Stablecoin regulation in 2025 is no longer theoretical. The United States and European Union have moved from debate to action, with the GENIUS Act and MiCA now actively reshaping the global stablecoin landscape. For legal professionals, crypto businesses, and institutional traders, understanding these frameworks is no longer optional, it’s mission-critical for compliance and market access.

The US GENIUS Act: A Federal Framework for Payment Stablecoins

Signed into law by President Trump on July 18,2025, the Guiding and Establishing National Innovation for U. S. Stablecoins Act (GENIUS Act) is the first comprehensive federal statute targeting payment stablecoins in the US. The law’s objective: deliver regulatory clarity while encouraging innovation without ceding control to shadow banking or offshore entities.

Key features of the GENIUS Act include:

- Issuer Authorization: Only “permitted payment stablecoin issuers” can operate. This includes insured depository institutions, credit union subsidiaries, and federally licensed nonbank stablecoin issuers, effectively raising the bar for entry.

- 100% Reserve Requirements: Every dollar of issued stablecoin must be backed by a corresponding dollar in highly liquid reserves. This eliminates fractional reserve risk and is designed to avoid systemic shocks.

- No Interest Payments: Issuers are barred from paying interest or yield on stablecoins, a move that draws a bright line between payment tokens and securities or deposit accounts.

- Marketing Restrictions: The law prohibits any implication of government backing or FDIC insurance unless explicitly granted, aiming to curb deceptive advertising practices seen in previous cycles.

Tether’s announcement of its new USAT token, designed specifically to comply with GENIUS, is a direct response to this regime shift. But as of November 2025, no issuer is yet fully certified under GENIUS; compliance audits and licensing reviews are ongoing as regulators ramp up enforcement.

The EU’s MiCA Regime: Harmonization With Strict Limits

The European Union’s Markets in Crypto-Assets Regulation (MiCA) went live at the end of December 2024, providing a harmonized framework for crypto-assets, including two categories of regulated stablecoins: asset-referenced tokens (ARTs) and electronic money tokens (EMTs). MiCA’s approach is both broad and granular:

- Issuer Licensing: All issuers must secure authorization from national competent authorities (NCAs), meet stringent governance standards, and submit detailed whitepapers outlining token mechanics and risk factors.

- Full Reserve Mandate: Like GENIUS, MiCA demands a 1: 1 liquid reserve ratio for all circulating stablecoins. Redemption rights at par value are mandatory.

- Usage Caps: To safeguard monetary policy autonomy, MiCA imposes daily transaction limits on EMTs used as payment instruments, a unique constraint not found in most other global regimes.

The European Securities and Markets Authority (ESMA) has been aggressive about enforcing these rules. Notably, Tether’s flagship USDT has not been approved under MiCA due to compliance gaps, a signal that pan-EU regulatory alignment now comes with teeth rather than just talk. By Q1 2025, all crypto-asset service providers (CASPs) must comply or face exclusion from the EU market.

Pivotal Differences: US vs EU Stablecoin Regulatory Models

The GENIUS Act and MiCA share some DNA, most notably around reserve requirements, prohibition on interest payments by issuers, and mandatory licensing, but their strategic aims diverge sharply at key points:

- Pace of Adoption: Projections suggest that under GENIUS adoption could hit half the addressable market within six years; under MiCA it may take more than a decade due to usage caps and stricter onboarding (see comparative analysis here).

- Sovereignty vs Scale: The EU prioritizes monetary sovereignty through transaction caps; the US model focuses more on financial stability via issuer vetting but allows broader payment use-cases once licensed.

- Securities Law Carve-Outs: Under the GENIUS Act, compliant payment stablecoins are explicitly excluded from securities or commodities treatment, removing major legal uncertainty for issuers operating in or serving US markets.

This divergence means cross-border interoperability remains elusive, issuers can’t simply port a product from one jurisdiction to another without major structural changes. For those navigating both markets simultaneously? Expect dual compliance headaches but also new opportunities as regulatory arbitrage disappears.

For market participants, the practical impact is immediate. US-based stablecoin issuers are now racing to complete licensing and compliance reviews, while EU-focused projects must retool token structures and transaction flows to fit MiCA’s daily usage thresholds. The days of regulatory ambiguity are over: every new stablecoin launch is now a test case for how well teams can operationalize these frameworks.

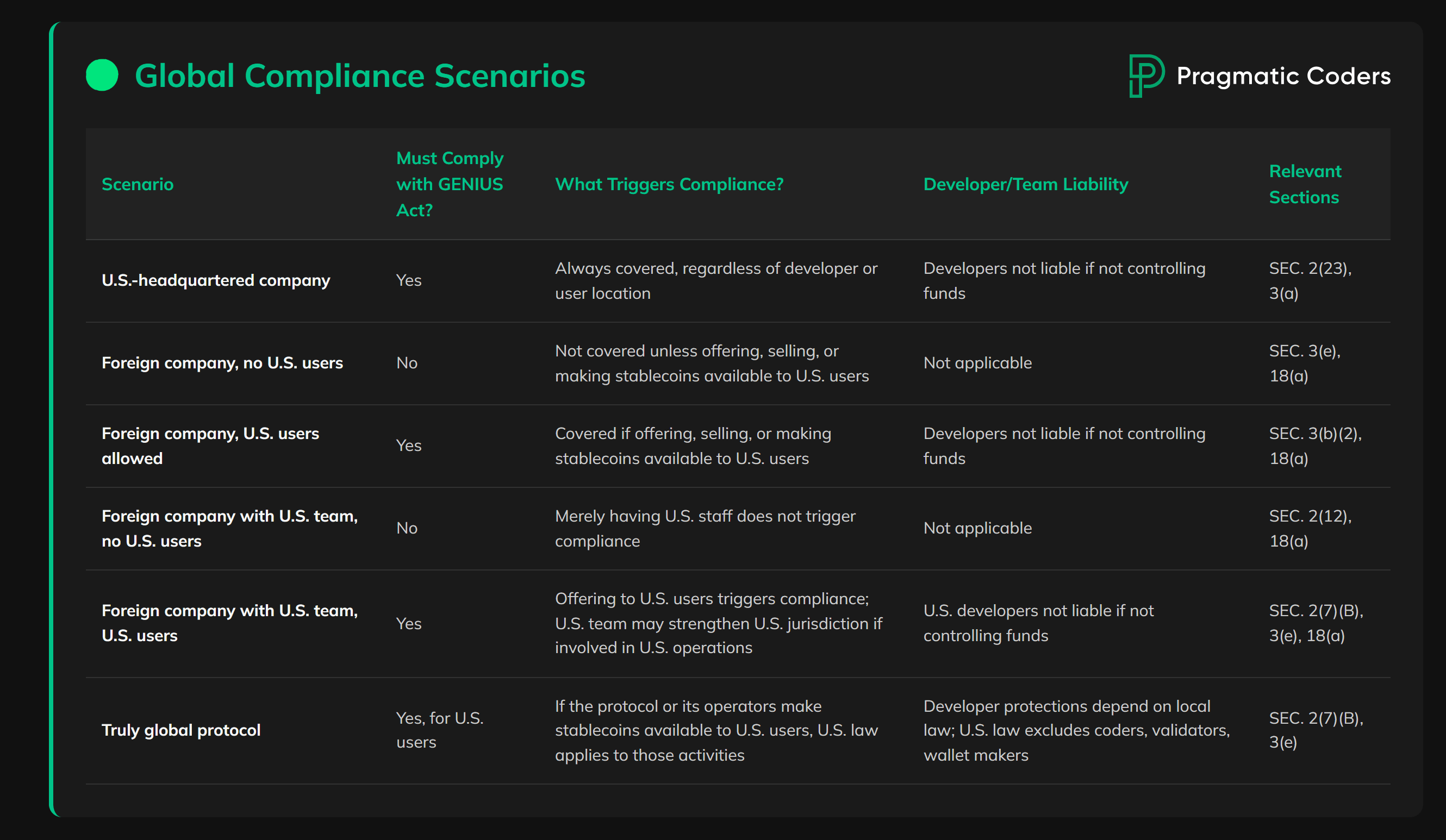

GENIUS Act vs MiCA: Key Compliance Hurdles for Stablecoin Issuers

-

Issuer Authorization Scope: The GENIUS Act restricts issuance to federally authorized entities (e.g., insured banks, credit unions, or licensed nonbanks), while MiCA allows both banks and nonbank entities to become issuers, pending approval from national competent authorities (NCAs).

-

Reserve Requirements: Both regimes mandate 100% reserve backing, but GENIUS Act specifies reserves must be held in highly liquid, risk-free assets, whereas MiCA provides more flexibility in eligible reserve assets, subject to liquidity and safety standards.

-

Interest Prohibition: Both frameworks prohibit stablecoin issuers from paying interest to holders, but the GENIUS Act explicitly distinguishes stablecoins from deposit accounts, whereas MiCA applies the ban primarily to electronic money tokens (EMTs).

-

Usage and Transaction Limits: MiCA imposes daily transaction caps and usage limits on stablecoins to protect monetary sovereignty, while the GENIUS Act does not set explicit transactional limits, focusing instead on reserve and consumer protection requirements.

-

Marketing and Consumer Protection: The GENIUS Act enforces strict marketing restrictions, prohibiting claims of federal backing or deposit insurance. MiCA requires clear disclosures but is less prescriptive about marketing content.

-

Passporting and Market Access: MiCA grants a single EU license (“passport”) for issuers to operate across all member states, streamlining EU-wide access. The GENIUS Act does not offer a comparable federal passport, requiring separate compliance for each U.S. jurisdiction where additional state rules apply.

Market Reactions and Strategic Shifts

The regulatory clarity provided by both regimes has catalyzed institutional interest but also triggered strategic pivots among major players. Tether’s move to launch USAT for the American market signals a willingness to play by federal rules, while Circle’s push for pan-European licensing under MiCA highlights the new premium on regulatory credentials over mere technical prowess.

Expect further fragmentation as some projects double down on single-jurisdiction compliance, while others attempt the heavy lift of dual certification. Cross-border stablecoin flows will increasingly depend on robust legal opinions and real-time attestation of reserve assets, not just smart contract code. For traders and DeFi protocols, this means tighter integration with regulated custodians and more granular tracking of which tokens are truly compliant in each market.

What’s Next? Compliance Deadlines, Enforcement, and Global Ripple Effects

Looking ahead to 2026, the competitive landscape will be shaped by who can clear these new regulatory bars fastest, and most transparently. The US Treasury and Federal Reserve have begun publishing lists of pending GENIUS Act applicants; ESMA is naming non-compliant CASPs in quarterly updates. Early movers with full licenses will enjoy first-mover advantages in banking partnerships and fiat on/off ramps.

Global harmonization remains elusive, but both regimes are already influencing policy debates across Asia-Pacific, the UK, and Canada. As other jurisdictions draft their own rules, often referencing GENIUS or MiCA as templates, the race is on to define what “safe” and “compliant” stablecoins mean worldwide.

The bottom line: GENIUS Act stablecoin regulation and MiCA stablecoin compliance are now the global benchmarks for crypto legal compliance in 2025. Issuers who invest early in robust legal infrastructure will not only survive, they’ll set the standards for the next era of digital payments.