Stablecoin compliance is entering a new era in 2025, thanks to the sweeping changes brought by the GENIUS Act. If you’re planning to launch or operate a stablecoin, building a robust compliance program is no longer optional – it’s your ticket to market access and consumer trust. With federal and state regulators rolling out detailed requirements around licensing, reserves, user protections, and anti-money laundering (AML) controls, the bar has never been higher. Let’s walk through the essential steps every issuer needs to follow to stay ahead of the regulatory curve this year.

Step 1: Assess and Map Regulatory Obligations Under the GENIUS Act and State Laws

Your first move should be a comprehensive assessment of all applicable rules. The GENIUS Act sets out federal licensing for most issuers, with oversight from the Office of the Comptroller of the Currency (OCC). However, if your outstanding stablecoins total $10 billion or less, you might qualify for state-level regulation – but only if your state’s framework matches federal standards. This dual-track system means mapping both federal and relevant state requirements is critical before you even start coding smart contracts or onboarding users.

Key questions at this stage include:

- Are you required to apply for a federal license, or does your business model fit within state-based oversight?

- What are the timelines for application submissions and approvals?

- How do cross-border activities impact your obligations?

This regulatory mapping exercise forms the backbone of your entire compliance strategy – get it right from day one.

Step 2: Develop a Comprehensive Risk-Based AML/KYC Framework for Stablecoin Users

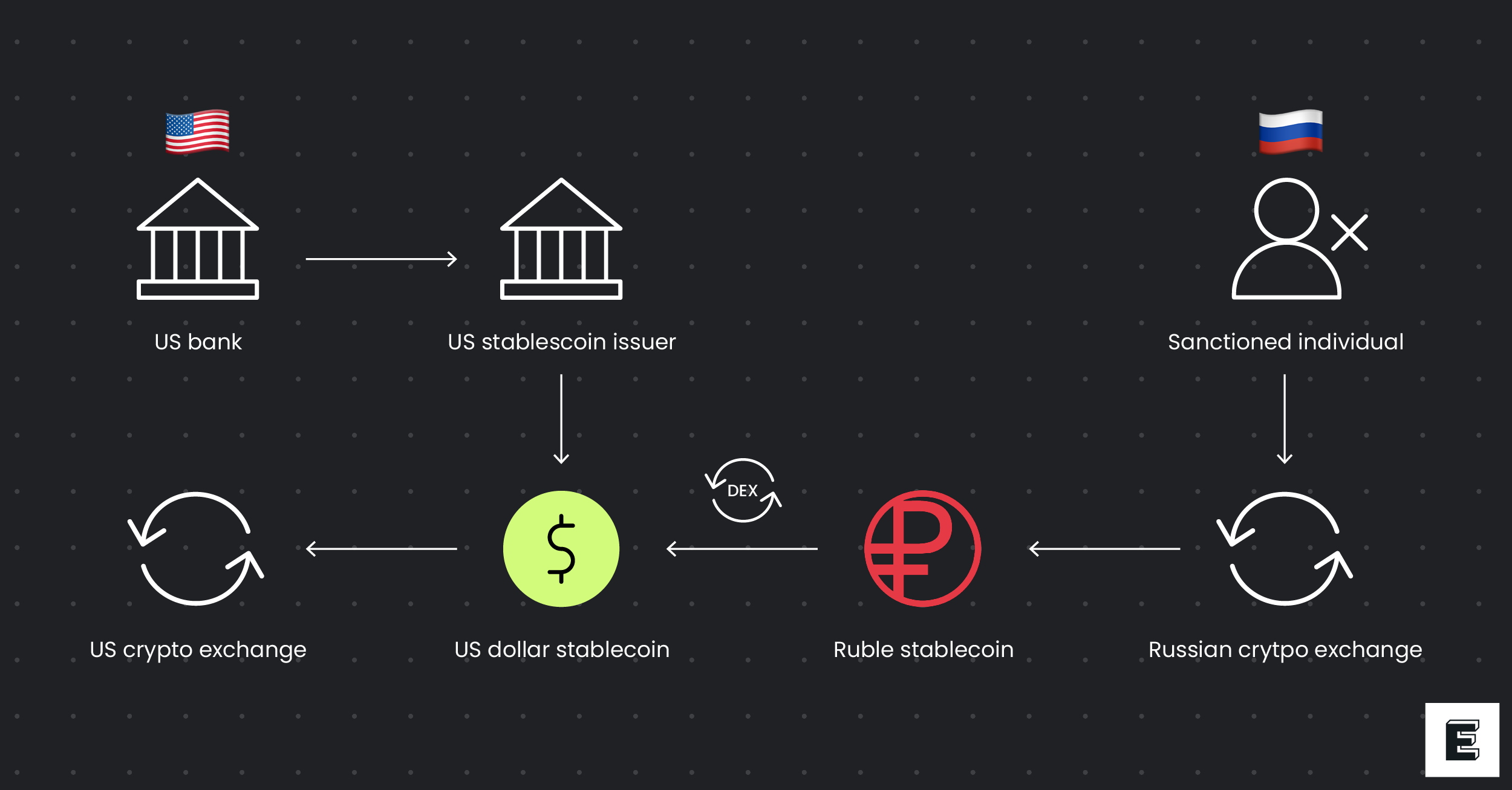

The GENIUS Act makes it clear: payment stablecoins must have ironclad AML programs in place. That means going beyond check-the-box identity verification. You’ll need a risk-based approach tailored to digital asset users, including enhanced due diligence for higher-risk profiles and automated transaction monitoring that can spot suspicious patterns in real time.

Your AML/KYC framework should address:

- User onboarding: Collecting identity documents with advanced liveness checks

- Ongoing monitoring: Detecting unusual activity across blockchain addresses

- Sanctions screening: Real-time checks against OFAC and global lists

- SAR filing: Procedures for reporting suspicious activity under Bank Secrecy Act standards

If you’re operating internationally, don’t forget local KYC requirements in each jurisdiction where users reside. Privacy laws can add another layer of complexity here. For more on how KYC frameworks are evolving in crypto, see recent coverage at KYC Chain.

Federal vs. State Stablecoin Compliance: Key Steps Compared

-

Assess and Map Regulatory Obligations Under the GENIUS Act and State LawsBegin by identifying whether your stablecoin issuance falls under federal oversight (GENIUS Act) or qualifies for state-level regulation (for issuers with ≤$10 billion outstanding). Federal compliance requires licensing through the Office of the Comptroller of the Currency (OCC), while state-level oversight demands alignment with federal standards and approval from relevant state authorities.

-

Develop a Comprehensive Risk-Based AML/KYC Framework for Stablecoin UsersBoth federal and state regimes require robust AML/KYC programs. Under the GENIUS Act, issuers must implement controls in line with the Bank Secrecy Act, including customer due diligence and transaction monitoring. State laws may vary, but generally mirror these federal requirements for consistency.

-

Implement Robust Reserve Management and Transparency ControlsFederal rules mandate 1:1 reserve backing with high-quality liquid assets (e.g., USD, Treasury bills), monthly independent audits, and public disclosure of reserve composition. State frameworks often require similar standards, but the GENIUS Act sets the national baseline for transparency and consumer protection.

-

Integrate Real-Time Transaction Monitoring and Reporting SystemsIssuers must deploy real-time monitoring tools to detect suspicious activity and comply with OFAC sanctions. Federal law is explicit on these points, while state requirements may differ in technology specifics but generally expect equivalent monitoring capabilities.

-

Establish Ongoing Compliance Training and Independent Audit ProtocolsBoth federal and state oversight demand regular staff training on compliance obligations and independent audits of compliance programs. Under the GENIUS Act, these audits and trainings are required to be documented and available for review by regulators such as the OCC or state financial authorities.

Step 3: Implement Robust Reserve Management and Transparency Controls

The days of opaque reserve practices are over. Under new rules, every stablecoin must be backed by high-quality liquid assets on a strict one-to-one basis – think U. S. dollars or short-term Treasuries. Monthly independent audits are now standard practice, with public disclosures about reserve composition expected as part of ongoing transparency commitments (NYU Compliance and Enforcement analysis).

This isn’t just about reassuring regulators; transparent reserves build user confidence at scale. Make sure your policies cover redemption rights (how users can cash out), fee disclosures, and what happens if insolvency strikes – because under GENIUS, protecting holders’ claims is non-negotiable.

Step 4: Integrate Real-Time Transaction Monitoring and Reporting Systems

With the GENIUS Act in force, real-time transaction monitoring is not just a best practice, it’s a regulatory expectation. You’ll need to deploy systems that can analyze blockchain activity as it happens, flagging suspicious transactions for further review. This includes automated tools that scan for patterns associated with money laundering, fraud, or sanctions violations. The ability to generate timely Suspicious Activity Reports (SARs) and maintain comprehensive audit trails will be essential when federal examiners come knocking.

Consider integrating solutions that offer:

- Blockchain analytics: Tools that trace asset flows across wallets and exchanges

- Automated alerts: Customizable rules to detect high-risk behaviors instantly

- Regulatory reporting modules: Pre-built templates for SARs, CTRs, and other compliance filings

- API integrations: Seamless connectivity with your core platform and banking partners

This level of visibility is vital for both compliance and reputation management, especially as regulators worldwide converge on similar standards.

Step 5: Establish Ongoing Compliance Training and Independent Audit Protocols

No stablecoin compliance program is complete without a commitment to continuous learning and independent oversight. The GENIUS Act expects issuers to keep their teams up-to-date on evolving requirements through regular training programs tailored to digital asset risks. This isn’t a one-and-done exercise, annual refreshers (at minimum) are now industry standard.

You’ll also need to schedule independent audits of both your operational controls and reserve attestations. These audits should be conducted by reputable third parties with experience in digital assets, ensuring an unbiased assessment of your program’s effectiveness. Findings should be reported directly to your board or senior leadership, and summarized in public disclosures where required.

Your Stablecoin Compliance Checklist for 2025

Tackling stablecoin regulation can feel overwhelming, but breaking it down step-by-step makes it manageable. Here’s a quick-reference checklist covering the five essentials discussed above:

The bottom line? Treat compliance as an ongoing process, not just a launch milestone. With strong governance, transparent reserves, smart technology investments, and proactive risk management, you’ll not only satisfy regulators but also position your stablecoin as a trusted player in the digital asset economy.