On July 18,2025, the US stablecoin landscape underwent a seismic shift as President Donald Trump signed the GENIUS Act into law. This landmark statute, formally titled the Guiding and Establishing National Innovation for US Stablecoins Act, creates an unprecedented federal regulatory framework for payment stablecoins. The act’s passage has already ignited debate among legal professionals, crypto industry insiders, and financial institutions about its sweeping compliance requirements, licensing hurdles, and the future shape of the dollar-backed digital asset market.

GENIUS Act Stablecoin Regulation: What’s Changed?

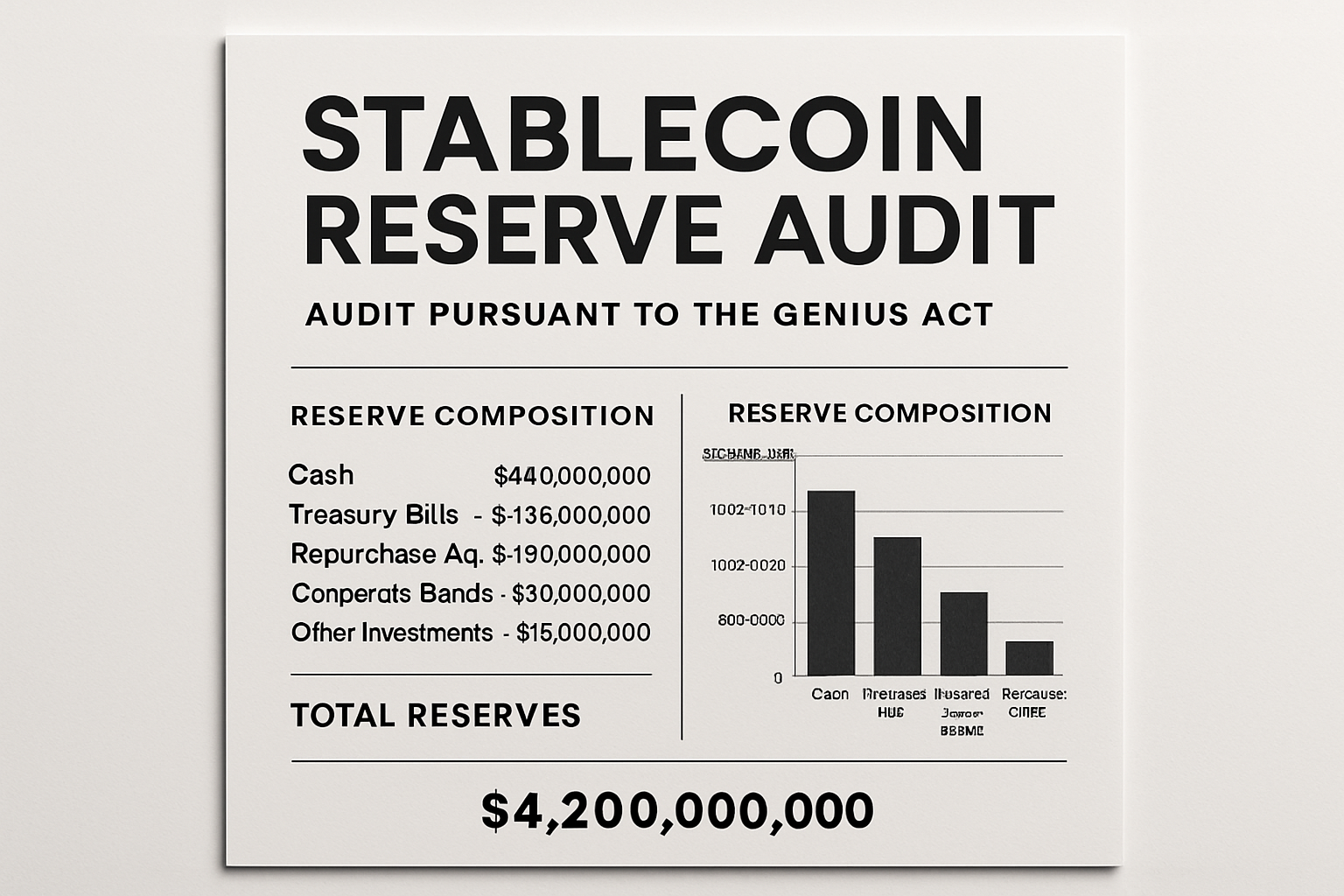

The GENIUS Act introduces a comprehensive legal framework designed to foster innovation while protecting consumers and preserving financial stability. At its core are strict stablecoin reserve rules: every payment stablecoin must be backed 1: 1 by high-quality liquid assets such as US dollars or Treasury bills. This is not just a best practice, it is now federal law. Issuers must submit to monthly independent audits verifying both reserve levels and asset quality, making transparency non-negotiable for market participants.

These new requirements are backed by robust anti-money laundering (AML) provisions. Issuers must maintain sophisticated AML programs capable of responding to regulatory directives, including seizing or freezing assets when required by law. The GENIUS Act also imposes tough marketing restrictions to prevent deceptive practices and misleading claims about dollar-backing or redemption rights.

Licensing Requirements: Who Can Issue Stablecoins?

The days of launching a stablecoin from a dorm room or foreign jurisdiction are over, at least in the United States. Under the GENIUS Act’s licensing regime, only three types of entities can issue payment stablecoins:

- Subsidiaries of insured depository institutions regulated by a federal banking agency

- Nonbank institutions directly supervised by the Office of the Comptroller of the Currency (OCC)

- State-chartered entities subject to federally imposed standards or substantially similar state regimes

This creates a tightly controlled environment where only well-capitalized and highly supervised organizations can participate at scale. Non-financial public companies face an even higher bar, they are generally prohibited from issuing stablecoins unless they obtain unanimous approval from the newly created Stablecoin Certification Review Committee (SCRC). The SCRC will assess each applicant’s potential impact on US banking system stability before granting any exceptions.

For more details on how these licensing pathways work in practice, and what it means for existing issuers, see our deep dive at GENIUS Act Explained: US Stablecoin Licensing, Reserve, and Audit Rules (2025).

Compliance Obligations: Transparency, Auditing, and AML Controls

The compliance landscape has never been more demanding for dollar-backed stablecoin issuers. Beyond monthly audits and reserve disclosures, issuers must implement robust AML controls that meet or exceed federal standards. This includes technical capabilities to freeze or block transfers in response to sanctions directives, a feature that could have significant implications for decentralized finance (DeFi) protocols reliant on permissionless transactions.

The GENIUS Act also strictly prohibits interest payments on payment stablecoins, a move intended to draw clear lines between payment instruments and deposit-like products regulated under traditional banking laws. For smaller issuers or DeFi projects previously operating in regulatory gray areas, these obligations may prove formidable.

Tether (USDT) Price Prediction 2026-2031 Post-GENIUS Act

Stablecoin Market Outlook in the Wake of US Regulatory Reform

| Year | Minimum Price | Average Price | Maximum Price | Notable Market Scenario |

|---|---|---|---|---|

| 2026 | $0.99 | $1.00 | $1.01 | Stable $1 peg maintained; minor volatility during regulatory adaptation |

| 2027 | $0.99 | $1.00 | $1.01 | Wider adoption in US payments; small price dislocations on high network stress |

| 2028 | $0.99 | $1.00 | $1.01 | Market cap expansion toward $2T; increased usage in global settlements |

| 2029 | $0.98 | $1.00 | $1.02 | Potential stress from competitor growth and DeFi restrictions; peg tested but restored |

| 2030 | $0.98 | $1.00 | $1.02 | Regulatory harmonization globally; brief depeg events during systemic shocks |

| 2031 | $0.97 | $1.00 | $1.03 | Possible competition from CBDCs; robust compliance keeps peg mostly intact |

Price Prediction Summary

Tether (USDT) is expected to maintain its $1.00 peg due to the strict reserve and audit requirements mandated by the GENIUS Act. While average prices remain at $1.00, the minimum and maximum predictions reflect brief, rare depegging events, usually under systemic market stress or exceptional circumstances. The overall outlook is for stability with minor volatility as the stablecoin market grows and matures under comprehensive regulation.

Key Factors Affecting Tether Price

- GENIUS Act’s 1:1 reserve and audit requirements, boosting consumer confidence and reducing depegging risks.

- Market cap growth and mainstream adoption driven by regulatory clarity.

- Prohibition on interest-bearing stablecoins may affect DeFi usage but enhances regulatory compliance.

- Potential for market consolidation, favoring large, well-resourced issuers like Tether.

- Possible volatility from competition (e.g., new US-regulated stablecoins or CBDCs) or global regulatory divergence.

- Technological improvements in transparency and compliance infrastructure.

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

The immediate market reaction has been muted provides USDT remains pegged at $1.00 with no price movement in the last 24 hours, reflecting confidence in existing reserves but also underscoring how much of the sector’s future depends on successful adaptation to these new rules.

Looking ahead, the GENIUS Act’s ripple effects are expected to extend well beyond compliance checklists and audit schedules. The act’s federal preemption provisions mean that state-level patchworks are replaced with a unified standard, reducing regulatory arbitrage but also raising questions about state innovation sandboxes and bespoke regimes. This harmonization is likely to streamline operations for large institutions but could squeeze out smaller players unable to meet the new federal thresholds.

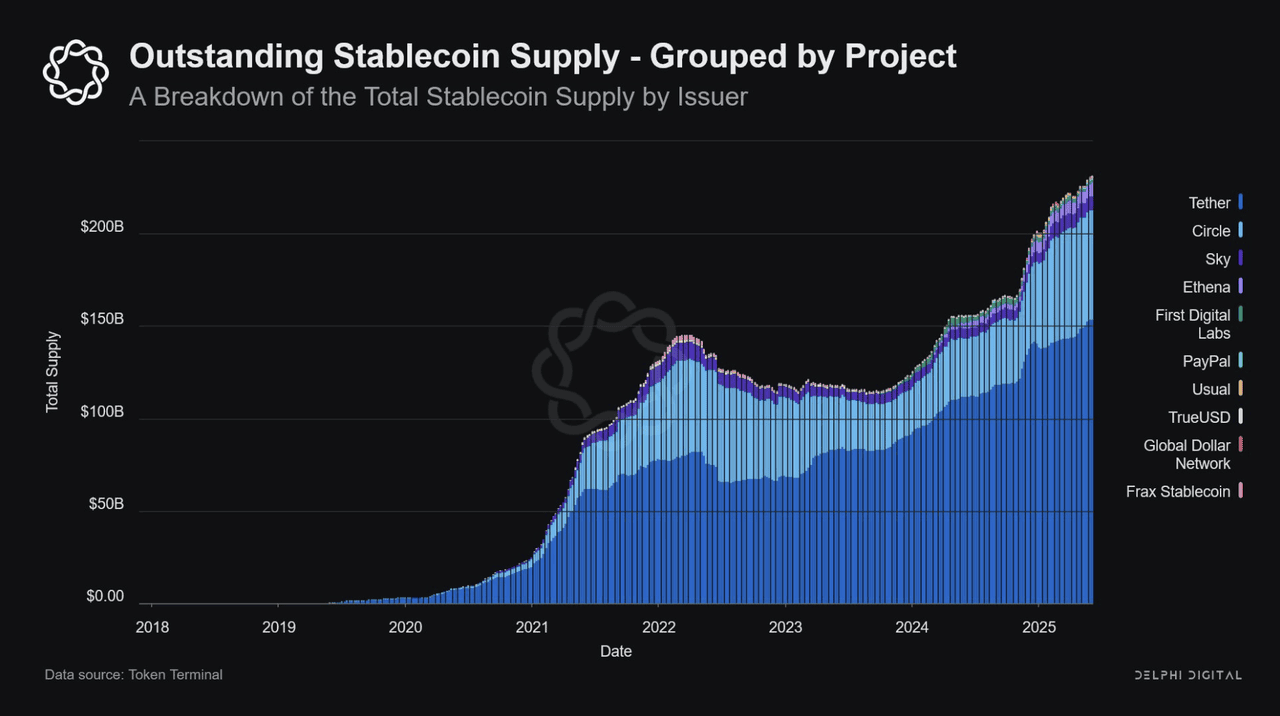

Market Structure and Competitive Dynamics: Winners, Losers, and Strategic Shifts

As the stablecoin market digests these sweeping changes, a few clear trends have emerged. First, market consolidation appears inevitable. The capital, legal expertise, and technical infrastructure required for compliance with monthly audits, 1: 1 reserve mandates, and ongoing SCRC oversight will favor established financial institutions and well-funded fintechs over scrappy startups or lightly regulated offshore operators.

Key Challenges for Stablecoin Issuers Under the GENIUS Act

-

Stringent 1:1 Reserve Requirements: Issuers must maintain a 1:1 reserve ratio backed by high-quality liquid assets such as U.S. dollars or Treasury bills, which can strain liquidity management and increase operational costs.

-

Mandatory Monthly Independent Audits: The Act requires monthly independent audits to verify reserve compositions, adding ongoing compliance costs and increasing the need for transparent accounting practices.

-

Comprehensive Anti-Money Laundering (AML) Compliance: Issuers must implement robust AML programs and demonstrate technical capabilities to freeze or seize assets, necessitating advanced compliance infrastructure and legal expertise.

-

Restrictive Licensing and Chartering Rules: Only certain federally regulated entities and approved state-chartered institutions can issue payment stablecoins, limiting market entry and increasing the complexity of obtaining required licenses.

-

Prohibition on Interest-Bearing Stablecoins: Issuers are forbidden from offering interest on stablecoins, which may reduce the appeal of these products for both retail and institutional users, particularly in DeFi applications.

-

Strict Marketing and Consumer Protection Standards: The Act enforces rigorous marketing rules to prevent deceptive practices, requiring issuers to overhaul promotional strategies and ensure full compliance with consumer protection mandates.

-

Potential for Market Consolidation: Smaller issuers may struggle to meet the Act’s requirements, potentially leading to consolidation that favors larger, well-resourced stablecoin providers.

Additionally, DeFi protocols face a new calculus. With interest payments on stablecoins now prohibited under federal law, protocols that previously relied on yield-generating stablecoins must pivot toward alternative models or risk regulatory scrutiny. This could reshape liquidity pools and lending markets across major DeFi platforms.

Consumer protection is another central theme. The act’s strict marketing rules target misleading claims about dollar-backing or redemption guarantees, an area of prior controversy that undermined trust in the sector. By requiring clear disclosures and independent verification of reserves, regulators aim to restore confidence among retail users and institutional investors alike.

Practical Steps for Issuers: Navigating the New Landscape

For existing issuers and new entrants alike, adaptation is non-negotiable. Immediate priorities include:

- Engaging external auditors to establish transparent reserve verification processes

- Upgrading AML compliance programs to meet enhanced federal standards

- Reviewing product offerings to ensure no interest is paid on payment stablecoins

- Liaising with federal regulators (OCC or SCRC) regarding licensing status and ongoing supervision

- Reassessing marketing materials for compliance with consumer protection mandates

The costs of non-compliance are high, potential penalties range from forced delisting to criminal liability in cases of willful misrepresentation or AML violations. For an in-depth breakdown of issuer obligations under the new regime, see GENIUS Act Explained: What US Stablecoin Issuers Need to Know About 1: 1 Backing, Licensing and Compliance (2025 Update).

The Global Angle: US Standard Setting?

The GENIUS Act positions the United States as a global standard-setter for fiat-backed digital assets. International issuers seeking access to US markets must now align with these rigorous requirements or risk exclusion from American exchanges and payment rails. This extraterritorial effect could catalyze similar reforms abroad as EU regulators finalize MiCA implementation and Asian jurisdictions weigh their own approaches.

Yet significant questions remain about interoperability with decentralized protocols and cross-border settlements, a topic that will evolve as both industry practices and regulatory guidance mature over time. For further analysis on global implications, visit our coverage at How the US GENIUS Act Transforms Stablecoin Compliance: Key Rules, Timelines and Global Impact.

Outlook: A Foundation for Mainstream Adoption?

The GENIUS Act represents a pivotal moment in digital asset regulation, balancing innovation incentives against systemic risk management. While it raises barriers to entry for some players, it also creates a more predictable environment for banks, payment processors, merchants, and consumers considering dollar-backed stablecoins as part of everyday commerce.

If successful implementation leads to increased adoption by mainstream financial institutions, and if market leaders can maintain stability at current levels such as $1.00 per USDT with zero volatility in the past 24 hours: the sector may see rapid growth toward projected trillion-dollar valuations by decade’s end.