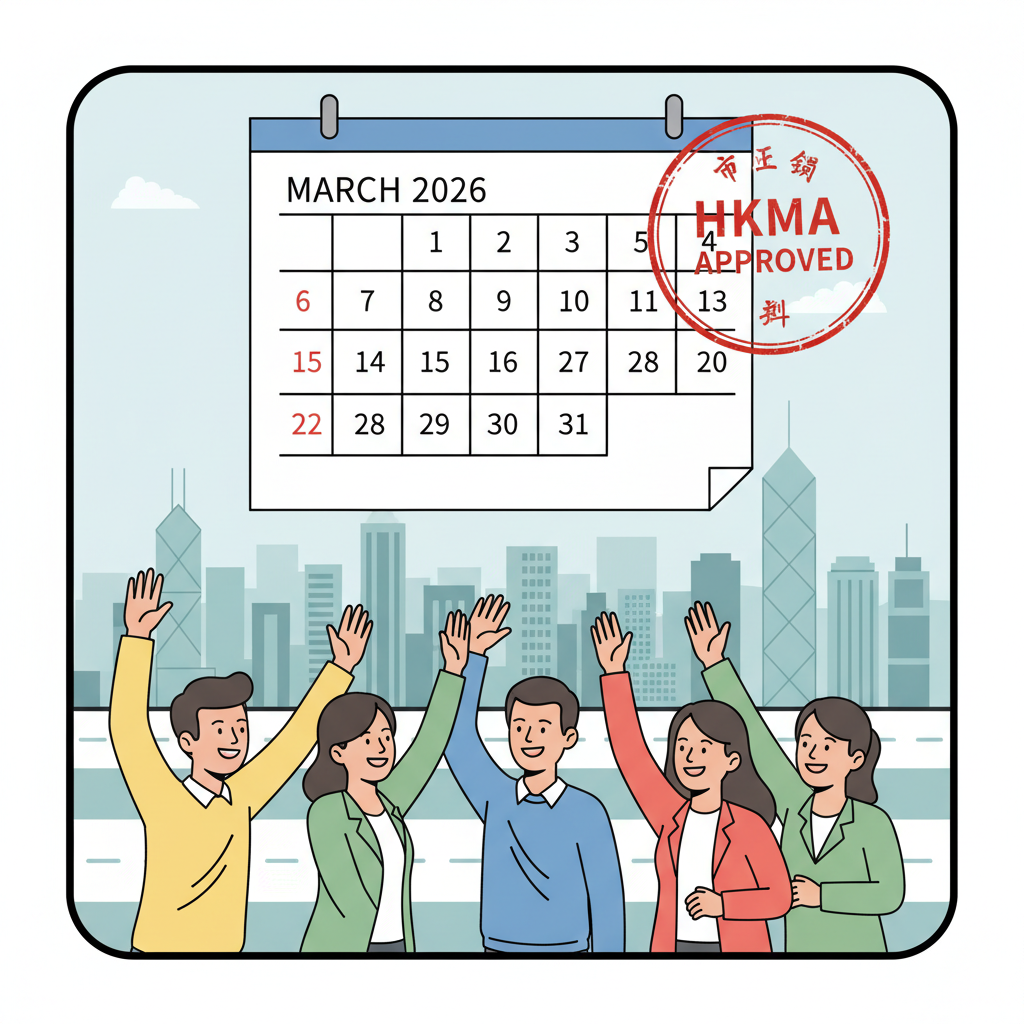

Hong Kong’s stablecoin scene is heating up fast as we hit early 2026, with the HKMA gearing up to drop the first hong kong stablecoin license approvals in March. Traders like me are watching closely; this isn’t just red tape, it’s a gateway to legit, HKD-pegged stability in a volatile crypto world. With 36 applications on the table, including heavy hitters like Animoca Brands and Standard Chartered, the HKMA stablecoin regulation 2026 framework is set to reshape issuance and trading ops right here.

The buzz from Reuters, CoinDesk, and HKMA pressers screams caution mixed with momentum. After the Stablecoins Ordinance kicked in on August 1,2025, every fiat-referenced stablecoin issuer in Hong Kong, plus foreign ones pegged to the HK dollar, must lock down that license or shut down. No more flying under the radar; this is regulatory arbitrage gold for compliant players ready to pounce on cleared assets.

Stablecoins Ordinance Core Pillars for HKMA Approval

At its heart, the ordinance demands ironclad stability to protect holders and markets. Issuers face a gauntlet of checks ensuring tokens hold value without drama. Think full backing, instant redemptions, and governance that screams professionalism. Sidley Austin nails it: high-quality liquid reserves segregated from ops funds are non-negotiable. This setup minimizes run risks, letting traders trust these pegs during wild swings.

HKMA’s public registry will spotlight licensed issuers, boosting transparency. Non-compliers? Fines up to HK$5 million or seven years inside. That’s real teeth, pushing only serious contenders through.

Breaking Down Hong Kong Stablecoin Issuer Requirements

Diving into the nitty-gritty of hong kong stablecoin issuer requirements, applicants must front HK$25 million minimum paid-up capital. That’s table stakes for proving skin in the game. Reserves? Fully backed by top-tier liquid assets, kept separate to dodge insolvency traps. Redemption rights let holders cash out at face value, no delays or gouging fees. Governance ramps up with independent risk committees and crystal-clear disclosures.

Key Requirements for Hong Kong Stablecoin Issuer Licenses (HKMA 2026)

| Requirement Category | Key Details |

|---|---|

| Capital Requirements | Minimum paid-up capital of HK$25 million |

| Reserve Assets | Fully backed by high-quality, liquid assets, segregated from the issuer’s operational funds |

| Redemption Rights | Redeemable at face value without delay or excessive fees |

| Governance Standards | Strong internal controls, independent risk committees, transparent disclosures |

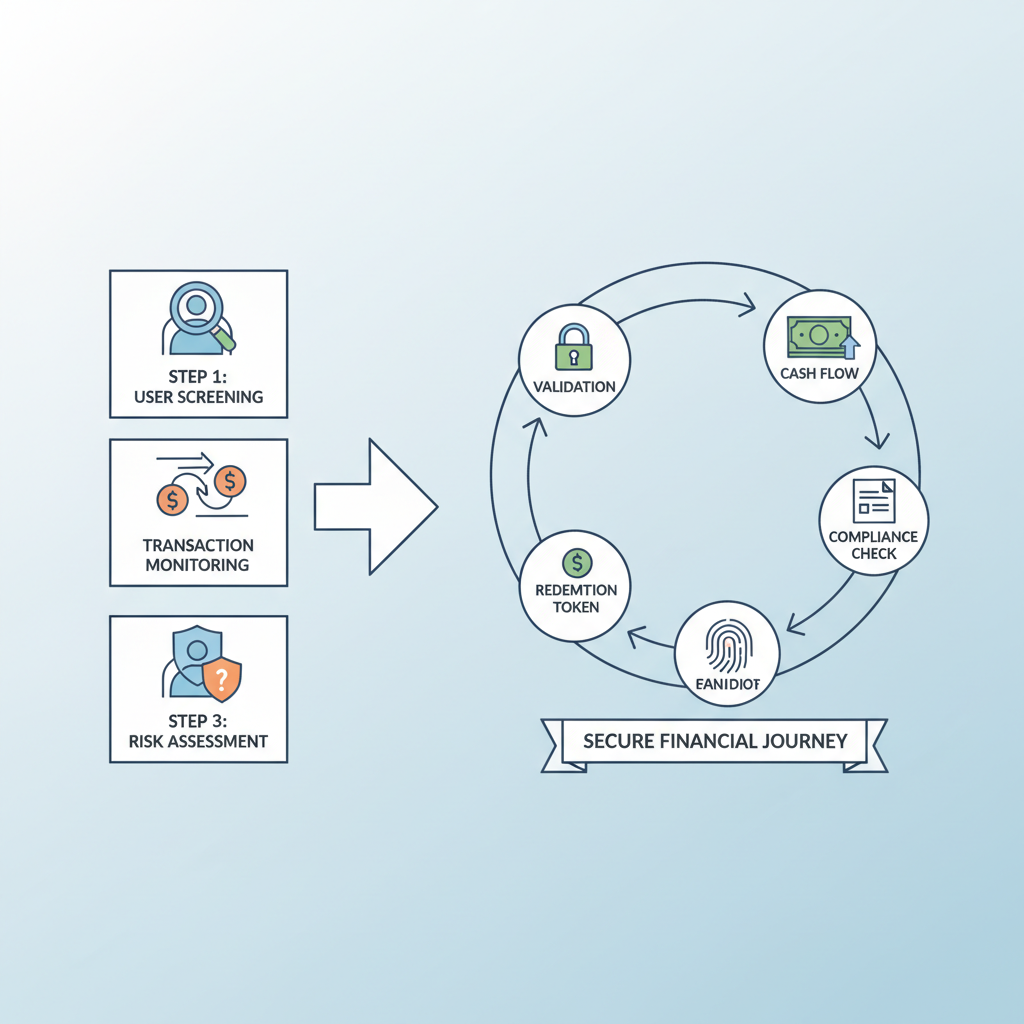

| AML Controls | Strict anti-money laundering protocols |

| Penalties for Non-Compliance | Fines up to HK$5 million and imprisonment up to 7 years |

These aren’t suggestions; they’re the blueprint for hkma stablecoin approval process. Early applicants who nailed transitional deadlines by October 31,2025, now sweat the review. HKMA’s picky, prioritizing AML muscle and real use cases over hype.

Navigating the HKMA Application Surge and First Mover Edge

Picture this: 36 completed apps by the August 1 deadline, a mix of locals and globals eyeing Hong Kong as Asia’s stablecoin hub. Animoca Brands brings Web3 firepower, Standard Chartered traditional finance heft. CryptoRank and Holder. io highlight the surge, but HKMA plans a tight first batch. Why? To test the waters without flooding the system.

Key First-Round Applicants

-

Animoca Brands: Web3 gaming stablecoin innovator among 36 applicants.

-

Standard Chartered: Bank-backed HKD peg powerhouse.

-

34 Others: Under HKMA review for March 2026 licenses.

Transitional players got till January 31,2026, to align or wind down orderly. Rejections mean liquidation mode, redeeming assets cleanly. For traders, licensed stablecoins mean reliable on-ramps for high-frequency plays, dodging black swan peg breaks. I’ve traded enough depegs to know: this regime could arbitrage HK’s strictness against looser spots like Singapore.

Expect the HKMA to grill on reserve audits and stress tests. Sources like Caixin Global underscore the stability focus; no room for fly-by-nights. As reviews wrap in February, March approvals will signal who’s primed for volume.

First-mover edge goes to those who ace the hkma stablecoin approval process. With HKMA’s eyes on robust AML and use-case viability, applicants are submitting detailed reserve management plans and live demos of redemption flows. I’ve seen similar scrutiny in other regs; it weeds out the weak, leaving gold for traders chasing low-slippage pairs.

Once licensed, issuers plug into HKMA’s registry, a real-time beacon for market trust. Traders get verifiable pegs for margin trading, arbitrage, and hedging BTC volatility against HKD stability. No more guessing if that stablecoin holds during a dump; charts align cleaner with licensed backing.

Trader Plays in Hong Kong’s Stablecoin Era

As a day trader glued to charts, this stablecoin licensing hong kong shift is pure alpha. Licensed HKD pegs mean tighter spreads on exchanges like HashKey or OSL, perfect for scalping HKD/USDT crosses. Regulatory arbitrage? Stack licensed HK stables against offshore ones for peg deviation trades. When March hits and names drop, volume spikes incoming; position for that liquidity pump.

Animoca could launch gaming-focused stables for in-app economies, while StanChart eyes cross-border payments. Mix that with HK’s Web3 push, and you’ve got catalysts for explosive adoption. But watch the rejects: forced wind-downs could dump assets, creating short opportunities on correlated tokens.

Risks, Penalties, and Post-License Roadmap

HKMA isn’t playing; unlicensed ops post-January 31 trigger enforcement. Winding-up mandates orderly redemptions, but delays breed panic sells. Penalties bite hard: HK$5 million fines, jail time. Licensed winners face ongoing audits, quarterly reserve attestations, and stress tests mimicking 2022’s Terra crash. Compliance costs rise, but so does premium pricing on their tokens.

Post-approval, expect HKMA sandbox expansions for DeFi integrations. Links to earlier regs groundwork show evolution from 2025 ordinance to 2026 reality. Issuers scaling fast will list on licensed platforms, fueling retail and institutional inflows.

From my trading desk, charts scream setup: stablecoin market cap poised to balloon as HK leads Asia. Peg stability lets me layer high-frequency strats without depeg dread. With 36 apps in play, March unveils the vanguard; get your watchlists ready. Hong Kong’s not just regulating, it’s igniting compliant crypto velocity. Eyes on the HKMA drop-offs for that first real-time edge.