Singapore has rapidly emerged as one of the most sophisticated jurisdictions for stablecoin regulation in Asia, with the Monetary Authority of Singapore (MAS) finalizing a comprehensive framework that came into effect in March 2025. For legal practitioners advising clients on stablecoin issuance and compliance, understanding the latest licensing requirements is crucial for navigating this dynamic landscape. This guide breaks down the essential regulatory obligations, eligibility criteria, and compliance standards that define Singapore’s approach to stablecoin oversight.

Key Features of Singapore’s Stablecoin Regulatory Framework

The MAS framework targets single-currency stablecoins pegged to the Singapore dollar (SGD) or G10 currencies, provided they are issued in Singapore and fully backed by high-quality, liquid reserve assets. The regulatory regime is designed to foster trust and stability while enabling responsible innovation within the digital asset sector.

MAS Stablecoin Regulatory Checklist (2025)

-

Obtain the Appropriate License: Secure a Stablecoin Issuance Service License (for issuers exceeding SGD 5 million supply) or a Digital Payment Token License (for issuers below SGD 5 million supply).

-

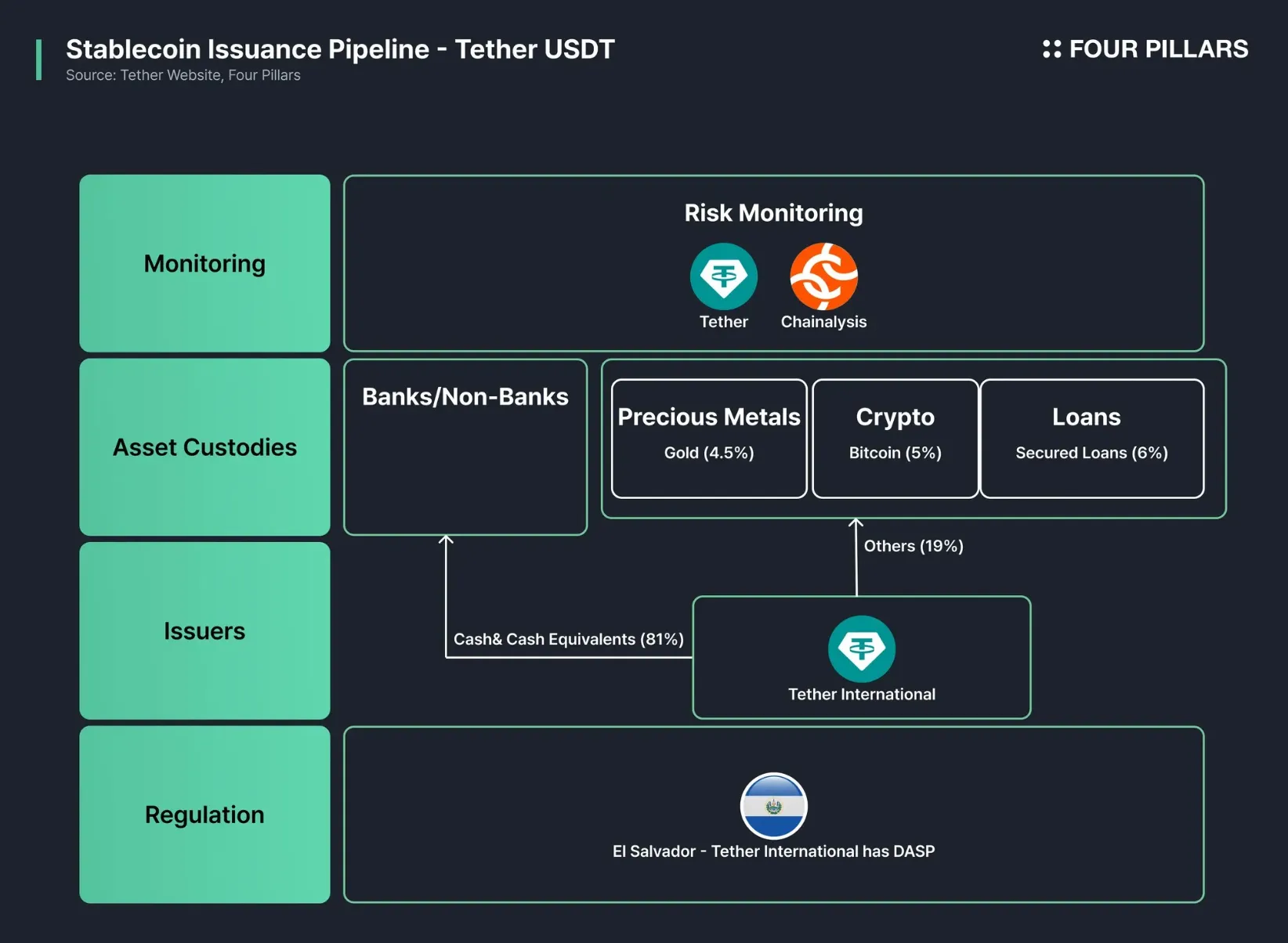

Ensure 1:1 Reserve Backing: Back all issued stablecoins with high-quality, liquid assets (cash, cash equivalents, or AAA-rated short-term sovereign bonds, including government bonds maturing within three months).

-

Offer 1:1 Redemption Guarantee: Provide users the right to redeem stablecoins at par value within five business days, with no unreasonable fees.

-

Issuer Eligibility: Operate as a bank or non-bank financial institution registered in Singapore to qualify as an MAS-regulated stablecoin issuer.

-

Implement Consumer Protection Measures: Restrict lending and staking services for retail customers to reduce risk exposures.

-

Maintain Robust Compliance Standards: Adhere to strict AML/CFT controls, technology risk management, segregation of client funds, and operational solvency requirements.

According to the latest MAS guidelines, issuers must meet stringent standards around asset backing, redemption rights, and operational resilience. These requirements are not simply best practices, they are mandatory for any entity seeking to issue or market “MAS-regulated stablecoins” in Singapore.

Stablecoin Licensing: Major Payment Institution vs. Digital Payment Token License

The licensing structure for stablecoin issuers is now highly stratified:

- Stablecoin Issuance Service License: Introduced in March 2025, this license is tailored specifically for stablecoin issuers whose supply exceeds SGD 5 million. It streamlines obligations by focusing on issuance without imposing the broader requirements associated with digital payment tokens.

- Major Payment Institution License: Required for issuers with a stablecoin supply above SGD 5 million, this license brings additional regulatory scrutiny and mandates compliance with all MAS stablecoin rules.

- Digital Payment Token License: For issuers below the SGD 5 million threshold, this standard license is sufficient, though voluntary compliance with higher standards is encouraged for recognition as an “MAS-regulated stablecoin. “

This tiered approach allows both established firms and innovative startups to participate in the market while scaling their compliance obligations appropriately.

Reserve Asset and Redemption Requirements

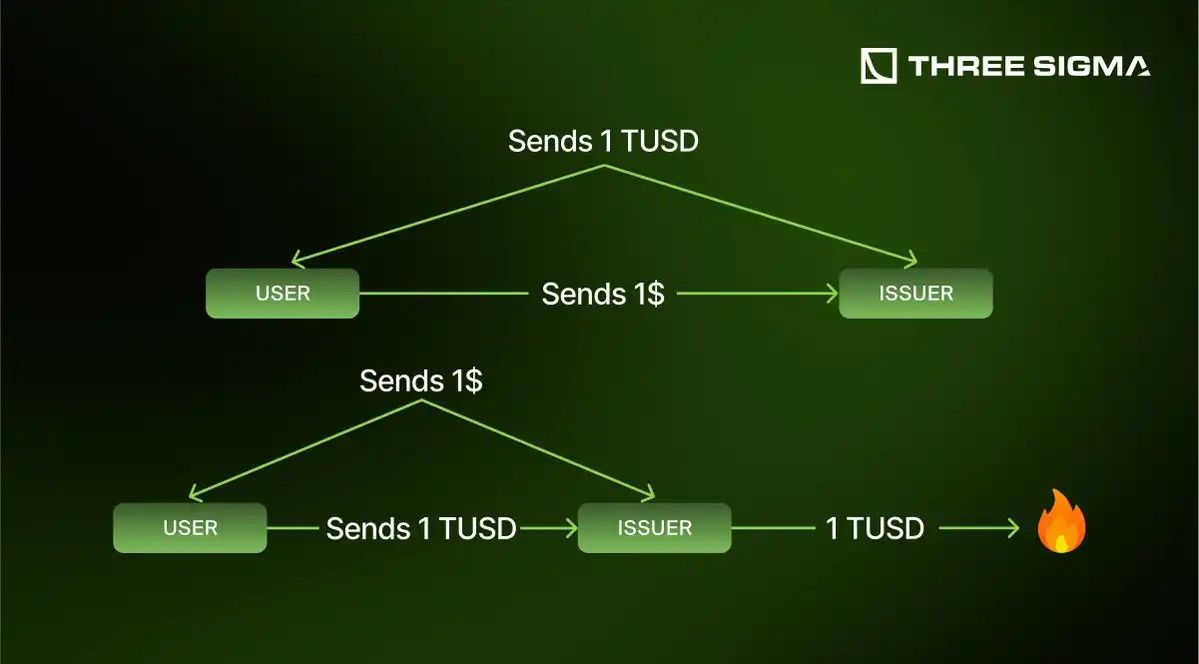

A cornerstone of MAS’s regulatory regime is the requirement that all regulated stablecoins be backed 1: 1 by high-quality liquid assets. Acceptable reserves include cash, cash equivalents, or AAA-rated short-term sovereign bonds, specifically government bonds maturing within three months from the pegged currency’s issuing country. This ensures that every token in circulation is fully redeemable at par value.

The redemption process itself is tightly regulated: users must be able to redeem their stablecoins within five business days at a guaranteed rate, with unreasonable fees strictly prohibited. This not only protects consumers but also underpins market confidence in regulated tokens.

Issuer Eligibility and Operational Requirements

As clarified by MAS in Q2 2025, only banks or non-bank financial institutions registered in Singapore are eligible to issue regulated stablecoins. The framework also introduces robust consumer protection measures, such as limits on lending and staking services offered to retail users, to mitigate risks associated with digital assets.

The operational compliance bar is set high: entities must implement strong Anti-Money Laundering (AML) and Counter-Terrorist Financing (CFT) controls, maintain strict segregation of client funds, adhere to technology risk management standards, and demonstrate ongoing operational solvency. These measures reflect MAS’s commitment to balancing innovation with systemic stability, and position Singapore as a global leader in digital asset regulation.

For legal teams and compliance professionals, the practical implications of these requirements are significant. The MAS framework does not merely set out a checklist, it mandates ongoing monitoring, internal audits, and third-party attestations to ensure reserve sufficiency and redemption reliability. Monthly independent audits of reserve assets are compulsory, and any discrepancies must be reported to MAS immediately. These expectations demand that issuers invest in robust infrastructure and governance systems from day one.

Consumer Protection and Market Conduct

MAS’s stablecoin regime goes beyond technical solvency. Issuers are prohibited from offering lending or staking to retail customers, a move aimed at curbing excessive risk-taking in the consumer segment. Marketing materials must be clear, accurate, and not misleading, a standard that is actively enforced by MAS through periodic reviews and spot checks. This approach is designed to prevent the kind of speculative excesses seen in less regulated markets and to anchor stablecoins as reliable payment instruments rather than high-risk investments.

Additionally, MAS requires issuers to maintain a permanent place of business in Singapore and to appoint at least one local resident director or partner. This enforces local accountability and ensures that regulatory oversight is not compromised by offshore structures.

Compliance Best Practices for Stablecoin Issuers

Key Compliance Steps for Stablecoin Issuers in Singapore

-

Obtain the Appropriate MAS License: Secure either a Stablecoin Issuance Service License (for supply above SGD 5 million) or a Digital Payment Token License (for supply below SGD 5 million) from the Monetary Authority of Singapore (MAS).

-

Ensure 1:1 Reserve Backing: Maintain full backing of all issued stablecoins with high-quality, liquid assets such as cash, cash equivalents, or AAA-rated short-term sovereign bonds. Reserves must be held in Singapore.

-

Implement Robust Redemption Policies: Guarantee 1:1 redemption at par value for users within five business days, with no unreasonable fees, as mandated by MAS regulations.

-

Meet Issuer Eligibility Criteria: Register as a bank or non-bank financial institution in Singapore to qualify as a regulated stablecoin issuer.

-

Comply with AML/CFT and Risk Management Standards: Establish comprehensive Anti-Money Laundering (AML) and Counter-Terrorist Financing (CFT) controls, technology risk management protocols, and ensure segregation of client funds.

-

Adhere to Consumer Protection Measures: Restrict lending and staking services for retail customers, and implement clear disclosures to enhance user safety and transparency.

-

Prepare for Regular Audits and Reporting: Conduct monthly audits of reserve assets and submit compliance reports to MAS to maintain regulatory status.

For practitioners guiding clients through the licensing process, early engagement with MAS is essential. Pre-application consultations can clarify regulatory expectations and identify potential stumbling blocks before formal submissions. Firms should also prioritize the development of transparent reserve management policies and invest in technology systems capable of real-time monitoring of assets and liabilities.

Given the pace of regulatory change across Asia, Singapore’s framework is likely to set a regional benchmark. Firms that achieve compliance here will be well-positioned as the broader APAC market moves toward similar standards.

Regulation is an opportunity, not an obstacle. Singapore’s approach demonstrates that rigorous oversight can coexist with vibrant innovation, provided firms are proactive about compliance and transparency.

Staying Ahead: Monitoring Regulatory Updates

The MAS framework is not static. Ongoing consultations mean that rules may evolve as market conditions shift or new risks emerge. Legal practitioners should encourage clients to subscribe to MAS circulars and participate in industry working groups to stay informed of updates. Regular training for compliance teams and board members is also advisable to ensure policies remain aligned with MAS expectations.

For a deeper dive into the official guidelines and recent regulatory developments, refer directly to the MAS stablecoin framework.

Singapore’s stablecoin licensing requirements are setting a new global standard for digital asset regulation. By embedding transparency, consumer protection, and operational resilience into the heart of its framework, MAS is fostering an environment where compliant innovation can thrive. For legal practitioners, staying agile and well-informed is key to helping clients seize the opportunities presented by this dynamic market.