As we hit February 2026, the clock is ticking louder for stablecoin issuers in the EU. The Markets in Crypto-Assets (MiCA) regulation’s full enforcement deadline of July 1,2026, means unauthorized issuers face delisting from exchanges, frozen operations, and hefty fines. If you’re running an EMT or ART, ignoring this MiCA stablecoin deadline 2026 isn’t an option; it’s a fast track to market exclusion.

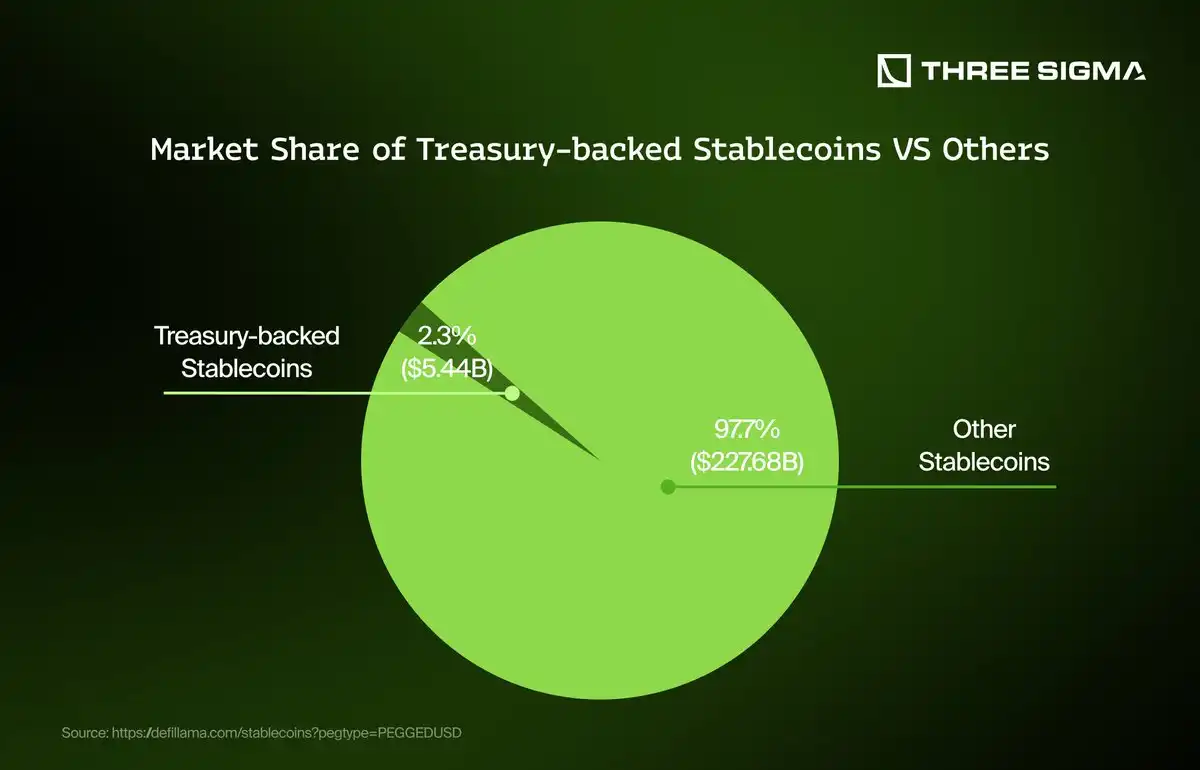

MiCA rolled out stablecoin rules back in June 2024, but the real pressure builds now. Only approved institutions can issue, backed by 1: 1 high-quality reserves. Non-compliant giants like USDT keep trading in EU markets, sparking stability worries from bodies like the European Systemic Risk Board. Yet, with just months left, many issuers scramble amid EU stablecoin licensing requirements that are tougher than expected.

Navigating Dual Licensing Hurdles Under MiCA and PSD2

The European Banking Authority dropped a bombshell: e-money token (EMT) issuers need both MiCA authorization and PSD2 compliance. This dual licensing requirement, kicking in March 2,2026, piles on capital demands and operational tweaks. Think stricter AML/KYC, liquidity rules, and oversight from national authorities. It’s not just paperwork; it’s a full rethink of your business model. I’ve seen fintechs pour resources into this, only to hit roadblocks on reserve audits or governance.

Why the overlap? MiCA treats stablecoins as crypto-assets, but EMTs double as payment instruments under PSD2. Issuers must pick a national competent authority (NCA) for MiCA but layer on payment services licensing. Smaller players feel the squeeze most, as costs skyrocket. Check our 2025 guide to stablecoin licensing for a deeper dive into prep steps.

Top 5 MiCA Licensing Risks

-

1. Dual MiCA/PSD2 Compliance: EMT issuers face dual licensing under MiCA and PSD2, per EBA clarification—effective March 2, 2026. This adds operational complexity and higher capital needs. Learn more

-

2. High Rejection Rates: As of Dec 2025, 45% of stablecoin applications rejected EU-wide. Only 16 stablecoins and 17 EMT issuers are compliant so far. Details

-

3. Varying National Deadlines: Transitional periods differ—Lithuania expired Dec 31, 2025; Netherlands July 1, 2025; Estonia June 30, 2026. Miss yours and risk shutdown.

-

4. Capital Hikes: Dual licensing ramps up capital requirements under MiCA/PSD2, hitting issuers’ finances hard amid rigorous scrutiny.

-

5. Reserve Proof Failures: Proving 1:1 high-quality reserves is mandatory; failures fuel rejections as authorities demand transparency for stability.

Rejection Rates Signal Stormy Waters Ahead

By December 2025, a staggering 45% of stablecoin applications got the boot across the EU. Only 16 stablecoins are fully MiCA-compliant, with 17 EMT issuers authorized and zero asset-referenced tokens (ARTs) greenlit as of January 2026. That’s amid 144 CASPs approved in 21 countries. Regulators aren’t messing around; they’re probing reserves, tech resilience, and conflict-of-interest policies with a fine-tooth comb.

Transitional periods add chaos. Lithuania’s ended December 31,2025, while others stretch to mid-2026. Miss your jurisdiction’s cutoff, and you’re out. This patchwork forces issuers into a compliance juggling act, especially cross-border ops. My advice? Map your exposures now; don’t wait for the EBA’s dual licensing hammer.

EU Country-Specific MiCA Stablecoin Deadlines

| Country | Deadline | Status (as of Feb 2026) |

|---|---|---|

| Netherlands | July 1, 2025 | Passed ❌ |

| Lithuania | December 31, 2025 | Expired ❌ |

| Estonia | June 30, 2026 | Upcoming ⏳ |

| Germany | July 1, 2026 | Upcoming ⏳ |

| France | TBD | Transitional ❓ |

| EU-wide | July 1, 2026 | Full Enforcement ⏰ |

Compliance Map: Who’s In, Who’s Out in 2026

Picture this map: 21 EU countries with 144 CASPs licensed, but stablecoin issuers lag badly. France and Germany lead authorizations, yet no ARTs anywhere signals caution on exotic pegs. Issuers must tailor apps to NCA quirks, Dutch AFM demands ironclad liquidity, while Estonia eyes tech innovation. Proactive chats with regulators can tip scales; I’ve guided startups through this to snag approvals others missed.

Varying deadlines mean no one-size-fits-all. Netherlands enforced early July 2025, pressuring early movers. As 2026 stablecoin regulation Europe tightens, expect exchange delistings for laggards. Tether’s eyeing options, but USDT’s EU trade persists, testing MiCA’s teeth.

Building a MiCA issuer authorization map reveals stark disparities. France boasts several approved EMTs thanks to AMF’s streamlined process, while Germany’s BaFin prioritizes robust risk management. Spain and Italy trail, with applications bogged down by localization rules. Cross-border issuers face the toughest path, needing to designate an EU entry point and satisfy multiple NCAs.

Operational Pitfalls and Cost Surges

These hurdles translate to real pain points. Dual licensing under MiCA and PSD2 demands segregated reserves, daily liquidity proofs, and enhanced redemption rights for holders. I’ve worked with teams burning through millions in audits and legal fees just to submit. Smaller issuers, eyeing euro-pegged tokens, grapple with 2% reserve fees and white-listing mandates that lock capital. Larger ones like Circle pivot faster, but even they warn of stablecoin MiCA compliance risks like sudden NCA reversals.

MiCA-Compliant Stablecoins: Authorization Status (as of February 2026)

| Stablecoin | Issuer | Countries | Status |

|---|---|---|---|

| USDC | Circle | FR/IE | ✅ Compliant |

| EURC | Circle | FR | ✅ Compliant |

| EURT | Tether | EU | ⏳ Pending |

| Stasis Euro | Stasis | EE | ✅ Compliant |

| Monerium eEUR | Monerium | IS/EE | ✅ Compliant |

Exchanges play enforcer too. Post-July 1, non-compliant tokens get the boot, slashing liquidity. Tether’s limbo status fuels speculation; will EU exchanges delist USDT en masse? Early signs point yes, with Kraken and Binance already signaling compliance scans.

Action Plan: Your Roadmap to MiCA Approval

Don’t panic, but act yesterday. Start by assessing your token type: EMTs need PSD2 overlay, ARTs demand college-of-regulators nods for references. Assemble a compliance war room with local counsel versed in your target NCA. Prioritize reserve transparency; regulators crave real-time attestations from Big Four firms.

7-Step MiCA Roadmap

-

Classify token (EMT/ART): Start by determining if your stablecoin is an e-money token (EMT) or asset-referenced token (ART). EMTs face dual MiCA and PSD2 licensing per EBA rules effective March 2, 2026.

-

Choose NCA and jurisdiction: Pick your National Competent Authority (NCA) and jurisdiction carefully—deadlines vary, like Netherlands’ July 1, 2025 or Estonia’s June 30, 2026. Lithuania’s transitional period ended Dec 31, 2025.

-

Build reserves/liquidity plan: Create a 1:1 backing plan with high-quality liquid reserves to ensure stability, as required for MiCA compliance and avoiding risks like non-compliant USDT.

-

Implement AML/KYC tech: Integrate robust AML/KYC systems meeting MiCA standards to handle customer verification and prevent illicit activities.

-

Draft whitepaper and governance: Write a detailed whitepaper covering token mechanics, risks, and a solid governance structure—key for approval amid high scrutiny.

-

Submit dual app (MiCA and PSD2): File joint applications for MiCA authorization and PSD2 e-money license. Only 17 EMT issuers authorized so far as of Jan 2026.

-

Engage in pre-approval dialogues: Kick off talks with NCAs early—45% rejection rate as of Dec 2025 means proactive chats can boost your odds before July 1, 2026 deadline.

This roadmap isn’t theory; it’s battle-tested from advising five issuers through approvals. Budget 6-12 months and €500K and for viability. Transitional grace periods buy time, but Lithuania’s expiry shows they’re no free pass. Link up with peers via industry forums for shared intel on NCA moods.

Pro tip: Euro stablecoins shine under MiCA. Regulated issuers like those partnering with Unicredit eye H2 2026 launches, blending bank-grade stability with blockchain speed.

Looking ahead, MiCA sets a global benchmark. While US GENIUS Act diverges on decentralization, EU’s rigor protects users without stifling innovation. Compliant issuers gain passporting rights across 27 states, unlocking seamless expansion. Laggards? They’ll watch from sidelines as regulated euro tokens dominate DeFi and payments.

Stake your claim now. Map jurisdictions, fortify reserves, and dialogue with authorities. The MiCA stablecoin deadline 2026 looms, but smart movers turn risk into regulated advantage.