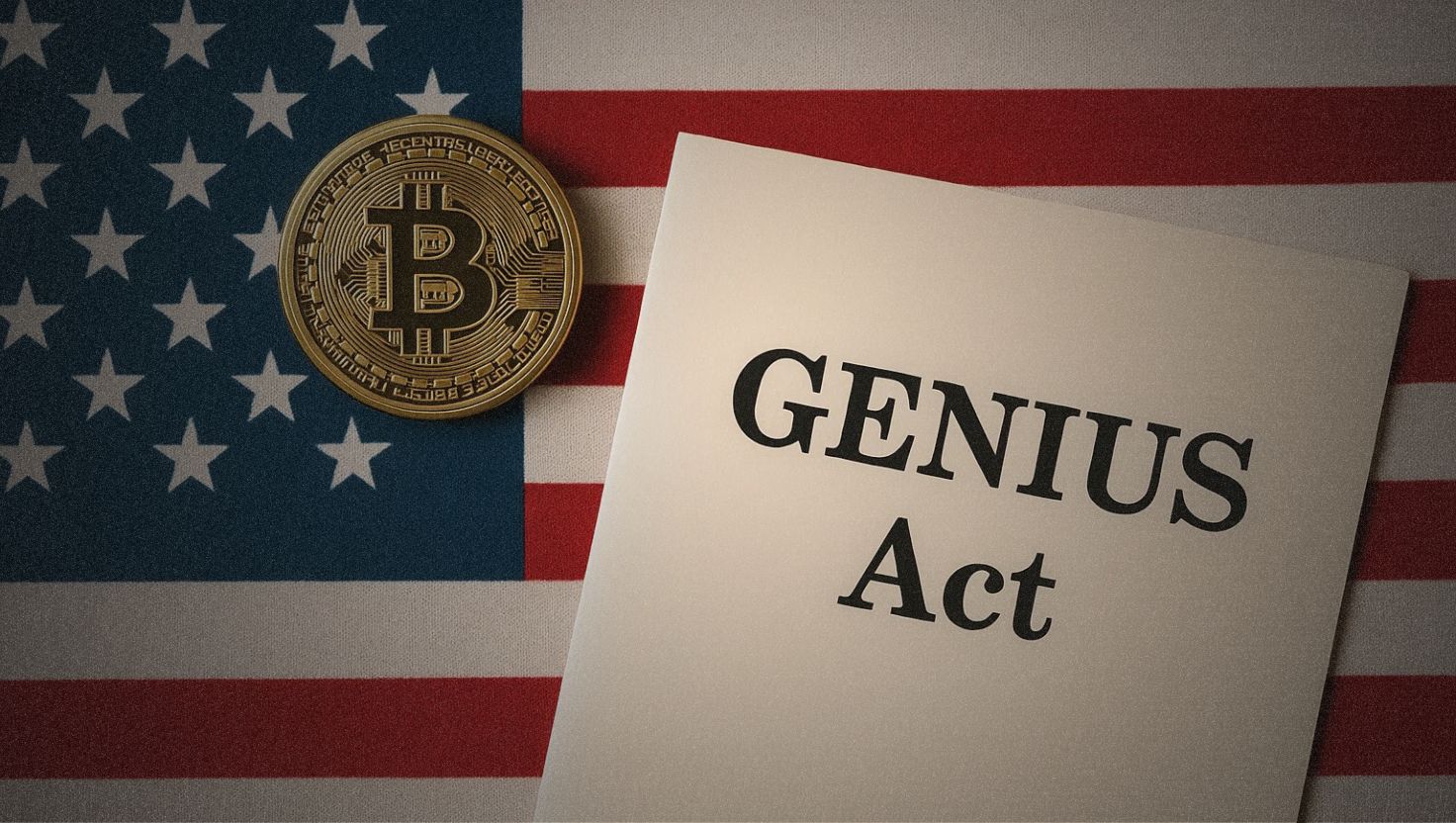

The U. S. stablecoin market has entered a transformative era with the passage of the GENIUS Act in July 2025. This landmark legislation delivers a sweeping federal framework for payment stablecoins, raising the bar for licensing, compliance, and operational transparency. For U. S. -based and foreign issuers alike, the rules of engagement have fundamentally changed. Here’s what you need to know as regulatory scrutiny intensifies and new compliance deadlines loom.

Federal Licensing: The New Gateway to U. S. Stablecoin Issuance

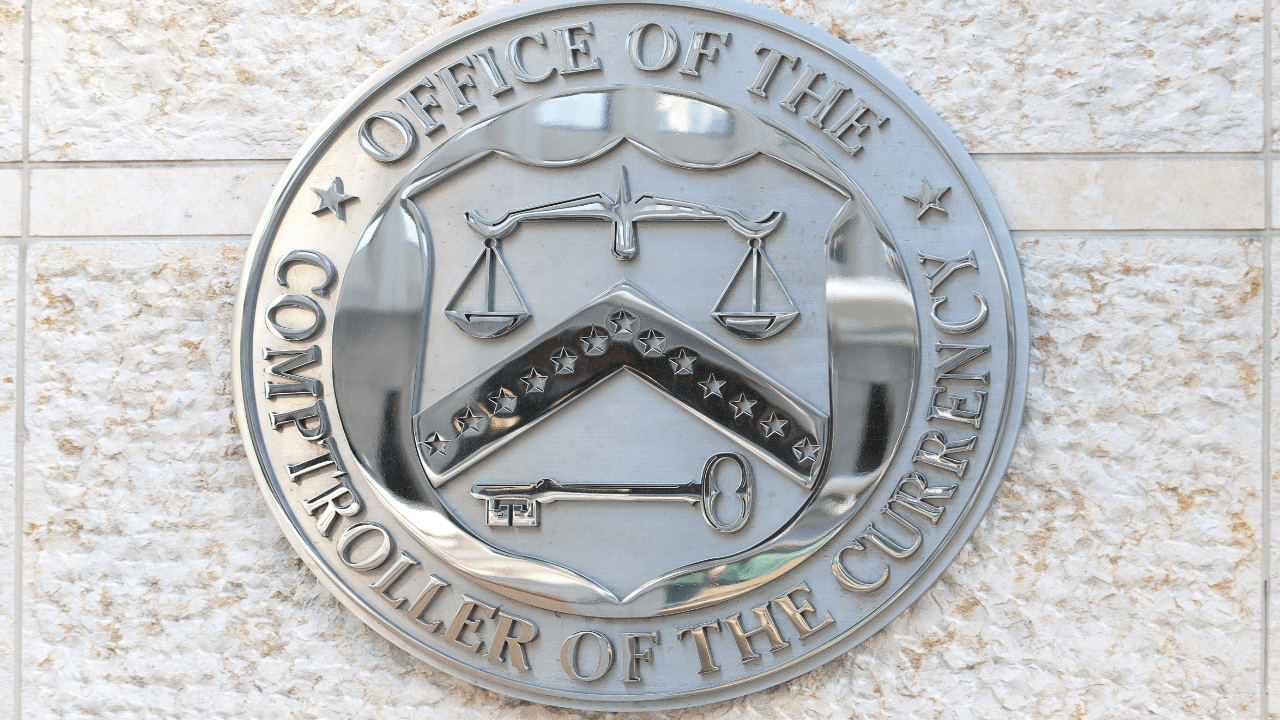

Under the GENIUS Act, no entity may issue or market payment stablecoins in the United States without proper authorization. Federal licensing is now administered by the Office of the Comptroller of the Currency (OCC), opening doors for non-bank fintechs but imposing rigorous entry requirements. State-level licensing remains an option only for smaller issuers – specifically those with less than $10 billion in outstanding stablecoins – but only if their state regime meets federal equivalency standards as certified by the Stablecoin Certification Review Committee (SCRC).

This dual-track approach means that issuers exceeding $10 billion must transition to federal oversight within 360 days, unless they secure a rare waiver. The days of regulatory arbitrage via state charters are effectively numbered. The Act also clarifies that it is unlawful to imply government backing or issue tokens without explicit approval, making compliance not just a best practice but an existential necessity.

GENIUS Act: Key Licensing Requirements for Stablecoin Issuers

-

Federal Licensing for Non-Bank Issuers: Non-bank entities seeking to issue payment stablecoins in the U.S. must obtain a federal license from the Office of the Comptroller of the Currency (OCC). This provides direct federal oversight and preempts conflicting state regulations.

-

State Licensing with Federal Certification: Issuers with less than $10 billion in outstanding stablecoins may operate under state supervision, provided their state’s regulatory framework is certified as “substantially similar” to the federal regime by the Stablecoin Certification Review Committee (SCRC).

-

Threshold for Federal Oversight: Issuers exceeding $10 billion in outstanding stablecoins must transition to federal licensing within 360 days unless granted a waiver, ensuring larger issuers are subject to robust federal standards.

-

Foreign Issuer Registration: Foreign stablecoin issuers may operate in the U.S. if they are supervised and regulated by a comparable foreign regime and are registered with U.S. authorities, subject to ongoing oversight and compliance checks.

-

Reserve Requirements: All permitted issuers must maintain 1:1 reserves backing outstanding stablecoins, limited to cash, short-term U.S. Treasuries, or Federal Reserve bank reserves—cryptocurrencies and corporate bonds are not allowed.

-

Transparency and Reporting: Issuers must publish monthly reserve disclosures, undergo monthly attestations by a PCAOB-registered audit firm, and submit annual financial audits. Issuers with over $50 billion in issuance face enhanced public disclosure obligations.

-

AML and KYC Compliance: Issuers are classified as financial institutions under the Bank Secrecy Act and must implement robust AML/KYC programs, monitor suspicious activity, and submit annual compliance certifications.

-

Operational Restrictions: The Act prohibits paying interest to stablecoin holders, requires clear redemption procedures, and bans the use of names suggesting government backing or guarantee.

-

Enforcement and Penalties: Non-compliance can result in civil penalties up to $100,000 per day, criminal penalties up to $1 million per violation, and up to five years imprisonment. Regulators may also issue cease-and-desist orders and temporary suspensions.

1: 1 Reserve Mandate: No Room for Creative Backing

The heart of GENIUS Act stablecoin regulation is its uncompromising reserve requirement: a strict 1: 1 backing for all outstanding payment stablecoins. Permitted reserve assets are limited to cash deposits, short-term U. S. Treasuries, and Federal Reserve bank reserves; cryptocurrencies and corporate bonds are strictly prohibited as collateral.

This clear-cut mandate aims to eliminate contagion risks from volatile or illiquid assets and restore confidence among institutional users and retail holders alike. Monthly public disclosures must detail not just aggregate reserve amounts but also asset composition, maturity profiles, and even geographic distribution, a level of transparency previously unseen in digital finance.

Transparency and Reporting: Raising the Bar on Accountability

The GENIUS Act compels issuers to operate with unprecedented transparency:

- Monthly reserve disclosures, audited by PCAOB-registered firms

- Annual financial audits, with enhanced requirements for issuers above $50 billion in circulation

- Public financial statement releases, further aligning digital asset practices with traditional finance norms

This robust reporting architecture is designed not only to protect consumers but also to provide regulators with early warning signals of systemic risk, an area where previous self-regulatory models fell short.

AML and KYC Compliance: No More Gray Areas for Issuers

The Act brings all permitted payment stablecoin issuers squarely within Bank Secrecy Act jurisdiction. That means KYC onboarding, ongoing AML monitoring, suspicious activity reporting, and economic sanctions compliance are mandatory across the board. Annual certifications must be filed affirming adherence, failure carries steep civil penalties (up to $100,000 per day) or even criminal liability.

The implications? Both domestic startups and global players seeking access to U. S. markets will need robust compliance infrastructure from day one, or risk being shut out entirely.

Read more about 1: 1 backing and compliance under the new law here.

Operationally, the GENIUS Act draws a hard line between payment stablecoins and yield-generating products. Issuers are strictly prohibited from paying interest to stablecoin holders, a move intended to prevent regulatory arbitrage with deposit-taking banks and reduce systemic risk. Redemption procedures must be clear, accessible, and publicly disclosed, no more ambiguous or opaque processes for converting stablecoins back to fiat. Names that imply government sponsorship or guarantee are also banned, closing loopholes that could mislead consumers or investors about the nature of these digital assets.

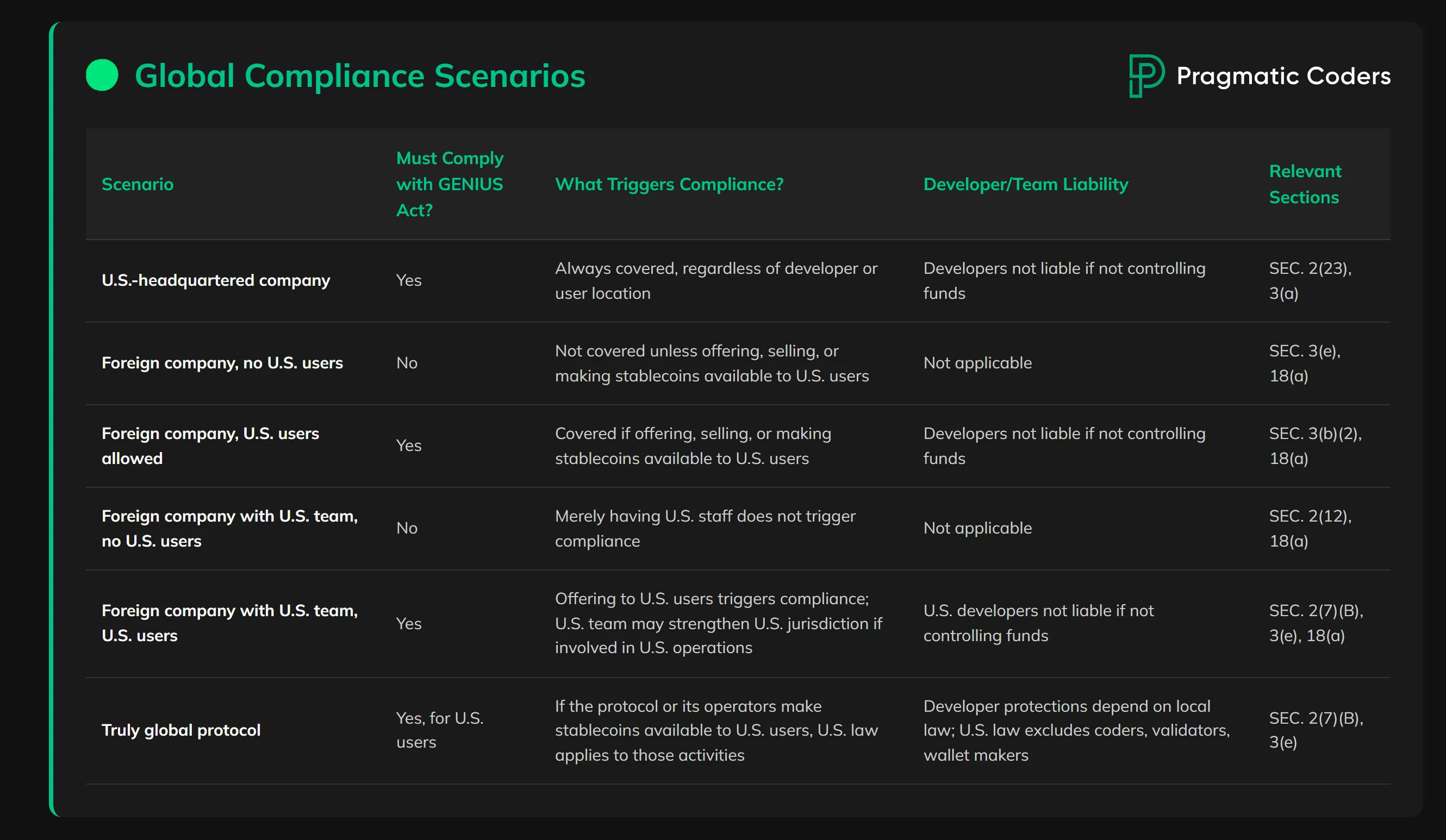

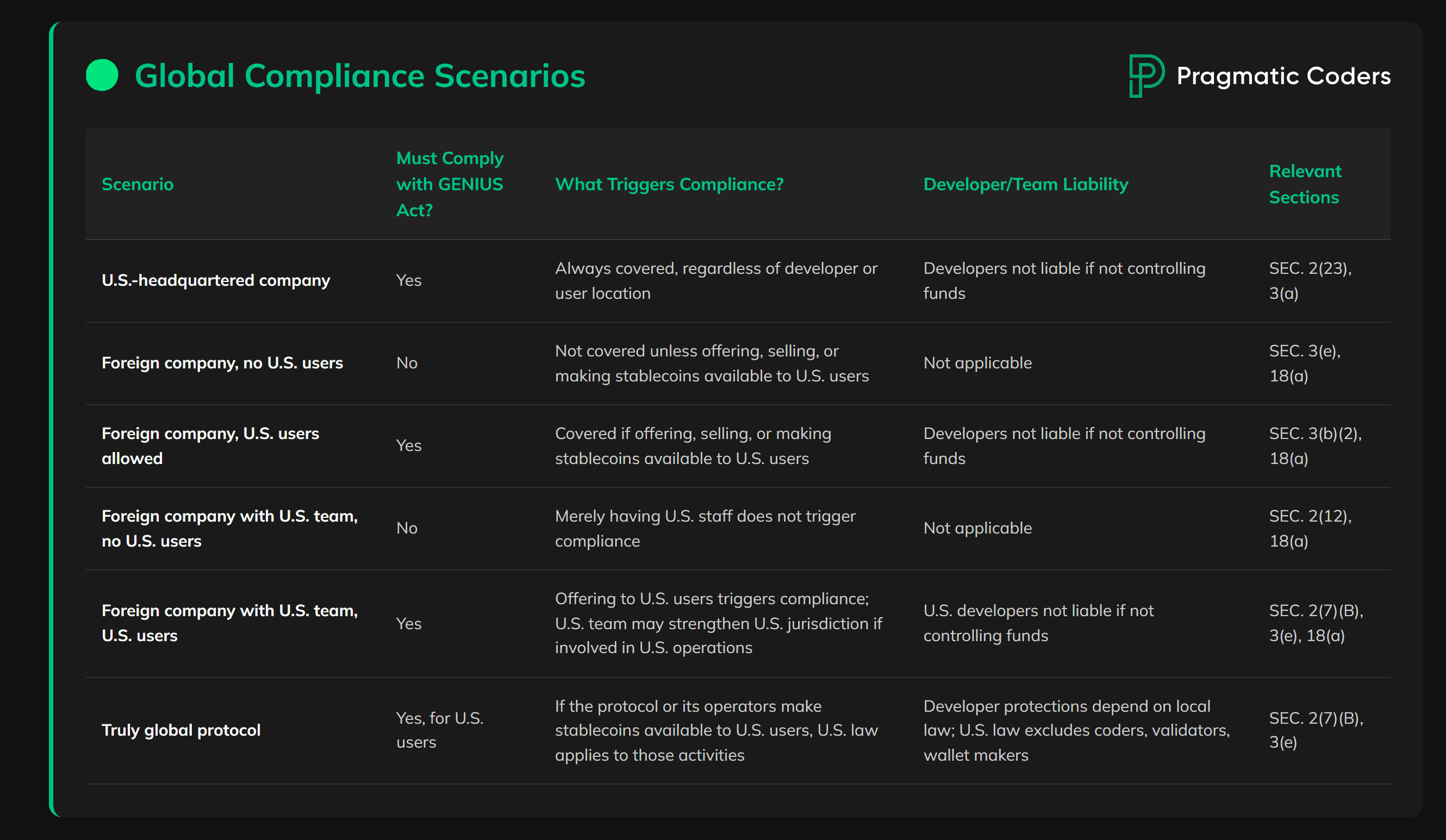

For foreign stablecoin issuers, the new regime is equally consequential. Only those supervised in their home jurisdictions by authorities deemed “comparable” to U. S. standards may seek registration in the U. S. , subject to ongoing oversight. This effectively sets a global compliance benchmark, making cross-border issuance more challenging but potentially harmonizing standards internationally.

Enforcement: Penalties That Bite

The GENIUS Act’s enforcement provisions are not mere window dressing. Non-compliance can trigger civil penalties of up to $100,000 per day and criminal penalties reaching $1 million per violation plus up to five years’ imprisonment. Regulators have broad powers to issue cease-and-desist orders and suspend noncompliant issuers pending investigation, a significant escalation from the fragmented enforcement landscape of previous years.

This means that even established players must reassess every aspect of their operations: reserve management, customer onboarding, transaction monitoring, and disclosure protocols all face heightened scrutiny. Market participants who underestimate these changes risk exclusion from the world’s largest stablecoin market.

Top Compliance Pitfalls Under the GENIUS Act

-

Inadequate Reserve Backing: Many issuers risk non-compliance by failing to maintain 1:1 reserve backing for all outstanding stablecoins, as required. Only cash deposits, short-term U.S. Treasuries, and Federal Reserve bank reserves are permitted; using crypto assets or corporate bonds is strictly prohibited.

-

Improper Licensing and Oversight: Issuers often misjudge whether they qualify for state or federal licensing. Those with over $10 billion in outstanding stablecoins must transition to federal oversight within 360 days, unless a waiver is granted. Operating without correct licensure exposes issuers to severe penalties.

-

Insufficient Transparency and Reporting: Failing to publish monthly reserve disclosures or undergo monthly attestations by a PCAOB-registered auditor is a common pitfall. Issuers with over $50 billion must also provide public financial disclosures and annual PCAOB-standard audits.

-

Weak AML and KYC Controls: The GENIUS Act classifies issuers as financial institutions under the Bank Secrecy Act. Lapses in implementing AML programs, customer identification (KYC), and suspicious activity monitoring can result in regulatory action and reputational harm.

-

Prohibited Operational Practices: Some issuers inadvertently violate operational restrictions, such as paying interest to stablecoin holders, or using names that imply government backing. Both are explicitly banned under the Act.

-

Non-Compliance with Redemption and Disclosure Rules: Failing to establish, disclose, or follow clear redemption procedures for stablecoin holders is a frequent compliance gap, undermining consumer trust and regulatory standing.

-

Delayed Response to Regulatory Changes: Issuers that do not promptly align operations with new GENIUS Act requirements risk enforcement actions, including civil penalties up to $100,000 per day and criminal penalties up to $1 million per violation.

Strategic Considerations for Issuers: Next Steps

Transition timelines are tight: Issuers above the $10 billion threshold have just 360 days to secure federal licensure or risk forced wind-downs. Even smaller state-regulated issuers should prepare for enhanced audits and reserve attestations as states race to meet SCRC certification standards. Foreign entities eyeing U. S. market entry must initiate registration promptly and demonstrate robust home-country supervision.

The winners in this new era will be those who invest early in compliance technology, legal expertise, and transparent governance structures. Expect M and A activity as smaller issuers seek scale or exit options rather than face costly regulatory upgrades alone.

Explore how global compliance teams are adapting strategies post-GENIUS Act

The GENIUS Act’s arrival marks a decisive shift toward mainstreaming digital dollars while preserving financial stability and consumer protection at scale. As implementation unfolds through late 2025 into 2026, legal teams and product leaders must stay vigilant, regulatory harmonization is now a moving target across both state lines and international borders.