The U. S. digital asset landscape shifted dramatically with the enactment of the GENIUS Act of 2025, a sweeping federal law that sets new standards for stablecoin issuers operating in or targeting American users. Whether you’re a crypto compliance officer, legal advisor, or fintech founder, understanding these rules is now mission-critical. The GENIUS Act doesn’t just tweak existing frameworks – it redefines who can issue stablecoins, how reserves must be managed, and what ongoing compliance looks like at scale.

Who Can Issue Stablecoins Under the GENIUS Act?

The core of GENIUS Act stablecoin regulation is exclusivity: only certain entities can become “permitted payment stablecoin issuers. ” The law restricts issuance to:

- Subsidiaries of insured depository institutions (think bank-affiliated fintechs)

- Nonbank financial firms with a qualifying federal or state license

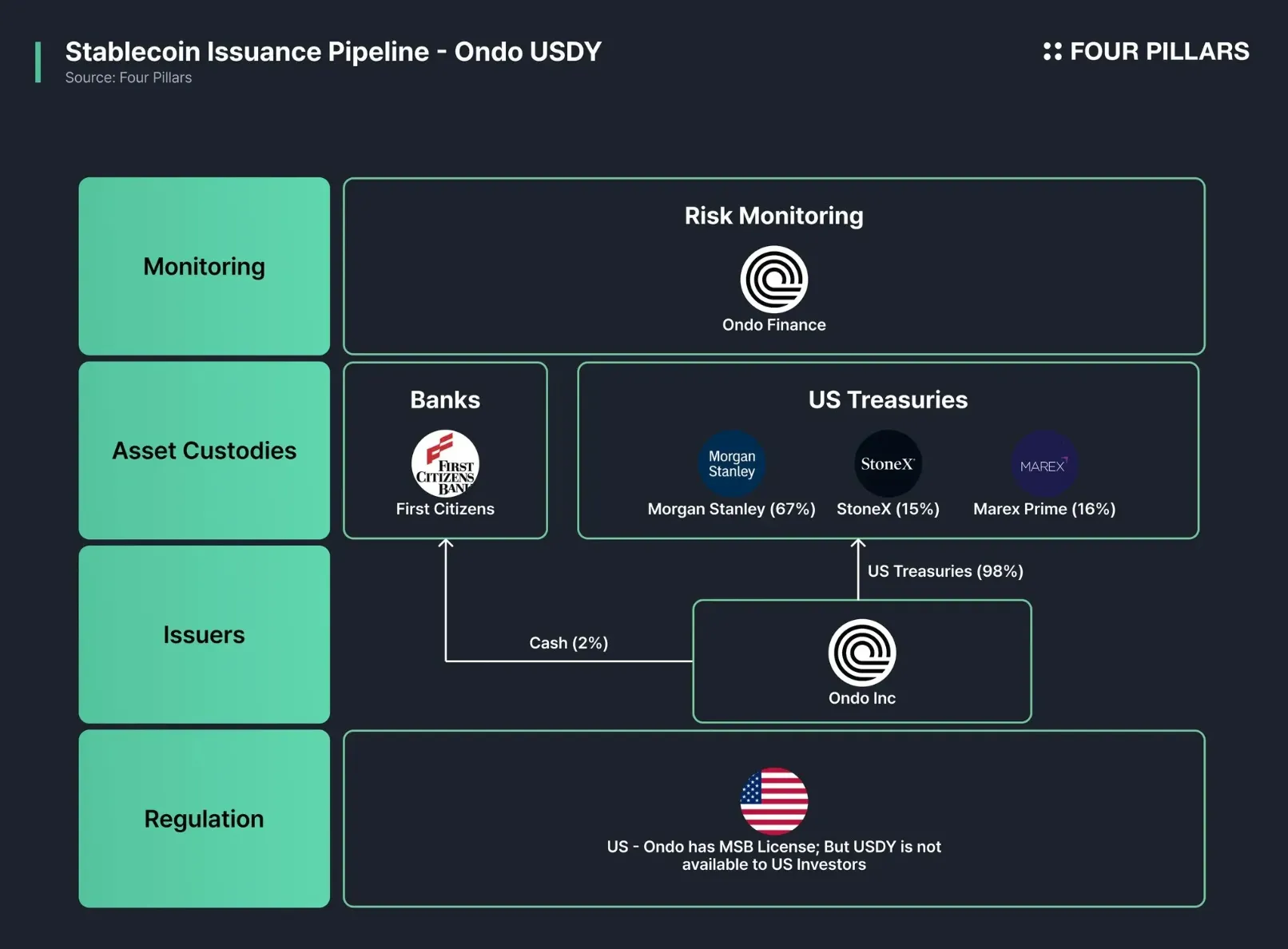

- Foreign issuers deemed qualified by U. S. regulators

If you’re a non-financial firm eyeing this space, your only shot is unanimous approval from the new Stablecoin Certification Review Committee (SCRC) – a high bar by design. This move aims to block big tech and retail giants from unilaterally launching dollar-backed tokens without robust oversight.

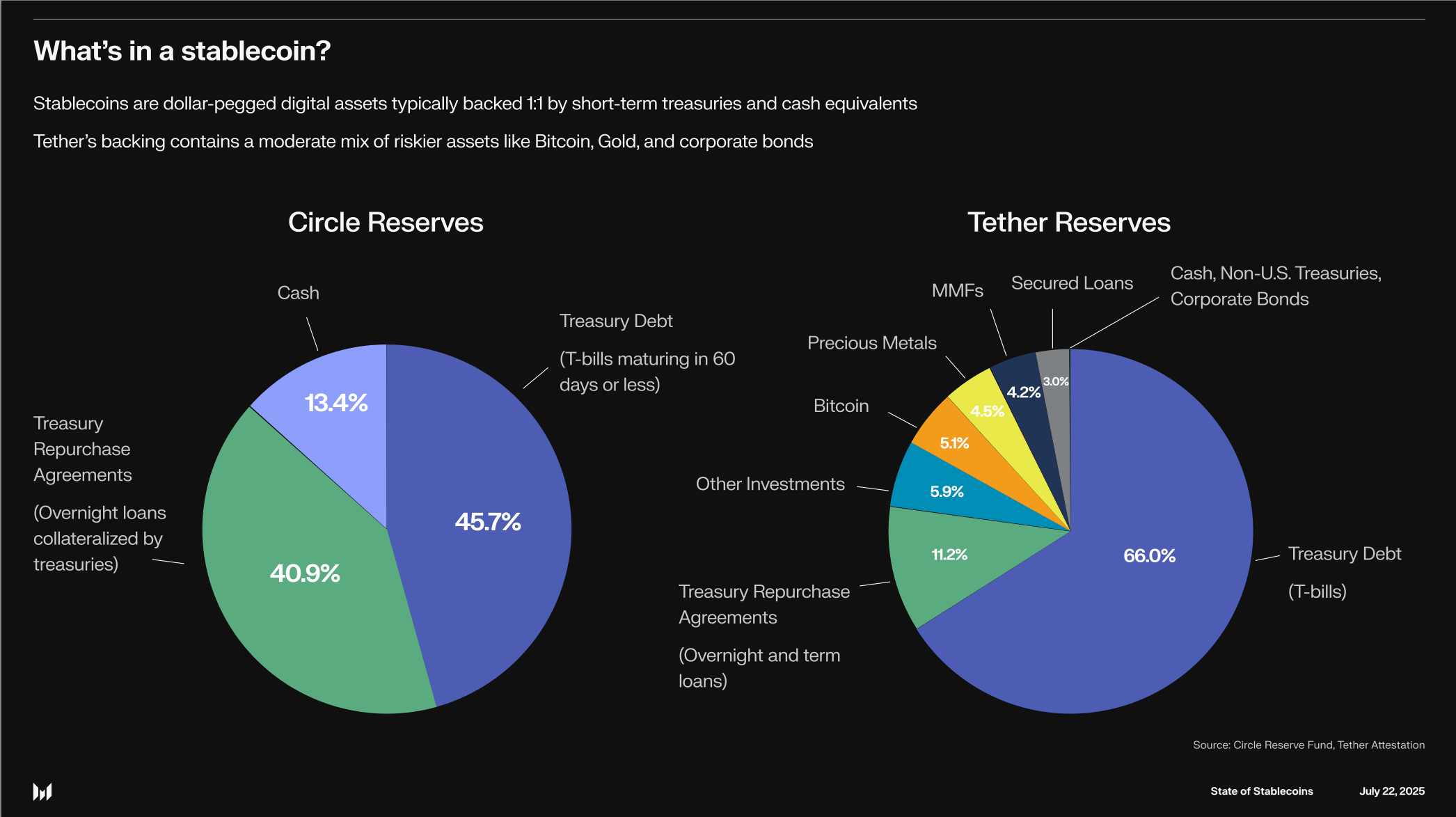

Dollar-Backed Reserve Rules: No Room for Algorithms or Commercial Paper

The days of algorithmic stablecoins and opaque backing are over in the U. S. market. The dollar-backed stablecoin rules in the GENIUS Act require:

- 1: 1 reserve backing: Every issued token must be matched by high-quality liquid assets – U. S. dollars, short-term Treasuries, and cash equivalents only.

- No commercial paper or algorithmic mechanisms: These are explicitly banned as reserve assets.

- No rehypothecation: Reserves can’t be reused except to meet redemption demands – no leveraging up on customer funds.

This tightens operational risk but also makes compliance more predictable for serious players. For a deeper breakdown on reserve mechanics and audit triggers, see our detailed guide: GENIUS Act Explained: What US Stablecoin Issuers Need to Know About 1: 1 Backing, Licensing and Compliance (2025 Update).

Key GENIUS Act Compliance Duties for Stablecoin Issuers

-

Issuer Eligibility: Only subsidiaries of insured depository institutions, federally or state-licensed nonbank financial firms, and qualified foreign issuers may issue payment stablecoins. Non-financial firms are generally prohibited unless unanimously approved by the Stablecoin Certification Review Committee (SCRC).

-

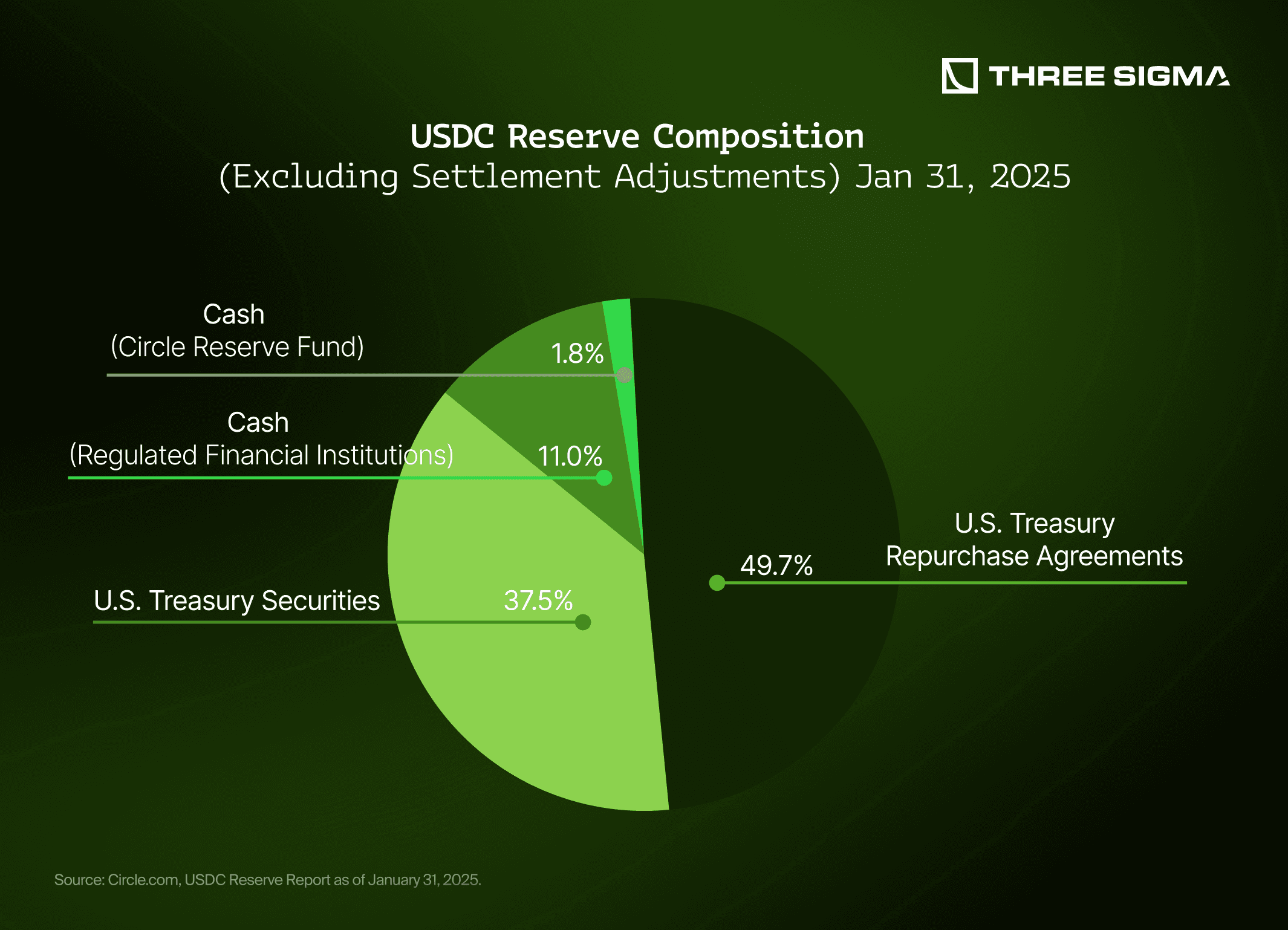

1:1 Reserve Backing: All issued stablecoins must be fully backed one-to-one by high-quality, liquid assets—such as U.S. dollars or short-term Treasury bills. Commercial paper and algorithmic mechanisms are strictly prohibited.

-

Anti-Money Laundering (AML) Compliance: Issuers are classified as financial institutions under the Bank Secrecy Act and must implement robust AML and sanctions compliance programs.

-

Transaction Controls: Issuers must maintain the ability to freeze and seize stablecoins to comply with lawful government orders.

-

Monthly Attestations & Annual Audits: Issuers must publish monthly reserve reports with independent third-party attestations. Those with over $10 billion in outstanding stablecoins must also submit annual audited financial statements.

-

Operational Restrictions: Stablecoin issuers are prohibited from paying interest to holders, and reserve assets cannot be rehypothecated, except for meeting reasonable redemption requests.

-

Regulatory Oversight: The Office of the Comptroller of the Currency (OCC) is the primary federal regulator for nonbank issuers. Nonbank issuers with under $10 billion in outstanding stablecoins may opt into a qualifying state regulatory regime.

-

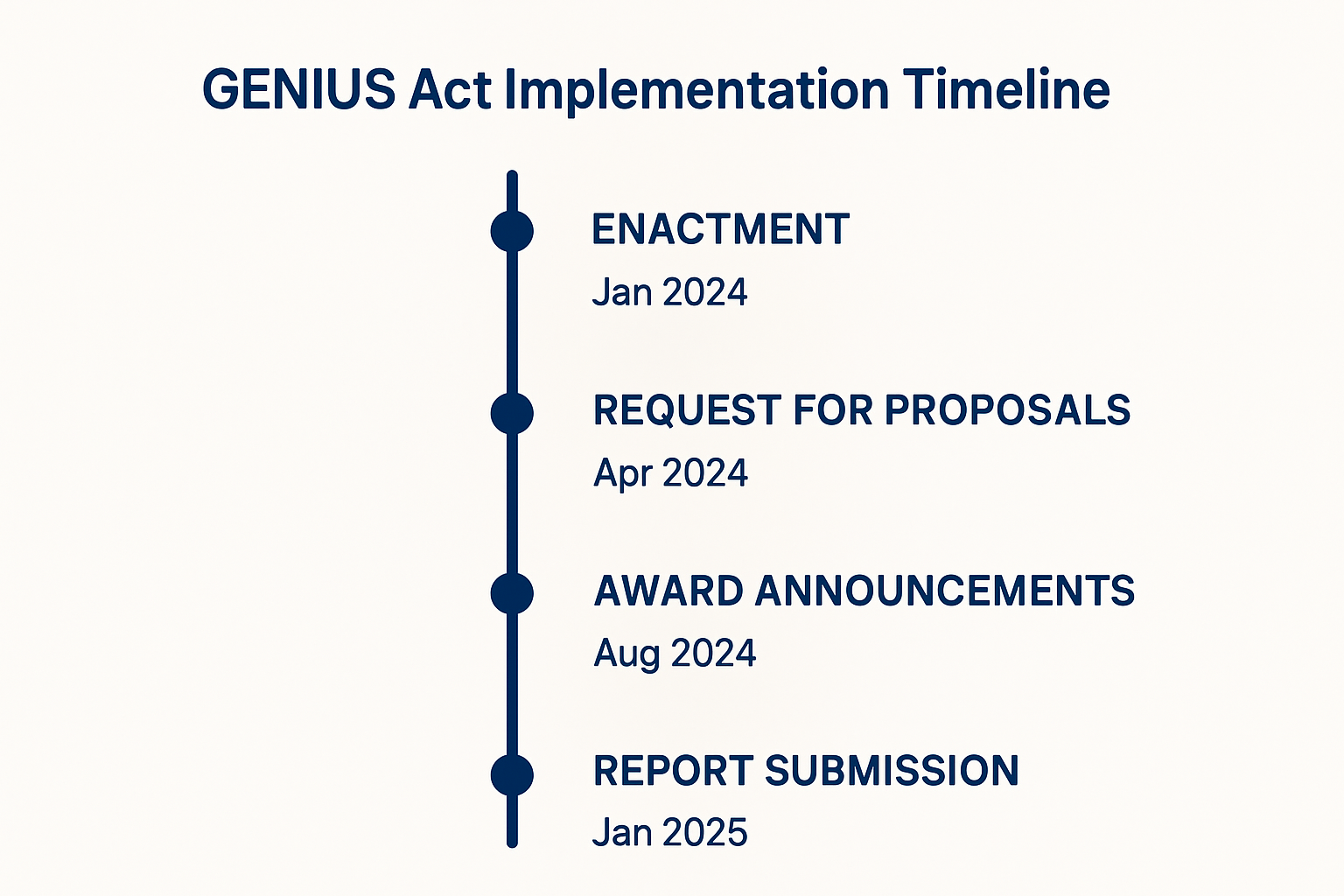

Implementation Timeline: The Act takes effect by the earlier of 18 months from enactment or 120 days after the issuance of implementing rules by primary regulators.

Compliance Obligations: AML, Attestations and Audit Burdens

The GENIUS Act classifies permitted issuers as financial institutions under the Bank Secrecy Act (BSA), triggering full-scale AML and sanctions requirements. This means:

- KYC on all counterparties

- Ongoing transaction monitoring and suspicious activity reporting

- The technical ability to freeze/seize coins in response to lawful orders

Transparency is non-negotiable. Issuers must publish monthly reserve attestations from independent auditors and provide annual audited financials if their outstanding coins exceed $10 billion. These requirements are designed to prevent another Terra-style collapse and restore institutional confidence in U. S. -issued payment tokens.

Federal vs State Oversight: Dual Regime Dynamics

The Office of the Comptroller of the Currency (OCC) is now lead regulator for nonbank issuers opting into the federal regime. However, smaller nonbanks (<$10 billion outstanding) can choose to remain under state oversight if their state framework mirrors federal standards closely enough. This dual-track approach preserves some regulatory competition while setting a high baseline for consumer protection nationwide.

If you’re an issuer currently licensed at the state level or considering entry into this market, review our compliance checklist for practical next steps: GENIUS Act 2025: What US Stablecoin Issuers Need to Know for Compliance.

Operationally, the GENIUS Act draws a hard line on how stablecoin businesses can interact with consumers and the broader financial system. No interest payments are allowed to stablecoin holders, blocking so-called ‘pseudo-savings’ products that once blurred the line between payments and unregulated banking. For firms used to leveraging reserves for yield or offering incentives to drive adoption, this is a paradigm shift. The goal: limit systemic risk and keep stablecoins tightly pegged to underlying assets, not speculative returns.

Audit Triggers and Disclosure Deadlines

Transparency is no longer optional. Issuers must publish monthly reserve attestations, with independent third-party validation, and, if above $10 billion in outstanding coins, submit annual audited financial statements. These disclosures are public-facing, not just for regulators. Expect market participants and competitors to scrutinize every footnote.

GENIUS Act Stablecoin Issuer Disclosure Checklist

-

Monthly Reserve Attestation: Publish a detailed report of all outstanding stablecoins and corresponding reserve assets, with independent third-party attestation.

-

Annual Audited Financial Statements: Submit comprehensive, independently audited financial statements if outstanding stablecoins exceed $10 billion.

-

AML and Sanctions Compliance Reporting: Maintain and periodically update records demonstrating robust anti-money laundering and sanctions compliance programs, as required under the Bank Secrecy Act.

-

Transaction Control Disclosures: Document and disclose capabilities to freeze and seize stablecoins in compliance with lawful orders from regulators or courts.

-

Reserve Asset Composition Breakdown: Provide transparent disclosure of the types and proportions of high-quality, liquid assets backing issued stablecoins (e.g., U.S. dollars, Treasury bills).

-

Marketing and Consumer Protection Statements: Publish regular disclosures affirming compliance with federal marketing rules and consumer protection standards, including prohibition of interest payments to holders.

For compliance teams, this means investing in robust internal controls and audit-readiness from day one. The era of ‘move fast and break things’ is over, now it’s ‘move fast and stay compliant. ‘ For more on audit triggers and best practices, see our expanded breakdown: GENIUS Act 2025: What US Stablecoin Issuers Need to Know About New Compliance Rules.

Implementation Timeline: No Grace for Delays

The implementation clock is ticking. The law takes effect the earlier of 18 months from enactment or 120 days after final rules drop from primary federal regulators. That means most U. S. -facing stablecoin projects have less than a year to overhaul their compliance programs, or risk being shut out of the American market entirely.

The transition period will be closely watched by both regulators and industry analysts as legacy players scramble to adapt while new entrants try to secure licenses under the stricter regime.

Strategic Takeaways for Issuers

- Review licensing status: Are you federally or state licensed? If not, start now, permitted issuer status is non-negotiable.

- Overhaul reserve management: Only high-quality liquid assets count; no commercial paper or crypto-backed reserves allowed.

- Upgrade AML/KYC infrastructure: Full BSA compliance is mandatory, including transaction freezing capabilities.

- Prepare for public scrutiny: Monthly attestations and annual audits will become industry benchmarks; transparency gaps will be punished by both regulators and markets.

This isn’t just box-checking, the GENIUS Act aims to make U. S. -issued payment stablecoins as safe as bank deposits while preserving blockchain’s programmability edge. For those who can meet the bar, the reward is access to a compliant dollar-based token market with global reach.

The next 12 months will separate serious operators from speculative players in U. S. stablecoins. Stay agile, stay informed, and keep your compliance playbook up-to-date as interpretive guidance emerges from Washington.