The U. S. stablecoin market just had its biggest shakeup yet. On July 18,2025, the Guiding and Establishing National Innovation for U. S. Stablecoins Act, better known as the GENIUS Act: was signed into law, ushering in a new era of regulatory clarity and compliance standards for digital dollar tokens. If you’re a legal professional, fintech founder, or compliance officer, this is the moment you’ve been waiting for (or dreading). Let’s break down what’s changing and why it matters so much in 2025.

What Is the GENIUS Act? The First Federal Stablecoin Law

The GENIUS Act is the United States’ first comprehensive federal legislation focused entirely on payment stablecoins. These are digital assets pegged to the U. S. dollar (or other fiat currencies) that aim to offer fast, borderless payments without wild price swings. For years, stablecoin issuers faced a patchwork of state-by-state licensing rules and regulatory uncertainty. The GENIUS Act changes all that by creating a unified national framework.

Here’s what stands out:

- Only permitted payment stablecoin issuers (PPSIs) can legally issue payment stablecoins in the U. S.: a major shift from the previous open market.

- PPSIs include bank subsidiaries, non-bank entities with state or federal licenses, and qualified foreign issuers from jurisdictions with comparable rules.

- The law specifically carves out payment stablecoins from being treated as securities or commodities under existing federal financial law.

If you’re looking for more granular details on how this impacts your compliance roadmap, check out our deep dive: GENIUS Act Explained: What the 2025 U. S. Stablecoin Law Means for Compliance, Licensing and Global Adoption.

Licensing Requirements: Who Can Issue Stablecoins Now?

This is where things get real for market participants. Under the GENIUS Act:

Key Steps to Secure a Stablecoin Issuer License (GENIUS Act 2025)

-

Determine Eligibility as a Permitted Payment Stablecoin Issuer (PPSI): Only subsidiaries of insured depository institutions (like banks and credit unions), non-bank entities with state or federal licenses, or qualified foreign issuers from approved jurisdictions can apply.

-

Submit a Formal Application to State or Federal Regulators: Prospective issuers must file a comprehensive application with the relevant regulatory authority, detailing business structure, compliance plans, and operational readiness.

-

Implement Robust AML, KYC, and Sanctions Compliance Programs: Applicants must establish anti-money laundering (AML), know-your-customer (KYC), and sanctions screening programs in line with Bank Secrecy Act requirements.

-

Meet 1:1 Reserve Backing and Disclosure Standards: Issuers are required to maintain a 1:1 reserve of high-quality assets and provide monthly public disclosures of stablecoin circulation and reserve composition.

-

Undergo Annual Independent Audits: Financial statements must be audited annually by a U.S.-registered public accounting firm to ensure transparency and compliance.

-

Comply with Consumer Protection Rules: Issuers must prohibit interest payments to holders and avoid misleading marketing that suggests government backing or insurance.

-

Await Regulatory Review and Approval: Regulators have 120 days to approve or deny the application; if no action is taken, approval is automatic after this period.

If you want to issue payment stablecoins to U. S. users, you’ll need to apply to either your state regulator or a designated federal agency. There’s a strict timeline too, federal regulators have 120 days to approve or deny applications; if they don’t act in time, your application is automatically approved.

This “shot clock” is designed to prevent regulatory bottlenecks but also means applicants must have airtight documentation ready from day one, think KYC/AML policies, risk management frameworks, business plans, and capital adequacy proof.

Fun fact: Foreign issuers aren’t left out, but only if they hail from countries with robust AML controls and no outstanding U. S. sanctions issues.

Compliance Standards: AML/KYC and Reserve Backing

The GENIUS Act classifies PPSIs as financial institutions under the Bank Secrecy Act (BSA). Translation? Every issuer must implement robust anti-money laundering (AML), know-your-customer (KYC), and sanctions screening programs that rival those of traditional banks.

But perhaps most headline-grabbing are the new reserve requirements:

- 1: 1 Reserve Backing: Every issued stablecoin must be backed by an equivalent dollar-value reserve asset, no exceptions or creative accounting allowed.

- Monthly Public Disclosures: Issuers must publish monthly reports detailing both total coins in circulation and reserve asset composition.

- Annual Audits: A registered public accounting firm must audit each issuer’s financial statements annually, making transparency non-negotiable.

If you want more insight into these rules, including how audits work and what counts as eligible reserves, see our full breakdown at GENIUS Act Explained: US Stablecoin Licensing, Reserve and Audit Rules 2025.

User Protections and Market Impact

The new law aims to protect consumers by strictly prohibiting interest payments or yield on stablecoins, a clear signal that these tokens are meant as payment instruments rather than investment vehicles. Marketing practices also come under scrutiny; it’s now illegal to suggest government backing or insurance unless it actually exists.

This is just part one of our ongoing coverage of the GENIUS Act’s rollout! In part two we’ll dissect implementation timelines, state-federal oversight challenges, and what all this means for global adoption, and your compliance checklist going into 2026.

As the dust settles on the GENIUS Act’s passage, the industry is buzzing with questions about what comes next. The implementation timeline is tight, and every stablecoin issuer, whether a fintech upstart or a bank subsidiary, faces a new compliance landscape.

Implementation Timeline and Regulatory Milestones

Federal and state regulators are now on the clock. They must issue implementing regulations within one year of enactment, setting a deadline of July 18,2026. But here’s where it gets tricky: the law takes effect on the earlier of two dates, either 18 months after signing (January 18,2027) or 120 days after final regulations are published. This means some issuers could be forced to comply sooner than anticipated if regulators move quickly.

For legal teams and compliance leads, this dual-trigger effective date calls for proactive planning. If you haven’t started mapping your licensing strategy or updating your AML/KYC framework, now’s the time. Don’t get caught scrambling when the shot clock expires.

Federal vs. State Oversight: A New Balance of Power

The GENIUS Act brings long-awaited federal preemption over host state licensing laws for most permitted payment stablecoin issuers. This is huge, it means no more navigating a patchwork of conflicting state regimes if you’re federally licensed. However, states still have an oversight role for non-bank entities seeking local licenses, so dual compliance burdens haven’t vanished entirely.

Some industry voices are already debating whether this creates regulatory arbitrage or fosters true national consistency. The new Stablecoin Regulatory Coordination Council (SCRC) will be tasked with ironing out these wrinkles as implementation unfolds.

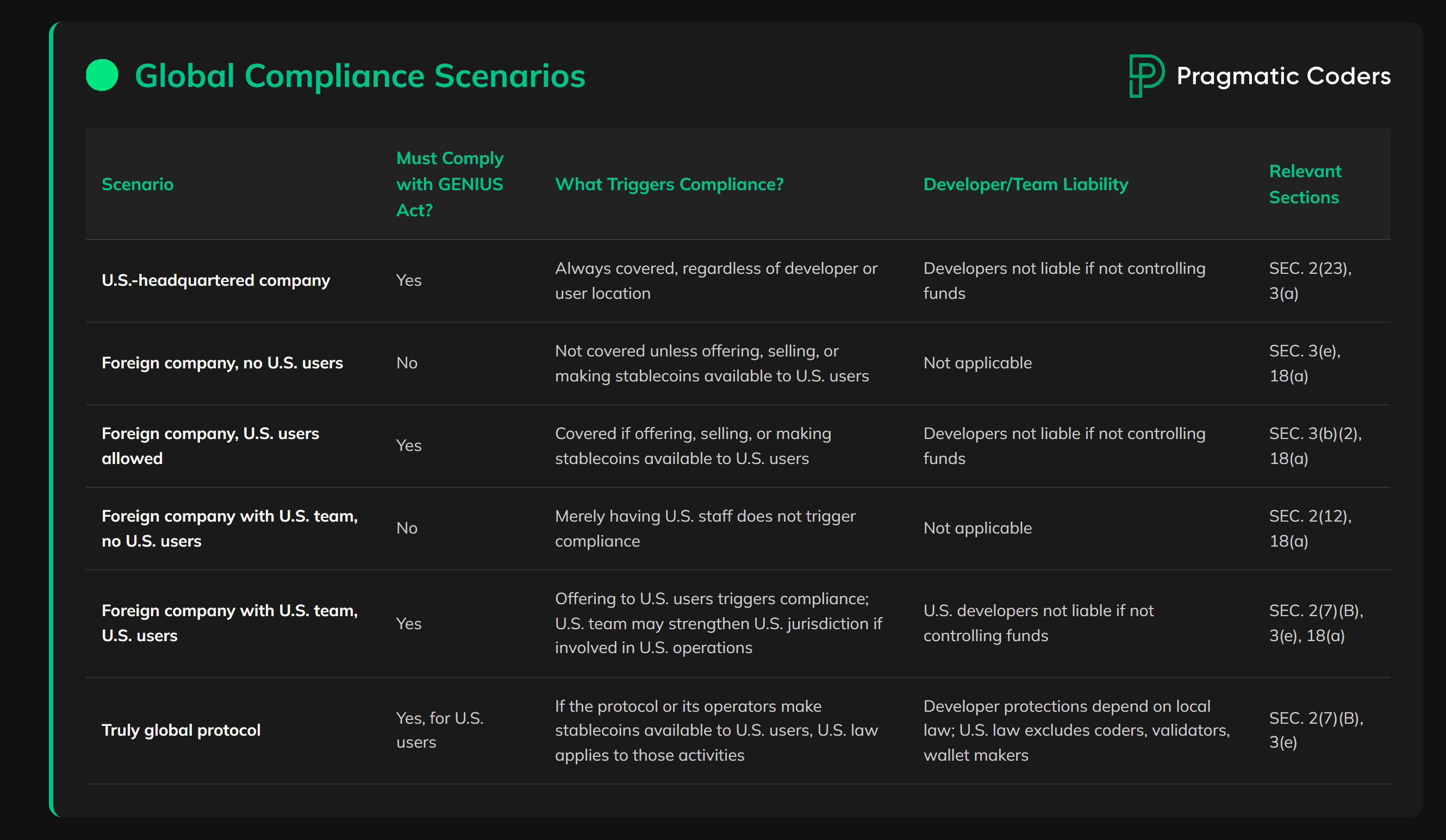

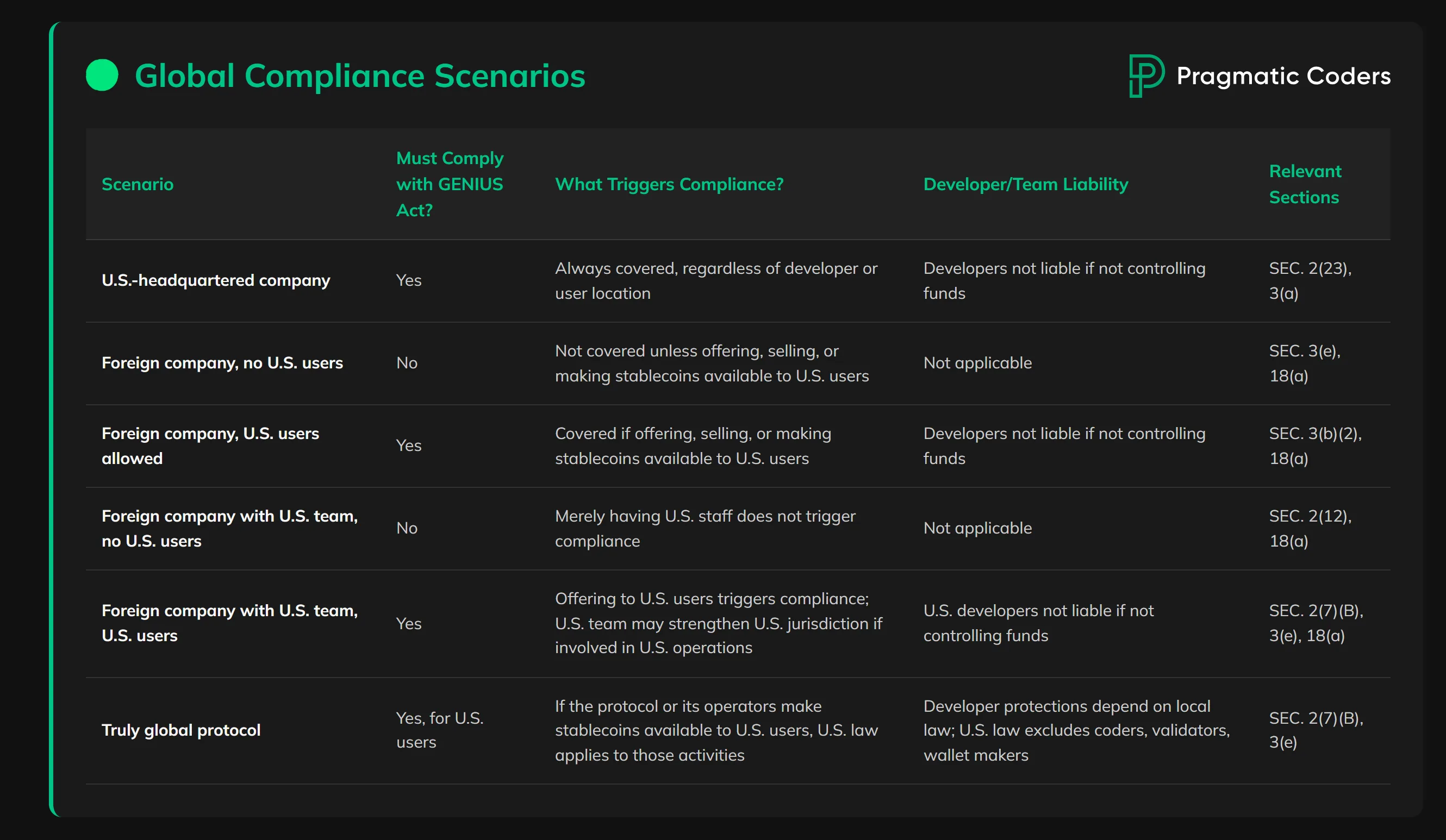

How Does This Affect Global Stablecoin Issuers?

Foreign issuers eyeing U. S. markets must clear several hurdles under the GENIUS Act stablecoin regulation framework:

- They must come from jurisdictions with comparable regulatory standards (think strong AML controls and no U. S. -imposed sanctions).

- They’re subject to all U. S. reserve, audit, and disclosure requirements, no shortcuts just because you’re overseas.

- If your home country’s rules are deemed insufficient by U. S. authorities, you’re out of luck until those standards improve.

This approach aims to prevent regulatory loopholes while keeping U. S. consumers protected from offshore risks, a balancing act that will shape global digital asset flows in years ahead.

What Should Issuers Do Now? Your Compliance Checklist

From licensing applications to monthly disclosures and annual audits, there’s no room for half-measures anymore. Even established players will need to overhaul documentation and internal controls to meet these new standards, and fast.

Industry Reactions: Opportunity or Overreach?

The GENIUS Act has drawn mixed reactions across crypto circles and traditional finance alike:

GENIUS Act: Pros and Cons According to Experts

-

Pro: Provides Regulatory Clarity for StablecoinsLegal experts praise the GENIUS Act for establishing the first comprehensive federal framework for payment stablecoins, giving issuers and users clear rules and reducing regulatory uncertainty.

-

Pro: Enhances Consumer ProtectionsIndustry leaders highlight robust consumer safeguards, including mandatory 1:1 reserve backing, monthly public disclosures, and annual audits, which help build trust and transparency.

-

Pro: Encourages Responsible InnovationThe Act is seen as fostering innovation by permitting non-bank entities and qualified foreign issuers to participate, as long as they meet strict compliance standards, broadening market access.

-

Con: Potential Federal-State Regulatory TensionsSome legal analysts warn that the Act’s federal preemption of state laws could create friction between state and federal regulators, complicating compliance for issuers operating nationally.

-

Con: High Compliance Costs for IssuersIndustry stakeholders note that stringent AML, KYC, and audit requirements may impose significant operational costs, potentially limiting participation to larger, well-funded entities.

-

Con: Limited Scope for Other Digital AssetsExperts point out that the GENIUS Act focuses solely on payment stablecoins, leaving regulatory gaps for other digital assets and potentially causing confusion in the broader crypto market.

-

Con: Concerns Over Financial Stability and SovereigntySome financial leaders caution that widespread stablecoin adoption under the Act could impact global financial stability and challenge national monetary sovereignty, especially if stablecoins become widely used for payments.

While most agree that clarity beats chaos, some worry about stifling innovation or inadvertently driving activity offshore if compliance costs soar too high. Others welcome a level playing field that could finally bring mainstream adoption, and institutional capital, to stablecoins in earnest.

If you want more analysis on how these changes impact banks, DeFi protocols, and cross-border payments, see our detailed update at GENIUS Act 2025: How New U. S. Stablecoin Regulations Impact Compliance, Banking and Global Payments.

Looking Forward: The Future of Stablecoins Under Federal Law

The GENIUS Act marks a watershed moment for digital assets in America, a move toward treating stablecoins as trusted payment rails rather than speculative tokens or legal gray areas. Expect more global jurisdictions to follow suit with their own frameworks as they watch how smoothly (or not) this rollout goes stateside.

If you’re an issuer, or advising one, the message is clear: compliance isn’t optional anymore; it’s foundational to market access in 2025 and beyond.