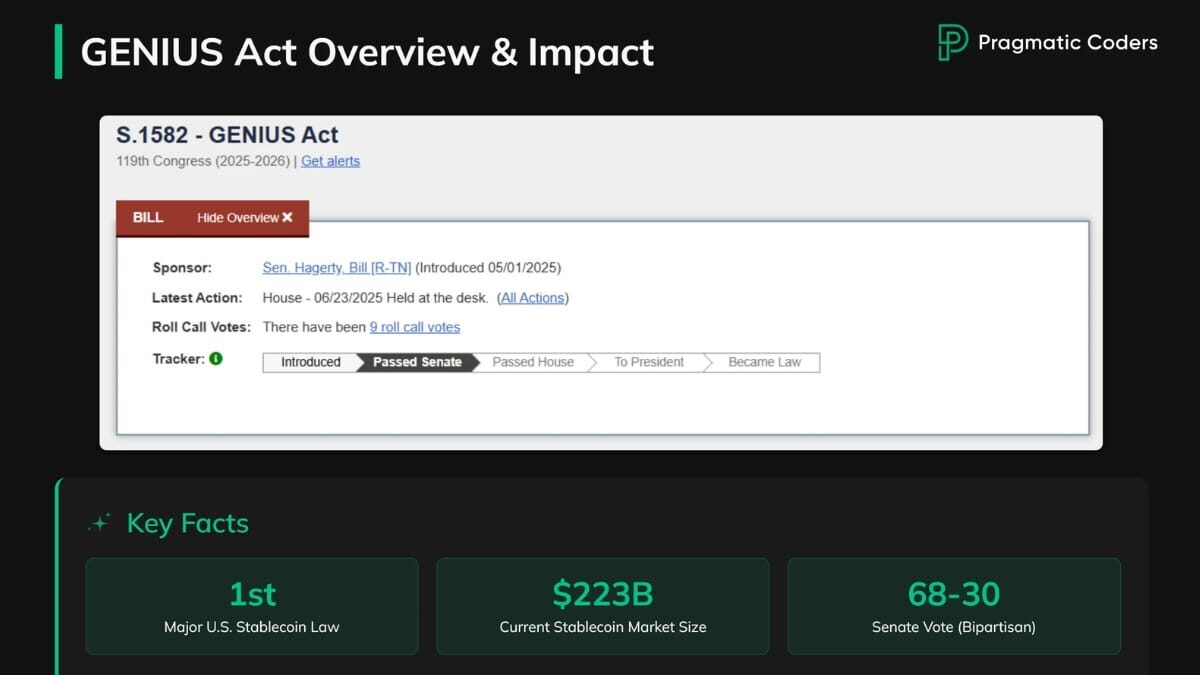

The landscape for stablecoin regulation in the United States has shifted dramatically with the enactment of the GENIUS Act in July 2025. This legislation, officially named the Guiding and Establishing National Innovation for U. S. Stablecoins (GENIUS) Act, marks a pivotal moment for digital asset compliance, licensing, and cross-border adoption. For legal professionals and crypto industry participants, understanding the nuances of this law is essential to navigating the new regulatory frontier.

Redefining Stablecoin Issuance: Who Can Operate Under the GENIUS Act?

The GENIUS Act introduces a clear distinction between permitted payment stablecoin issuers and other market participants. Only three categories of entities are now authorized to issue payment stablecoins in the U. S.:

- Subsidiaries of insured depository institutions

- Nonbank institutions supervised by the Office of the Comptroller of the Currency (OCC)

- State-chartered entities that meet rigorous federal standards

This federal preemption means that state-level licensing alone is not sufficient unless an issuer also adheres to federally mandated standards. Non-financial public companies face an even higher bar: they are generally excluded from issuing stablecoins unless unanimously approved by the Stablecoin Certification Review Committee (SCRC). This restriction is designed to prevent tech giants or large non-financial conglomerates from dominating digital payments without robust oversight.

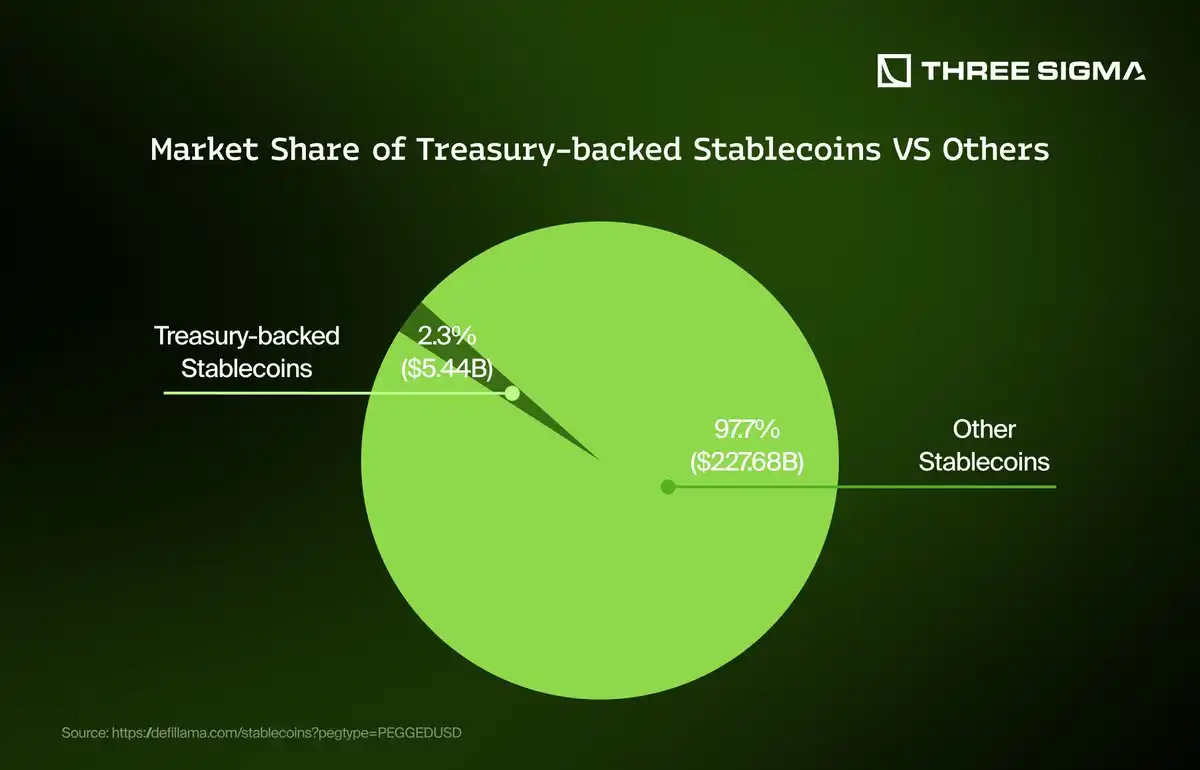

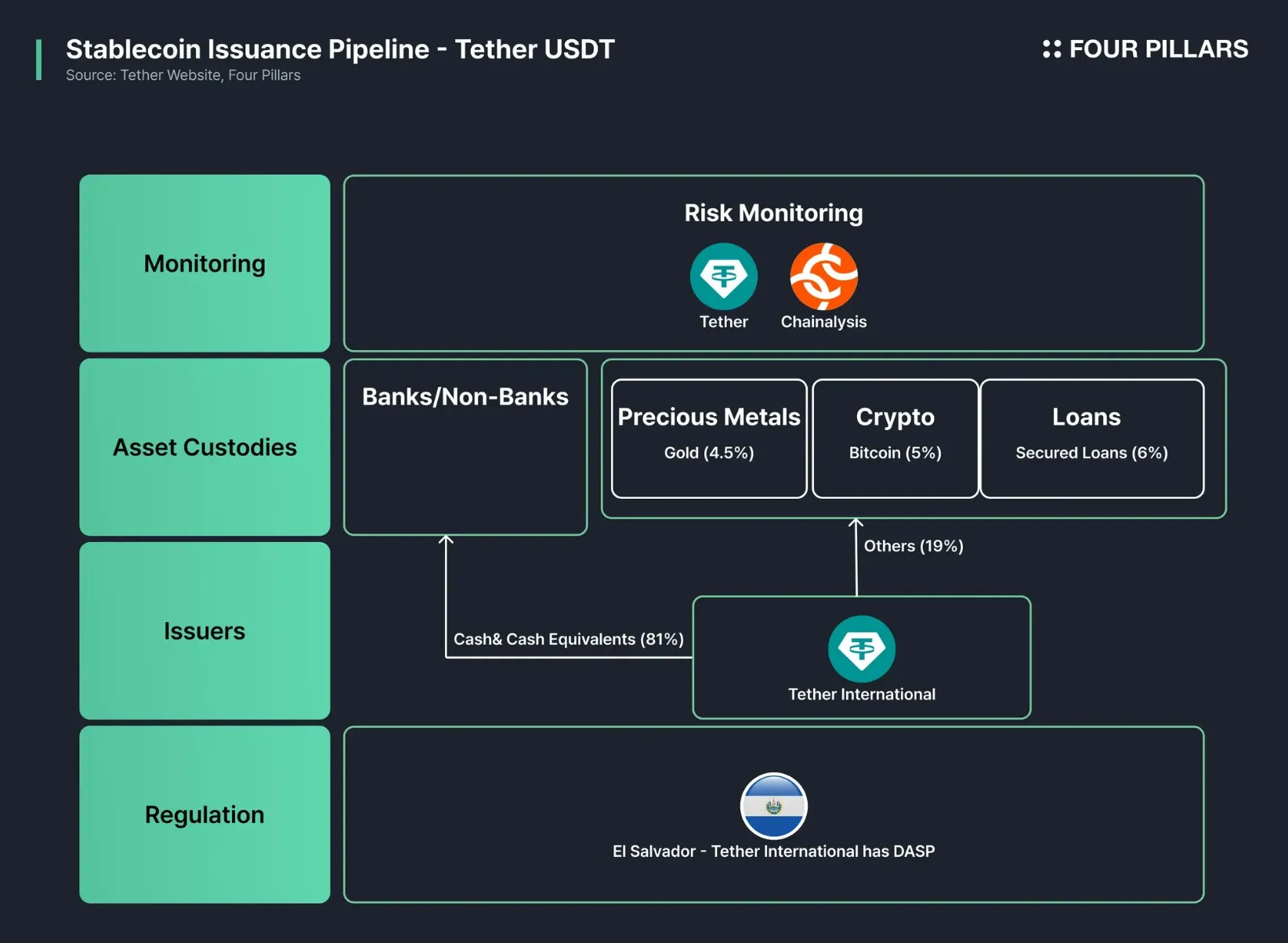

The New Gold Standard: Reserve Backing and Transparency

A cornerstone of the GENIUS Act is its uncompromising approach to reserve management. Every payment stablecoin must be backed on a one-to-one basis with highly liquid assets such as U. S. dollars or Treasury bills. This rule aims to eliminate ambiguity around stablecoin solvency and protect consumers from unexpected losses.

Transparency is no longer optional; it’s mandatory. Issuers are required to publish monthly public disclosures detailing both:

- The total quantity of outstanding stablecoins

- The exact composition and location of their reserve assets

If an issuer’s circulation exceeds $10 billion, annual independent audits become obligatory, subjecting these firms to enhanced scrutiny by federal regulators.

Key Compliance Steps Under the GENIUS Act (2025)

-

Obtain Federal or State Issuer License: Only entities that are subsidiaries of insured depository institutions, OCC-supervised nonbanks, or state-chartered institutions meeting federal standards may issue payment stablecoins. Securing the appropriate license is the foundational compliance step.

-

Maintain 1:1 Reserve Backing: Issuers must hold reserves equal to the value of all outstanding stablecoins, backed by liquid assets such as U.S. dollars and Treasury bills, ensuring full redemption capability at all times.

-

Implement Robust AML and Sanctions Compliance Programs: As financial institutions under the Bank Secrecy Act, issuers must establish comprehensive anti-money laundering and sanctions screening procedures, including customer due diligence and suspicious activity monitoring.

-

Provide Monthly Public Disclosures and Annual Audits: Issuers are required to publish monthly reports detailing the quantity of stablecoins in circulation and the composition of reserves. Those with over $10 billion in circulation must undergo annual independent audits and enhanced federal oversight.

-

Adhere to Restrictions on Non-Financial Issuers: Non-financial public companies are generally prohibited from issuing stablecoins unless they receive unanimous approval from the Stablecoin Certification Review Committee (SCRC).

This shift toward transparency aligns with global calls for greater accountability in digital finance, giving both users and regulators insight into market stability at any given time.

Compliance Isn’t Optional: Licensing Requirements and AML Mandates

The GENIUS Act transforms compliance from a patchwork process into a standardized national regime. To operate legally, every issuer must obtain either a federal or qualifying state license, demonstrating strict adherence to capital requirements, liquidity ratios, risk management protocols, and ongoing disclosure obligations.

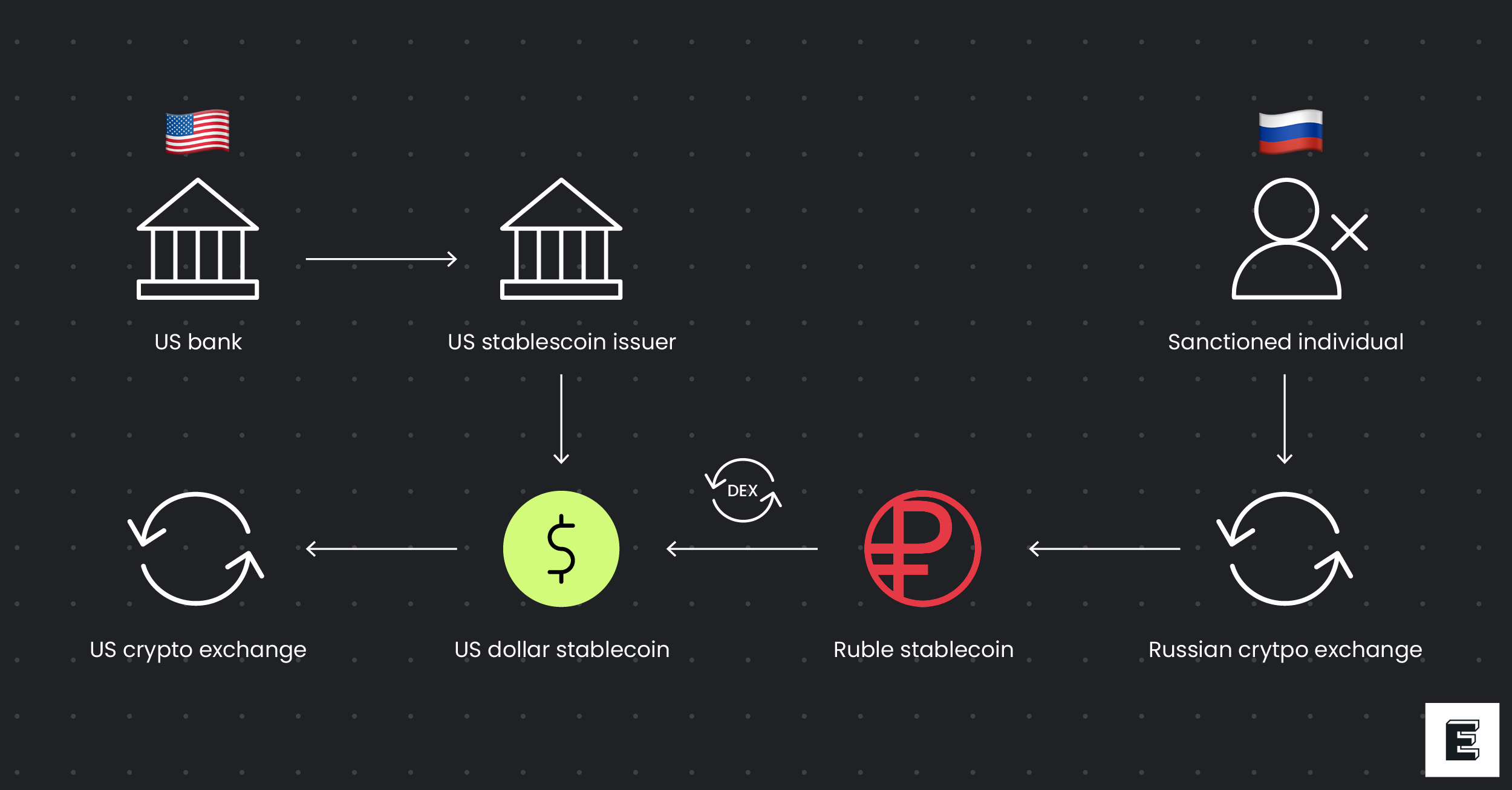

Crucially, all permitted issuers are now classified as financial institutions under the Bank Secrecy Act (BSA). This brings robust anti-money laundering (AML) and sanctions screening programs squarely into focus, failure to comply can result in severe penalties or loss of operating privileges within the U. S. market.

If you’re seeking a detailed breakdown on how these rules affect issuers’ day-to-day operations, including licensing pathways, see our guide on GENIUS Act compliance essentials.

Impact on Global Adoption and Market Growth Forecasts

The ripples from this legislation extend far beyond American borders. By establishing rigorous standards for reserve backing and transparency, the U. S. hopes to set a global benchmark for digital asset regulation. However, some international observers warn that this could accelerate dollarization worldwide or disrupt local monetary policies, concerns echoed by major financial institutions like Amundi.

On the market front, J. P. Morgan has revised its growth forecasts downward in response to these regulations; it now predicts that total stablecoin supply will reach $500 billion by 2028, a stark contrast to previous multi-trillion dollar estimates.

This recalibration illustrates both the promise and the limitations of the GENIUS Act: while regulatory clarity can unlock mainstream adoption, it also places firm boundaries on who can participate and how quickly the market can expand. For many industry players, the new compliance costs and licensing hurdles are a double-edged sword, ushering in institutional confidence but potentially crowding out smaller innovators.

Cross-Border Payments and Merchant Adoption: A New Playing Field

For cross-border stablecoin payments, the GENIUS Act offers both reassurance and friction. Merchants and payment processors now have a clear legal pathway to integrate U. S. -issued stablecoins, knowing that assets are fully backed and issuers are subject to ongoing audits. This could spur wider merchant adoption, particularly among global e-commerce platforms seeking fast, transparent settlement in U. S. dollars.

However, increased regulatory scrutiny may complicate onboarding for international partners. Foreign exchanges or fintechs wishing to support U. S. -regulated stablecoins must ensure their own compliance programs meet American AML standards, a challenge for firms in less regulated jurisdictions.

5 Ways the GENIUS Act Transforms Cross-Border Stablecoin Payments

-

1. Federal Licensing Streamlines Global AccessThe GENIUS Act requires stablecoin issuers to obtain federal or state licenses, creating a standardized entry point for cross-border payment providers. This unified framework reduces regulatory fragmentation, making it easier for international businesses to interact with U.S.-issued stablecoins.

-

2. 1:1 Reserve Backing Enhances Trust and LiquidityIssuers must maintain a 1:1 reserve in liquid assets (such as U.S. dollars and Treasury bills), ensuring that every stablecoin is fully backed. This requirement boosts confidence among global users and counterparties, facilitating smoother and more reliable cross-border transactions.

-

3. Mandatory Transparency and Audits Increase ReliabilityMonthly public disclosures and annual audits for large issuers provide unprecedented transparency into stablecoin reserves and circulation. This openness reassures international partners and regulators, making U.S.-issued stablecoins more attractive for cross-border payments.

-

4. Robust AML Compliance Aligns with Global StandardsBy classifying stablecoin issuers as financial institutions under the Bank Secrecy Act, the GENIUS Act enforces stringent anti-money laundering (AML) and sanctions compliance. This alignment with international norms reduces friction for cross-border transfers and helps prevent illicit activity.

-

5. Federal Preemption Simplifies Multi-State OperationsThe Act preempts conflicting state laws for permitted issuers, allowing them to operate across all U.S. states under a single regulatory regime. This consistency benefits global payment networks by reducing legal uncertainty and operational complexity when handling U.S.-based stablecoins.

As a result, we may see a bifurcation between compliant, institutionally-backed coins favored by major merchants and more loosely regulated alternatives serving niche or offshore markets.

Practical Steps for Issuers: Meeting 2025’s Compliance Deadlines

The rollout of the GENIUS Act includes transitional provisions but little room for error. Issuers already operating in the U. S. must either secure a federal license or demonstrate that their state charter aligns with new federal standards before continuing operations. Key deadlines loom for reserve attestations, implementation of AML programs, and public reporting requirements.

Legal teams should prioritize:

- Gap analysis between current practices and GENIUS standards

- Engagement with regulators to clarify state-federal overlap

- Investment in audit infrastructure for timely disclosures

- Staff training on enhanced AML protocols

If your organization is unsure where to begin, our step-by-step guide on new licensing, reserve, and audit requirements under the GENIUS Act provides actionable insights.

Looking Ahead: The U. S. as a Global Stablecoin Standard Setter?

The full effects of the 2025 US stablecoin law will play out over years rather than months. As other jurisdictions, from Hong Kong to Europe, develop their own frameworks, global harmonization remains uncertain. Yet by mandating strict reserve rules, transparency through monthly disclosures, and robust AML compliance at scale, the United States has positioned itself as a reference point for responsible digital asset issuance.

The challenge now lies in balancing security with innovation: ensuring consumer protection without stifling competition or excluding new entrants from underserved regions. For legal professionals advising clients or industry leaders plotting expansion strategies, staying current with evolving interpretations is essential.

The bottom line? The GENIUS Act marks an inflection point for digital finance, one that rewards those who treat compliance as a core pillar of market strategy rather than an afterthought. As always in this sector: knowledge is your best investment.