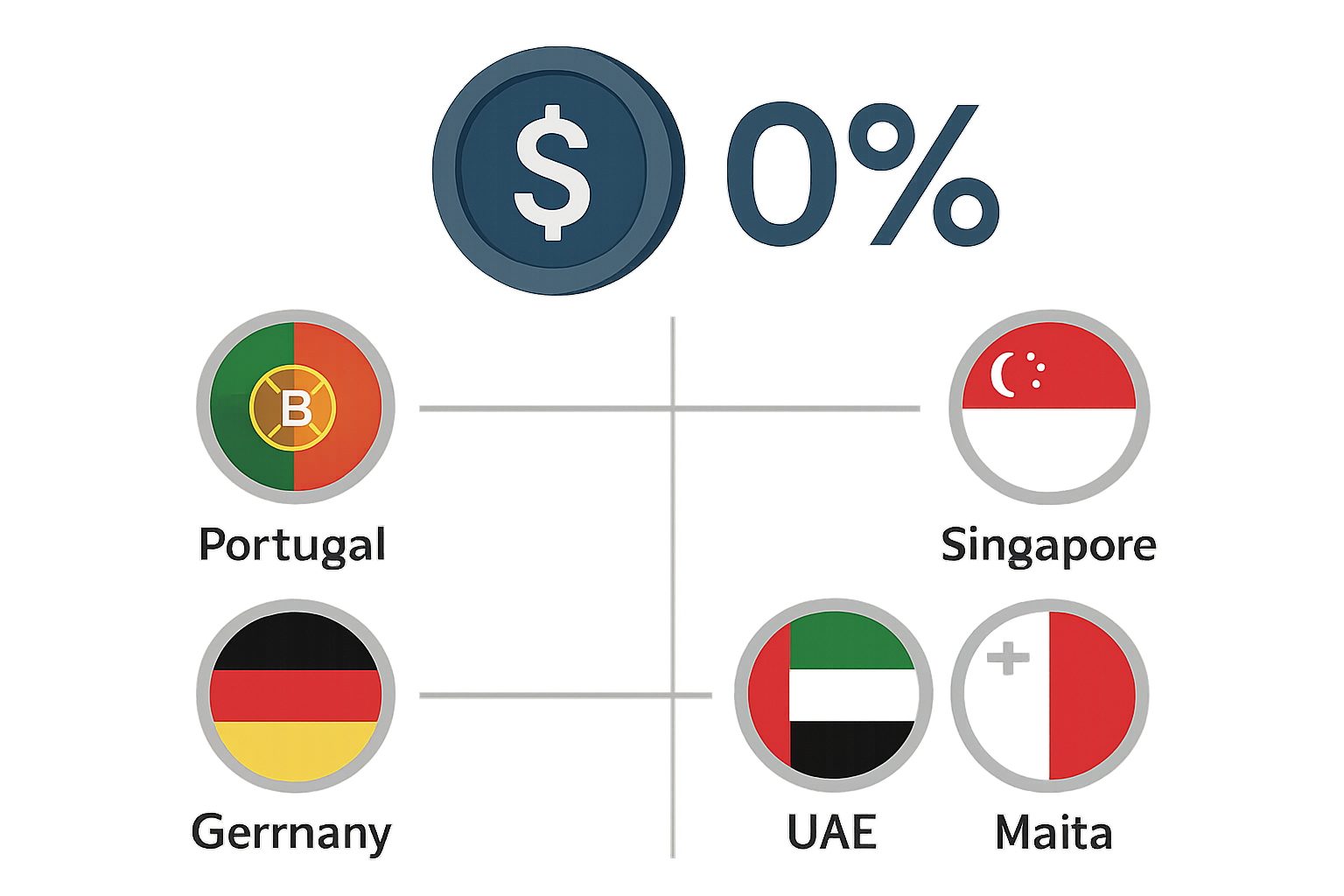

Stablecoin adoption continues to surge in 2025, but the real game-changer for investors is the emergence of true crypto tax havens. For stablecoin holders and traders, understanding where capital gains are taxed at 0% is critical for both portfolio optimization and regulatory compliance. This year, a select group of countries and territories in the EU, Asia, and globally have cemented their reputations as zero-tax jurisdictions for stablecoins and other digital assets.

Why Stablecoin Taxation Matters in 2025

Stablecoins have become a cornerstone of global crypto markets, offering price stability and serving as on-ramps to DeFi, remittances, and digital payments. However, taxation on stablecoin transactions varies dramatically by jurisdiction. In some regions, capital gains from stablecoins are taxed just like any other crypto asset; elsewhere, long-term holding or specific residency status can grant complete exemption.

With regulatory frameworks like the EU’s MiCAR now in full effect (PwC Global Crypto Regulation Report 2025), clarity around stablecoin taxation is sharper than ever. Investors need to know precisely where they stand if they want to maximize returns without falling afoul of tax authorities.

The Definitive List: 17 Countries With 0% Crypto Tax Policies

17 Countries With 0% Crypto Tax on Stablecoins (2025)

-

Portugal: Known for its crypto-friendly tax regime, Portugal exempts capital gains tax on cryptocurrencies, including stablecoins, held for more than 365 days.

-

Germany: Germany offers 0% capital gains tax on crypto assets, including stablecoins, if held for over one year—ideal for long-term investors.

-

Singapore: With no capital gains tax on crypto, Singapore remains a top destination for stablecoin holders seeking regulatory clarity and tax efficiency.

-

United Arab Emirates (UAE): The UAE, including Dubai and Abu Dhabi, applies a 0% tax rate on crypto income and capital gains, covering stablecoins across all emirates.

-

Malta: Malta, the “Blockchain Island,” imposes no capital gains tax on long-term crypto holdings, supporting stablecoin investors with a robust legal framework.

-

Switzerland: Crypto gains, including from stablecoins, are tax-free for individual investors in Switzerland, provided trading is not a primary occupation.

-

Malaysia: Malaysia does not tax capital gains on cryptocurrencies for individuals, making it attractive for stablecoin investors.

-

Hong Kong: Hong Kong’s regulatory clarity and 0% capital gains tax on crypto, including stablecoins, make it a leading Asian crypto hub.

-

El Salvador: As the first country to adopt Bitcoin as legal tender, El Salvador offers no capital gains tax on crypto, including stablecoins.

-

Georgia: Georgia exempts foreign-sourced crypto income from tax for residents, including stablecoin gains, fostering a favorable environment for crypto investors.

-

Belarus: Belarus maintains a tax holiday on crypto activities, including stablecoin transactions, until at least 2025.

-

Puerto Rico (US territory): Puerto Rico offers unique tax incentives for US citizens, including 0% capital gains tax on crypto under certain residency programs.

-

Cayman Islands: The Cayman Islands impose no direct taxes on crypto gains, including stablecoins, attracting global investors and crypto businesses.

-

Bermuda: Bermuda’s progressive crypto regulations include 0% capital gains tax on digital assets, supporting stablecoin adoption and innovation.

-

Slovenia: Slovenia offers tax-free capital gains for individuals selling cryptocurrencies, including stablecoins, under personal income tax rules.

-

Estonia: Estonia does not tax capital gains on crypto for individuals, provided the activity is not business-related, making it favorable for stablecoin holders.

-

Gibraltar: Gibraltar’s crypto-friendly legislation ensures no capital gains tax on crypto, including stablecoins, and a supportive regulatory environment.

This exclusive list includes:

- Portugal

- Germany

- Singapore

- United Arab Emirates (UAE)

- Malta

- Switzerland

- Malaysia

- Hong Kong

- El Salvador

- Georgia

- Belarus

- Puerto Rico (US territory)

- Cayman Islands

- Bermuda

- Slovenia

- Estonia

- Gibraltar

This selection is based on up-to-date regulatory analysis from leading sources such as Cointelegraph’s guide to tax-free crypto countries (2025), TokenTax, and Coincub. Each jurisdiction has its own nuances – some exempt only long-term capital gains while others provide blanket tax relief for all crypto transactions.

The European Landscape: Key Jurisdictions Explained

The European Union features several standout destinations for stablecoin investors seeking a zero-tax environment:

- Portugal: Exempts capital gains on cryptocurrencies held longer than one year. Short-term trades (under one year) are taxed at a flat rate of 28%. This regime applies to both traditional cryptos and stablecoins alike.

- Germany: Maintains a progressive approach – any cryptocurrency or stablecoin held for more than twelve months is entirely free from capital gains tax. This policy has attracted both retail users and institutional players seeking legal certainty.

- Malta and Switzerland: Long known for their blockchain-friendly stance, both countries offer favorable regimes that generally exempt private individuals from paying taxes on crypto capital gains under most circumstances.

- S Slovenia and Estonia: : These smaller EU states have implemented clear guidelines that exclude individual investors from capital gains taxes on most crypto sales or swaps – including those involving major stablecoins.

- Gibraltar: : As an overseas territory with its own legal system, Gibraltar remains committed to fostering innovation while maintaining a competitive zero-tax environment for digital assets.

The net result? Europe now offers multiple options where long-term stability meets regulatory clarity for those holding USDT, USDC, DAI or other major stablecoins.

The Asian Advantage: Singapore, Hong Kong and Beyond

The Asia-Pacific region has emerged as a powerhouse of crypto innovation – and favorable taxation is part of that story. Here’s how top Asian hubs stack up in 2025:

- Singapore: No capital gains tax applies to any cryptocurrency or stablecoin sale by individuals. Income generated through activities like staking may be taxable but routine trading remains untouched by direct taxes (see more here).