On November 24,2025, Stablecorp Digital Currencies Inc. marked a turning point for Canada’s digital asset landscape when its QCAD Digital Trust secured final regulatory approval from the Canadian Securities Administrators (CSA). This greenlight for QCAD positions it as the nation’s first compliant Canadian dollar-backed stablecoin, complete with a prospectus receipt that qualifies public distribution. For those tracking QCAD stablecoin regulation, this isn’t just news; it’s a blueprint for how issuers can thrive under CSA approval Canada stablecoin standards.

Stablecorp’s journey underscores a deliberate push toward legitimacy in a sector often clouded by uncertainty. QCAD maintains a precise 1: 1 peg to the Canadian dollar through reserves held at regulated financial institutions. Regular audits and public attestations back this promise, offering users a level of trust rarely seen in unregulated tokens. As someone who’s navigated crypto compliance for years, I see this as a supportive step that invites more institutional players into Canada’s blockchain ecosystem without compromising safety.

QCAD’s Mechanics: Stability Meets Innovation

At its core, QCAD functions as a digital representation of CAD on blockchain networks, enabling seamless transactions while mirroring the stability of fiat currency. Each token corresponds directly to one dollar in segregated reserves, a structure vetted rigorously by the CSA. This isn’t mere marketing; it’s a response to past stablecoin failures elsewhere, where opacity led to collapses. Canada’s approach here feels measured and forward-thinking, prioritizing consumer protection through enforceable standards.

What sets QCAD apart in the crowded stablecoin field is its native alignment with Canadian regulations. Issuers like Stablecorp had to demonstrate not just financial backing but also robust governance. The multi-year process involved detailed disclosures on reserve management, redemption mechanisms, and risk controls, culminating in that pivotal prospectus receipt. For legal professionals advising on Stablecorp QCAD licensing, this case study reveals the CSA’s expectations: transparency first, innovation second.

Key Benefits of QCAD

-

Instant, Low-Cost Transactions: QCAD enables near-instantaneous domestic and cross-border payments at a fraction of traditional banking fees, benefiting e-commerce, payroll, remittances, and everyday payments.

-

Bridge to the Digital Economy: As a regulated on-ramp between the traditional Canadian financial system and the global blockchain ecosystem, QCAD facilitates seamless integration with blockchain-based applications and Web3 innovations.

-

Transparency and Security: Canadian dollar reserves backing QCAD undergo regular audits and public attestations, providing strong consumer protection and peace of mind.

Navigating Canada’s Evolving Stablecoin Rules

The CSA’s interim framework for value-referenced assets like stablecoins emerged from coordinated efforts across provinces, with Ontario’s Securities Commission playing a key role. This approval aligns with broader signals from the Bank of Canada, which in September 2025 called for unified federal-provincial oversight on digital payments. QCAD’s success highlights how Canada CAD stablecoin rules are maturing faster than many anticipate, potentially setting precedents for future entrants.

Critically, this isn’t federal legislation yet, but a securities-based pathway that functions nationally. The prospectus outlines QCAD’s operations under strict conditions, including monthly reserve attestations and immediate redemption rights for holders. Regulators demanded proof that reserves exceed circulating supply at all times, a safeguard against depegging risks. In my view, this framework strikes a smart balance, encouraging growth while mitigating systemic threats.

Steps to Secure Your Own CSA Stablecoin Approval

Aspiring issuers eyeing federally regulated stablecoin Canada status should note that QCAD’s path is replicable but demanding. Stablecorp’s experience offers clear lessons in structuring for compliance from day one. Begin by isolating assets in a dedicated trust, then layer on the documentation that regulators crave.

Engaging early with the CSA review team can accelerate timelines, as iterative feedback refined Stablecorp’s filings. Beyond paperwork, operational readiness matters: automated redemption systems and real-time monitoring tools impressed examiners. This process, while rigorous, supports issuers committed to long-term viability over quick launches.

Once approved, ongoing compliance becomes the new normal. Stablecorp’s model emphasizes monthly reserve reports and third-party audits, which not only satisfy the CSA but also build user confidence. For startups dreaming of launching under Canada CAD stablecoin rules, this means budgeting for continuous oversight, not just a one-time filing fee. It’s a supportive ecosystem that rewards diligence, turning potential roadblocks into competitive edges.

Global Echoes: Canada’s Lead in Stablecoin Compliance

QCAD’s breakthrough ripples beyond borders, offering a template for jurisdictions grappling with stablecoin oversight. While the U. S. MiCA framework in Europe sets high bars, Canada’s securities-driven path feels more accessible for fiat-pegged tokens. I’ve advised teams on similar pursuits, and QCAD demonstrates how provincial-federal harmony can fast-track innovation. Expect copycats: other CAD issuers will lean on this precedent, accelerating Canada’s role as a stablecoin hub.

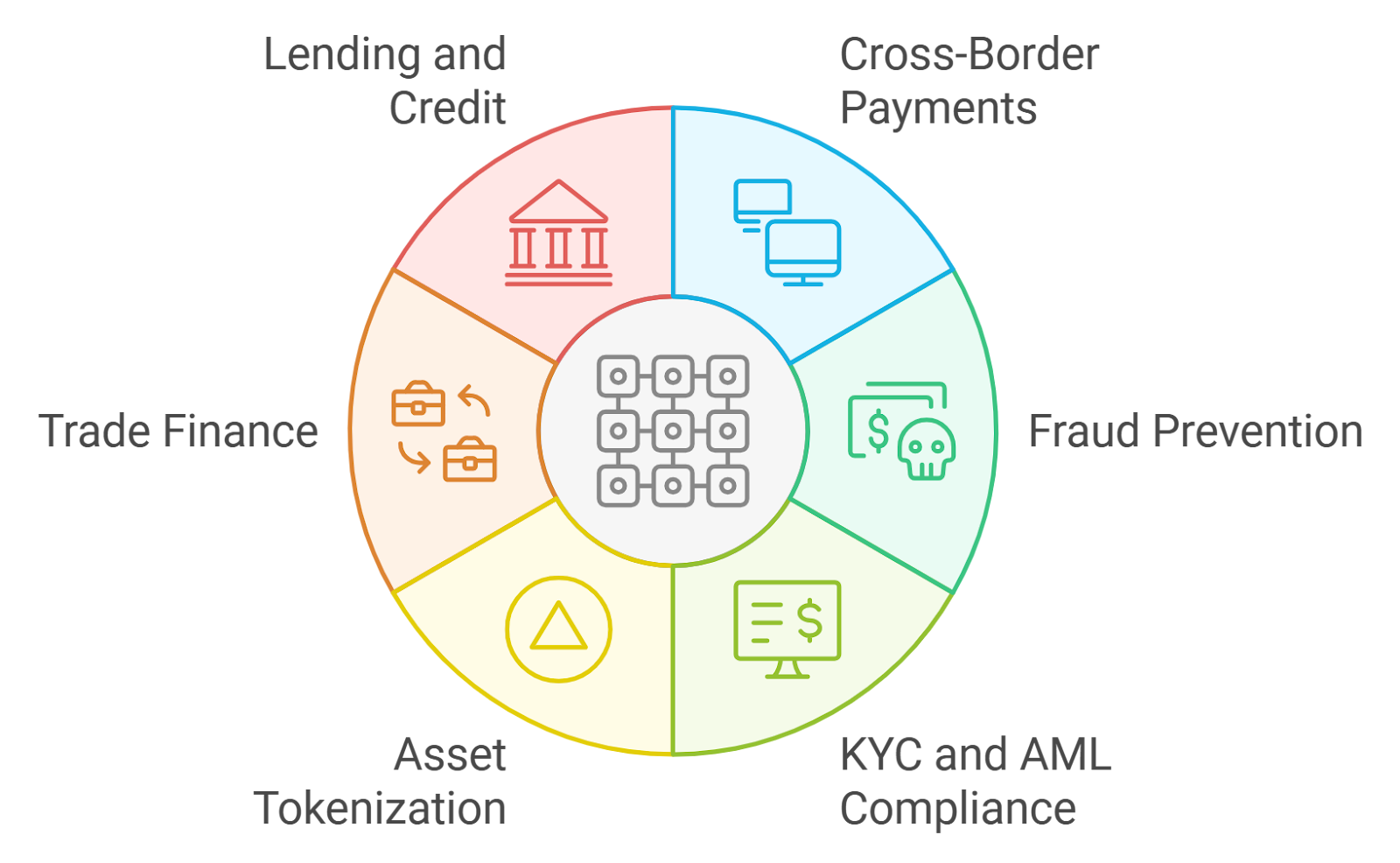

This isn’t hype; it’s happening amid a global race where regulated stablecoins like USDC and EURC dominate volumes. QCAD slots in as a localized powerhouse, ideal for Canadian businesses avoiding FX volatility. Traders and developers get a compliant on-ramp to DeFi, where QCAD could power lending protocols or NFT marketplaces tailored to CAD economics. The real win? It normalizes crypto for everyday use, from remittances to payroll, without the wild swings of BTC or ETH.

From a risk management angle, QCAD’s structure shines. Segregated reserves at Schedule 1 banks mean redemption risks plummet, a far cry from offshore issuers prone to freezes. Pair that with blockchain transparency, and you’ve got a hybrid asset that’s as reliable as a bank account but as versatile as Ethereum. For legal pros mapping federally regulated stablecoin Canada paths, Stablecorp’s playbook is gold: prove your reserves, disclose your ops, and iterate relentlessly.

Looking ahead, watch for Bank of Canada pilots integrating QCAD into payment rails. This could slash cross-border costs for the $100 billion CAD remittance market, empowering small businesses overlooked by legacy banks. Compliance fatigue is real, but QCAD proves the payoff: trust unlocks scale. Whether you’re a regulator drafting rules, a firm seeking Stablecorp QCAD licensing, or a user stacking digital CAD, this moment cements Canada’s forward momentum in digital finance.

Stakeholders now have a north star. By emulating QCAD’s rigor, the ecosystem grows safer and stronger, bridging fiat stability with blockchain speed. Knowledge like this isn’t just informative; it’s your edge in navigating tomorrow’s regs.