As stablecoins become foundational to the global digital asset ecosystem, regulatory clarity is now a competitive advantage. The United States, European Union, and United Kingdom have each advanced landmark frameworks in 2025 to address the risks and opportunities of fiat-backed stablecoins. This article compares the US GENIUS Act, EU Markets in Crypto-Assets Regulation (MiCA), and the UK FCA Stablecoin Regulatory Framework, with a focus on licensing, reserves, redemption rights, yield prohibition, and supervisory authorities. Understanding these regimes is essential for legal professionals, crypto issuers, and investors navigating compliance in a rapidly evolving environment.

![]()

Regulatory Race: Why 2025 Is a Pivotal Year for Stablecoin Law

The last two years have seen an unprecedented push by major economies to formalize rules for stablecoins. With global trading volumes exceeding $3 trillion monthly and institutional adoption accelerating, governments are determined to prevent regulatory arbitrage while safeguarding consumers. In 2025, three frameworks stand out:

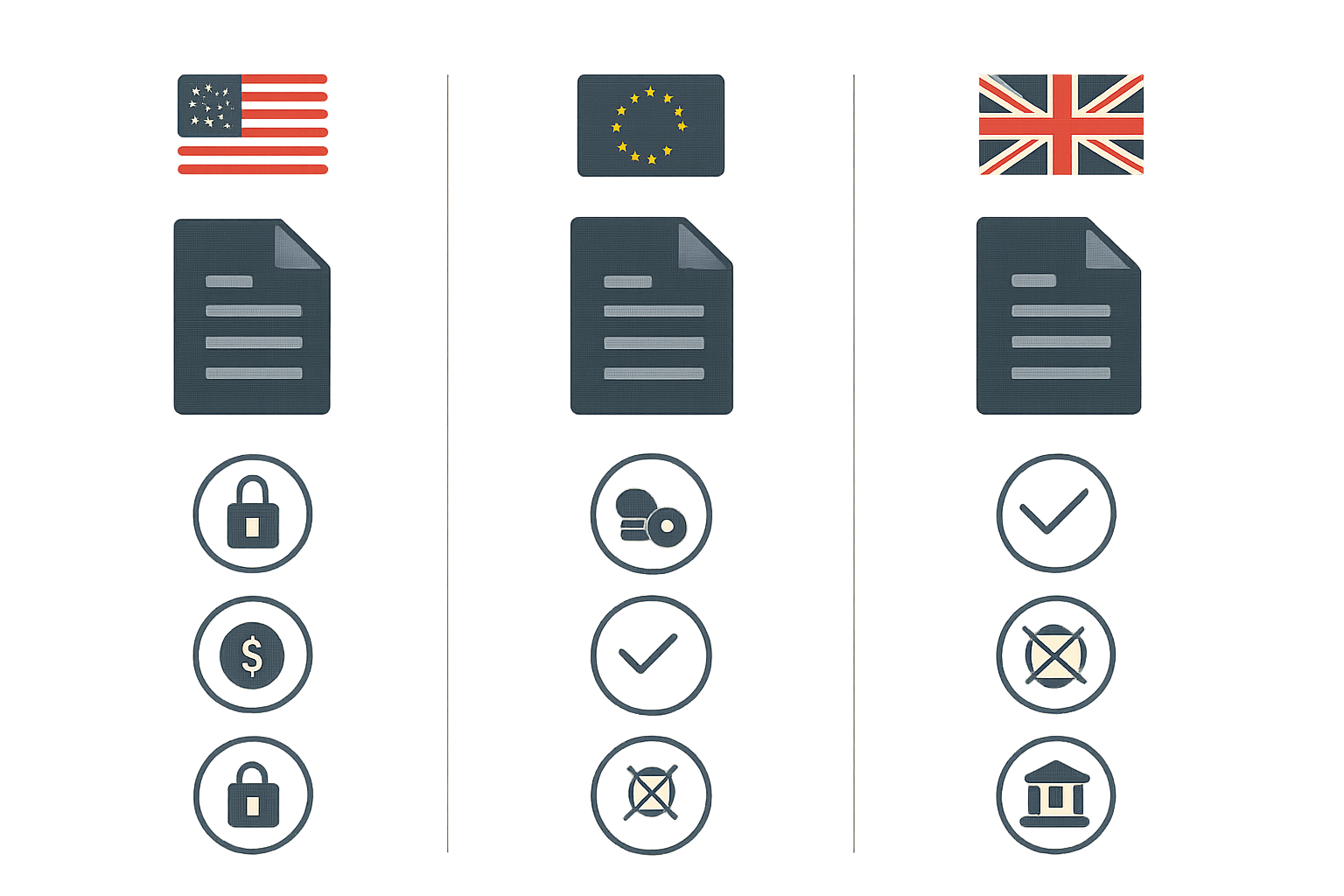

Key Stablecoin Regulatory Frameworks Compared (2025)

-

US GENIUS Act (2025): The Generational Economic National Innovation for Universal Stablecoins Act establishes a federal licensing regime for stablecoin issuers, mandates 1:1 fiat reserves, enforces strict redemption rights at par value, prohibits interest payments to token holders, and sets out comprehensive oversight by federal agencies including the Federal Reserve and OCC.

-

EU Markets in Crypto-Assets Regulation (MiCA) (2024/2025): MiCA creates a unified regulatory framework across EU member states for stablecoin issuers, requiring authorization from national competent authorities, robust reserve requirements, mandatory redemption rights at par, prohibition of yield payments on stablecoins, and ongoing supervision by the European Banking Authority (EBA).

-

UK FCA Stablecoin Regulatory Framework (2025): Under the Financial Services and Markets Act 2023 amendments effective in 2025, the UK FCA will regulate fiat-backed stablecoins as a means of payment, requiring registration or authorization for issuers and custodians, implementation of safeguarding and capital requirements, clear redemption obligations for consumers, and oversight to ensure market integrity.

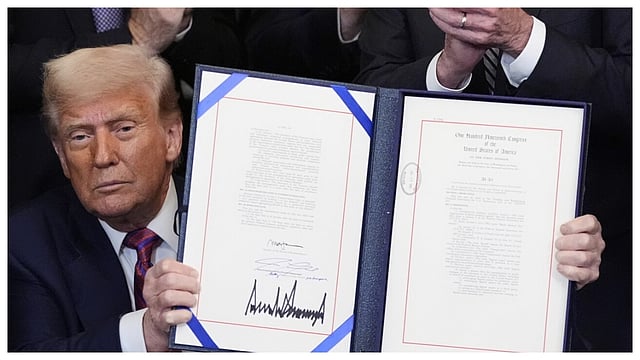

The US GENIUS Act, signed into law in July 2025, marks America’s first comprehensive federal regime for payment stablecoins. Meanwhile, the EU’s MiCA framework aims to harmonize rules across all member states after years of fragmented national approaches. The UK FCA’s new proposals, set to take effect in 2026 following public consultation, reflect London’s ambition to remain a fintech leader post-Brexit, even as it diverges from both US and EU models.

The US GENIUS Act: Federal Licensing and Stringent Reserves

The Generational Economic National Innovation for Universal Stablecoins Act (GENIUS) establishes a clear federal licensing regime. Only certain entities can issue payment stablecoins:

- Insured depository institutions

- Their subsidiaries

- Nonbank entities approved by the OCC

- Uninsured national banks

- Federal branches of foreign banks

This approach sharply curtails unregulated issuance, one of the sector’s main vulnerabilities during past market turbulence.

Reserves must be maintained on at least a one-to-one basis with U. S. dollars or short-term Treasuries. Longer-term bonds are explicitly prohibited as reserve assets, a move designed to avoid liquidity mismatches during stress events. Issuers must also offer clear redemption rights at par value; if you own $100 worth of stablecoins, you can always redeem them for $100 in fiat.

No interest or yield can be paid directly to holders, an important consumer protection shared with MiCA regulations. Oversight falls primarily to the Office of the Comptroller of the Currency (OCC) and Federal Reserve.

The EU MiCA Approach: Harmonization With Local Nuance

The European Union’s Markets in Crypto-Assets Regulation (MiCA) is now fully effective across all member states as of late 2025. It creates a unified regime that covers authorization requirements for all stablecoin issuers (“asset-referenced tokens”), robust reserve mandates (typically one-to-one backing), mandatory redemption at par value within short timeframes, and strict prohibitions on any yield or interest payments tied directly to holding or using these tokens.

A notable feature is supervision by national competent authorities under EBA coordination, though recent disputes over “passporting” show that local implementation can still vary significantly between countries such as France and Italy. The Bank of Italy has raised concerns about so-called “multi-issuance models, ” where identical tokens are issued by different branches across jurisdictions, a potential challenge for legal clarity and financial stability.

Differentiators: Redemption Rights and Foreign Issuer Restrictions

Both GENIUS and MiCA enshrine strong redemption rights at par, a safeguard long absent from many earlier stablecoin projects (source). However, under Section 3(a) of GENIUS, US persons cannot purchase stablecoins from foreign issuers unless those issuers hold a valid US license, an extraterritorial reach not mirrored in MiCA’s current form.

MiCA, by contrast, is more focused on harmonizing standards within the EU’s borders, though policymakers like ECB President Christine Lagarde have called for tighter equivalence and safeguards against systemic risks from non-EU stablecoins. This reflects a growing consensus that global coordination is needed, even as regions build their own regulatory firewalls. The ongoing debate over “passporting” rights, especially France’s threat to block certain crypto firms despite their EU licenses, highlights the complexities of enforcing a single rulebook across diverse financial landscapes.

UK FCA Stablecoin Framework: A Pragmatic Path Forward?

The United Kingdom’s Financial Conduct Authority (FCA) is shaping its own distinct approach under the amended Financial Services and Markets Act 2023. The FCA framework will require all fiat-backed stablecoin issuers and custodians to register or obtain authorization. Key requirements include robust safeguarding of customer assets (segregation from firm funds), capital adequacy standards, and clear redemption rights for consumers. The UK regime also places strong emphasis on market integrity, though recent proposals suggest certain regulatory exemptions for crypto firms, such as waiving some principles related to integrity and customer focus, to boost competitiveness in the post-Brexit era (FCA Consultation CP25/14).

The FCA’s consultation process has drawn both support and criticism: some market participants welcome the flexibility intended to attract innovation, while consumer advocates warn of potential risks if oversight is diluted. Final rules are due in 2026, but it’s clear the UK aims to balance openness with sufficient guardrails, a different flavor from the US’s strict federal licensing or the EU’s harmonized but locally nuanced regime.

Stablecoin Regulatory Frameworks: 2025 Compliance Checklist

-

US GENIUS Act (2025): The Generational Economic National Innovation for Universal Stablecoins Act establishes a federal licensing regime for stablecoin issuers, mandates 1:1 fiat reserves, enforces strict redemption rights at par value, prohibits interest payments to token holders, and sets out comprehensive oversight by federal agencies including the Federal Reserve and OCC.

-

EU Markets in Crypto-Assets Regulation (MiCA) (2024/2025): MiCA creates a unified regulatory framework across EU member states for stablecoin issuers, requiring authorization from national competent authorities, robust reserve requirements, mandatory redemption rights at par, prohibition of yield payments on stablecoins, and ongoing supervision by the European Banking Authority (EBA).

-

UK FCA Stablecoin Regulatory Framework (2025): Under the Financial Services and Markets Act 2023 amendments effective in 2025, the UK FCA will regulate fiat-backed stablecoins as a means of payment, requiring registration or authorization for issuers and custodians, implementation of safeguarding and capital requirements, clear redemption obligations for consumers, and oversight to ensure market integrity.

Key Takeaways: Convergence and Divergence in Global Stablecoin Law

Despite regional differences, these three frameworks share several core pillars:

- Licensing/Authorization: All require formal approval for issuers, federal licensing in the US (GENIUS), national competent authority authorization in the EU (MiCA), and FCA registration or authorization in the UK.

- Reserve Requirements: 1: 1 backing with high-quality fiat assets is now standard; longer-dated or riskier reserves are generally banned.

- Redemption Rights: Par value redemption within short timeframes is mandatory across all regimes.

- No Yield Payments: Interest or yield directly tied to holding stablecoins is prohibited by law.

- Supervisory Oversight: Each region designates clear supervisory authorities, OCC/Federal Reserve (US), EBA/national regulators (EU), FCA (UK).

The main divergences lie in scope and extraterritorial reach. The GENIUS Act explicitly restricts foreign stablecoin access unless issuers obtain a US license, a significant barrier for international projects targeting American users. MiCA faces its own challenges with cross-border passporting and national exceptions within the EU bloc. The UK seeks a pragmatic middle ground by combining rigorous consumer protection with select regulatory exemptions intended to foster innovation.

For legal teams and compliance officers, understanding these nuances isn’t just academic, it’s mission critical for launch strategies, cross-border operations, and risk management as enforcement ramps up in 2025,2026.

Looking Ahead: A New Era of Global Stablecoin Standards?

The convergence around licensing, reserves, redemption rights, yield prohibition, and clear oversight signals an emerging baseline for global stablecoin regulation. Yet divergence persists where politics, financial sovereignty concerns, or strategic priorities differ. As technology evolves, and as regulators respond to new risks like multi-jurisdictional issuance models, the next few years will test whether these frameworks can adapt while maintaining market stability.

Navigating this landscape requires vigilance. For those building or investing in stablecoins across borders, monitoring updates from authorities like the OCC (source) or tracking evolving guidance from European regulators (source) will be essential steps toward sustainable growth, and legal peace of mind, in this pivotal year for digital asset law.