With the signing of the GENIUS Act on July 18,2025, the United States has entered a new regulatory era for stablecoins. This landmark legislation, championed as a response to rapid growth and mainstream adoption of digital dollar-pegged assets, establishes clear federal guidelines governing who can issue stablecoins, how they must be backed, and what compliance standards must be met. For U. S. stablecoin issuers and legal professionals alike, understanding these changes is now essential to operating within the law and maintaining consumer trust.

GENIUS Act Stablecoin Regulation: The New Federal Standard

The GENIUS Act introduces a comprehensive framework for payment stablecoin issuance in the U. S. , focusing on three critical pillars: 1: 1 reserve backing, federal and state licensing, and robust compliance obligations. This brings much-needed clarity to an industry previously mired in regulatory ambiguity.

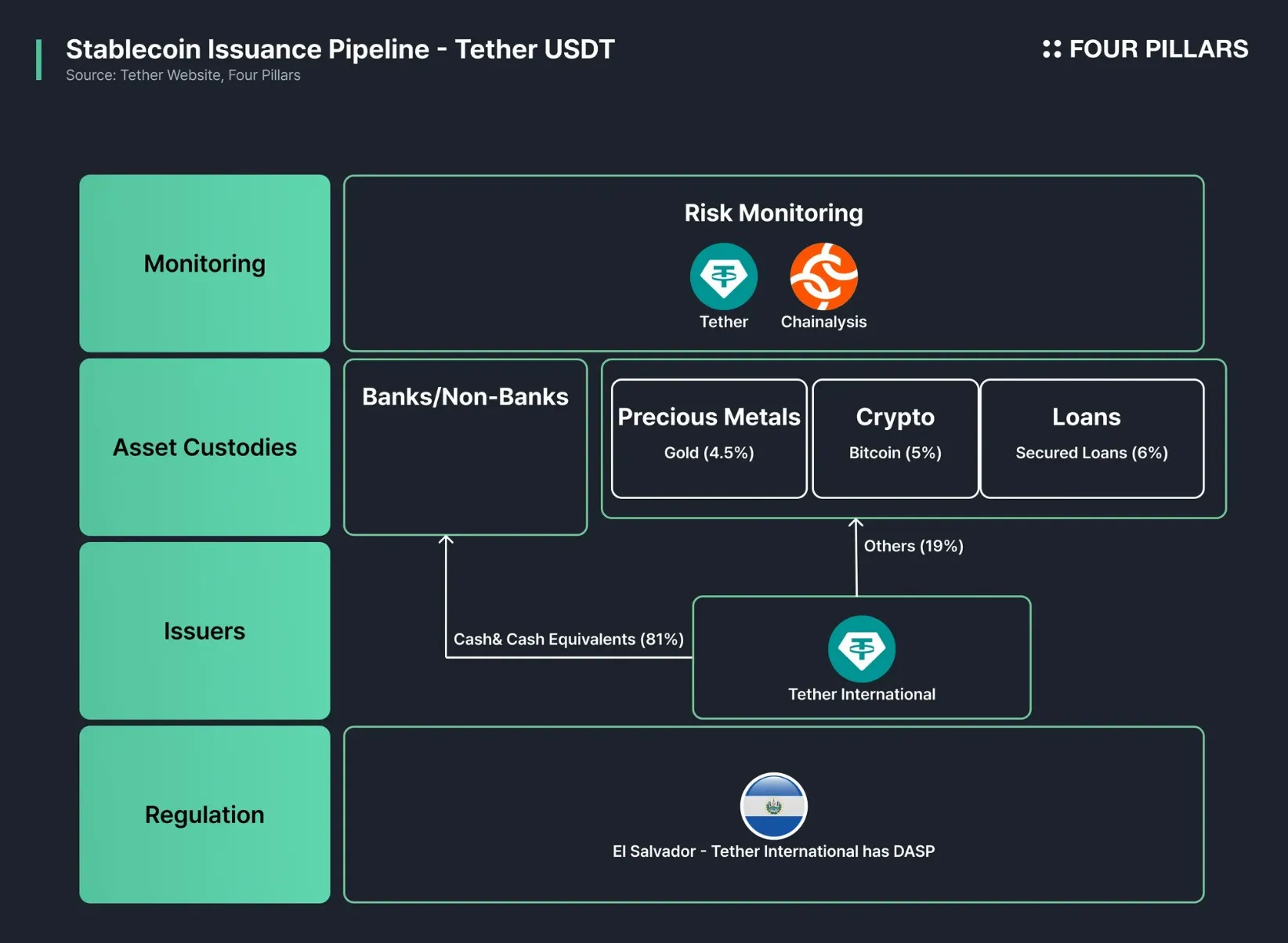

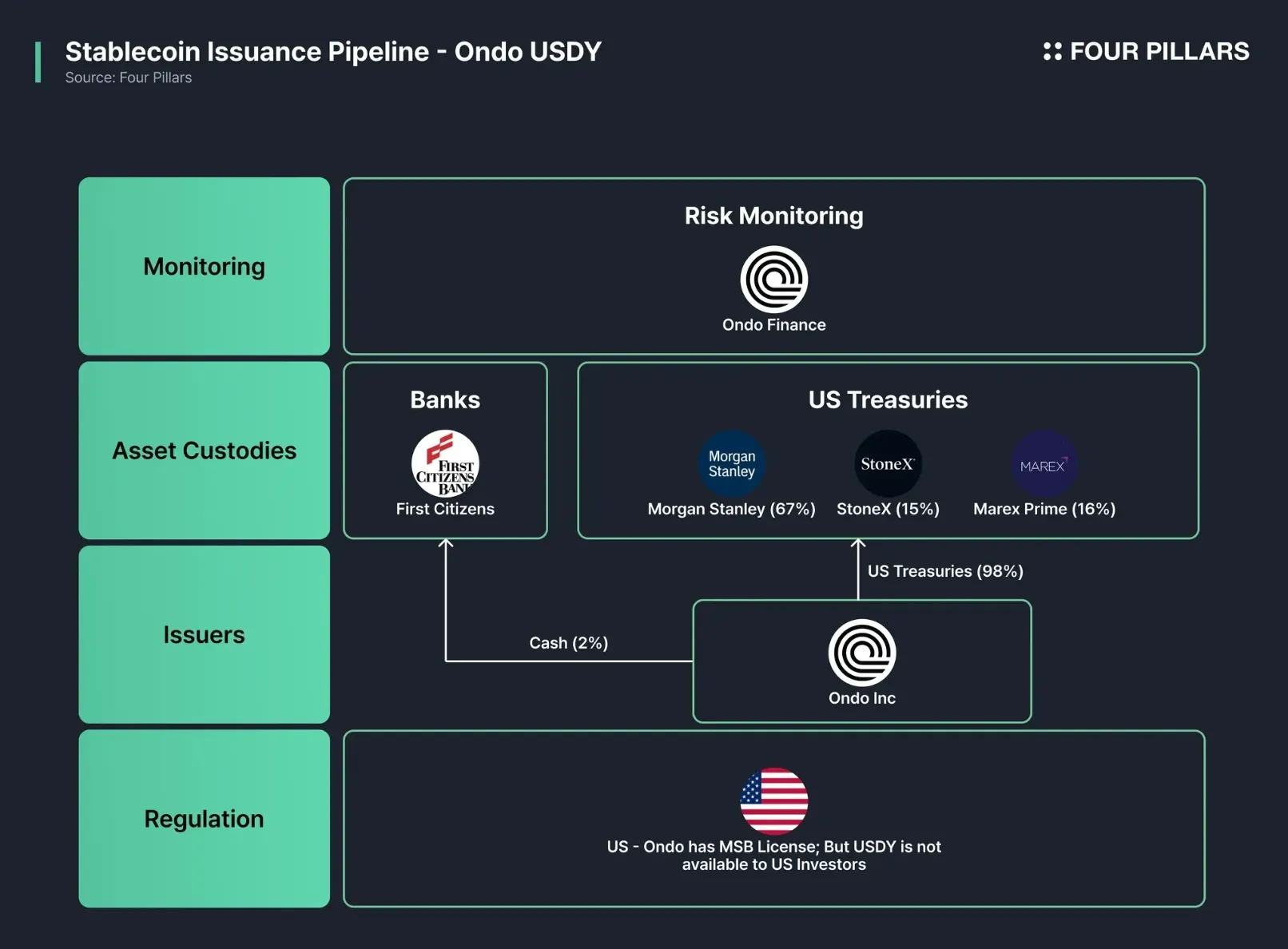

At its core, the Act requires that all permitted payment stablecoins be fully backed by high-quality liquid assets on a one-to-one basis. Permitted reserves include U. S. dollars, short-term Treasury bills, and other cash-equivalent instruments, held in bankruptcy-remote accounts separate from an issuer’s corporate assets. This ensures that every $1 stablecoin in circulation is matched by $1 in redeemable reserves at all times.

“The GENIUS Act’s 1: 1 reserve requirement is a game-changer for market stability and consumer confidence. “

Key US Stablecoin Issuer Requirements Under the GENIUS Act

Key GENIUS Act Requirements for US Stablecoin Issuers

-

1:1 Reserve Backing: All payment stablecoins must be fully backed on a one-to-one basis by high-quality, liquid assets such as U.S. dollars or short-term U.S. Treasury bills. Reserves must be held in bankruptcy-remote accounts and be available for redemption at par value ($1 per stablecoin) at any time.

-

Federal or State Licensing: Issuers with over $10 billion in outstanding stablecoins require federal oversight from agencies like the OCC, Federal Reserve, or FDIC. Smaller issuers may opt for certified state-level regulation if their regime is deemed “substantially similar” to the federal framework.

-

Monthly Reserve Reporting & Auditing: Issuers must publish monthly reports detailing the number of outstanding stablecoins and reserve composition. Reports must be certified by the CEO and CFO and reviewed by independent auditors.

-

Anti-Money Laundering (AML) Compliance: Issuers are classified as financial institutions under the Bank Secrecy Act and must implement robust AML and sanctions compliance programs.

-

Consumer Protection & Insolvency Safeguards: In case of issuer insolvency, stablecoin holders have priority claims on reserves. Issuers must also clearly disclose redemption policies, fees, and must not misrepresent government backing or FDIC insurance.

-

Interest Prohibition: Stablecoins cannot pay interest or yield, reinforcing their use as payment tools rather than investment products.

-

Securities Clarification: The Act explicitly states that payment stablecoins are not classified as securities, deposits, or bank liabilities under federal law.

The legislation sets out strict rules for who can issue payment stablecoins:

- Federal Oversight: Issuers with more than $10 billion outstanding must operate under primary federal supervision, typically by the OCC, Federal Reserve Board, or FDIC.

- State Oversight Option: Smaller issuers (with $10 billion or less) may opt for state regulation if their regime is certified as “substantially similar” to federal rules by the Stablecoin Certification Review Committee.

- No Non-Financial Public Companies: Non-financial public companies are barred from issuing payment stablecoins unless unanimously approved by the Review Committee.

This dual-track approach recognizes both national scale operators and innovative startups while raising the bar for risk management and consumer protection across the board.

Monthly Audit Compliance and Transparency Rules

A cornerstone of GENIUS Act stablecoin regulation is transparency. Every issuer must publish monthly reports detailing total outstanding coins and precise reserve composition. These disclosures require certification from both CEO and CFO, and independent auditor review, to ensure accuracy. This monthly audit regime aims to prevent hidden risks that plagued earlier generations of crypto projects.

The law also bans interest payments on payment stablecoins. By prohibiting yields or dividends, regulators reinforce that these tokens are meant for payments, not speculative investment, drawing a clear line between payment infrastructure and financial products subject to securities laws.

The Big Picture: Consumer Protections and Legal Clarity

The GENIUS Act doesn’t stop at technical requirements; it embeds strong consumer protections as well. Holders have priority claims on reserves if an issuer becomes insolvent, a critical safeguard in times of market stress. Furthermore, issuers may not imply government backing or FDIC insurance unless expressly authorized, curbing deceptive marketing practices seen elsewhere in crypto finance.

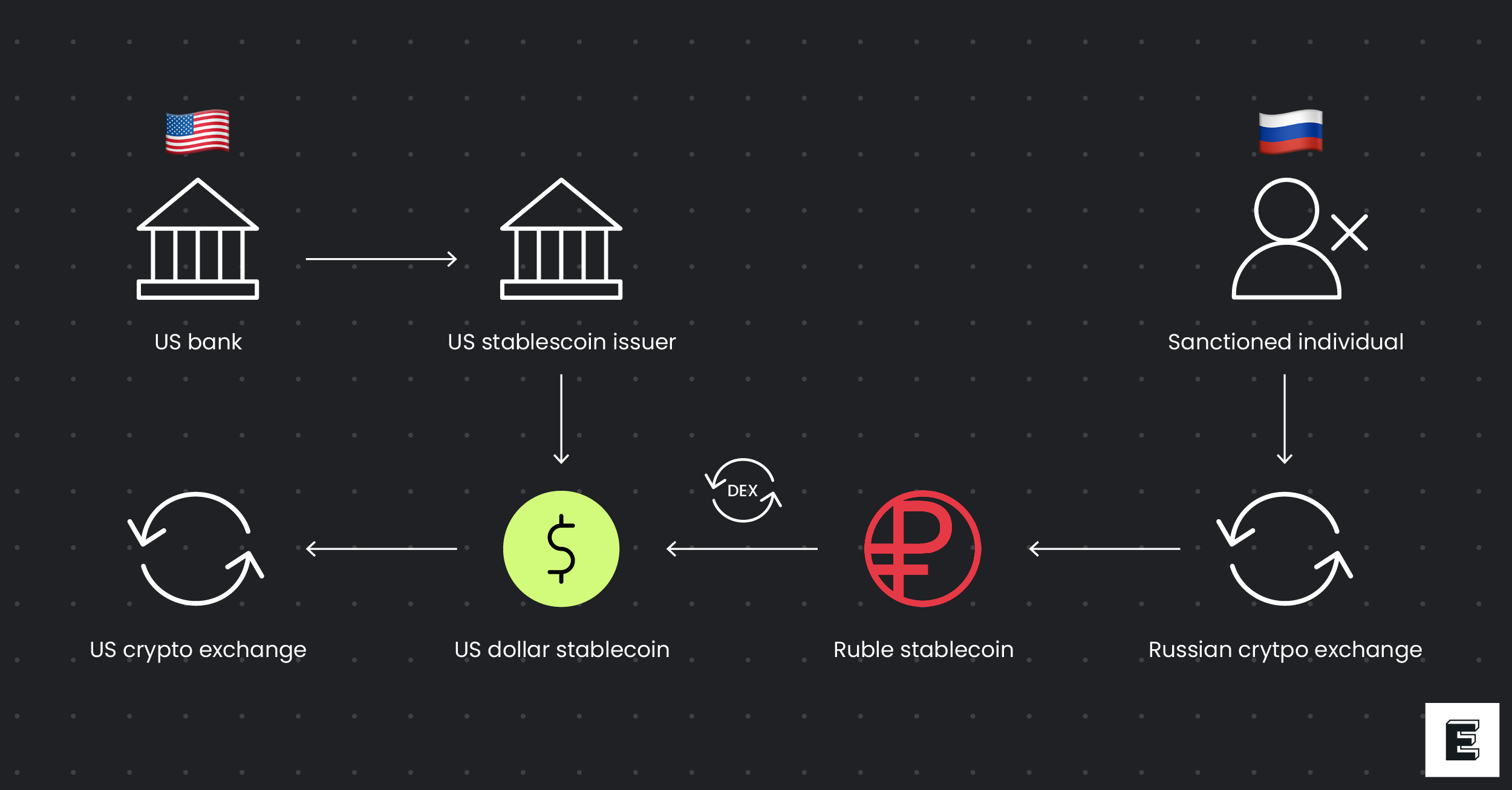

Compliance extends beyond financial transparency. Stablecoin issuers are now classified as financial institutions under the Bank Secrecy Act, bringing them under the same anti-money laundering (AML) and sanctions screening obligations as banks and broker-dealers. This move is designed to prevent illicit usage of stablecoins, and it marks a significant shift in how crypto businesses must approach onboarding, transaction monitoring, and reporting suspicious activities.

“By holding stablecoin issuers to traditional AML standards, the GENIUS Act bridges the gap between digital assets and established financial safeguards. “

Additionally, the Act clarifies that payment stablecoins are not considered securities or commodities. This removes a major source of regulatory uncertainty that previously hampered innovation and investment in U. S. stablecoin projects. With this legal certainty, issuers can focus on compliance and product development rather than navigating overlapping federal agency claims.

How These Rules Are Changing the US Crypto Landscape

The GENIUS Act’s clear boundaries for 1: 1 reserve rules, licensing, and monthly audit compliance have already begun to reshape market behavior. Industry leaders have ramped up their internal controls, hired compliance professionals with banking backgrounds, and sought independent certification for their reserves to meet new disclosure standards.

For smaller startups, the state-level pathway preserves room for innovation while ensuring that consumer protection is non-negotiable. The Stablecoin Certification Review Committee’s role as a gatekeeper ensures that only robust state regimes are allowed, a move welcomed by both regulators and responsible industry participants.

Key Operational Changes for US Stablecoin Issuers Post-GENIUS Act

-

Mandatory 1:1 Reserve Backing: Issuers must fully back all outstanding stablecoins with high-quality, liquid assets such as U.S. dollars and short-term Treasury bills, held in bankruptcy-remote accounts and separate from corporate funds.

-

Monthly Public Reserve Reporting: Issuers are required to publish monthly, independently audited reports detailing the number of stablecoins in circulation and the exact composition of their reserves, certified by the CEO and CFO.

-

Federal or State Licensing Requirements: Issuers with over $10 billion in outstanding stablecoins must obtain federal licenses and submit to oversight by agencies like the OCC, Federal Reserve, and FDIC. Smaller issuers may operate under state regimes certified as equivalent by the Stablecoin Certification Review Committee.

-

Enhanced AML and Sanctions Compliance: All issuers are classified as financial institutions under the Bank Secrecy Act, requiring robust anti-money laundering and sanctions programs, including customer due diligence and suspicious activity reporting.

-

Strict Marketing and Government Backing Restrictions: Issuers must comply with new marketing rules, prohibiting any suggestion that stablecoins are government-backed or FDIC-insured, and must avoid deceptive consumer practices.

-

Prohibition on Paying Interest or Yield: Stablecoins cannot offer interest or yield to holders, reinforcing their use as payment instruments rather than investment products.

-

Priority Claims for Holders in Insolvency: In the event of issuer insolvency, stablecoin holders are granted priority claims on the segregated reserves, ensuring enhanced consumer protection.

-

Clarification of Regulatory Status: The Act confirms that payment stablecoins are not classified as securities, deposits, or bank liabilities, providing regulatory certainty for issuers and users.

One of the most impactful provisions is insolvency protection. In a scenario where an issuer fails, holders’ claims on reserves take precedence over other creditors, a safeguard rarely seen in traditional finance until now. This prioritization directly addresses one of the biggest fears among everyday users: losing access to funds during corporate distress events.

Looking Ahead: What US Stablecoin Issuers Should Do Now

If you are involved with a U. S. -based stablecoin project, whether as legal counsel or operational lead, the GENIUS Act requires immediate action:

- Review reserve management policies: Ensure all assets meet federal quality standards and are held in bankruptcy-remote accounts.

- Upgrade compliance programs: Implement rigorous AML/KYC procedures aligned with federal requirements.

- Prepare for monthly audits: Establish workflows for timely CEO/CFO certifications and independent auditor reviews.

- Audit marketing materials: Remove any language suggesting government backing or FDIC insurance unless explicitly authorized.

- Engage with regulators early: Especially if pursuing state-level licensing or facing novel business model questions.

The GENIUS Act sets a new global benchmark for digital asset regulation, one that balances innovation with stability, transparency with privacy, and growth with consumer safety. As these rules come into full effect over the coming months, expect further guidance from federal agencies clarifying edge cases such as cross-border issuance or integration with decentralized finance protocols.

For ongoing updates on evolving requirements, including maps of certified state regimes and practical compliance tips, see our detailed resource at GENIUS Act Explained: US Stablecoin Licensing and Reserve Rules (2025).