The U. S. digital asset landscape entered a new era on July 18,2025, as the GENIUS Act became law, setting a robust federal framework for payment stablecoins. While the crypto industry has long debated the optimal balance between innovation and consumer protection, the GENIUS Act stablecoin regulation marks a decisive pivot toward mainstream legitimacy, imposing strict licensing, reserve, and compliance requirements that will reshape how issuers operate in the world’s largest economy.

Who Can Issue Stablecoins Under the GENIUS Act?

The law draws a sharp line around eligibility, restricting stablecoin issuance to three categories of entities:

- Subsidiaries of insured depository institutions (banks and credit unions with FDIC or NCUA backing)

- Nonbank financial institutions that hold state or federal licenses

- Qualified foreign issuers meeting U. S. regulatory standards

For non-financial firms aiming to enter this space, the bar is even higher: unanimous approval from the Stablecoin Certification Review Committee (SCRC) is required, and only if they pose no material risk to financial stability and adhere to stringent data use rules. This approach aims to prevent tech giants or unregulated actors from dominating digital dollar markets while aligning with global best practices on systemic risk mitigation.

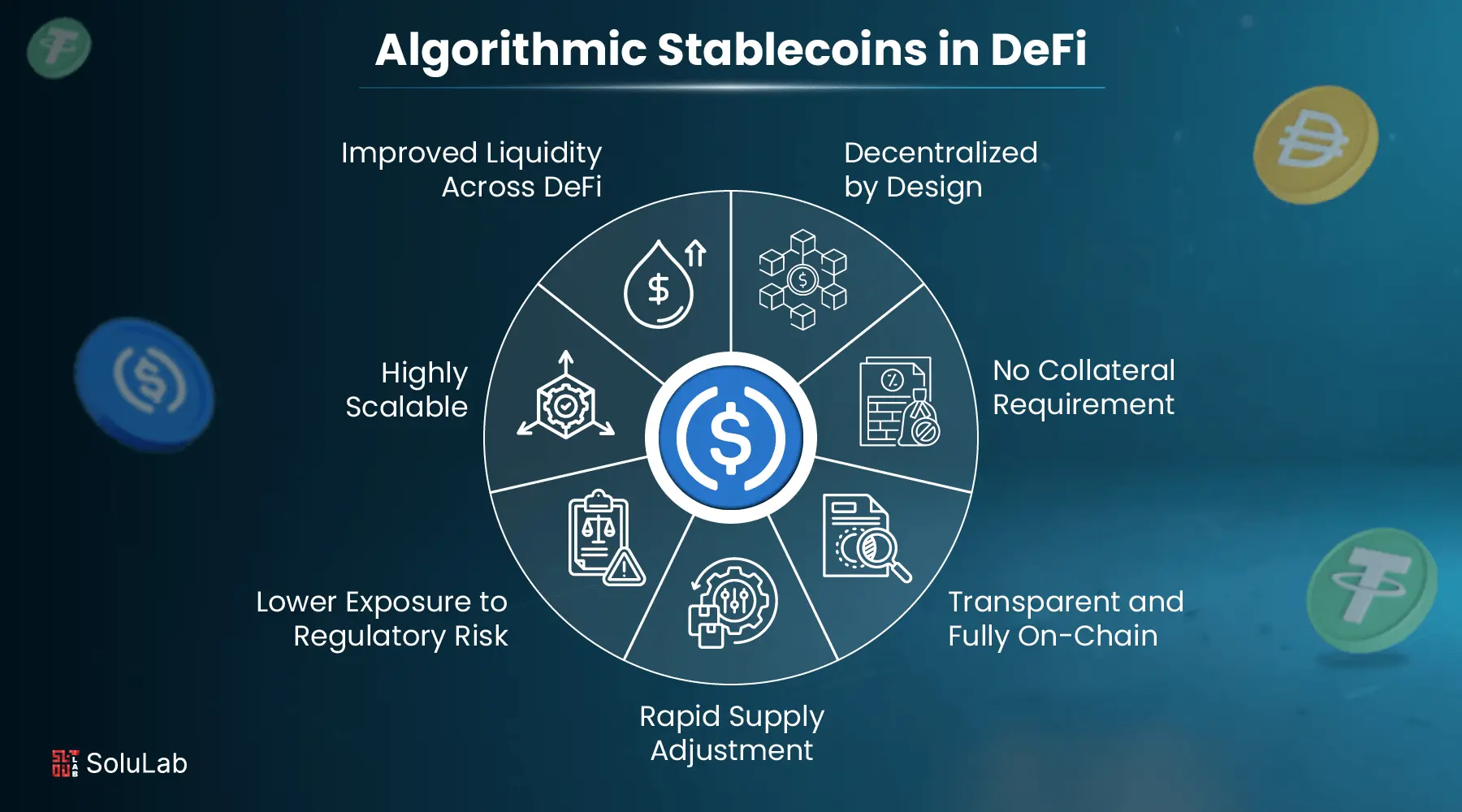

Reserve Backing: The End of Algorithmic and Unbacked Models

The GENIUS Act’s reserve requirements are arguably its most consequential feature for both compliance professionals and market participants. Every permitted payment stablecoin must be backed by reserves equal to at least one U. S. dollar per token, no exceptions, no algorithmic trickery.

Key Differences in Stablecoin Reserve Models: Pre- vs. Post-GENIUS Act

-

1. Reserve Asset Requirements: Pre-GENIUS: Issuers could back stablecoins with a mix of assets, including commercial paper, corporate bonds, and sometimes even algorithmic mechanisms. Post-GENIUS: Only highly liquid, low-risk assets are permitted—such as U.S. dollars, Treasury bills, overnight repos, demand deposits, and shares in registered government money market funds. Commercial paper and algorithmic stabilization are explicitly banned.

-

2. 1:1 Reserve Backing Mandate: Pre-GENIUS: Some issuers maintained partial or mixed reserves, and full transparency was not always required. Post-GENIUS: Every stablecoin must be backed by at least one U.S. dollar or equivalent eligible asset per token, with strict enforcement and no exceptions.

-

3. Prohibition on Interest Payments: Pre-GENIUS: Certain issuers offered interest or yield to stablecoin holders, sometimes through lending or DeFi protocols. Post-GENIUS: Issuers are forbidden from paying interest to stablecoin holders, eliminating yield-bearing stablecoins from regulated U.S. issuers.

-

4. Enhanced Reserve Transparency and Reporting: Pre-GENIUS: Disclosure practices varied widely; some issuers published irregular or unaudited reserve attestations. Post-GENIUS: Monthly public disclosures of reserve composition and circulation are mandatory, with annual audits by U.S.-registered public accounting firms for large issuers.

-

5. Priority Claims for Holders in Insolvency: Pre-GENIUS: Stablecoin holders’ rights in the event of issuer bankruptcy were often unclear or subordinate to other creditors. Post-GENIUS: Stablecoin holders now have priority claims on reserve assets, providing enhanced consumer protection in insolvency scenarios.

-

6. Issuer Eligibility and Oversight: Pre-GENIUS: A wide range of entities, including non-financial tech firms, could issue stablecoins with minimal federal oversight. Post-GENIUS: Only subsidiaries of insured depository institutions, licensed nonbank financial institutions, and qualified foreign issuers are permitted, subject to ongoing federal supervision.

Permitted reserve assets include:

- U. S. dollars and coins held at insured institutions

- Treasury bills and overnight repos

- Demand deposits

- Shares in registered government money market funds

Banned outright:

- Commercial paper (to avoid contagion from shadow banking)

- Algorithmic mechanisms (ending Terra-style risk in U. S. markets)

- The payment of interest to stablecoin holders (to preserve their non-security status)

This one-to-one reserve mandate is designed to eliminate ambiguity about redemption value, a critical step given global regulatory scrutiny after high-profile failures elsewhere. For details on how these rules compare with other major jurisdictions’ approaches, see our analysis at GENIUS Act Explained: What the 2025 U. S. Stablecoin Law Means for Compliance, Licensing, and Global Adoption.

The New Compliance Checklist for Issuers in 2025

If you’re an issuer, or advising one, the GENIUS Act introduces a rigorous set of ongoing obligations that go far beyond basic licensing:

BSA/AML and Sanctions Controls:

- KYC at onboarding and redemption for all users

- Suspicious activity monitoring aligned with Bank Secrecy Act protocols

- The ability to freeze or burn tokens in response to lawful orders (a controversial but globally trending requirement)

Transparency and Reporting:

- Monthly public disclosures on circulating supply and reserve composition

- Annual audits by U. S. -registered public accounting firms if outstanding tokens exceed $10 billion

This regime may feel familiar to those tracking MiCA in Europe, but it’s more prescriptive on reserves than even its EU counterpart. For a deeper dive into what this means for your business model or cross-border operations, visit our guide: How the New US Stablecoin Law Changes Compliance for Merchants and Issuers.

Beyond the technical compliance checklist, the GENIUS Act stablecoin regulation is reshaping market conduct and consumer protection standards across the digital dollar ecosystem. Issuers are now subject to strict marketing rules designed to prevent deceptive practices, with explicit bans on any branding that could imply government sponsorship or guarantee. This provision is a direct response to past controversies, where ambiguous language blurred lines between private and public money.

Consumer Protections and Legal Safeguards

Perhaps most significant for end users, the Act grants priority claims on reserve assets to stablecoin holders in the event of an issuer insolvency. This means that, unlike traditional bank depositors or crypto exchange customers, stablecoin holders move to the front of the line, an unprecedented protection in U. S. financial law. The explicit exclusion of payment stablecoins from securities classification further reduces legal ambiguity for both issuers and users.

Legal analysts have noted that these steps align U. S. policy with emerging global norms while also setting a new bar for transparency and user rights. For businesses considering entry or expansion in this space, understanding these nuances is non-negotiable, especially as cross-border stablecoin payments become more common and regulatory harmonization efforts accelerate worldwide.

Impact on Cross-Border Payments and Global Adoption

The GENIUS Act does not just create a domestic playbook, it signals America’s intent to shape international stablecoin standards. By mandating robust reserve backing and clear compliance rails, U. S. -issued payment stablecoins are positioned to gain credibility as trusted settlement instruments for cross-border commerce. This could accelerate global adoption but will also require issuers to navigate overlapping regulatory regimes abroad.

For companies seeking global reach, interoperability with foreign licensing frameworks and real-time auditability will be key differentiators going forward. The Act’s ban on algorithmic stabilization effectively sidelines some experimental models but gives institutional players clarity, and potentially a first-mover advantage, as regulated dollar-backed tokens become a new standard for international settlements.

What Should Issuers Do Now?

Action items:

- Review entity structure: Only certain firms can qualify as permitted issuers, evaluate your eligibility now.

- Upgrade compliance systems: Prepare for enhanced KYC/AML monitoring and token freezing capabilities.

- Audit reserves: Move assets into permitted categories; ensure full one-to-one backing at all times.

- Monitor reporting deadlines: Set up monthly disclosure workflows and arrange annual third-party audits if you’re above the $10 billion threshold.

The coming months will see further clarifications from regulators as rulemaking proceeds. Stakeholders should expect additional guidance around technical implementation, especially regarding wallet providers and secondary market obligations. For ongoing updates on how these requirements are unfolding, and what they mean for your business, see our dedicated coverage at What U. S. Stablecoin Issuers Need to Know About New Compliance Rules.

Final Thoughts: The Road Ahead

The GENIUS Act marks a watershed moment for digital dollar regulation, balancing innovation with systemic safeguards in ways that few other jurisdictions have attempted at scale. While some industry voices warn of stifling smaller entrants or reducing flexibility in product design, others argue this clarity will unlock institutional adoption by removing existential legal risks surrounding redemption value and consumer rights.

The next phase will test whether this regulatory architecture can keep pace with technology, particularly as programmable money, DeFi integrations, and cross-chain settlement networks continue to evolve globally. For now, one thing is certain: compliance teams must move quickly to adapt or risk being left behind as America’s stablecoin regime becomes a global benchmark.