The GENIUS Act is the new regulatory reality for stablecoin issuers in the United States. Enacted on July 18,2025, this sweeping legislation sets a clear, federally preemptive framework for payment stablecoins. As the digital asset sector faces mounting scrutiny and institutional adoption accelerates, the GENIUS Act aims to strike a pragmatic balance: fostering innovation while locking in consumer protection and systemic stability. If you’re an issuer, investor, or compliance professional, understanding these requirements isn’t optional, it’s existential.

Who Can Issue Stablecoins? GENIUS Act Licensing Rules

The days of launching a USD-backed token with little more than a whitepaper and a legal memo are over. The GENIUS Act stablecoin regulation mandates that only entities designated as Permitted Payment Stablecoin Issuers (PPSIs) can legally issue payment stablecoins in the US. Here’s what that means in practice:

- Subsidiaries of insured depository institutions: Think major banks and their fintech arms.

- Non-bank entities: Must secure appropriate state or federal licenses, no shortcuts allowed.

- Qualified foreign issuers: Only those meeting strict equivalency standards.

If you’re a non-financial public company dreaming of launching your own coin, you’ll need unanimous approval from the new Stablecoin Certification Review Committee (SCRC), which includes heavyweights from Treasury, the Fed, and FDIC. This is deliberate gatekeeping, the US wants to avoid another algorithmic-stablecoin disaster or shadow banking run.

1: 1 Reserve Backing: No More Fractional Funny Business

The heart of the GENIUS Act is its uncompromising approach to reserves. Every outstanding payment stablecoin must be backed one-to-one by high-quality liquid assets. Forget about creative collateralization or risky rehypothecation strategies, the law spells out exactly what counts:

GENIUS Act Permissible Reserve Assets Checklist

-

U.S. Currency (Physical and Electronic): Only U.S. dollars, whether held as cash or in digital form, are permitted for stablecoin reserves under the Act.

-

U.S. Treasury Bills, Notes, or Bonds (≤93 Days Maturity): Short-term Treasuries with maturities of 93 days or less are allowed, ensuring reserves remain highly liquid and low-risk.

-

Short-Term Repurchase Agreements Backed by Treasuries: Repurchase agreements (repos) must be fully collateralized by U.S. Treasuries and have short maturities, supporting liquidity and safety.

-

Demand Deposits at Insured Depository Institutions: Funds can be held in demand deposit accounts at FDIC-insured banks, providing immediate access and federal insurance protection.

-

Money Market Funds Investing Exclusively in Permitted Assets: Reserve assets may include shares of money market funds, but only if those funds invest solely in U.S. dollars, short-term Treasuries, or qualifying repos.

This means U. S. currency, Treasury bills/notes/bonds maturing within 93 days, certain short-term repo agreements fully backed by Treasuries, demand deposits at insured banks, and money market funds holding only these assets. Rehypothecation is strictly limited, only allowed for liquidity management and with explicit regulatory sign-off.

This isn’t just belt-and-suspenders; it’s triple-wrapped security aimed at preventing contagion risk if redemptions surge during market stress.

Monthly Audits and Executive Accountability: Raising the Bar on Transparency

If you’re used to quarterly “attestations” signed off by friendly auditors with little oversight, prepare for a culture shock. The GENIUS Act’s audit requirements are among the most stringent in global digital asset law:

- Monthly disclosures: Issuers must publish detailed reports every month covering total outstanding coins and reserve composition.

- Independent audits: Each monthly report must be examined by an independent public accounting firm. For issuers with more than $50 billion outstanding? Annual PCAOB-standard audits are mandatory.

- C-suite attestations: Both CEO and CFO must personally certify each report’s accuracy, and submit these directly to regulators.

This regime doesn’t just increase transparency; it puts personal liability squarely on top executives’ shoulders, a move clearly meant to deter creative accounting or reserve mismanagement seen in past cycles.

The net effect? The US now offers arguably the most robust, and demanding, regulatory home for fiat-backed stablecoins globally. But compliance isn’t just about box-ticking; it’s about earning trust in an era where digital asset credibility can evaporate overnight.

Beyond the headline requirements, the GENIUS Act stablecoin regulation introduces new compliance realities for every PPSI. Issuers must not only maintain airtight reserves and submit to regular audits, but also comply with a thicket of operational, cybersecurity, and anti-money laundering (AML) rules. The Act explicitly prohibits marketing that could mislead consumers about redemption rights or reserve backing, any hint of deceptive advertising is grounds for swift enforcement action. This is a direct response to past industry scandals and a clear signal: U. S. regulators are prioritizing retail protection as stablecoins go mainstream.

Federal Preemption and State Law: A New Playing Field

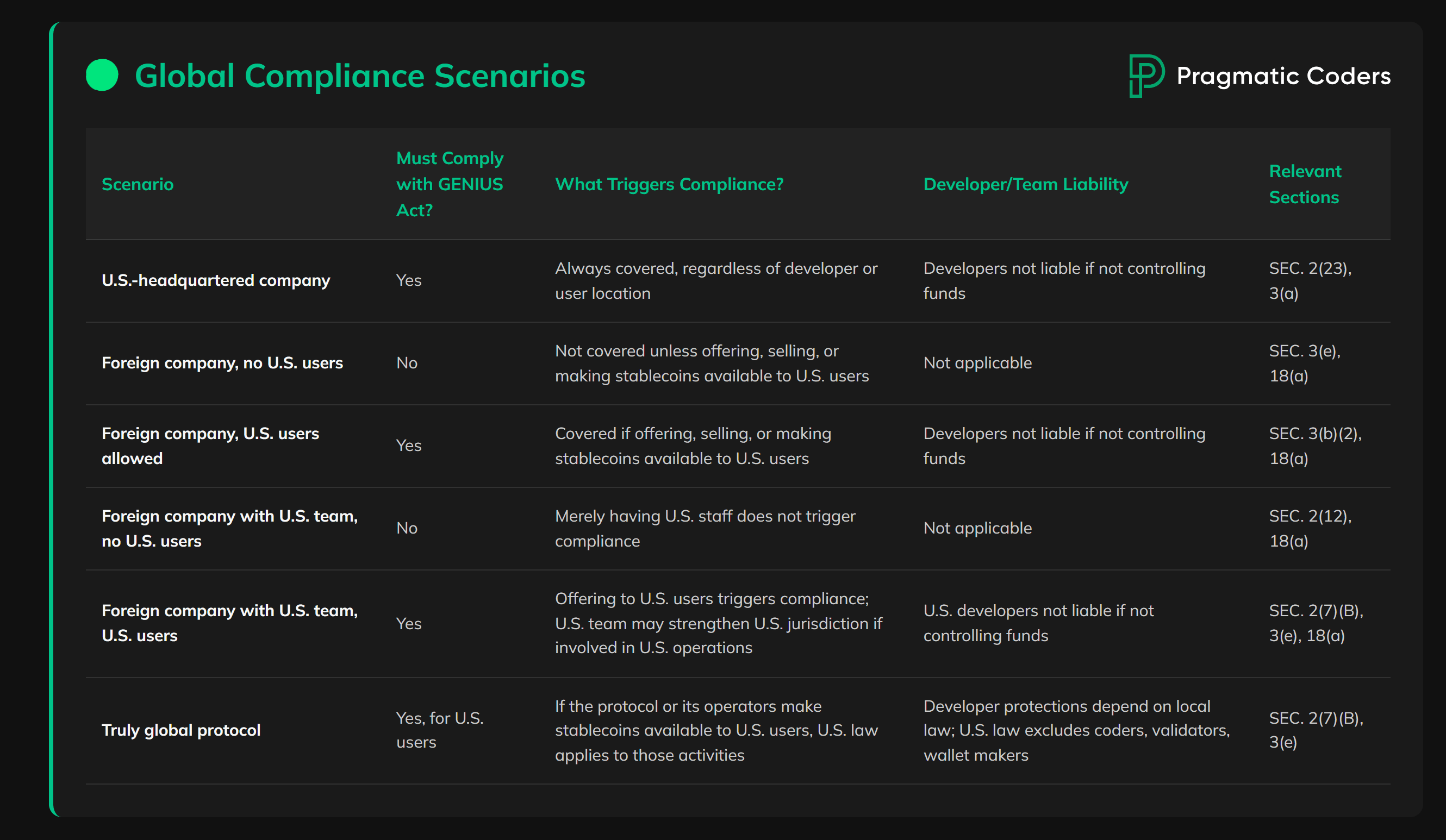

One of the most consequential shifts under the GENIUS Act is its federal preemption provision. For the first time, permitted payment stablecoin issuers can operate under a unified national regime, bypassing the patchwork of state money transmitter laws that previously stifled scale and innovation. This doesn’t mean a free-for-all, there are robust federal oversight mechanisms, but it does finally give clarity to projects that want to serve all 50 states without 50 different licenses.

Still, state regulators retain some authority over consumer complaints and fraud investigations, creating a dual-layered system designed to maximize both efficiency and accountability. The result? Legal certainty for issuers, and fewer regulatory arbitrage opportunities for those hoping to exploit jurisdictional gray zones.

Innovation vs. Illicit Finance: Striking the Balance

The GENIUS Act isn’t just about risk mitigation; it’s also about aligning U. S. digital asset policy with global standards while preserving room for healthy innovation. Treasury has been tasked with developing rules that foster responsible experimentation in DeFi and programmable payments, so long as these don’t open new vectors for illicit finance or systemic risk.

This means more than just checking boxes on AML/KYC compliance. Issuers will be expected to implement advanced transaction monitoring systems, respond quickly to suspicious activity reports (SARs), and participate in cross-agency information sharing initiatives. For DeFi protocols seeking integration with regulated stablecoins, this is both an invitation, and a warning, that regulatory engagement is now table stakes.

Essential GENIUS Act Compliance Tasks for Stablecoin Issuers

-

Obtain PPSI Designation: Secure approval as a Permitted Payment Stablecoin Issuer (PPSI) from the relevant federal regulator (e.g., U.S. Department of the Treasury or Federal Reserve) before issuing any stablecoins.

-

Maintain One-to-One Reserve Backing: Back all outstanding stablecoins with high-quality liquid assets such as U.S. currency, Treasury bills (≤93 days), or insured demand deposits, ensuring strict one-to-one parity.

-

Prohibit Unauthorized Rehypothecation: Do not rehypothecate or reuse reserve assets, except for limited liquidity management with explicit regulatory approval.

-

Publish Monthly Reserve and Circulation Reports: Release monthly public disclosures detailing the total number of outstanding stablecoins and the full composition of reserve assets.

-

Undergo Independent Audits: Ensure all monthly reserve reports are examined by an independent public accounting firm; issuers with over $50 billion outstanding must also provide annual PCAOB-standard audited financials.

-

Submit Executive Attestations: Require the CEO and CFO to certify the accuracy of all disclosures and submit them to the appropriate federal or state regulator.

-

Comply with Marketing and Consumer Protection Rules: Adhere to strict marketing guidelines to avoid deceptive practices and ensure consumer protection as mandated by the GENIUS Act.

What’s Next? Implementation Timeline and Industry Impact

The rollout of the GENIUS Act is already underway, with Treasury soliciting public comment on technical implementation details ranging from reserve custody structures to privacy safeguards in reporting frameworks. Expect phased compliance deadlines through late 2025 into 2026 as agencies finalize interpretive guidance.

For existing stablecoin players, this means urgent legal reviews of reserve management protocols, audit relationships, executive liability insurance, and yes, marketing copy. For would-be entrants (especially non-bank fintechs), it’s time to assess whether your business model can withstand this new regulatory heat, or whether partnership with an existing PPSI makes more sense.

The upshot? The U. S. is staking out leadership in global stablecoin compliance, setting standards that will ripple through international markets and force foreign issuers eyeing American users to step up their game or risk exclusion.

Stay Ahead: Real-Time Resources for Compliance Professionals

If you’re navigating these changes in real time, and you should be, bookmark our ongoing coverage at GENIUS Act Explained: What US Stablecoin Issuers Need To Know About 1: 1 Backing and Licensing (2025 Update). We’ll keep you updated on interpretive guidance releases, enforcement actions, and key compliance milestones as they happen.

The bottom line: As institutional capital pours into digital assets and policymakers seek stability without stifling progress, the GENIUS Act sets a high bar, and raises the stakes, for everyone building in this space. If you’re not already adapting your playbook for this new era of stablecoin monthly audits 2025, now’s the moment to start listening… because in crypto law as in trading, timing is everything.