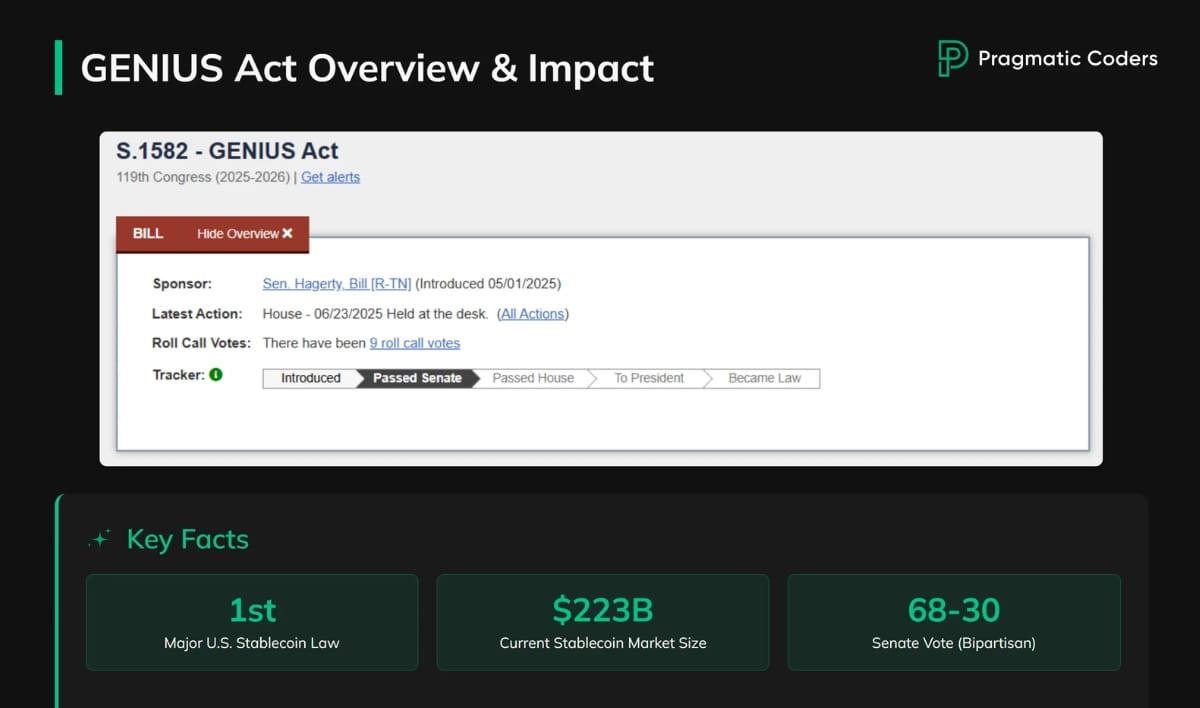

In 2025, the regulatory battleground for stablecoins is defined by two landmark frameworks: the United States’ GENIUS Act stablecoin regulation and the European Union’s MiCA stablecoin compliance regime. Both frameworks aim to bring clarity and security to digital asset markets, but their approaches reflect fundamentally different priorities rooted in monetary policy, financial stability, and cross-border ambitions.

Core Principles: GENIUS Act vs. MiCA

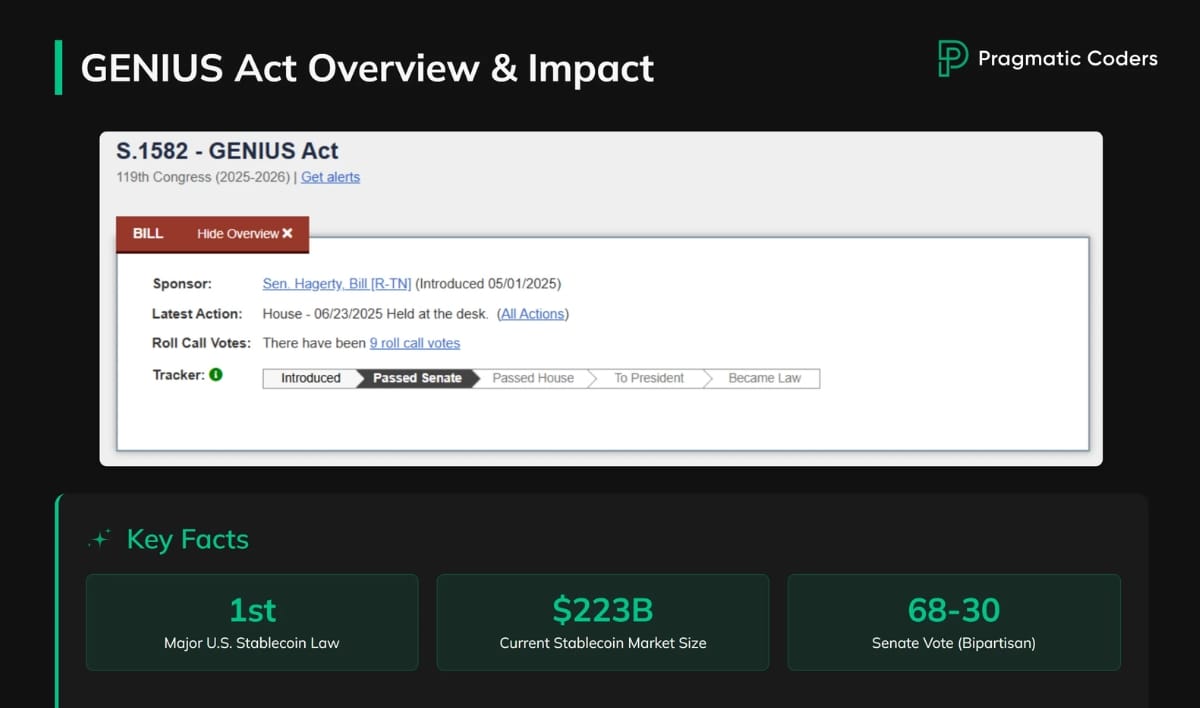

The GENIUS Act, signed into law on July 18,2025, positions the U. S. dollar at the heart of its regulatory model. Only insured depository institutions or specially approved non-bank entities may issue payment stablecoins. Critically, every token must be backed 1: 1 by high-quality liquid assets – exclusively U. S. dollars or short-term Treasury securities – with explicit prohibitions on offering yield or interest to holders. This ensures that U. S. -issued stablecoins remain tightly integrated with the traditional banking system and cannot become substitutes for deposit accounts.

Explore details of the GENIUS Act here.

The EU’s Markets in Crypto-Assets Regulation (MiCA), effective since December 2024, takes a broader approach. MiCA distinguishes between Electronic Money Tokens (EMTs), which are pegged to a single official currency (such as the euro), and Asset-Referenced Tokens (ARTs), which reference multiple currencies or commodities. Both categories face stringent reserve requirements – full backing with liquid assets held in segregated accounts – but MiCA goes further by imposing usage caps on large-scale tokens and banning algorithmic stablecoins outright to preserve monetary sovereignty within the eurozone.

Read more about MiCA’s requirements here.

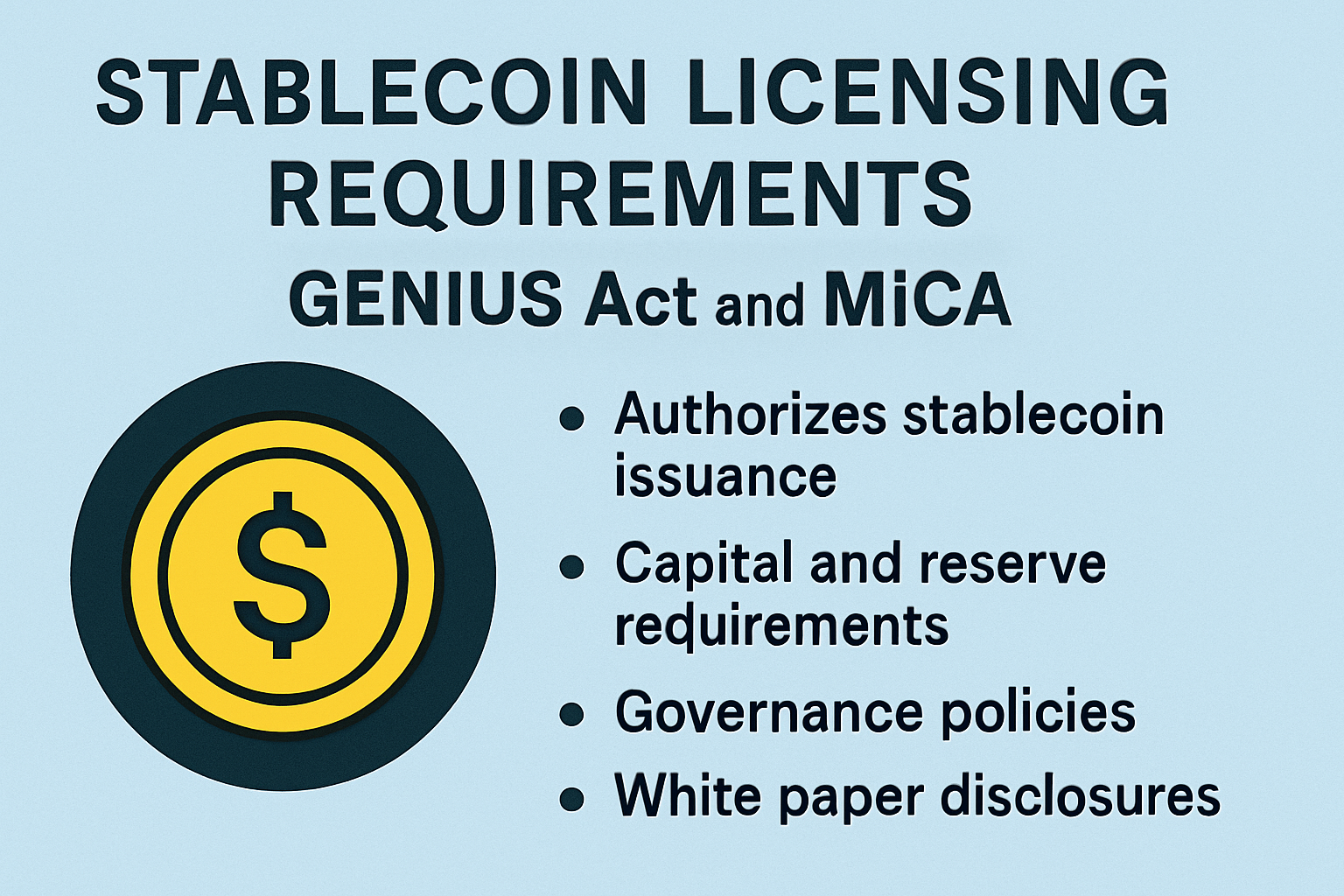

Licensing, Oversight and Issuer Obligations

A key divergence between US vs EU stablecoin laws lies in licensing and oversight mechanisms:

Licensing Requirements: GENIUS Act vs. MiCA for Stablecoin Issuers

-

GENIUS Act: Issuer Eligibility — Only insured depository institutions (such as FDIC-insured banks) or approved non-bank entities may issue payment stablecoins in the U.S. under the GENIUS Act. All issuers must obtain explicit federal approval and meet ongoing regulatory oversight.

-

MiCA: EU Licensing Regime — Under MiCA, stablecoin issuers must be licensed by an EU national competent authority. Only credit institutions (banks) and electronic money institutions (EMIs) can issue Electronic Money Tokens (EMTs), while Asset-Referenced Token (ART) issuers must also be EU-based and authorized.

-

Reserve Requirements — The GENIUS Act mandates 1:1 reserve backing with high-quality liquid assets (e.g., U.S. dollars, short-term Treasuries). MiCA also requires full backing, but allows a broader range of liquid assets for reserves depending on the token type.

-

Prohibitions and Restrictions — GENIUS Act prohibits stablecoin issuers from offering interest or yield to holders and bans rehypothecation of reserves (except for limited margin purposes). MiCA bans algorithmic stablecoins and imposes usage and scale limits to protect EU monetary sovereignty.

-

Supervisory Authorities — GENIUS Act subjects issuers to federal oversight by U.S. banking regulators. MiCA issuers are supervised by national competent authorities within the EU, with the European Banking Authority (EBA) overseeing significant stablecoin issuers.

The GENIUS Act mandates that all issuers be either federally regulated banks or non-banks meeting rigorous standards set by federal agencies. Reserve assets must be independently audited monthly, with detailed disclosures published for public scrutiny. Notably, stablecoins under this act are exempt from being classified as securities or commodities at the federal level – a move designed to eliminate overlapping jurisdictional battles between the SEC and CFTC.

MiCA requires all EMT issuers to be licensed as e-money institutions or credit institutions within an EU member state; ART issuers must also secure authorization from EU regulators and maintain a legal presence in Europe. The framework introduces strict liability for issuers regarding reserve management failures, prioritizing consumer redress in insolvency scenarios.

Reserve Backing and Consumer Protections

The commitment to full reserve backing is central in both regimes but implemented with notable differences:

- GENIUS Act: Mandates reserves held only in cash or short-term Treasuries; prohibits rehypothecation except for limited margin needs; monthly audits required; bankruptcy protections prioritize holder claims over creditors.

- MiCA: Allows reserves in select liquid assets; segregated accounts required; bans lending out reserves entirely; imposes scale limits on large tokens to avoid systemic risk; algorithmic designs are excluded from authorization entirely.

This divergence reflects each jurisdiction’s risk tolerance and strategic goals: while the U. S. focuses on operational soundness within its banking system, Europe’s rules are explicitly crafted to safeguard monetary sovereignty and prevent private digital money from undermining the euro.

Pace of Adoption and Strategic Implications

An often-overlooked aspect is how these rules shape market adoption curves. According to recent research (source), adoption rates under the GENIUS Act could reach 50% of their potential market within six years, compared to eleven years projected under MiCA due to stricter onboarding hurdles and usage caps imposed by European regulators.

The GENIUS Act is widely viewed as a catalyst for mainstream adoption among U. S. -based fintechs seeking regulatory certainty without sacrificing innovation capacity.

However, MiCA’s more measured pace is intentional. By prioritizing monetary sovereignty and imposing rigid controls on large-scale stablecoins, the EU aims to prevent destabilizing capital flows and limit the systemic footprint of private digital currencies. This difference in regulatory philosophy will likely influence not just adoption speed, but also the global competitive dynamics between U. S. – and EU-based stablecoin issuers.

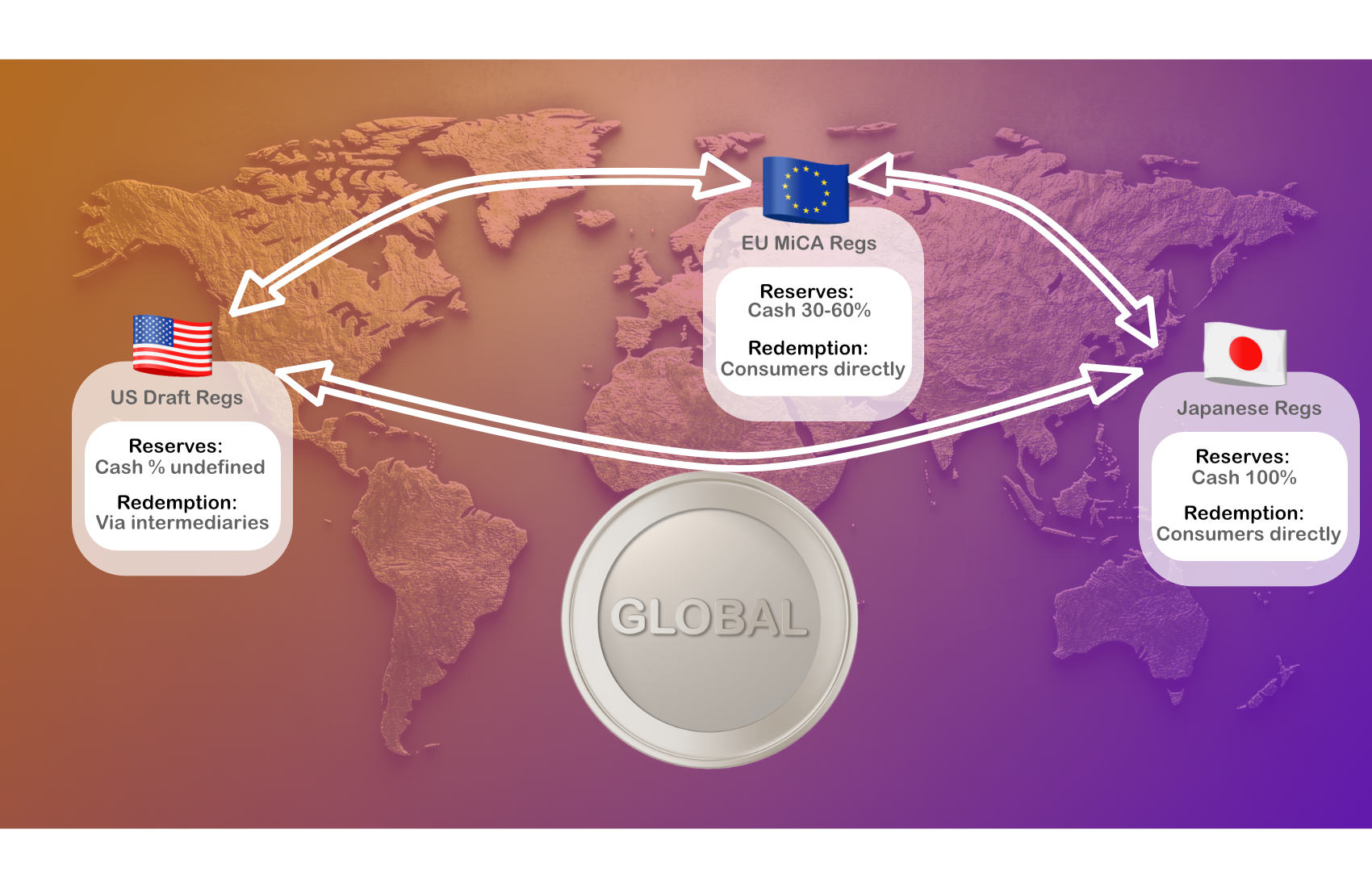

Cross-Border Stablecoin Rules and Interoperability

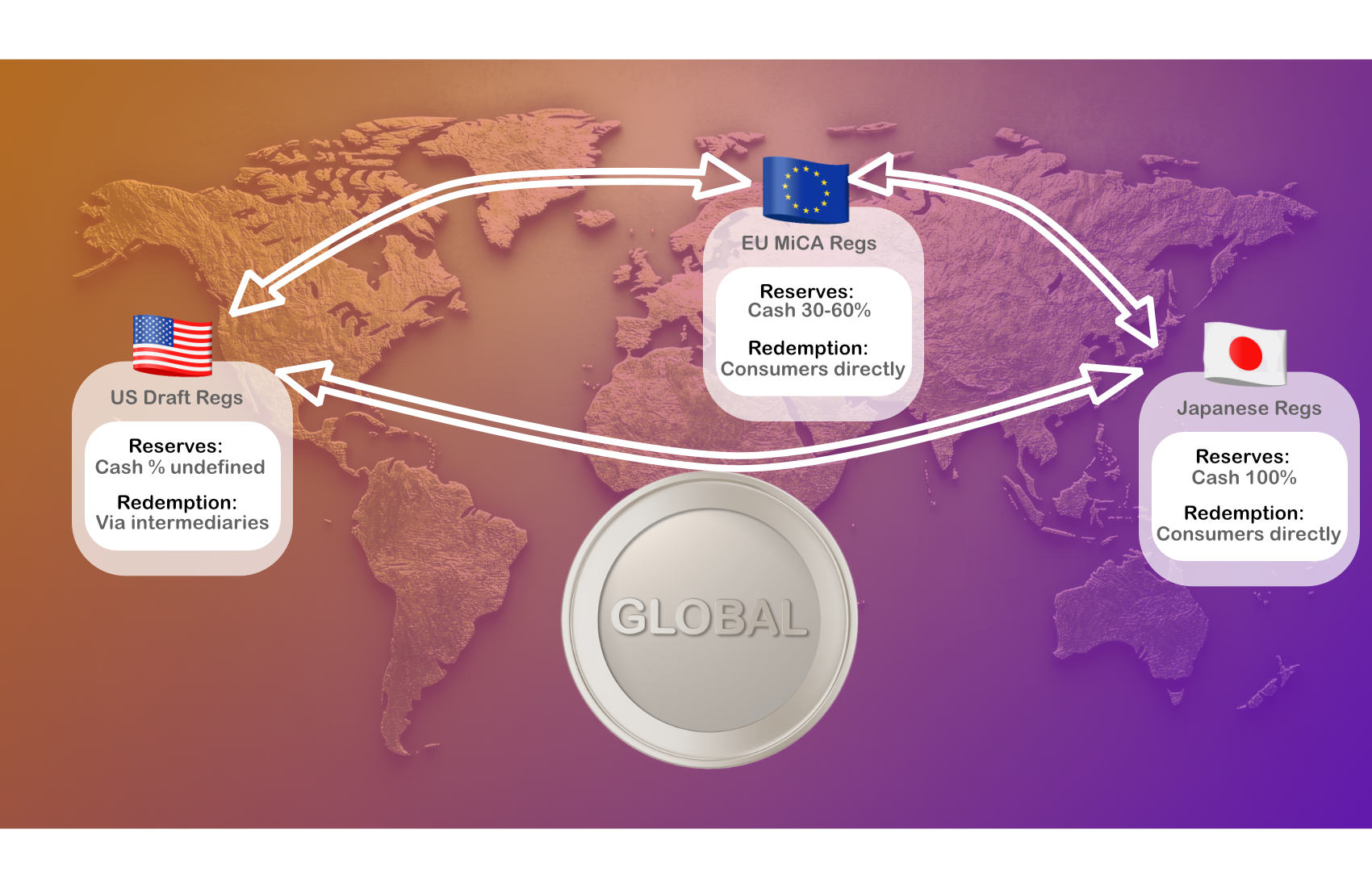

As global commerce increasingly relies on digital assets, cross-border stablecoin rules are becoming a flashpoint for legal professionals and market participants. The GENIUS Act’s exclusion of stablecoins from U. S. securities and commodities laws simplifies domestic compliance but creates ambiguity for issuers operating internationally, especially when their tokens are accessible to EU residents. MiCA, by contrast, requires non-EU issuers to comply with its regime if they target EU users or offer tokens denominated in euro or other EU currencies.

This creates a challenging environment for multinational projects: dual licensing may be required, along with parallel compliance programs tailored to each jurisdiction’s unique demands. For example, a U. S. -based issuer seeking access to European markets must obtain an e-money license under MiCA and implement strict controls on reserve management that may exceed U. S. requirements.

Key Cross-Border Compliance Challenges for Stablecoin Issuers

-

Dual Licensing and Authorization Requirements: Under the GENIUS Act, only U.S.-approved entities (insured depository institutions or licensed non-banks) can issue stablecoins, while MiCA requires EU-based authorization for issuers of Electronic Money Tokens (EMTs) and Asset-Referenced Tokens (ARTs). This creates a complex dual-licensing burden for issuers seeking to operate in both jurisdictions.

-

Reserve Asset Composition and Segregation Rules: The GENIUS Act mandates 1:1 reserve backing with high-quality liquid U.S. assets (e.g., U.S. dollars, short-term Treasuries), whereas MiCA permits a broader range of liquid assets for reserves but imposes strict segregation and custody rules. Reconciling these differing standards is a major compliance hurdle for cross-border issuers.

-

Prohibition of Interest and Yield on Stablecoins: U.S. law under the GENIUS Act prohibits offering interest or yield to stablecoin holders, while MiCA does not explicitly ban yield but tightly regulates remuneration structures. Designing compliant products for both markets is challenging for global issuers.

-

Reporting, Audit, and Transparency Obligations: GENIUS Act requires regular public disclosures and independent audits of reserves, while MiCA mandates detailed reporting to EU regulators and public transparency. Synchronizing audit cycles, formats, and disclosures across both regimes increases operational complexity.

-

Restrictions on Algorithmic and Asset-Referenced Stablecoins: MiCA effectively bans algorithmic stablecoins and imposes scale and usage limits on ARTs to protect monetary sovereignty, while the GENIUS Act focuses on fiat-backed stablecoins and does not address algorithmic models. Issuers must navigate diverging token eligibility criteria when operating internationally.

-

Market Abuse and Consumer Protection Standards: MiCA directly addresses market abuse and imposes strict conduct obligations, while the GENIUS Act emphasizes operational requirements and bankruptcy protections. Aligning compliance programs to meet both sets of standards is a significant challenge for cross-border issuers.

Enforcement Priorities and Market Abuse

Another critical distinction is enforcement focus. MiCA explicitly addresses market abuse, insider trading, price manipulation, and misleading disclosures, by imposing conduct obligations on all crypto-asset service providers. The GENIUS Act, while robust on operational risk and bankruptcy protections, delegates most market conduct oversight to existing banking regulators without introducing new crypto-specific anti-abuse rules.

This divergence could affect investor confidence depending on where tokens are issued or traded. Issuers seeking reputational advantage in Europe may need to implement additional monitoring systems, not just for reserve backing but also for ongoing surveillance of trading activity.

Looking Ahead: 2025 Stablecoin Regulatory Frameworks

The interplay between the GENIUS Act stablecoin regulation and MiCA stablecoin compliance will define the next phase of digital asset evolution. Both frameworks aim to fortify consumer protection while supporting innovation; however, their divergent approaches reflect deeper strategic priorities, U. S. dollar hegemony versus eurozone sovereignty, and set distinct expectations for licensing, reserves, cross-border activity, and enforcement.

Legal professionals advising clients in this space should closely monitor ongoing interpretive guidance from both U. S. federal agencies and EU authorities as practical implementation unfolds throughout 2025-2026. Market participants must prepare for a world where true interoperability will require not just technical solutions but also sophisticated multi-jurisdictional compliance strategies.

Which stablecoin regulatory framework better balances innovation with financial stability?

With both the US GENIUS Act and the EU’s MiCA now in effect, each region has taken a different approach to regulating stablecoins. The GENIUS Act focuses on strict reserve backing and integration with the US financial system, while MiCA emphasizes comprehensive oversight and monetary sovereignty. Which framework do you think strikes the right balance between fostering innovation and ensuring financial stability?