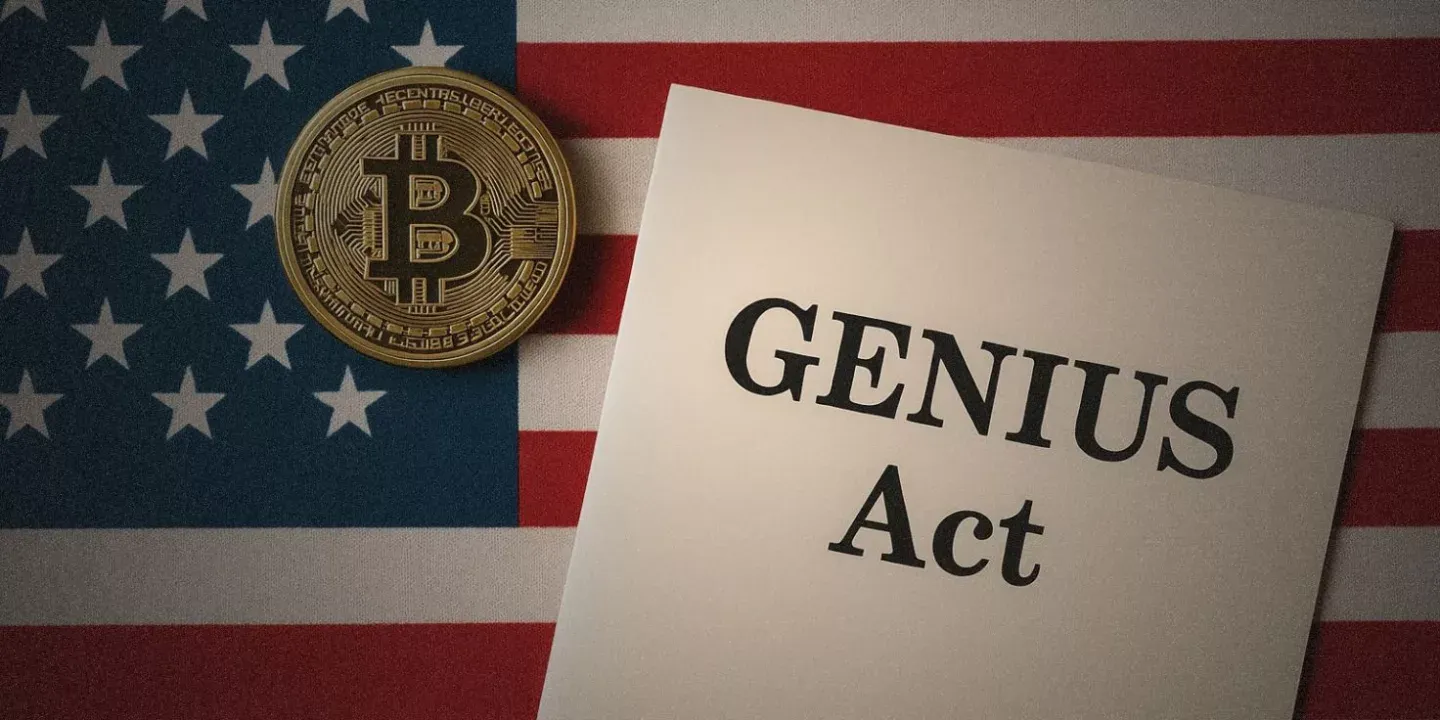

The U. S. stablecoin landscape just changed forever. On July 18,2025, the Guiding and Establishing National Innovation for U. S. Stablecoins (GENIUS) Act became law, marking the first comprehensive federal framework for payment stablecoins in America. For issuers and merchants, this isn’t just another regulatory update, it’s a seismic shift in how digital dollars are created, managed, and accepted in the U. S. economy.

Let’s break down what the GENIUS Act means for your business, your compliance checklist, and the future of stablecoin adoption.

Who Can Issue Stablecoins Under the GENIUS Act?

Gone are the days when any tech startup could launch a U. S. -pegged stablecoin with a few lines of code and a marketing plan. The GENIUS Act stablecoin regulation draws a hard line between permitted issuers and everyone else:

- Banks and Insured Depository Institutions: Subsidiaries of federally insured banks can issue payment stablecoins.

- Federally Qualified Nonbank Issuers: These are nonbank financial firms that meet strict federal oversight criteria.

- State-Qualified Issuers: Entities recognized by state regulators but still subject to federal rules.

If you’re not on this list, say you’re a non-financial tech company, you can only issue stablecoins if you receive unanimous approval from the Stablecoin Certification Review Committee (SCRC). This is no rubber stamp; it’s designed to keep fly-by-night operators out of the market.

Key Differences: Permitted Issuers vs. Restricted Entities

-

Who Can Issue Stablecoins: Permitted issuers are limited to insured depository institutions (like national banks), federally qualified nonbank issuers, and state-qualified issuers. Restricted entities—including most non-financial firms—cannot issue payment stablecoins unless they receive unanimous approval from the Stablecoin Certification Review Committee (SCRC).

-

Reserve Requirements: Permitted issuers must maintain 1:1 reserves in U.S. dollars or similarly liquid assets, held in bankruptcy-remote accounts with monthly public disclosures. Restricted entities are not allowed to issue stablecoins, so these requirements do not apply to them.

-

Anti-Money Laundering (AML) Compliance: Permitted issuers are classified as financial institutions under the Bank Secrecy Act, requiring robust AML and sanctions compliance programs. Restricted entities are not subject to these requirements, as they cannot legally issue payment stablecoins.

-

Interest Payments: Both permitted and restricted entities are prohibited from paying any form of interest or yield to stablecoin holders under the GENIUS Act, reinforcing stablecoins as payment tools, not investments.

-

Marketing and Consumer Protection: Permitted issuers must follow strict marketing rules—including bans on deceptive claims and misrepresenting government backing. Restricted entities are not allowed to market or issue stablecoins at all.

Tougher Reserve Requirements: One-to-One Backing or Bust

The heart of federal stablecoin issuer requirements under GENIUS is transparency and security. Every payment stablecoin must be backed one-to-one with U. S. currency or similarly liquid assets. These reserves aren’t just held anywhere, they must be kept in separate, bankruptcy-remote accounts to protect holders if an issuer goes under.

This means monthly public disclosures about reserve composition are now mandatory. Gone are vague promises of “full backing”: now it’s about verifiable numbers and real assets. For legal teams and compliance officers, this introduces new audit trails and reporting obligations that will require robust systems and clear documentation.

No Interest Payments: Payment Instrument Only

If you were hoping to launch a yield-bearing stablecoin product for retail customers, think again. Section 4(a)(11) of the GENIUS Act makes it illegal for permitted payment stablecoin issuers (PPSIs) or federally permitted stablecoin issuers (FPSIs) to pay any form of interest or yield to holders. This draws a bright line between payment instruments (like cash) and investment products (like securities).

This provision aims to keep merchant stablecoin adoption legal, simple, and low-risk, no more confusing hybrid products blurring regulatory boundaries.

Marketing and Consumer Protection Rules Get Serious

The days of splashy ads claiming “backed by Uncle Sam” are over. The law prohibits any representation that payment stablecoins are backed by the full faith and credit of the United States or guaranteed by federal insurance schemes like FDIC.

This isn’t just about semantics; misleading marketing is now grounds for enforcement action. Issuers have to walk a tightrope: promote their product’s safety without implying government backing they don’t actually have.

AML/KYC Compliance Moves Front-and-Center

The GENIUS Act doesn’t pull punches on anti-money laundering (AML) or know-your-customer (KYC) rules either. All permitted issuers are classified as financial institutions under the Bank Secrecy Act, which means robust AML programs, sanctions screening, suspicious activity reporting, and ongoing risk assessments are non-negotiable parts of your compliance stack now.

If you’re building or scaling a compliance program post-GENIUS, check out our guide: What U. S. Stablecoin Issuers Need To Know About 1: 1 Backing, Licensing and Compliance [2025 Update].

For merchants, this new compliance environment is a double-edged sword: the upfront onboarding and diligence requirements are more rigorous, but the upside is a safer, more predictable digital payments ecosystem. Merchants can now accept stablecoins with confidence that issuers are subject to federal oversight, clear reserve mandates, and ongoing audits.

How Merchants Benefit: Legal Clarity and Consumer Trust

The GENIUS Act’s impact on merchant stablecoin adoption legal status is immediate. With federal law now providing a single set of rules for what constitutes a compliant payment stablecoin, uncertainty around legal risk drops dramatically. Merchants no longer need to guess whether their payment provider’s token will run afoul of state regulators or face sudden enforcement action.

This clarity also translates into greater consumer trust. Shoppers know that when they pay with an approved U. S. stablecoin, it’s backed by real dollars in bankruptcy-remote accounts, not vaporware or risky off-shore schemes. These protections could help drive mainstream adoption well beyond crypto-native circles.

Implementation Timeline: What Happens Next?

The rollout of the GENIUS Act isn’t instantaneous, there’s a transition window for both issuers and merchants to get up to speed. The law takes effect on the earlier of 18 months after enactment (that’s January 2027) or 120 days after federal regulators publish final rules. Expect a flurry of guidance from Treasury and other agencies as they fill in the technical details over the coming year.

Key GENIUS Act Compliance Deadlines & Milestones

-

July 18, 2025: GENIUS Act signed into law, officially establishing the federal regulatory framework for payment stablecoins in the U.S.

-

October 15, 2025 (Projected): U.S. Treasury and primary federal stablecoin regulators expected to issue final implementing regulations for the GENIUS Act. The 120-day countdown for compliance may begin once these are published.

-

18 Months After Enactment (January 18, 2027): Latest possible effective date for all GENIUS Act provisions if final regulations are not issued sooner. All permitted stablecoin issuers and merchants must be fully compliant by this date.

-

Within 30 Days of Effective Date: Permitted stablecoin issuers must submit initial compliance certifications to federal regulators, including documentation of reserve holdings, AML programs, and consumer protection measures.

-

Monthly, Ongoing: Issuers are required to provide monthly public disclosures detailing the composition and value of stablecoin reserves, ensuring transparency and consumer trust.

If you’re an issuer or merchant, this is your window to audit your current practices against new requirements, and close any gaps before enforcement ramps up. Early movers who nail compliance now could gain first-mover advantage as legacy players scramble to catch up.

What Legal Teams Should Do Now

With so much at stake, legal and compliance teams should prioritize:

- Gap analysis: Review existing reserve management, AML/KYC protocols, and marketing materials against GENIUS Act standards.

- Licensing strategy: Determine if your entity qualifies as a permitted issuer, or if you’ll need SCRC approval.

- Merchant onboarding: Prepare updated disclosures and training for merchant partners accepting stablecoins under the new regime.

If you’re looking for deep dives into specific compliance topics, like one-to-one reserve structures or audit requirements, see our resource hub: What U. S. Stablecoin Issuers Need To Know About New Compliance Rules.

The Big Picture: A More Stable Future?

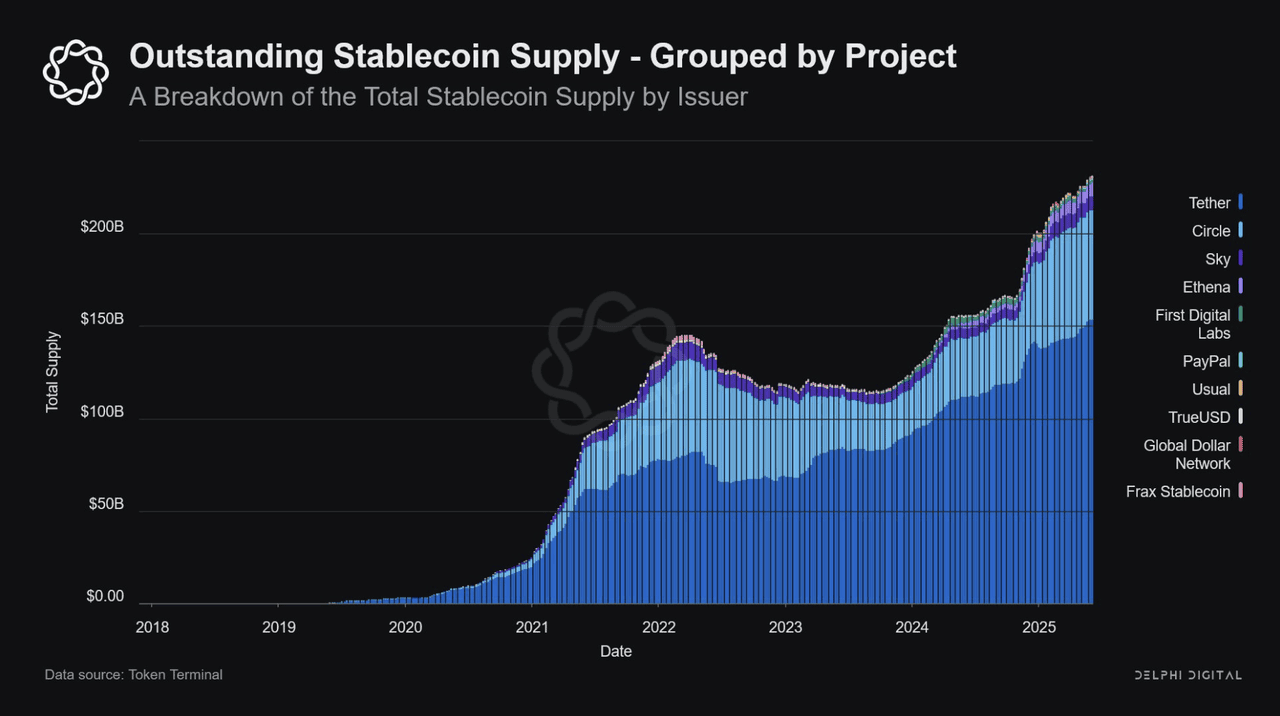

The GENIUS Act puts the U. S. at the forefront of global stablecoin regulation, no small feat given years of regulatory ambiguity. By pairing strict licensing with transparency and consumer safeguards, lawmakers hope to unlock digital dollar innovation while minimizing systemic risk.

No law is perfect out of the gate; expect ongoing debate about how these rules interact with DeFi protocols, cross-border payments, or non-U. S. -issued tokens circulating domestically. But for now, one thing is clear: both issuers and merchants finally have a roadmap, and those willing to adapt quickly may find themselves leading the next era of digital finance.