The UK’s proposed £20,000 stablecoin cap for individuals and £10 million for businesses is poised to reshape the crypto landscape in 2025. With the Bank of England (BoE) and Financial Conduct Authority (FCA) moving toward a more defined regulatory environment, these holding limits are set to become a pivotal test of the UK’s ambition to balance innovation with financial stability. For crypto businesses operating in or targeting the UK market, understanding and preparing for these caps is now an urgent compliance priority.

Understanding the £20,000 Stablecoin Cap: Regulatory Intentions and Market Context

The temporary holding limits provides £20,000 per individual user and £10 million per business, are designed as a circuit-breaker mechanism. The BoE aims to mitigate systemic risks associated with sudden, large-scale movements from traditional bank deposits into stablecoins. This is particularly relevant as sterling-denominated stablecoins begin to see broader adoption within payment systems and digital commerce.

According to the BoE’s consultation paper (full analysis here), these caps are not meant to be permanent. Instead, they serve as a transitional safeguard while regulators assess real-world impacts on monetary policy transmission, bank funding stability, and consumer protection.

Operational Impact: Compliance Burdens and Business Model Adjustments

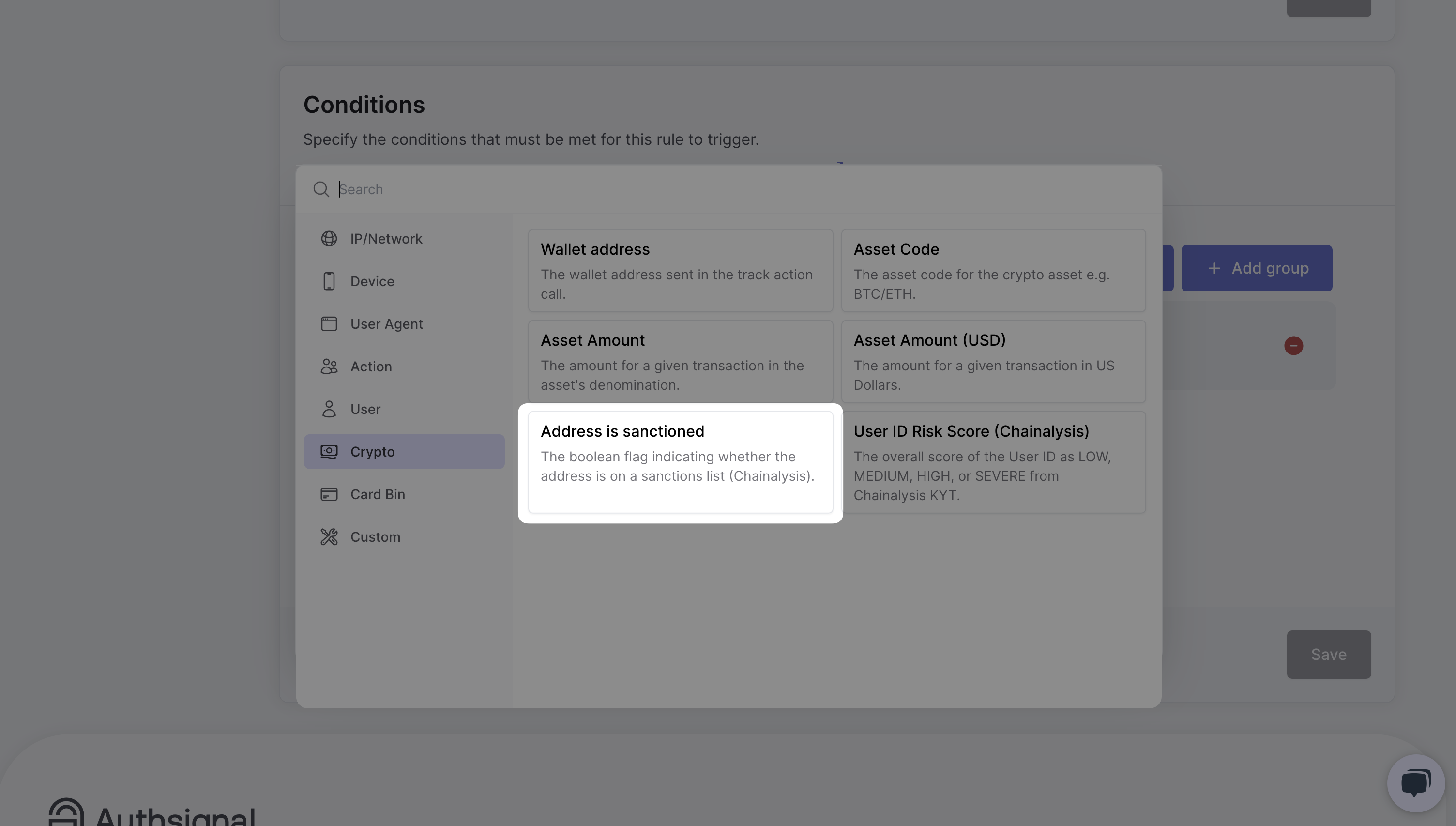

For crypto exchanges, wallet providers, and payment platforms, enforcing these limits will require robust monitoring systems capable of tracking aggregate user holdings across multiple accounts. This introduces new layers of operational complexity:

- KYC/AML Integration: Businesses must enhance onboarding processes to verify user identity at lower thresholds than before.

- Real-Time Monitoring: Automated tools will be needed to freeze or block transactions that would breach the cap.

- Reporting Obligations: Firms should expect increased FCA scrutiny regarding their compliance controls and incident response protocols.

The cost of implementing such controls may be significant for smaller firms or new entrants. Larger players may absorb these costs more easily but could face reputational risks if breaches occur. Ultimately, businesses must weigh whether the UK market remains attractive under this regime or if expansion into more permissive jurisdictions offers better risk-adjusted returns.

Competitive Dynamics: Will Innovation Leave the UK?

The introduction of strict holding caps has triggered concern among both domestic startups and international players considering UK expansion. Industry voices warn that such measures may inadvertently stifle innovation by making sterling-backed stablecoins less attractive compared to their dollar or euro counterparts, especially in markets where no similar restrictions exist.

This sentiment is echoed in recent commentary from crypto industry groups and fintech advocates who argue that the cap sends a “terrible signal” about the UK’s openness to digital asset innovation. There is particular anxiety that high-growth projects will simply relocate development efforts abroad rather than contend with restrictive local rules.

The BoE has acknowledged these concerns by framing the limits as temporary and subject to review following industry feedback during an open consultation period (ending February 2026). Still, until there is clarity on when, or if, the caps will be lifted or adjusted upward, uncertainty may linger over long-term investment decisions in the sector.

Amid this uncertainty, crypto businesses must adopt a pragmatic approach. Some may pivot to offering non-sterling stablecoins or prioritize cross-border services to sidestep domestic constraints. Others will invest in compliance infrastructure, betting on the UK’s eventual evolution into a more innovation-friendly jurisdiction once regulators are satisfied that systemic risks are contained.

Practical Steps for UK Crypto Businesses to Adapt

-

Upgrade Compliance Systems: Implement robust monitoring tools, such as Chainalysis or Elliptic, to track and enforce the £10 million stablecoin cap for business accounts.

-

Automate User Limit Controls: Integrate automated wallet management solutions, like Fireblocks, to ensure individual and business customers cannot exceed BoE-imposed stablecoin holding limits.

-

Engage with Regulatory Consultations: Participate in the Bank of England’s ongoing consultation process through industry groups such as UK Finance or CryptoUK to provide feedback and advocate for practical regulatory outcomes.

-

Educate Clients on New Limits: Create clear, accessible resources—such as webinars or FAQ pages—explaining the £20,000 individual and £10 million business stablecoin caps and their implications.

Market dynamics could also shift as users and businesses seek workarounds. For instance, there may be increased demand for multi-currency wallets or platforms that facilitate seamless conversion between capped sterling stablecoins and uncapped alternatives. However, such strategies carry their own legal and operational risks, especially if authorities interpret them as attempts to circumvent regulatory intent.

The FCA’s stance on technical design, encouraging innovation “where appropriate”: offers a narrow path forward for product differentiation. Some firms may explore programmable compliance features or dynamic transaction limits as value-added services for clients navigating the new regime.

Looking Ahead: Regulatory Uncertainty and Strategic Positioning

With the consultation period open until February 2026, there is still time for industry stakeholders to influence final rules. Constructive engagement with both the BoE and FCA will be critical in advocating for proportionate regulation that protects financial stability without undermining competitiveness.

Ultimately, the UK’s £20,000 stablecoin cap is more than just a compliance hurdle, it is a signal of how regulators worldwide may seek to balance digital asset innovation with systemic risk management. For crypto businesses weighing their next move, careful scenario planning and regulatory dialogue will be essential tools in navigating this pivotal transition period.

For an in-depth breakdown of technical requirements and ongoing updates on the UK’s evolving stablecoin regime, see our comprehensive resource: UK Stablecoin Regulations 2025: Understanding the £20k Cap.