The global stablecoin landscape is undergoing a seismic shift as the United States and Hong Kong roll out landmark regulatory frameworks in 2025. With the GENIUS Act now federal law in the US and Hong Kong’s Stablecoin Ordinance coming into force, both jurisdictions are setting new standards for transparency, reserve management, and institutional oversight. These moves are not just shaping local compliance, they’re catalyzing a global recalibration of how stablecoin issuers operate across borders.

GENIUS Act Ushers in Comprehensive US Stablecoin Regulation

Signed into law on July 18,2025, the GENIUS Act establishes the first comprehensive federal framework for stablecoin regulation in the United States. This legislation introduces a licensing regime specifically for “permitted payment stablecoin issuers, ” requiring full fiat backing and subjecting issuers to rigorous quarterly audits. The act also mandates robust AML/KYC compliance and excludes algorithmic stablecoins from its scope, signaling clear intent to prioritize consumer protection and systemic stability.

The GENIUS Act’s impact is immediate: stablecoin issuers must now hold 100% of their reserves in highly liquid assets, with monthly public attestations to bolster market confidence. Market participants are already adapting to heightened scrutiny, as regulators look to pre-empt risks that could spill over into traditional finance.

For context, Dai (DAI): one of the most widely used decentralized stablecoins, currently trades at $1.00, reflecting market stability amid these sweeping regulatory changes. The GENIUS Act’s requirements around fiat backing and transparency are designed to keep such pegs resilient even under stress.

Hong Kong’s 2025 Stablecoin Licensing: A New Regional Benchmark

Meanwhile, Hong Kong has cemented its position as a digital asset hub by passing the Stablecoins Ordinance, effective August 1,2025. This ordinance requires all fiat-referenced stablecoin issuers to secure a license from the Hong Kong Monetary Authority (HKMA). Key provisions include stringent reserve asset management rules, mandatory redemption procedures at par value, and enhanced risk controls, all designed to safeguard investors and maintain financial stability amid growing cross-border flows.

The HKMA’s approach is pragmatic yet firm: only fully backed stablecoins will be permitted for public distribution or use in payment systems. By drawing clear lines between compliant and non-compliant products, Hong Kong aims to attract institutional players seeking regulatory certainty while discouraging speculative or opaque models.

Comparing US vs Hong Kong: Divergent Paths Toward Global Stablecoin Compliance

The contrasting approaches of Washington and Hong Kong are already influencing global compliance strategies:

- Reserve Requirements: Both demand full backing by liquid assets but differ on audit frequency and acceptable reserve instruments.

- Licensing: The US model centralizes oversight under federal agencies; Hong Kong relies on its monetary authority with a strong focus on cross-border interoperability.

- Scope: Algorithmic stablecoins remain outside both regimes’ core frameworks, a calculated move that leaves innovation space but increases fragmentation risk.

This divergence means international issuers face complex licensing decisions as they navigate overlapping requirements for global market access. For legal teams and compliance officers, staying ahead means mapping jurisdictional obligations with precision, and preparing for ongoing updates as regulators react to new risks or market trends.

Dai (DAI) Price Stability Forecast: 2026-2031 Under New US/HK Stablecoin Regulations

Projected DAI price range under the GENIUS Act and Hong Kong’s Stablecoin Ordinance, reflecting enhanced regulatory compliance and market stability.

| Year | Minimum Price | Average Price | Maximum Price | % Change (Avg YoY) | Market Scenario Insight |

|---|---|---|---|---|---|

| 2026 | $0.995 | $1.00 | $1.005 | 0% | DAI remains tightly pegged due to full-reserve and audit requirements; minor volatility possible during initial regulatory implementation. |

| 2027 | $0.995 | $1.00 | $1.006 | 0% | Stability persists as US/HK regulatory frameworks mature; increased institutional adoption supports peg. |

| 2028 | $0.994 | $1.00 | $1.007 | 0% | Stablecoin market competition grows, but DAI’s compliance and transparency maintain its $1.00 peg. |

| 2029 | $0.993 | $1.00 | $1.008 | 0% | Broader global adoption of stablecoin regulations; DAI’s reputation for compliance keeps volatility at historic lows. |

| 2030 | $0.992 | $1.00 | $1.009 | 0% | Potential for minor deviation during market stress events, but regulatory frameworks ensure rapid return to peg. |

| 2031 | $0.991 | $1.00 | $1.010 | 0% | DAI remains a trusted stablecoin as international standards harmonize; peg stability expected despite evolving market conditions. |

Price Prediction Summary

DAI is forecast to maintain exceptional price stability through 2031, with its average price remaining at $1.00 annually. Minimum and maximum prices reflect minor, temporary deviations typical of stablecoins, especially under stress or extreme market conditions. The GENIUS Act and Hong Kong’s regulations significantly reduce systemic risks, increase transparency, and bolster market confidence in DAI’s peg. No significant year-over-year change in average price is expected, underscoring DAI’s reliability as a dollar-pegged asset.

Key Factors Affecting Dai Price

- Full-reserve and regular audit requirements under the GENIUS Act and HK Stablecoin Ordinance.

- Increased regulatory clarity attracting institutional and retail adoption.

- Stringent AML/KYC and risk management standards reducing systemic risk.

- Potential for heightened competition from other compliant stablecoins.

- Market stress events (e.g., liquidity crunches) could cause minor, short-lived peg deviations.

- Global regulatory convergence and evolving digital asset standards.

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

With the GENIUS Act and Hong Kong’s Stablecoin Ordinance now operational, the regulatory environment for stablecoins is more defined, but also more demanding. The days of regulatory ambiguity are over for issuers targeting US or Hong Kong markets. Both regimes require not just compliance, but ongoing transparency, monthly audits in the US and real-time reserve monitoring in Hong Kong. This shift is already driving institutional adoption, as major payment firms and banks seek stablecoin licenses to serve both retail and cross-border clients.

Institutional Adoption: New Players, New Standards

These frameworks are catalyzing a wave of new entrants. Traditional financial institutions, previously wary of unclear rules, are now applying for stablecoin licenses in both jurisdictions. The GENIUS Act’s federal charter and Hong Kong’s HKMA licensing offer clear roadmaps for compliance, making it easier to launch products that meet global standards for anti-money laundering (AML), know-your-customer (KYC), and consumer protection.

Expect to see more partnerships between banks and crypto-native firms as they navigate these requirements together. For fintechs, the cost of compliance is rising, but so too is market credibility. In an environment where Dai (DAI) remains steady at $1.00, stability is not just a technical feature; it’s a regulatory mandate.

Key Compliance Steps for Stablecoin Issuers (US & HK)

-

Obtain Required Licenses — Under the GENIUS Act, issuers must secure a federal license as a “permitted payment stablecoin issuer.” In Hong Kong, a license from the Hong Kong Monetary Authority (HKMA) is mandatory for fiat-referenced stablecoins.

-

Maintain 100% Fiat-Backed Reserves — The GENIUS Act and HK Stablecoin Ordinance both require stablecoins to be fully backed by high-quality, liquid fiat assets to ensure redemption at par value.

-

Conduct Regular Independent Audits — US issuers must publish monthly reserve audits as mandated by the GENIUS Act. Hong Kong requires periodic independent audits to verify reserve sufficiency and transparency.

-

Implement Robust AML/KYC Procedures — Both regimes require comprehensive Anti-Money Laundering (AML) and Know Your Customer (KYC) frameworks to monitor and report suspicious activity.

-

Establish Clear Redemption Policies — Issuers must provide transparent, prompt redemption mechanisms for users wishing to exchange stablecoins for fiat, as stipulated by both the GENIUS Act and HKMA regulations.

-

Comply with Ongoing Regulatory Reporting — Regular disclosure of financial, operational, and risk management information to regulators is required in both jurisdictions to maintain compliance and market integrity.

Cross-Border Payments: Regulatory Fragmentation or Harmonization?

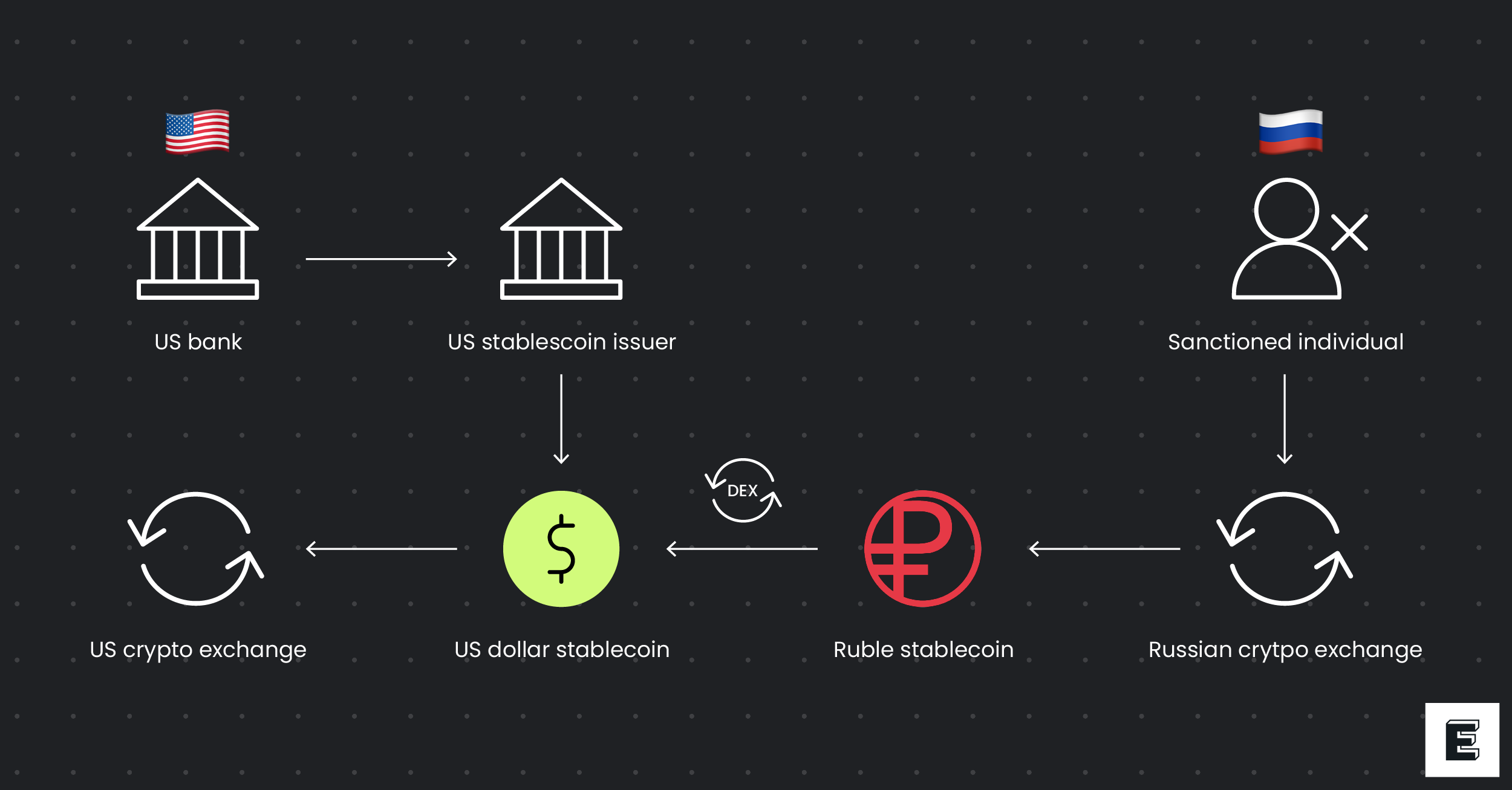

One immediate challenge is regulatory fragmentation. Issuers operating globally must reconcile diverging rules on reserve composition, redemption rights, reporting frequency, and permissible business models. While both the US and Hong Kong demand 100% fiat backing and robust disclosures, subtle differences, like audit cadence or accepted asset types, complicate cross-border offerings.

This patchwork also creates opportunities for arbitrage: some issuers may gravitate toward jurisdictions with lighter-touch supervision or faster licensing processes. However, large-scale payment networks, especially those serving multinational corporates, are likely to prioritize fully compliant products to minimize legal risk.

For regulators elsewhere, these developments set new benchmarks. The European Union’s MiCA regime will need to address gaps left by the US-HK divergence if it wants to remain competitive as a digital asset hub. Meanwhile, smaller jurisdictions may find themselves forced to harmonize with these standards or risk exclusion from major payment corridors.

What’s Next? Strategic Takeaways

- Map your exposure: Legal teams must chart where their stablecoins are issued, distributed, or held, and align with both US federal law and HKMA rules if serving those markets.

- Prioritize transparency: Monthly audits (GENIUS Act) and real-time reserve reporting (HKMA) are non-negotiable requirements for continued market access.

- Monitor legislative updates: Both regimes will likely evolve; staying agile means tracking amendments or new guidance closely.

The bottom line? Regulation is no longer an afterthought, it’s a core driver of product design, risk management, and market strategy in the stablecoin sector.

Dai (DAI) Price Stability Forecast: 2026–2031

Projected DAI price range under US GENIUS Act & Hong Kong Stablecoin Ordinance through 2031

| Year | Minimum Price | Average Price | Maximum Price | Year-over-Year Range (%) | Market Scenario Insights |

|---|---|---|---|---|---|

| 2026 | $0.99 | $1.00 | $1.01 | 2% | GENIUS Act & HKMA rules stabilize DAI; minor deviations possible during market stress |

| 2027 | $0.99 | $1.00 | $1.01 | 2% | Continued regulatory clarity and reserve audits further boost confidence; volatility remains minimal |

| 2028 | $0.98 | $1.00 | $1.02 | 4% | Potential for brief depegs during global macro shocks; regulatory compliance keeps average near $1.00 |

| 2029 | $0.98 | $1.00 | $1.02 | 4% | Stablecoin competition intensifies; DAI benefits from strong compliance, but innovation in rivals may cause brief price pressure |

| 2030 | $0.98 | $1.00 | $1.02 | 4% | Matured regulatory frameworks globally; DAI stability persists, with rare deviations in extreme scenarios |

| 2031 | $0.97 | $1.00 | $1.03 | 6% | Long-term: Systemic financial events could test pegs, but robust reserve and redemption mechanisms expected to hold average at $1.00 |

Price Prediction Summary

DAI is projected to maintain strong price stability through 2031, with average prices anchored at $1.00 due to robust US and Hong Kong regulatory regimes. Minor deviations are possible during high-stress market periods, but full-reserve and audit requirements enforced by the GENIUS Act and HKMA make sustained depegs unlikely. DAI’s compliance-first approach positions it as a leading stablecoin for global users seeking regulatory assurance.

Key Factors Affecting Dai Price

- GENIUS Act mandates 100% fiat backing and monthly audits, increasing transparency and stability.

- Hong Kong’s Stablecoin Ordinance imposes strict licensing and reserve management, reinforcing market trust.

- Global trend toward harmonized stablecoin regulation reduces risk of regulatory arbitrage.

- DAI’s decentralized model remains attractive as long as it meets reserve and compliance standards.

- Potential risks from systemic market shocks or technological vulnerabilities, although mitigated by new regulations.

- Competition from other compliant stablecoins could impact market share but not core price stability.

- Ongoing adoption in DeFi and cross-border payments supports demand and peg integrity.

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.