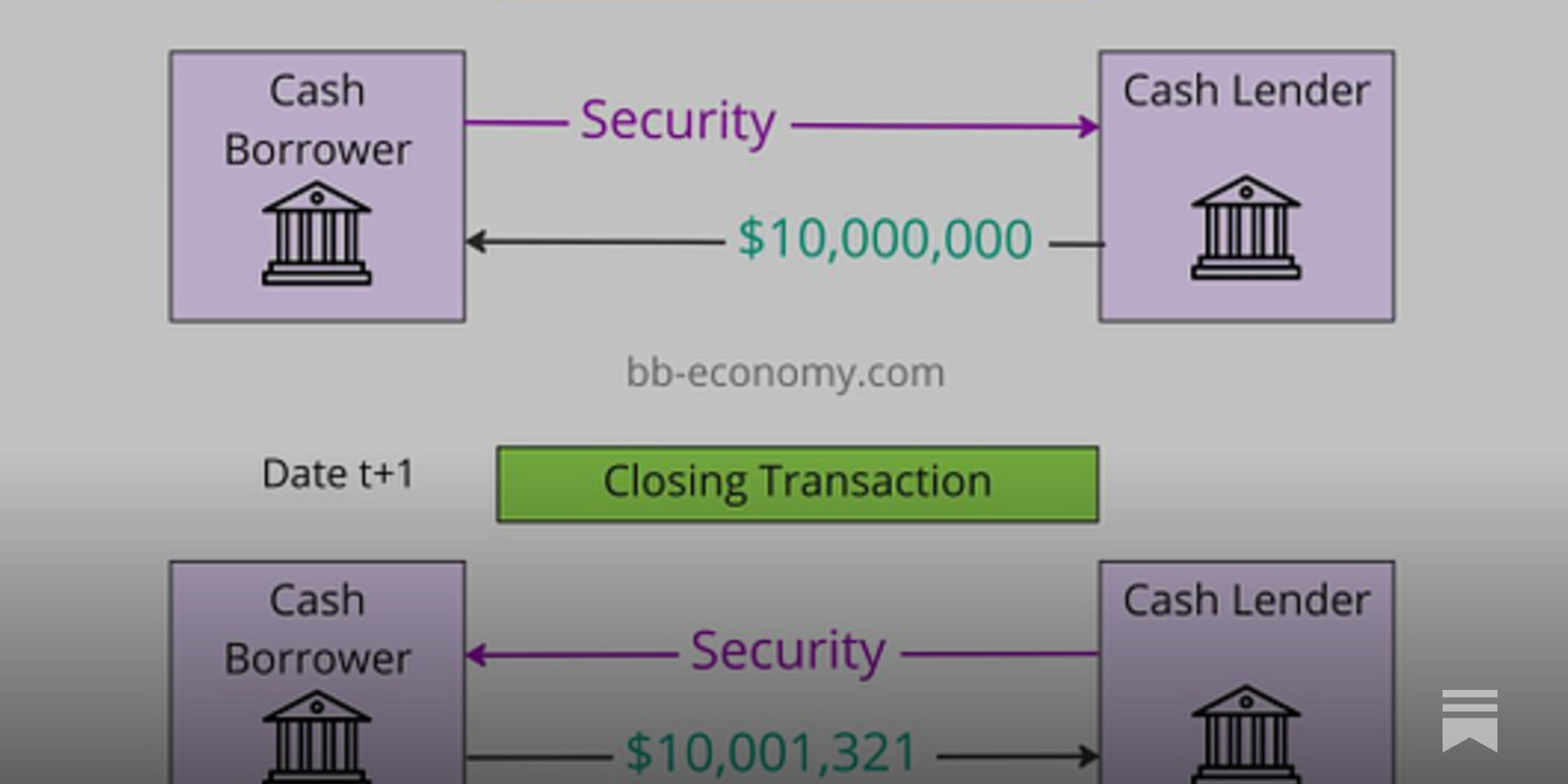

Overnight repurchase agreements backed by Treasury securities (≤93 days): Collateralized overnight loans.

-

Overnight reverse repurchase agreements backed by Treasury securities: Reverse repo transactions.

-

Shares of qualifying money market funds: Funds investing only in listed assets.

These reserves must segregate into bankruptcy-remote accounts, a safeguard that shields user funds from issuer insolvency. Public disclosure of redemption policies adds transparency, detailing procedures, timelines, and fees. In my modeling of regulatory scenarios, this setup slashes tail-risk probabilities by anchoring assets to the safest harbors, yet it challenges issuers to optimize yields within tight constraints.

Recent Treasury actions underscore urgency. The Advance Notice of Proposed Rulemaking (ANPRM), published September 19,2025, closed November 4 after drawing 403 comments, informing rules on US stablecoin reserves 2025. Treasury now dissects feedback on effectiveness, costs, privacy, and cybersecurity, signaling refined implementations ahead.

KYC Fortress: AML Obligations Reshaping Issuer Operations

Stablecoin issuers ascend to financial institution status under the Bank Secrecy Act, thrusting them into a web of stablecoin KYC requirements USA. Robust identity verification at issuance and redemption forms the gateway, coupled with real-time transaction monitoring for red flags. Suspicious activity reports to authorities become routine, as does the power to freeze or reject illicit flows.

This compliance architecture mirrors banks, transforming stablecoins from shadowy transfers to auditable ledgers. Issuers must calibrate systems for scalability; a single oversight could trigger FinCEN scrutiny. Creatively, forward-thinking firms integrate AI-driven anomaly detection, turning mandates into competitive moats. Yet, privacy advocates in ANPRM comments highlighted tensions, urging Treasury to balance security with data minimization.

Oversight Dichotomy: Federal Licensing for Scale Players[/h2>

The GENIUS Act carves a dual path for stablecoin issuer licensing GENIUS Act, hinging on issuance volume. Below $10 billion outstanding, state regimes qualify if substantially similar to federal standards. Surpass that threshold, and federal oversight via the OCC beckons within 360 days, waivers notwithstanding.

Non-bank national issuers secure OCC licenses, enduring supervision akin to charters. Foreign entrants face steeper hurdles: comparability to US rules plus OCC registration, with Section 8 enforcing compliance through lawful orders or designations. This tiered model incentivizes growth under scrutiny, quantifying risk by scale. In volatility models, it dampens contagion; smaller players innovate locally, giants fortify nationally under US Treasury stablecoin oversight.

Read more on reserve compliance at GENIUS Act Explained: Reserves and Compliance.

Public nonfinancial companies face an extra layer: Section 4(a)(12) bars them from issuing without unanimous board approval, curbing speculative forays into stablecoins. This provision, highlighted in Treasury’s outreach, tempers corporate exuberance while channeling focus to dedicated issuers.

Foreign Issuers Under Scrutiny: Comparability and Enforcement

Section 8 of the GENIUS Act casts a long shadow over foreign stablecoin issuers targeting U. S. users. Compliance with lawful orders is non-negotiable; noncompliance risks Treasury designation, potentially blocking access to American markets. Registration with the OCC, paired with a demonstration of regulatory comparability, sets a high bar. In my risk models, this extraterritorial reach compresses global arbitrage opportunities, forcing offshore players to mirror U. S. rigor or retreat.

Treasury’s ANPRM solicited views on these dynamics, with comments closing November 4,2025, after 403 submissions. Feedback spanned effectiveness of reserves, AML burdens, and cybersecurity postures, per Federal Register notices. FinCEN and industry voices, from Winston and Strawn to SIFMA, urged clarifications on ledger types and software exemptions, shaping forthcoming rules.

This table distills the oversight dichotomy, quantifying pathways for issuers navigating GENIUS Act mandates.

Navigating Compliance: Costs, Innovation, and Risk Mitigation

Implementation hinges on Treasury’s synthesis of public input. Stakeholders, including ICBA and Hunton Andrews Kurth observers, emphasized balancing innovation with safeguards. Costs loom large: segregating reserves, deploying KYC engines, and securing OCC charters demand capital. Yet, my quantitative lens reveals upsides; compliant issuers gain trust premiums, evidenced in lower redemption spreads during stress tests.

Privacy and cybersecurity emerged as flashpoints in comments. Treasury probes data minimization alongside robust defenses, potentially birthing hybrid regimes where zero-knowledge proofs augment traditional AML. Creatively, issuers could leverage permissioned ledgers for efficiency, as SIFMA advocated, without sacrificing auditability.

For deeper dives, explore GENIUS Act 2025: Reserves and Licensing Checklist or Compliance Rules for Issuers.

Forward-modeling scenarios, the GENIUS Act recalibrates stablecoin ecosystems toward resilience. Issuers quantifying these shifts- from reserve yields compressed to 4-5% ceilings, to KYC latencies halved via AI- position for dominance. Treasury’s iterative rulemaking, fueled by diverse comments, promises a framework that fosters U. S. -led innovation without repeating crypto’s boom-bust cycles. Stakeholders ignore it at their peril; mastery unlocks the next era of programmable money.