The National Credit Union Administration’s (NCUA) February 11,2026, proposal marks a pivotal shift in US stablecoin regulation GENIUS Act implementation, carving out a structured path for credit unions to enter the payment stablecoin arena. As the GENIUS Act hurtles toward its 2027 effective date, this draft rule demystifies credit union stablecoin licensing, mandating rigorous applications through credit union service organizations (CUSOs). For quantitative minds tracking regulatory volatility, this framework quantifies entry barriers, blending financial safeguards with compliance imperatives to mitigate systemic risks in stablecoin ecosystems.

GENIUS Act Backbone: Restricting Stablecoin Issuance to Permitted Entities

Enacted on July 18,2025, the GENIUS Act erects a federal perimeter around payment stablecoins, designating only permitted payment stablecoin issuers (PPSIs) to serve U. S. persons. This legislation, effective January 18,2027, or 120 days post-primary regulations, imposes rulemaking on agencies like NCUA, targeting credit unions’ unique member-focused model. Credit unions cannot issue stablecoins directly; instead, subsidiaries via CUSOs must secure NCUA approval, ensuring reserves match circulating supply and operations align with not-for-profit ethos.

From a risk-modeling lens, the Act’s prohibition on interest-bearing stablecoins curtails yield-chasing speculation, fostering stability akin to demand deposits. NCUA’s draft interprets “subsidiary of an insured credit union” stringently, requiring parental oversight and capital adequacy to weather redemption pressures, critical in scenarios where 10% daily outflows could test even robust reserves.

NCUA Draft Rules 2026: Application Framework Dissected

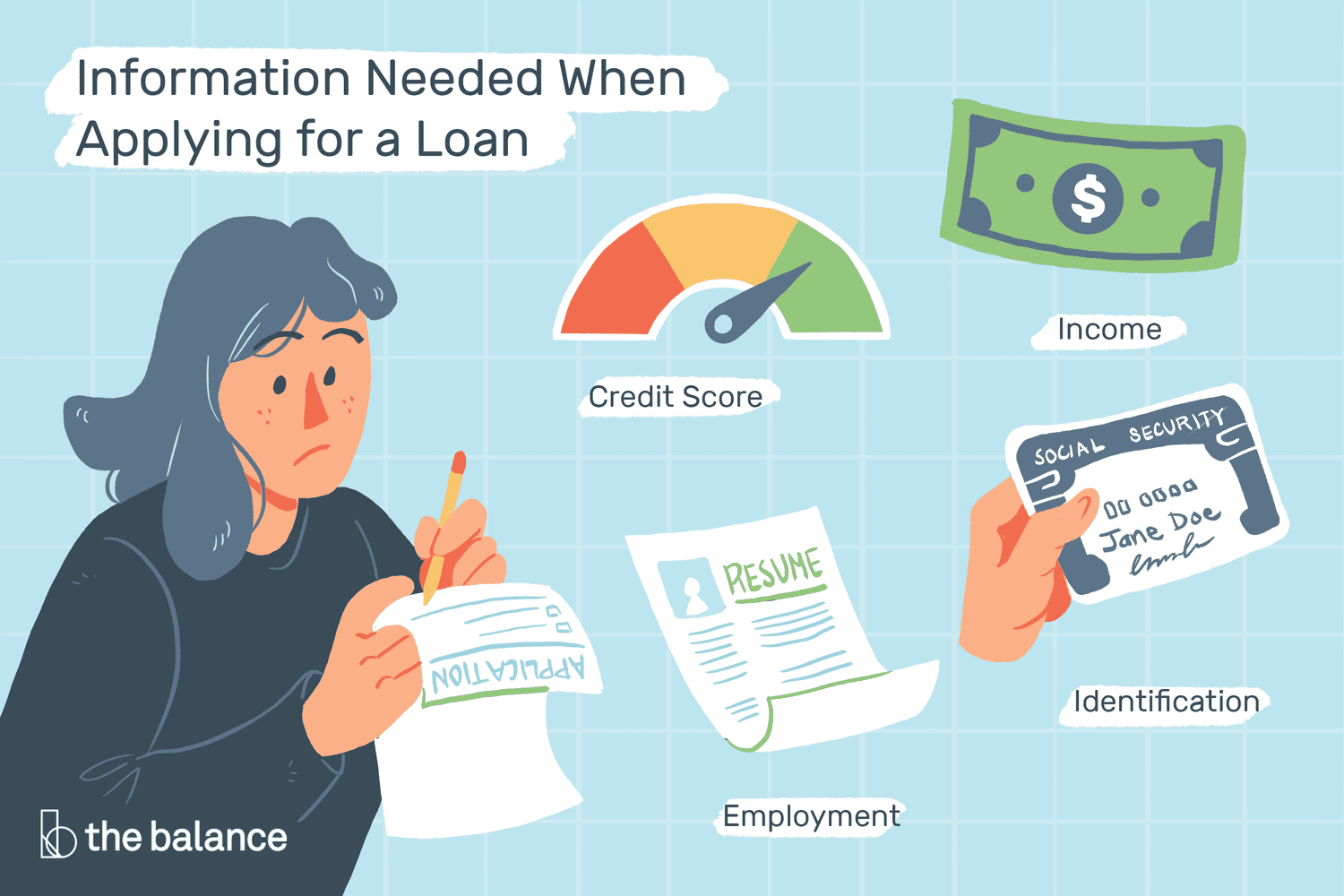

NCUA’s proposal zeroes in on payment stablecoin issuance requirements, demanding comprehensive applications from PPSIs and parent credit unions. Financial health metrics dominate: applicants must demonstrate net worth exceeding 2% of outstanding stablecoins, liquidity coverage ratios surpassing 100%, and stress-tested redemption capacities. Management vetting scrutinizes track records, with quantitative thresholds like zero tolerance for prior sanctions violations.

Business plans face forensic review, projecting member adoption rates, reserve compositions (prioritizing cash and Treasuries), and oracle integrations for real-time peg maintenance. The agency pledges 120-day turnaround on complete filings, a boon for agile applicants modeling approval probabilities via logistic regressions on disclosure depth.

NCUA PPSI Application Checklist

-

Audited Financial Statements: Provide recent audited statements to demonstrate financial health and stability as required for PPSI approval.

-

AML/Sanctions Program Certification: Certify compliance with anti-money laundering and economic sanctions programs, due within 180 days of approval and annually thereafter.

-

CUSO Governance Documents: Submit governance documents for the Credit Union Service Organization (CUSO) used by federal credit unions to issue stablecoins.

-

Reserve Management Policy: Detail policy for managing reserves backing the payment stablecoin, ensuring 1:1 asset backing under GENIUS Act.

-

Member Servicing Plan: Outline plan for servicing credit union members as primary users of the issued stablecoins.

Compliance Trajectories: From Approval to Ongoing Oversight

Post-approval, PPSIs certify AML and sanctions programs within 180 days, renewing annually, a perpetual motion machine of regulatory scrutiny. NCUA emphasizes CUSO structures serving primarily credit union members, capping external exposure to preserve cooperative integrity. This bifurcated issuance model, credit unions as guardians, CUSOs as engines, innovates within constraints, potentially unlocking $50 billion in member-driven stablecoin circulation by 2030, per conservative growth models.

Yet, creativity shines in permissible exceptions: safe harbors for non-U. S. persons and de minimis thresholds sidestep overreach, allowing nimble pilots. For strategists, the draft’s precision in defining “payment stablecoin”: fiat-redeemable, pegged, non-yield-bearing, sharpens competitive edges against bank-affiliated issuers under parallel FDIC rules.

Quantitatively, these contours enable Monte Carlo simulations of peg stability, factoring redemption queues and collateral haircuts under correlated Treasury yield spikes. Credit unions, with their deposit-like stability, emerge as natural stewards, their NCUA stablecoin rules 2026 layering probabilistic safeguards absent in offshore analogs.

Reserve Mechanics: Precision Engineering for Peg Integrity

At the draft’s core lie reserve mandates, echoing GENIUS Act edicts: 100% backing with high-quality liquid assets, daily attestations, and monthly public disclosures. NCUA drills deeper, capping non-cash assets at 20% initially, with phased diversification to Treasuries under 93 days maturity. This architecture, modeled after liquidity coverage ratios, anticipates black-swan outflows; a 30-day stress test at 20% volume drain demands unfettered access to Fed master accounts for CUSO conduits.

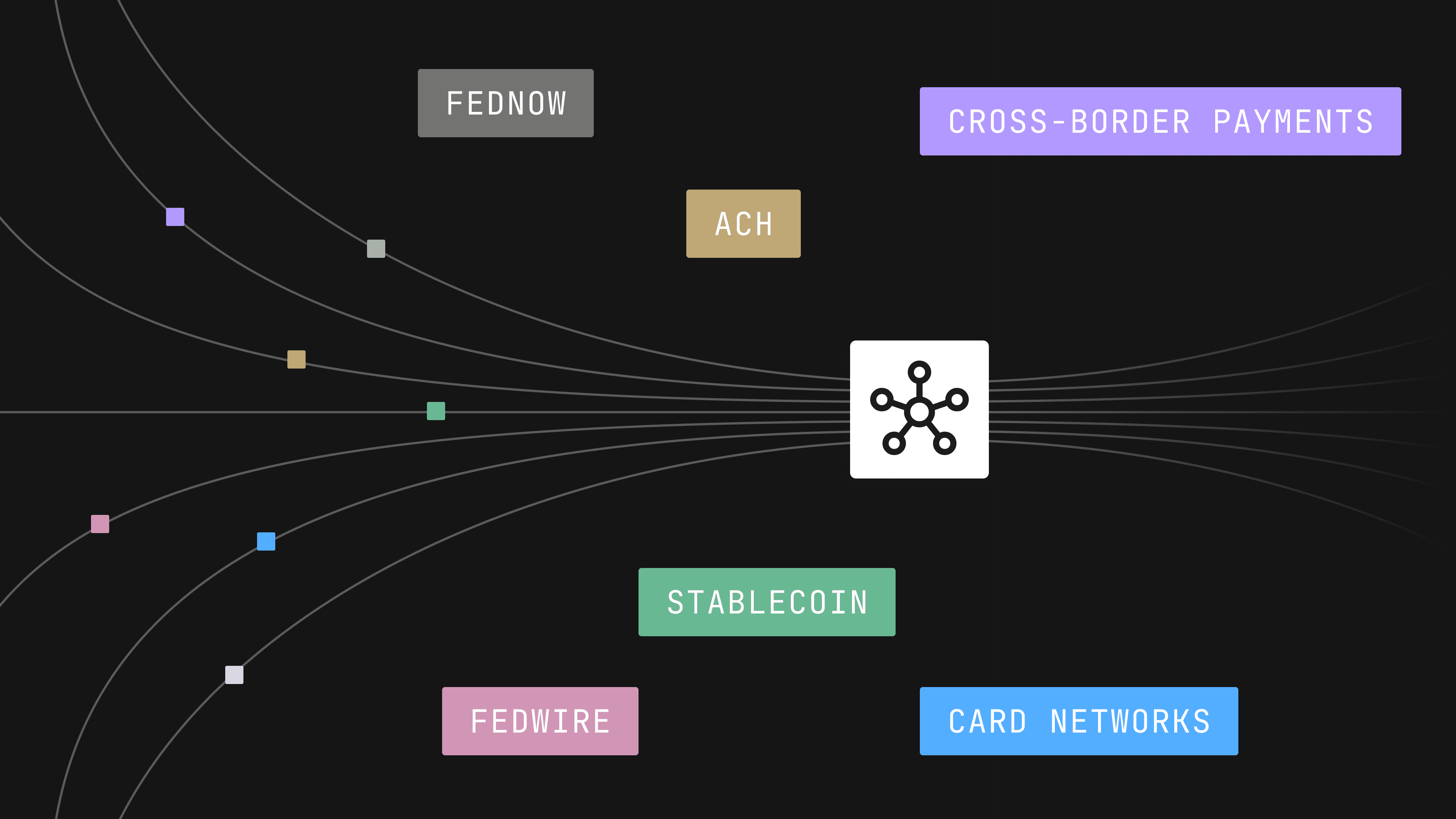

For options strategists, these translate to volatility surfaces where implied vols on stablecoin pegs compress under NCUA imprimatur, potentially halving basis risks versus unregulated tokens. Yet, the no-interest clause, a GENIUS Act linchpin, redirects focus to transactional velocity, positioning credit union stablecoins as frictionless rails for member remittances and P2P settlements.

NCUA vs. FDIC Stablecoin Requirements Under GENIUS Act

| Requirement | NCUA | FDIC |

|---|---|---|

| Reserve Backing | 100% HQLA | 100% cash/Treasuries |

| Approval Timeline | 120 days | 90 days |

| Issuer Structure | CUSO subsidiary | Bank subsidiary |

| AML Certification | Annual | Annual |

Interagency Synergy: NCUA’s Role in Broader GENIUS Ecosystem

NCUA’s path dovetails FDIC’s parallel rulemaking, unveiled concurrently, fostering a dual-track for depository institutions. While banks leverage direct subsidiaries, credit unions’ CUSO pivot preserves member primacy, limiting issuance to 50% non-member use. This calibrated asymmetry, opinionated in its favoritism toward cooperatives, could bifurcate the market: bank stablecoins scaling globally, credit union variants anchoring domestic loyalty loops.

Regulatory arbitrage shrinks as both treat PPSIs as Bank Secrecy Act financial institutions, mandating suspicious activity reporting and customer due diligence. NCUA’s innovation? Member opt-in disclosures, quantifying adoption via stratified sampling of credit union networks, a data moat against predatory issuance.

Modeling Adoption Horizons: From Pilot to Scale

Projecting forward, logistic growth curves peg early movers at 5% of 80 million credit union members by 2028, scaling to $100 billion circulation if pegs hold within 50 basis points. Risks cluster around oracle failures and custody concentrations; NCUA counters with dual-verifier mandates and bankruptcy-remote structures. Strategically, applicants should bootstrap with tokenized member shares, blending loyalty incentives minus yield prohibitions.

This framework, stringent yet inventive, quantifies the regulatory frontier. Credit unions, long sidelined in crypto’s gold rush, now wield calibrated tools to issue stable value at scale, their not-for-profit DNA fortifying pegs where profit motives falter. As comment periods close April 13,2026, forward-thinkers will refine models, stress-testing against interagency harmonization.

By empowering quantitative scrutiny of issuance vectors, NCUA’s draft not only complies with GENIUS imperatives but elevates credit unions as peg guardians, their measured ascent reshaping US stablecoin regulation GENIUS Act dynamics for a resilient digital dollar ecosystem.