Singapore has moved decisively into the global spotlight as a regulatory leader for stablecoins, setting clear rules that balance innovation with consumer protection. For crypto businesses and legal professionals navigating stablecoin licensing Singapore in 2024, understanding the evolving requirements is critical. The Monetary Authority of Singapore (MAS) has finalized a robust framework that targets stability, transparency, and market integrity, offering both clarity and opportunity for compliant issuers.

Who Needs a Stablecoin License in Singapore?

The current regime applies to single-currency stablecoins (SCS) pegged to either the Singapore Dollar (SGD) or any G10 currency, issued within Singapore. If you’re planning to issue SCS with more than S$5 million in circulation, you must secure a Major Payment Institution (MPI) license under the Payment Services Act (PSA). This license now features a dedicated “Stablecoin Issuance Service” category, an explicit nod to the sector’s growing importance.

If your SCS issuance stays below S$5 million, you are not off the hook: a Digital Payment Token (DPT) license is mandatory. Smaller issuers may opt into the full Stablecoin Issuance Service license but aren’t required to do so at this threshold. This dual-track approach ensures proportional oversight while keeping entry barriers reasonable for startups and niche players.

Core MAS Stablecoin Requirements: Backing, Redemption, and Capital

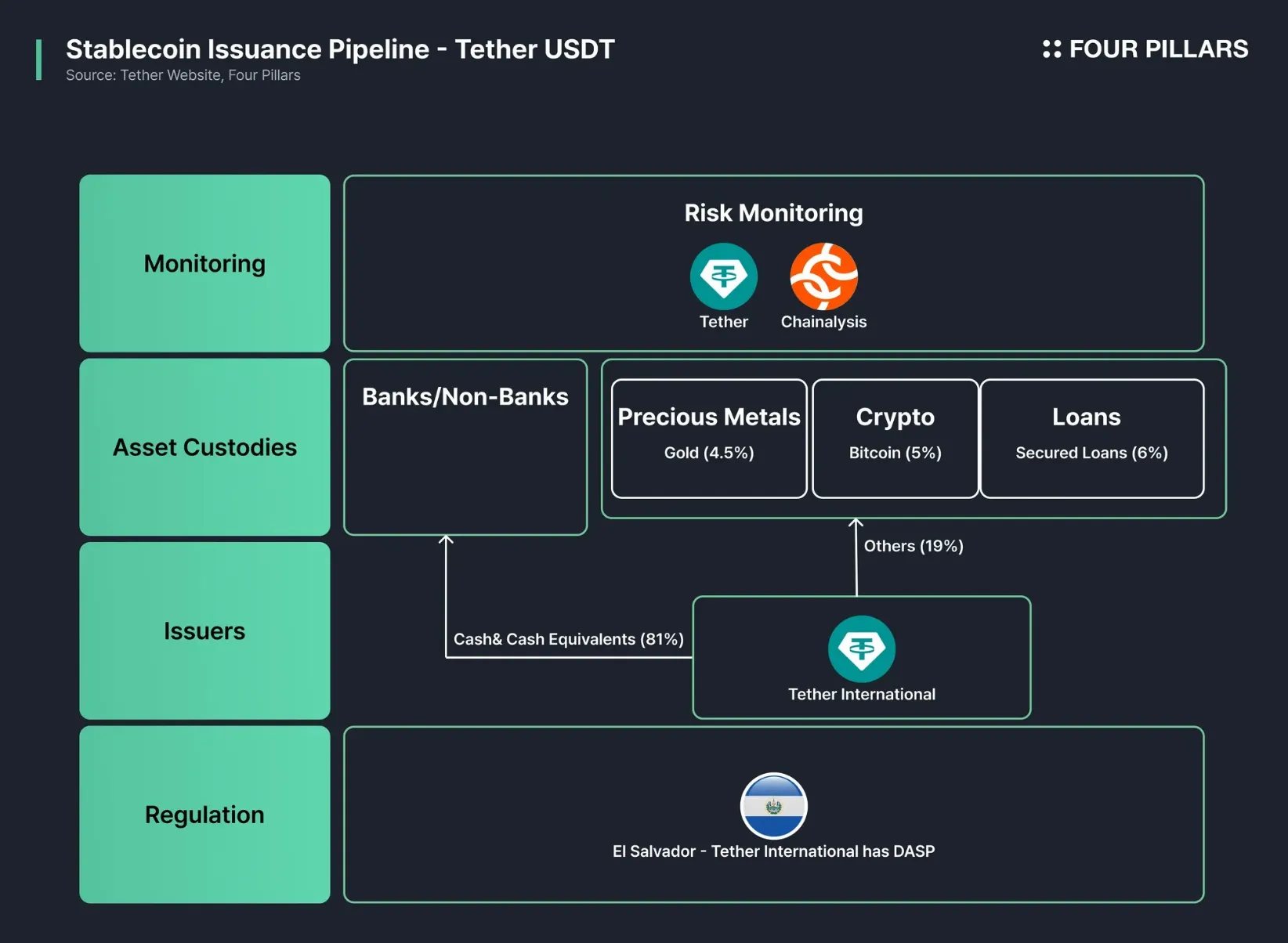

Stablecoin compliance Singapore hinges on strict reserve asset rules. All regulated SCS must be backed by reserves equal to at least 100% of outstanding tokens, no fractional reserves allowed. These assets must be held in low-risk, highly liquid instruments like cash or short-term government securities (maturing within three months), denominated in the same currency as the stablecoin peg.

The MAS also mandates monthly independent attestations of reserve holdings and annual financial audits by qualified professionals. Custody requirements are equally stringent: reserves must be segregated from operating funds and placed with licensed custodians.

Key Compliance Requirements for Stablecoin Issuers in Singapore

-

Obtain the Appropriate License: Issuers of single-currency stablecoins (SCS) exceeding S$5 million in circulation must secure a Major Payment Institution (MPI) license with the Stablecoin Issuance Service category under the Payment Services Act (PSA). Issuers below this threshold require a Digital Payment Token (DPT) license and may opt for the Stablecoin Issuance Service license.

-

Maintain 100% Reserve Asset Backing: All SCS must be fully backed by reserve assets equivalent to the par value of tokens in circulation. Reserves must be held in low-risk, highly liquid assets (such as cash or short-term government securities) denominated in the same currency as the SCS.

-

Segregation, Custody, and Audit of Reserves: Reserve assets must be segregated and held with licensed custodians. Issuers are required to provide monthly independent attestations and undergo annual financial audits to verify reserve compliance.

-

Redemption and Capital Requirements: Issuers must redeem SCS at par value within five business days upon request. They must also maintain a minimum base capital of S$1 million or 50% of annual operating expenses (whichever is higher), and hold sufficient liquid assets to support recovery or an orderly wind-down.

-

Consumer Protection and Transparency: Issuers are required to provide clear disclosures on value stabilization mechanisms, rights of stablecoin holders, and audit results. Only stablecoins that meet all MAS requirements can be labeled as “MAS-regulated stablecoins”.

-

Compliance with FSMA and Additional Safeguards: From June 30, 2025, all digital token service providers (DTSPs) must obtain a license under the Financial Services and Markets Act (FSMA), even if serving overseas markets. MAS has also introduced restrictions on lending and staking services for retail customers to enhance consumer protection.

Redemption rights are non-negotiable. Issuers must guarantee redemption at par value within five business days upon request, providing users with reliability unmatched by most unregulated alternatives. Capital standards are equally robust: regulated issuers need a minimum base capital of S$1 million or 50% of annual operating expenses, whichever is higher. Liquidity buffers must cover over half of annual operating expenses or be sufficient for an orderly wind-down scenario.

The FSMA Deadline and Expanded Licensing Scope

The regulatory landscape shifted further on June 30,2025, when new requirements under the Financial Services and Markets Act (FSMA) took effect. Now all digital token service providers, not just those serving local clients, must obtain relevant licenses if they operate from Singapore. Non-compliance can mean heavy penalties: fines up to S$250,000 and up to three years’ imprisonment (source). This move cements Singapore’s reputation for zero tolerance toward illicit activities while giving legitimate players a predictable path forward.

This evolving regime comes alongside other consumer protection measures, including recent restrictions on lending and staking services for retail customers, a direct response to global risk events in digital asset markets (details here). For those aiming to label their products as “MAS-regulated stablecoins, ” full adherence is essential; only compliant coins can legally use this designation, a mark now synonymous with solvency and transparency.

Market participants are finding that Singapore’s approach to stablecoin regulation 2024 is not just about ticking boxes – it’s about building trust in a rapidly evolving sector. The MAS framework is intentionally rigorous, but it also delivers a level playing field for both established firms and ambitious startups. The result? A regulatory environment that is attracting global issuers and fostering healthy competition.

Industry Impact and Real-World Adoption

Singapore’s clear licensing structure is already influencing the digital asset landscape. In September 2025, crypto exchange OKX rolled out a stablecoin payment solution with GrabPay, underlining the growing utility and acceptance of regulated stablecoins in mainstream commerce. This type of partnership signals a new era where compliance is a competitive advantage – not a burden.

With the regulatory bar set high, industry participants are prioritizing compliance strategies and robust risk management. The MAS’s insistence on transparency and monthly attestations means that stablecoin issuers must invest in internal controls and third-party audits from day one. This is a shift from the ‘move fast and break things’ mentality that once dominated crypto.

Checklist: Preparing for Stablecoin Licensing in Singapore

Legal teams and founders should focus on these core action points to meet MAS stablecoin requirements and secure a license:

These steps are critical for demonstrating operational readiness and long-term viability. Don’t underestimate the importance of documenting your reserve management processes and consumer disclosures – MAS reviews these areas closely.

Looking Ahead: What’s Next for Stablecoin Compliance in Singapore?

As the regulatory landscape matures, expect further refinement of MAS guidelines and potential harmonization with international standards. The current focus is on single-currency stablecoins, but multi-currency and algorithmic models are likely to attract more scrutiny as adoption grows. Market participants should monitor MAS consultations and global regulatory developments to stay ahead of future requirements.

For now, Singapore’s stablecoin licensing regime stands out for its clarity and enforceability. Businesses willing to meet the high bar set by MAS will find themselves well-positioned to serve both local and global markets with confidence.

Regulation is an opportunity, not an obstacle. As Singapore’s experience shows, clear rules can drive innovation and market growth – provided you are ready to engage with them proactively.

For more on the technical details or to review the full regulatory texts, visit the MAS stablecoin framework summary or review recent compliance updates at Risk Management Masters.