The regulatory landscape for stablecoins in the United States has entered a new era with the enactment of the GENIUS Act on July 18,2025. This landmark legislation delivers a sweeping federal framework for stablecoin licensing and compliance, setting out to balance innovation with consumer protection and financial stability. As digital assets become increasingly embedded in global finance, understanding how the GENIUS Act reshapes the rules for issuers and market participants is essential.

Federal Licensing: A New Gatekeeping Standard

A core pillar of the GENIUS Act is its introduction of a federal licensing regime for payment stablecoin issuers. Any entity aiming to issue USD-backed stablecoins at scale must now secure approval from the Office of the Comptroller of the Currency (OCC), regardless of whether they are a new entrant or an established player. State-chartered issuers can continue operating under state oversight, but only until their outstanding issuance exceeds $10 billion – at which point they must transition to federal supervision.

This dual approach reflects a pragmatic compromise: it supports local innovation while ensuring that systemically significant players are subject to uniform national standards. For legal teams and compliance officers, this means navigating both state and federal requirements as their operations grow. The OCC’s role as primary regulator is expected to bring rigorous vetting processes, ongoing examinations, and elevated expectations around risk management.

Full Reserve Mandates and Transparency Requirements

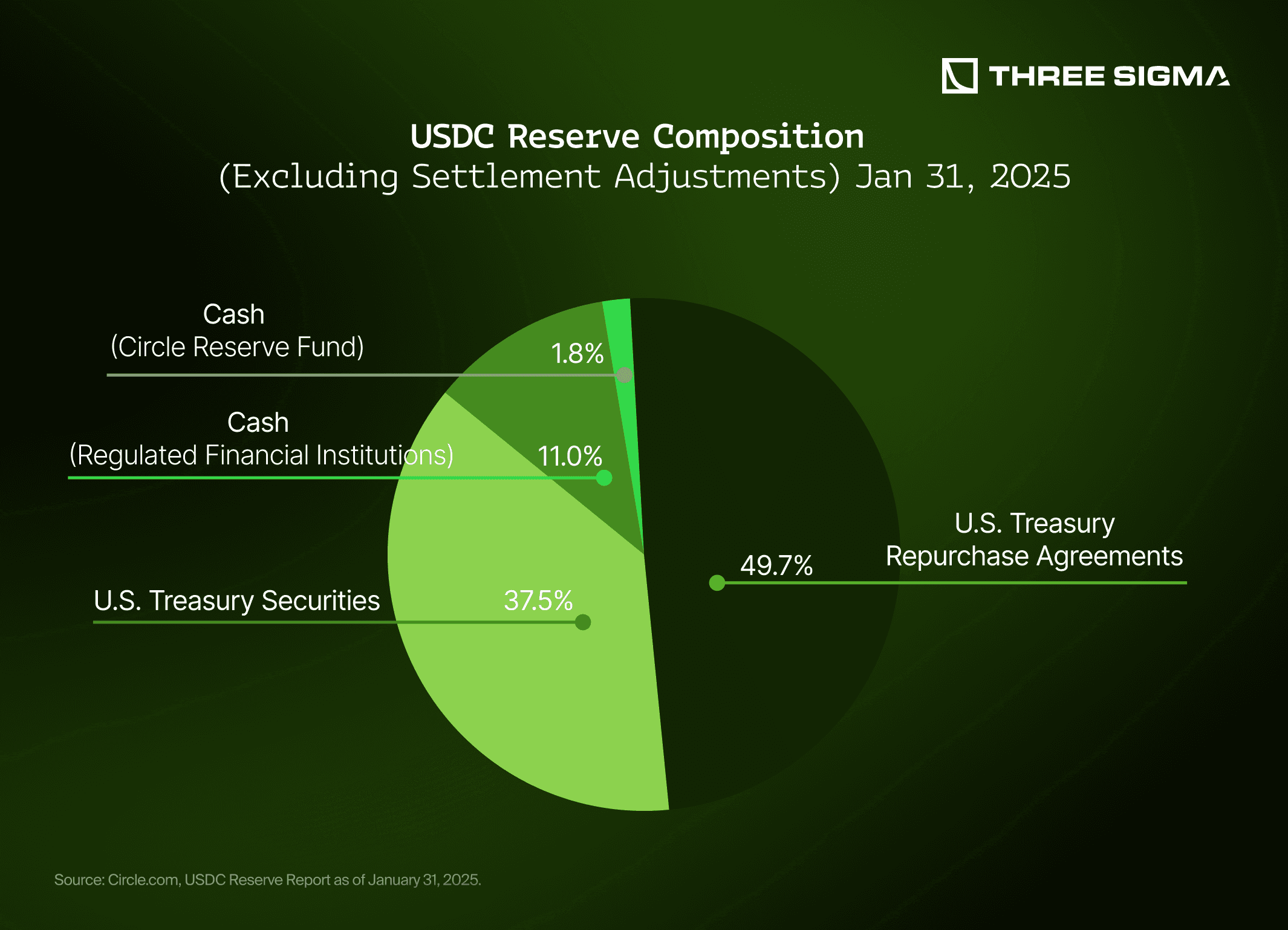

The GENIUS Act decisively addresses one of the most contentious issues in stablecoin regulation: reserve backing. All permitted payment stablecoins must be backed one-to-one by highly liquid assets – specifically U. S. dollars or short-term U. S. Treasury securities. This full-reserve requirement aims to eliminate ambiguity over redemption rights and ensure that every token in circulation is immediately redeemable at par value.

Transparency is enshrined as law rather than best practice. Issuers are obligated to publish monthly public attestations detailing reserve composition and sufficiency, alongside regular third-party audits. These measures are designed not only to foster trust among users but also to provide regulators with timely insight into systemic risks that could emerge from rapid growth or poor asset management.

For more detailed guidance on reserve requirements and compliance timelines under the new law, see GENIUS Act Explained: U. S. Stablecoin Regulations, Reserve Requirements, and Compliance in 2025.

Robust AML/CFT Compliance Obligations

The GENIUS Act places stablecoin issuers firmly within the scope of U. S. anti-money laundering (AML) law by designating them as financial institutions under the Bank Secrecy Act (BSA). This brings a suite of obligations familiar to traditional banks but novel for many crypto-native firms:

- Comprehensive AML programs, including internal controls and independent testing

- Customer identification procedures (CIP), commonly known as Know Your Customer (KYC)

- Ongoing transaction monitoring for suspicious activity

- Tight reporting obligations, including Suspicious Activity Reports (SARs) where warranted

This alignment with mainstream financial regulation underscores policymakers’ intent to close perceived gaps that could be exploited for illicit finance while supporting responsible growth in digital payments infrastructure.

Consumer Protection at the Forefront

A critical aspect often overlooked in previous frameworks is consumer protection – here, it takes center stage. Issuers must honor redemption requests at par value without delay, clearly disclose all rights and fees in plain language, and implement robust complaint resolution mechanisms. Marketing practices are also tightly regulated; deceptive advertising or misleading claims can trigger severe penalties under both consumer protection statutes and OCC enforcement authority.

This focus marks a significant shift from earlier patchwork approaches where user recourse was often unclear or inconsistent across providers.

The next section will explore how these rules apply to foreign issuers entering the U. S. , implementation timelines, consequences for non-compliance, and how these standards compare globally.

Foreign Issuers and Cross-Border Access

The GENIUS Act draws a clear line for non-U. S. stablecoin issuers seeking access to the American market. Foreign stablecoins cannot be offered, sold, or made available in the U. S. unless their issuers are headquartered in jurisdictions with regulatory frameworks deemed “comparable” by U. S. authorities and have registered with the OCC. This provision is designed to prevent regulatory arbitrage, ensuring that all stablecoins circulating in the U. S.: regardless of origin, adhere to similar standards of reserve backing, transparency, and compliance.

For global firms, this means that market entry is now contingent on both home-country regulation and U. S. approval. The bar for comparability is intentionally high, reflecting growing international consensus around full-reserve mandates and rigorous oversight. As other major economies develop their own frameworks, we are likely to see a convergence on best practices, but for now, the GENIUS Act sets one of the world’s most demanding benchmarks.

Key GENIUS Act Requirements for Foreign Stablecoin Issuers

-

Federal Licensing Required: Foreign stablecoin issuers must obtain a federal license from the Office of the Comptroller of the Currency (OCC) before offering payment stablecoins in the U.S. market.

-

Comparable Regulatory Jurisdiction: Issuers must be based in a jurisdiction with a regulatory framework comparable to the GENIUS Act to qualify for U.S. market access.

-

1:1 Reserve Backing: All payment stablecoins must be backed one-to-one by U.S. dollars or short-term U.S. Treasury securities, with monthly public attestations and regular third-party audits.

-

Anti-Money Laundering (AML) Compliance: Foreign issuers must implement robust AML and counter-terrorist financing programs in line with the U.S. Bank Secrecy Act, including customer identification and transaction monitoring.

-

Transparent Redemption Procedures: Issuers are required to honor redemption of stablecoins at par value and provide clear, plain-language disclosures of redemption rights and any associated fees.

-

Registration with U.S. Authorities: Foreign issuers must register with the OCC and comply with all federal oversight requirements to operate in the U.S.

-

Implementation Timeline: There is an 18-month transition period (until January 18, 2027) for foreign issuers to comply with all GENIUS Act requirements.

Implementation Timelines and Transition Periods

Recognizing the operational overhaul required for compliance, Congress built an 18-month transition window into the law. Existing issuers have until January 18,2027 to align their operations with the new federal standards. Meanwhile, regulators, including the OCC and Treasury, face a one-year deadline to finalize implementing rules and provide further guidance on technical issues like reserve segregation or cross-border remittances.

This phased approach gives both industry and regulators time to adapt without creating unnecessary market disruption. However, it also means that firms dragging their feet risk being shut out of the U. S. market once enforcement begins in earnest.

Consequences for Non-Compliance

The GENIUS Act features teeth as well as carrots: operating without a license, failing to maintain 1: 1 reserves, or violating AML/consumer protection rules can result in severe penalties, including fines, cease-and-desist orders, or criminal liability for willful misconduct. The OCC’s expanded enforcement powers mean that even large incumbents are not immune from scrutiny.

For industry participants weighing risk versus reward under this new regime, proactive engagement with regulators will be essential. Firms should prioritize robust compliance infrastructure from day one, not just to avoid sanctions but also to build trust with institutional partners and end users alike.

Comparison With Global Stablecoin Norms

The GENIUS Act positions the United States at the forefront of global stablecoin regulation, setting standards that are already influencing policy discussions in Europe, Asia-Pacific, and beyond. Its insistence on full-reserve backing echoes recent moves by Singapore’s MAS and proposed EU MiCA rules but goes further by mandating monthly public attestations and third-party audits.

While some critics argue that these requirements may stifle smaller innovators or push activity offshore, proponents counter that clarity breeds confidence, and ultimately attracts responsible capital flows into digital assets.

What Comes Next?

With final regulations due within a year and enforcement set for early 2027, all eyes are now on both federal agencies’ rulemaking processes and industry adaptation strategies. Will we see consolidation among issuers unable or unwilling to meet new thresholds? Could state-chartered models persist below $10 billion issuance? And how will global players respond as comparable regimes emerge abroad?

For ongoing analysis of these developments, including updates on OCC licensing trends and evolving compliance best practices, see our coverage at How the US GENIUS Act Transforms Stablecoin Compliance.