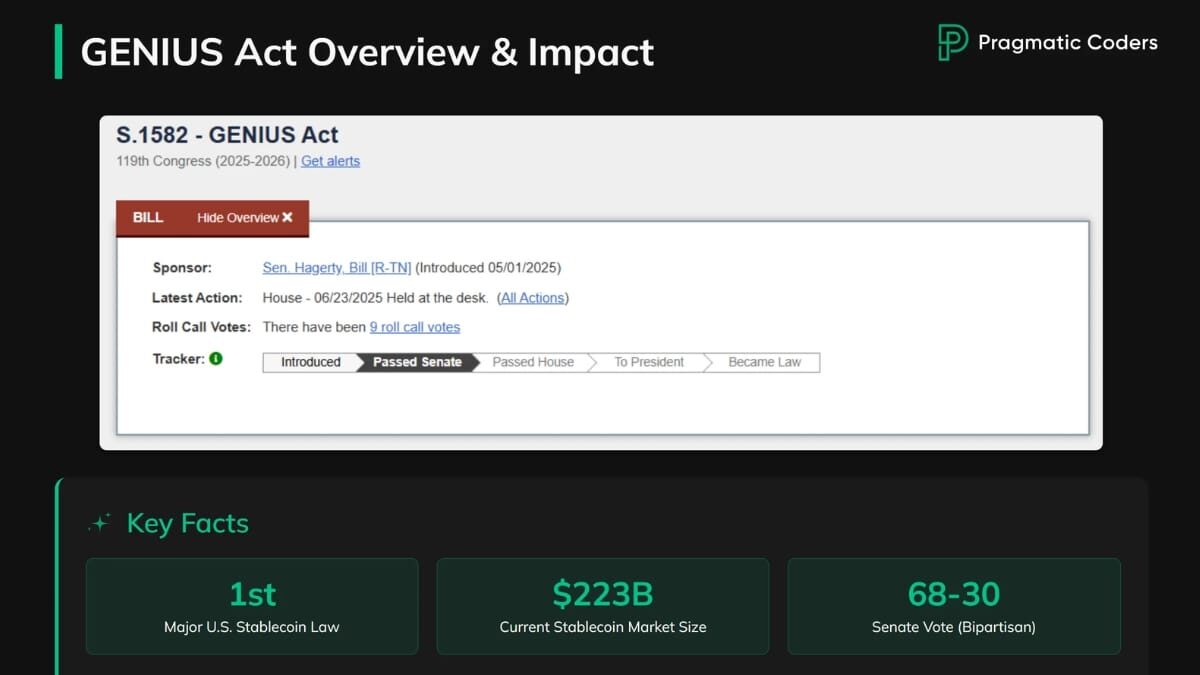

The landscape for stablecoin regulation in the United States fundamentally shifted with the passage of the Guiding and Establishing National Innovation for U. S. Stablecoins Act (GENIUS Act) on July 18,2025. This landmark law shapes how digital dollar-backed assets are issued, managed, and adopted by businesses, while setting an ambitious standard for global stablecoin compliance. For legal professionals, crypto businesses, and compliance teams, understanding the GENIUS Act is now essential for navigating the evolving regulatory environment and harnessing new opportunities in digital finance.

GENIUS Act Stablecoin Regulation: Key Provisions and Industry Impact

The GENIUS Act introduces a comprehensive federal framework for stablecoins, aiming to balance innovation with consumer protection and financial stability. Its most impactful features include:

- Issuer Eligibility: Only federally or state-approved entities can issue payment stablecoins. This group includes subsidiaries of insured depository institutions regulated by a federal banking agency, nonbank institutions under the Office of the Comptroller of the Currency (OCC), and state-chartered entities meeting federal standards.

- Reserve Requirements: Every stablecoin must be backed at least one-to-one by reserves such as U. S. dollars, short-term Treasury bills, or other high-quality liquid assets. This ensures that users can redeem stablecoins at face value at any time.

- Prohibition on Interest Payments: Issuers are barred from offering any yield or interest to stablecoin holders, sharply distinguishing regulated stablecoins from DeFi yield products.

- AML and KYC Compliance: Robust anti-money laundering (AML) and know-your-customer (KYC) procedures are mandatory, including identity verification at issuance and redemption, ongoing monitoring, and collaboration with regulated custodians.

- Consumer Protection and Transparency: Issuers must clearly outline redemption procedures and publish regular, independently audited reports on outstanding stablecoins and reserve composition.

- Regulatory Oversight: Issuers with more than $10 billion in circulation fall under federal OCC supervision, while smaller issuers may opt for state regulation if their state regime aligns with federal standards.

These requirements are designed to foster trust, reduce systemic risk, and provide a clear legal pathway for both established financial institutions and innovative fintechs to participate in the stablecoin market. For a detailed breakdown of compliance and licensing requirements, see this guide.

2025 U. S. Stablecoin Law: Compliance Requirements for Issuers and Businesses

Compliance under the GENIUS Act is rigorous, reflecting the government’s intent to integrate stablecoins into the mainstream financial system while minimizing risks. Businesses and issuers must:

- Maintain 1: 1 Reserve Backing: Stablecoins must be fully backed by permitted assets at all times. This is critical for user confidence and regulatory acceptance.

- Implement Robust AML/KYC Programs: Issuers must collect and verify customer identities, monitor transactions for suspicious activity, and report as required under federal law.

- Undergo Regular Audits: Financial statements and reserve attestations must be certified by executives and examined by registered public accounting firms, with results disclosed to the public.

- Disclose Redemption Procedures: Consumers must have transparent information on how to redeem stablecoins for U. S. dollars or other assets.

These requirements apply not just to issuers but also to businesses leveraging stablecoins for payments, remittances, or treasury management. Failure to comply can result in significant penalties and loss of market access.

Market Confidence and the Role of Regulatory Clarity

The GENIUS Act’s clear rules are already boosting confidence among both consumers and institutional players. Stablecoin adoption in business-to-business (B2B) settlements, cross-border payments, and digital commerce is expected to accelerate as regulatory uncertainty fades. The law’s dual oversight model – federal for large issuers, state for smaller ones – provides flexibility while ensuring a high compliance baseline nationwide. For more on how these changes affect merchant adoption and DeFi platforms, read this analysis.

Tether (USDT) Price Prediction 2026-2031

USDT Price Outlook Under the GENIUS Act Regulatory Framework (2025-2031)

| Year | Minimum Price | Average Price | Maximum Price | % Change (Avg) YoY | Market Scenario Insights |

|---|---|---|---|---|---|

| 2026 | $0.98 | $1.00 | $1.01 | 0% | GENIUS Act ensures robust 1:1 backing; price stability expected except for minor deviations during high volatility events. |

| 2027 | $0.98 | $1.00 | $1.01 | 0% | Continued regulatory compliance and growing business adoption support stable peg; risk of minor depegs during market stress. |

| 2028 | $0.97 | $1.00 | $1.02 | 0% | Increased global usage and cross-border payments could cause brief premium in emerging markets, but peg remains strong. |

| 2029 | $0.97 | $1.00 | $1.02 | 0% | Potential technological advancements (e.g., faster settlement) and competition from CBDCs; minor fluctuations possible. |

| 2030 | $0.96 | $1.00 | $1.03 | 0% | If global stablecoin regulation diverges, slight volatility could emerge, but U.S. framework keeps price close to $1.00. |

| 2031 | $0.96 | $1.00 | $1.03 | 0% | USDT remains the dominant dollar stablecoin; extreme black swan events could test the peg, but compliance and reserves provide strong defense. |

Price Prediction Summary

Tether (USDT) is expected to maintain its dollar peg closely from 2026 through 2031 under the GENIUS Act framework. Regulatory clarity, strict reserve requirements, and robust compliance measures ensure high price stability, with only minor deviations likely during market stress or global financial events. Average price is projected to remain at $1.00, with minimums and maximums reflecting rare, short-lived deviations.

Key Factors Affecting Tether Price

- GENIUS Act reserve and compliance requirements ensure 1:1 USD backing.

- Prohibition on paying interest reduces risk of speculative runs.

- Stringent AML/KYC rules reduce regulatory risk and legal uncertainty.

- Increased institutional adoption and business use drive demand and liquidity.

- Potential global regulatory divergence and competition from CBDCs could introduce minor volatility.

- Market stress events (e.g., major exchange failures, geopolitical crises) may cause brief depegs but are likely to be quickly resolved due to transparency and reserves.

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Stablecoin Business Adoption in 2025: Opportunities and Challenges

With the GENIUS Act in place, businesses face both new opportunities and challenges. Regulatory certainty is unlocking mainstream adoption of stablecoins for payroll, remittances, and supply chain payments. At the same time, operational costs are rising as companies invest in compliance infrastructure and regular audits. Importantly, the prohibition on non-financial firms issuing stablecoins without special approval is narrowing the competitive field, favoring licensed banks and fintechs over big tech entrants.

As of October 2025, Polygon Bridged USDT (Polygon) trades at $1.00, reflecting continued market confidence in dollar-backed stablecoins under the new regulatory regime. The absence of price volatility underscores the effectiveness of the Act’s reserve requirements and transparency mandates.

For businesses evaluating stablecoin integration, understanding the GENIUS Act’s nuanced compliance requirements is now a prerequisite for strategic planning. The law’s impact is especially pronounced in sectors like cross-border trade, where stablecoins offer instant settlement and reduced transaction costs compared to legacy payment rails. However, the compliance burden, particularly around AML/KYC and reserve attestations, means that only well-capitalized, compliance-focused firms will thrive in this new environment.

How the GENIUS Act Shapes International Stablecoin Policy

Beyond U. S. borders, the GENIUS Act is already influencing global regulatory conversations. Jurisdictions aiming to maintain access to U. S. markets or USD-backed stablecoins are under pressure to adopt comparable regulatory standards. This trend is particularly visible in Europe and Asia, where regulators are reassessing their frameworks to avoid being deemed ‘non-comparable’ and potentially excluded from U. S. -issued stablecoin ecosystems.

Yet, the Act’s focus on dollar-backing and U. S. -centric oversight has sparked debate about the potential for dollarization of international payments, with some foreign regulators voicing concerns over monetary sovereignty and financial stability. These cross-border implications underscore the importance of ongoing dialogue between U. S. authorities and global partners as the stablecoin market matures. For a deeper dive into international impacts and compliance harmonization, see this resource.

Top 5 Compliance Actions Under the GENIUS Act

-

1. Verify Stablecoin Issuer EligibilityEnsure your business partners only with federally or state-approved stablecoin issuers—such as subsidiaries of insured depository institutions, OCC-supervised nonbanks, or state-chartered entities with equivalent standards. This is a core requirement under the GENIUS Act.

-

2. Maintain One-to-One Reserve BackingAdopt processes to confirm that all stablecoins used or issued by your business are fully backed by permitted reserves (U.S. dollars, short-term Treasury bills, or high-quality liquid assets) on a one-to-one basis, as mandated by the Act.

-

3. Implement Robust AML/KYC ProceduresIntegrate anti-money laundering (AML) and know your customer (KYC) protocols into your stablecoin operations. This includes verifying customer identities at issuance and redemption, ongoing monitoring, and collaborating with regulated custodians.

-

4. Establish Transparent Consumer DisclosuresProvide clear disclosures on stablecoin redemption, reserve composition, and periodic reports certified by executives and audited by registered public accounting firms, as required for consumer protection.

-

5. Prepare for Regulatory Oversight and AuditsSet up internal controls and documentation to facilitate federal or state regulatory oversight. Businesses dealing with over $10 billion in stablecoins must comply with OCC supervision, while smaller issuers should ensure state oversight aligns with federal standards.

What Issuers and Enterprises Need to Watch Next

Looking forward, several regulatory and market developments will shape the stablecoin landscape:

- Ongoing Regulatory Guidance: The OCC and state regulators are expected to release further interpretive guidance on permissible activities, reporting standards, and cross-border use cases.

- Enforcement Actions: Early enforcement against non-compliant issuers will set precedents for how strictly the Act is applied and may influence business risk assessments.

- Technological Standards: As stablecoin infrastructure evolves, interoperability and security requirements will become central to both compliance and market adoption.

The GENIUS Act’s dual oversight model also means that state-level innovations (such as sandbox programs or bespoke licensing) could drive experimentation, provided they remain aligned with federal standards. Enterprises should closely monitor both federal and state developments to stay ahead of compliance risks and capitalize on emerging opportunities.

Preparing for the Future: Compliance Best Practices

To navigate the evolving regulatory terrain, businesses should prioritize the following:

- Establish clear internal controls for reserve management and reporting.

- Invest in advanced AML/KYC technology to streamline customer onboarding and transaction monitoring.

- Engage with legal counsel experienced in digital asset regulation for proactive compliance reviews.

- Monitor regulatory updates from both federal and state agencies.

- Foster transparent communication with customers about redemption rights and audit outcomes.

The GENIUS Act sets a high bar, one that rewards diligent preparation, investment in compliance infrastructure, and a willingness to adapt as new guidance emerges. For comprehensive guidance on licensing, reserve management, and issuer eligibility under the Act, visit this compliance update.

The GENIUS Act has established a new era for U. S. stablecoin regulation, one defined by clarity, strict oversight, and global influence. As Polygon Bridged USDT (Polygon) remains steady at $1.00, businesses can move forward with greater confidence, knowing that transparent rules now govern the path from digital asset innovation to mainstream financial adoption.