Stablecoin regulation is no longer a theoretical debate. With the passage of the GENIUS Act in the United States and the implementation of MiCA across the European Union, two of the world’s largest markets have drawn clear regulatory lines in the sand. While both frameworks aim to protect consumers and ensure financial stability, their approaches are fundamentally incompatible for multi-jurisdictional stablecoin issuers. This regulatory divergence is shaping not just compliance strategy, but also market structure, innovation pathways, and ultimately who gets to participate in the next phase of digital finance.

The Regulatory Blueprints: GENIUS Act vs. MiCA

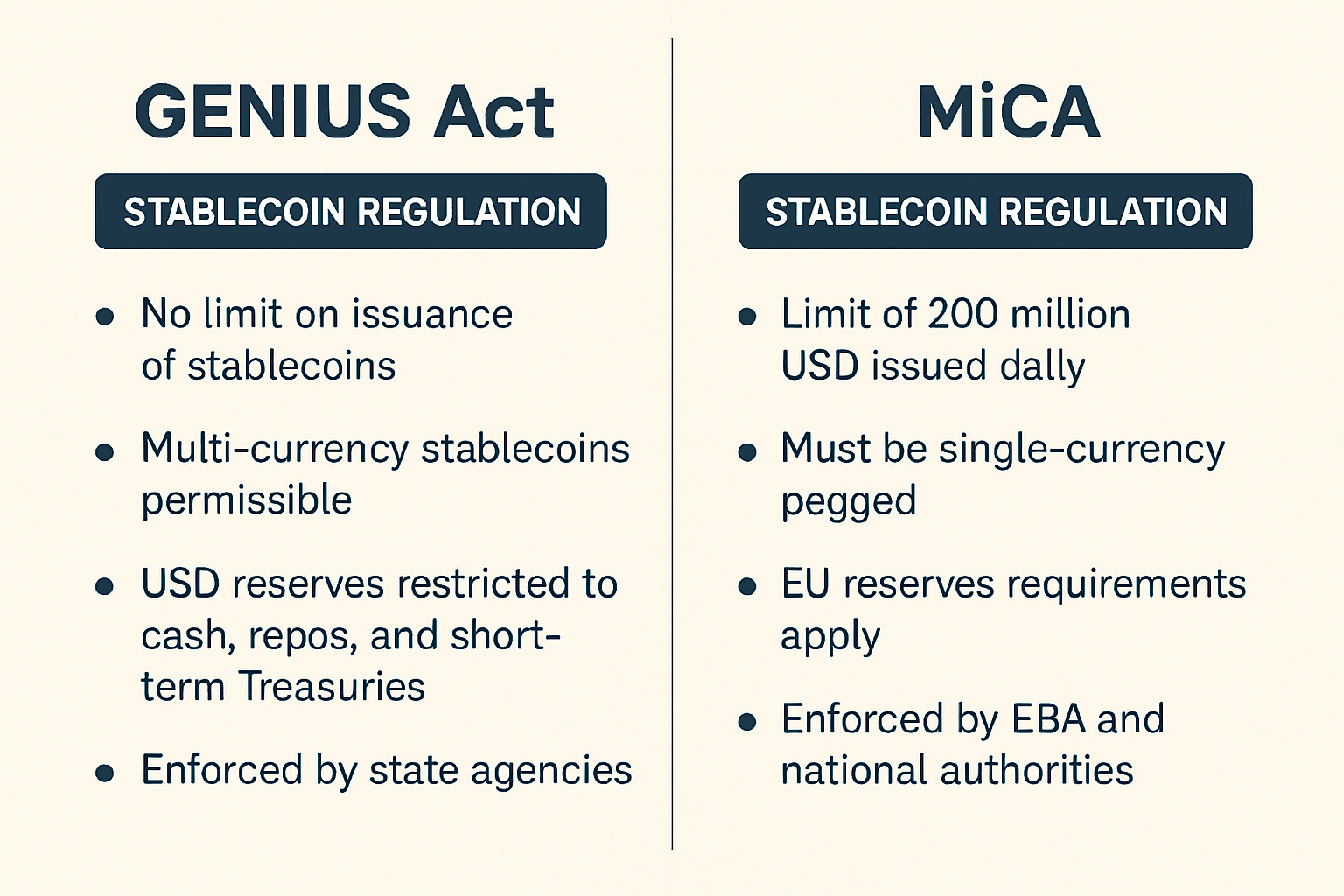

The GENIUS Act stablecoin framework, enacted in July 2025, is a distinctly American solution to stablecoin risk. Only subsidiaries of insured depository institutions or federally qualified nonbank entities can issue payment stablecoins in the U. S. , with strict 1: 1 reserve requirements using U. S. dollars or short-term Treasuries. Oversight falls to federal or state regulators depending on issuer type and scale.

Contrast this with MiCA stablecoin regulation, which came into effect across the EU in December 2024. MiCA divides stablecoins into e-money tokens (EMTs) and asset-referenced tokens (ARTs). Only EU-based credit or e-money institutions can issue EMTs; ART issuers must be authorized and established within the EU. Full reserve backing is required, but with nuances: reserves must be held partly as deposits at EU credit institutions, not just cash or sovereign debt.

This divergence isn’t academic, it’s operationally critical for any entity considering multi-jurisdictional stablecoin issuance. The frameworks overlap on some consumer protections, such as redemption at par value and prohibitions on interest payments, but they split on nearly every other core element.

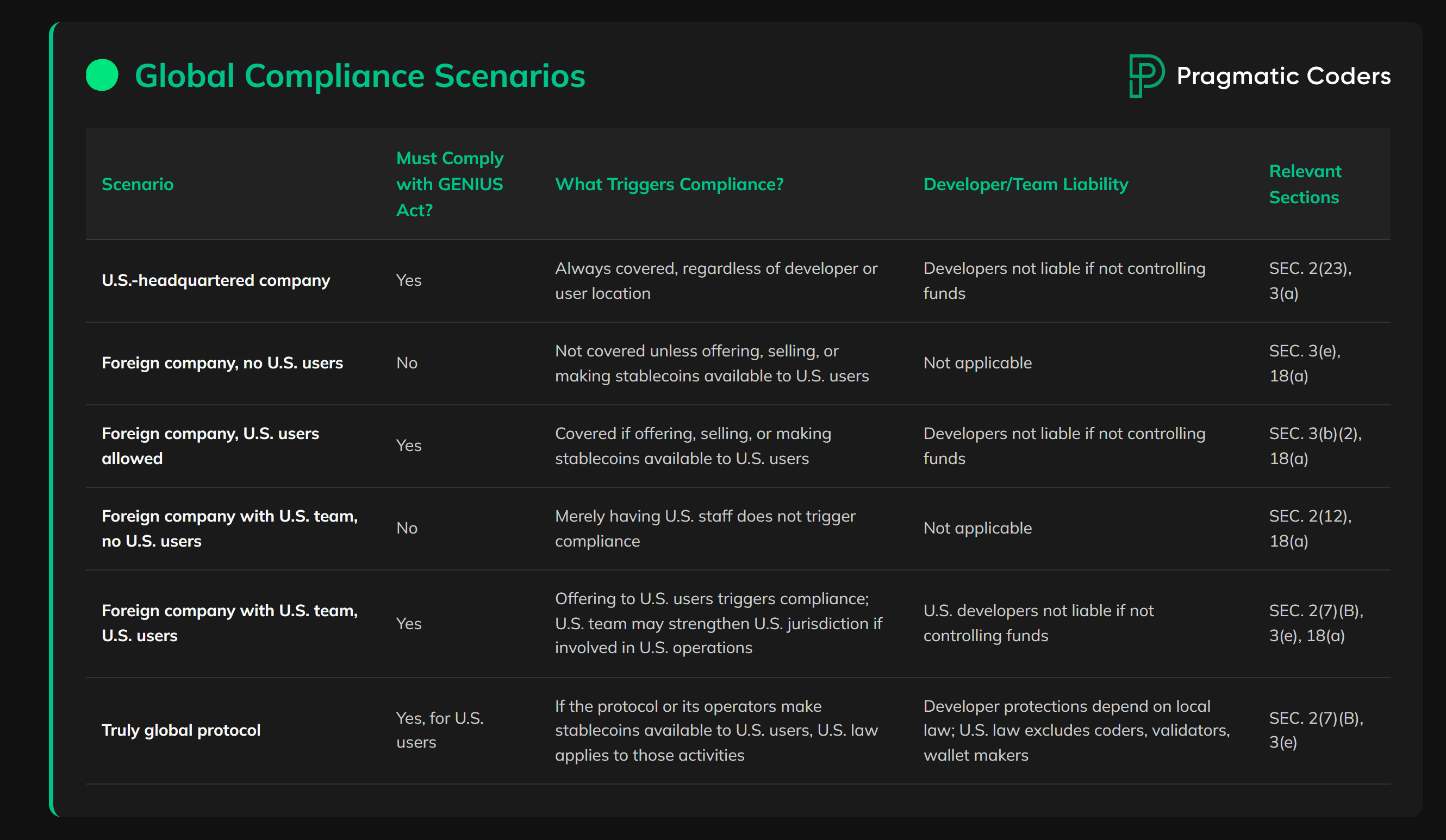

Issuer Eligibility: Territorial vs. Conditional Access

The most immediate incompatibility comes down to who can legally issue a stablecoin:

- GENIUS Act: Permits certain U. S. -regulated nonbanks alongside traditional banks, expanding issuer eligibility but keeping oversight domestic.

- MiCA: Restricts issuance to EU-based financial institutions only, foreign entities must establish an EU subsidiary and obtain local authorization.

This territorial requirement under MiCA means a U. S. -licensed issuer cannot simply “passport” its compliance across the Atlantic. Instead, cross-border operations require duplicative legal structures, a significant barrier for global scale.

Divergent Reserve Requirements: What Counts as Safe?

Reserve composition is another flashpoint for US-EU stablecoin compliance. Both regimes insist on full backing, but what counts as “safe” differs:

- GENIUS Act: Mandates reserves be held in U. S. dollars or short-term Treasuries, assets directly tied to American monetary policy.

- MiCA: Requires reserves be held partly as deposits at EU credit institutions, embedding monetary control within the Eurozone banking system.

This means an issuer operating under both regimes would likely need two distinct pools of collateral, one dollar-based for U. S. -issued tokens, one euro-centric for EU-issued tokens, complicating treasury management and increasing operational costs.

| GENIUS Act (U. S. ) | MiCA (EU) | |

|---|---|---|

| Main Issuer Eligibility | Banks and select nonbanks (U. S. -regulated) | EU-based banks and e-money institutions only |

| Main Reserve Assets Allowed | $USD cash and short-term Treasuries only | Mainly deposits at EU banks; some sovereign debt allowed |

| Main Regulator/Supervisor | Federal/state agencies (depending on size) | EBA and national authorities; must have EU presence |

| User Redemption Rights | At par value; disclosure-focused enforcement | Straightforward redemption right enshrined by law; user limits apply for some coins |

| Treatment of Foreign Issuers | No physical presence required if compliant with GENIUS rules | MUST establish an entity within EU territory and obtain license locally |

| Maturity Date/Status (2025) | In force (July 2025) | In force (Dec 2024) |

The Cross-Border Compliance Puzzle: Fragmentation Risks Ahead

This regulatory fragmentation means that global issuers face a choice: operate separate legal entities with distinct compliance playbooks for each region, or retreat from one market entirely. For those targeting both sides of the Atlantic, dual reporting lines, segregated collateral pools, and conflicting supervision models are now part of standard operating procedure.

The result? Fewer firms able to compete at scale, and greater complexity for users seeking reliable access to trusted digital money worldwide.

Market participants are already seeing the effects. U. S. stablecoin issuers that once eyed seamless EU expansion must now weigh the cost of local subsidiaries, restructured reserve management, and divergent audit requirements. Conversely, EU-based issuers face a steep climb if they hope to serve American users without running afoul of the GENIUS Act’s eligibility and asset rules.

Key Operational Hurdles for Dual GENIUS Act & MiCA Compliance

-

Conflicting Issuer Eligibility Requirements: The GENIUS Act allows issuance by certain nonbank entities in the U.S., while MiCA restricts stablecoin issuance to EU-based credit or e-money institutions. U.S. issuers must establish or partner with compliant EU entities to operate in both markets.

-

Divergent Reserve Asset Rules: Under the GENIUS Act, reserves must be held in U.S. dollars or short-term Treasuries. MiCA, however, requires reserves to be held at least partly in deposits with EU credit institutions, complicating reserve management for global issuers.

-

Supervisory Presence and Oversight: MiCA mandates direct supervision by the European Banking Authority (EBA) and a physical presence in the EU. The GENIUS Act does not impose a U.S. presence requirement for foreign issuers, creating a compliance gap for cross-border operations.

-

Inconsistent Consumer Protection Standards: MiCA enforces strict redemption rights and transaction limits for certain stablecoins, while the GENIUS Act emphasizes reserve transparency and disclosure without identical consumer safeguards, requiring issuers to tailor protections by region.

-

Multi-Issuer Stablecoin Restrictions: MiCA’s evolving stance on multi-issuer stablecoins—potentially banning or heavily restricting them—contrasts with the GENIUS Act’s conditional access model, forcing issuers to restructure offerings or limit cross-jurisdictional issuance.

One particularly thorny issue is multi-issuer stablecoins, where several entities collaborate on issuance or liquidity provision. While the GENIUS Act allows for nonbank participation under federal oversight, MiCA’s territoriality and single-jurisdiction supervision create legal uncertainty for cross-border consortia. The European Systemic Risk Board has even recommended a ban on multi-issuer models in the EU until risks are better understood, a stance at odds with U. S. innovation policy.

Consumer protection also plays out differently across regimes. MiCA enforces strict redemption rights and volume caps for certain tokens, aiming to limit systemic risk in times of market stress. The GENIUS Act focuses on transparency, mandating regular disclosures about reserves and redemption, but leaves redemption mechanics more flexible, provided disclosure standards are met. This creates a patchwork of user rights depending on where a token is issued or redeemed.

Strategic Implications: What Issuers Need to Do Now

For legal teams and compliance officers, the days of one-size-fits-all global stablecoin launches are over. Instead:

- Assess local licensing requirements: Both frameworks require direct engagement with regulators, be prepared for detailed due diligence and ongoing reporting.

- Segregate reserve assets: Maintain separate pools in line with local law; do not assume dollar or euro assets will be mutually recognized.

- Map consumer rights by jurisdiction: Redemption processes, transaction limits, and disclosures must be tailored to each market’s rules.

- Monitor regulatory developments: Both regimes are subject to amendments as authorities respond to new risks, especially around multi-issuer models and systemic tokens.

The bottom line is clear: regulatory fragmentation isn’t going away soon. For some firms, this means doubling down on their home market; for others, it means investing in robust cross-border compliance infrastructure and legal expertise. Either way, only those who treat regulation as a strategic opportunity, not just an obstacle, will thrive in this new era of digital money.

If you’re looking for deeper insights into how these frameworks affect your business model or want practical guidance on next steps, see our detailed comparison at GENIUS Act vs. MiCA: Comparing US and EU Stablecoin Regulatory Frameworks for 2025.