The US GENIUS Act of 2025 marks a decisive shift in stablecoin regulation, setting new standards for transparency, consumer protection, and cross-border digital finance. For legal professionals and compliance teams, understanding its core requirements is non-negotiable. This article breaks down the three most transformative rules introduced by the Act, and why they matter for both domestic issuers and the global digital asset ecosystem.

1: 1 Reserve Backing and Monthly Attestation: A New Era of Stablecoin Transparency

The GENIUS Act mandates that every permitted payment stablecoin must be backed 1: 1 by liquid assets, such as US dollars or short-term Treasuries. This requirement eliminates ambiguity around reserve composition, a persistent concern for regulators and users alike. Issuers must provide monthly public attestations detailing the makeup of their reserves, with regular third-party audits to reinforce trust.

This rule is more than box-ticking; it’s about restoring confidence after years of market uncertainty. The monthly attestation obligation means no more waiting for annual reports or relying on opaque statements. Instead, stakeholders get real-time visibility into whether stablecoins are truly redeemable at par value.

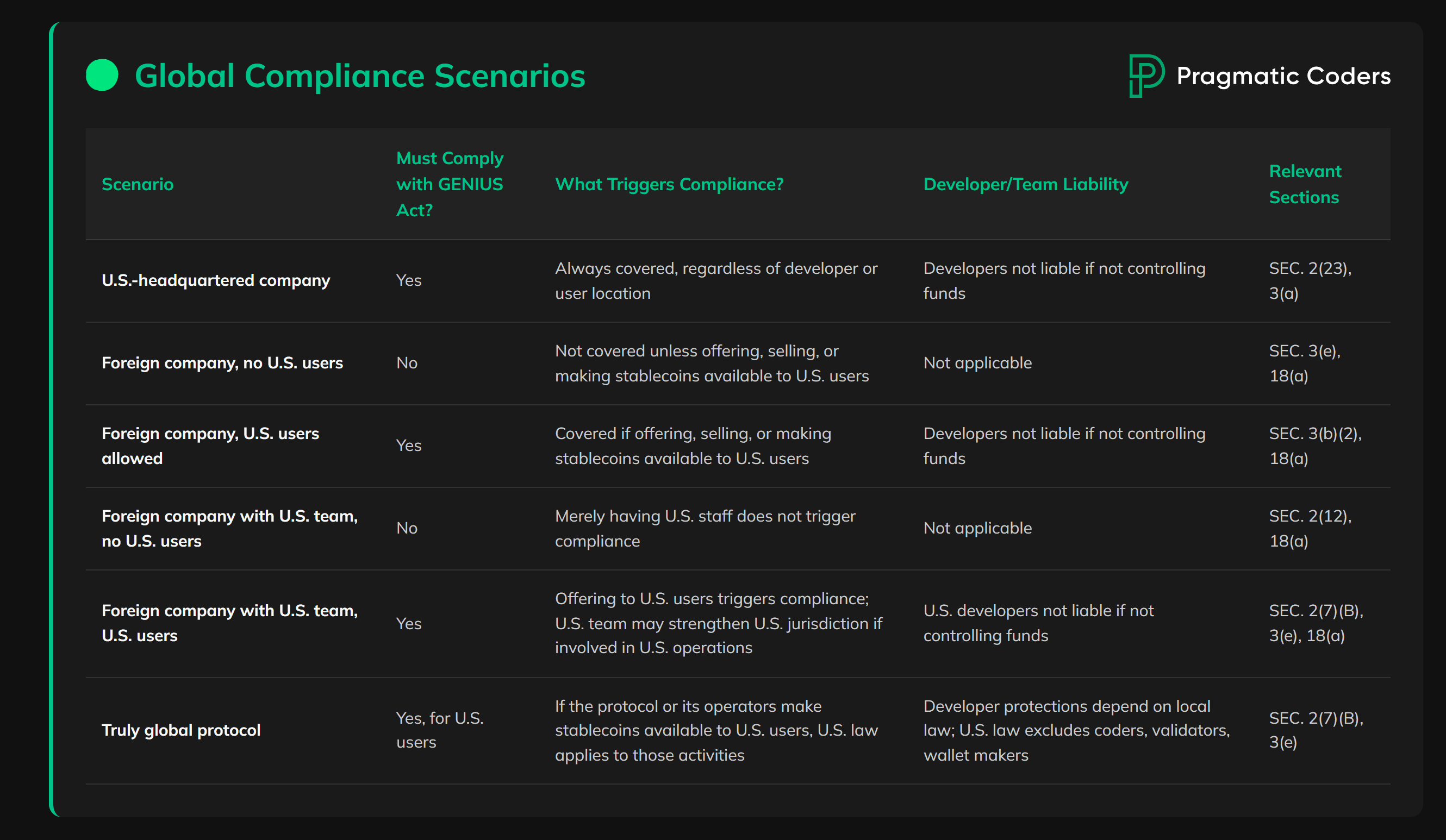

GENIUS Act: Key Steps for Stablecoin Compliance

-

1:1 Reserve Backing and Monthly Attestation Requirement: The GENIUS Act mandates that all permitted payment stablecoins must be backed 1:1 by liquid assets such as U.S. dollars or short-term Treasuries. Issuers are required to provide monthly public attestations of reserve holdings and undergo regular third-party audits to ensure transparency and consumer protection.

-

Federal Licensing and Dual Oversight Regime: Stablecoin issuers must obtain a federal license from the Office of the Comptroller of the Currency (OCC) and comply with both federal and applicable state regulatory requirements. This dual oversight ensures robust consumer protection and anti-money laundering (AML) standards are maintained across the industry.

-

Transition Timelines and Global Regulatory Alignment: The Act establishes an 18-month transition period for existing issuers to achieve compliance. It also sets new standards that are influencing international approaches to stablecoin regulation, promoting cross-border interoperability and regulatory harmonization.

Federal Licensing and Dual Oversight: Raising the Bar on Compliance

Under the GENIUS Act, only entities approved as Permitted Payment Stablecoin Issuers (PPSIs) can operate in the US market. To qualify, issuers must obtain a federal license from the Office of the Comptroller of the Currency (OCC). This centralizes oversight while still requiring compliance with applicable state rules, creating a dual regulatory regime that few jurisdictions have attempted.

PPSIs are now classified as financial institutions under the Bank Secrecy Act, subject to robust anti-money laundering (AML) programs and annual certifications. For legal teams, this means adapting policies to meet both federal standards and any relevant state-level requirements, a significant operational lift but one that aims to harmonize consumer protection across all states.

Transition Timelines and Global Regulatory Alignment

The GENIUS Act doesn’t expect instant compliance. Its implementation timeline gives existing issuers an 18-month transition period from enactment, until January 18,2027, to align operations with new rules. Federal agencies are required to finalize implementing regulations within one year, ensuring clarity ahead of enforcement.

This measured approach is already influencing international regulatory thinking. By codifying standards around reserve backing, licensing, and auditability, the Act sets benchmarks that other jurisdictions may emulate, promoting cross-border interoperability and regulatory harmonization in digital asset markets.

If you’re looking to dive deeper into what these rules mean for your business or clients, see our full guide on GENIUS Act stablecoin compliance requirements.

For stablecoin issuers, the GENIUS Act’s transition period is both a runway and a stress test. Existing providers must overhaul reserve management, update disclosure protocols, and rework compliance architecture to meet the OCC’s licensing criteria. Digital Asset Service Providers (DASPs) face a hard stop: within three years of enactment, they must cease handling non-compliant stablecoins, a move that will reshape liquidity pools and market listings across US-facing platforms.

Globally, the Act’s insistence on 1: 1 reserve backing and transparent monthly attestations is setting a de facto standard. EU policymakers reviewing MiCA implementation are already referencing GENIUS Act benchmarks in consultations. In APAC, regulators are weighing whether to require similar third-party attestation regimes for local stablecoin projects. The risk of accelerating global dollarization is real, some jurisdictions worry about ceding monetary sovereignty as US dollar-backed coins become more attractive under this new regime.

Why Global Alignment Matters

Harmonized standards reduce friction for cross-border payments and lower legal uncertainty for multinational exchanges. But they also force tough conversations about privacy, data sharing, and systemic risk. The GENIUS Act’s dual oversight, federal licensing plus state-level compliance, offers a blueprint for balancing innovation with accountability, but it isn’t without critics. Some see potential regulatory overlap as an operational headache; others argue it’s necessary to close gaps exploited by shadow banking operations in digital assets.

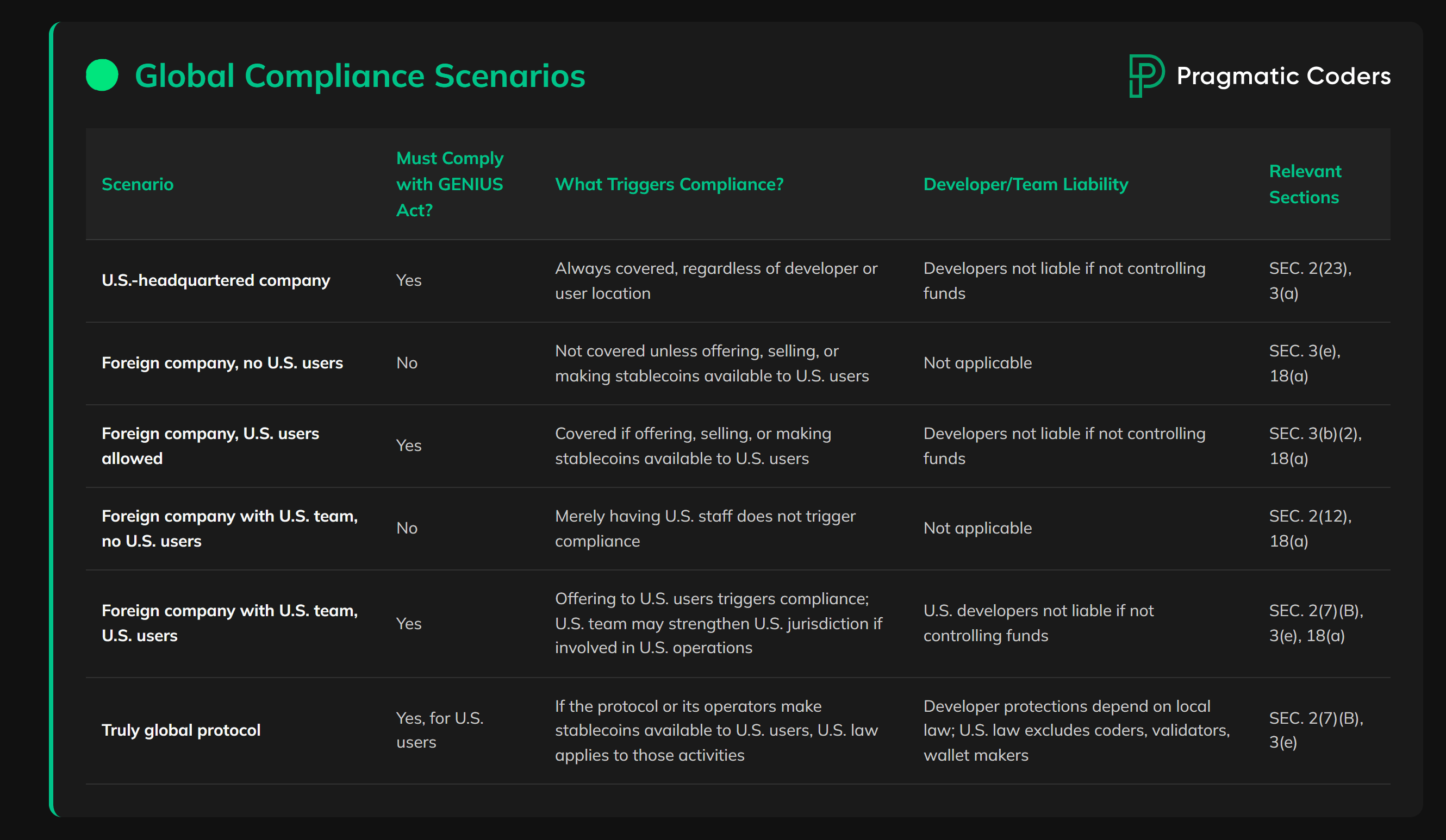

How the GENIUS Act Shapes Global Stablecoin Policy

-

1:1 Reserve Backing and Monthly Attestation Requirement: The GENIUS Act mandates that all permitted payment stablecoins must be backed 1:1 by liquid assets such as U.S. dollars or short-term Treasuries. Issuers are required to provide monthly public attestations and undergo regular third-party audits, setting a new global benchmark for transparency and reserve security.

-

Federal Licensing and Dual Oversight Regime: Stablecoin issuers must obtain a federal license from the Office of the Comptroller of the Currency (OCC) and comply with both federal and applicable state regulatory requirements. This dual oversight ensures robust consumer protection and anti-money laundering (AML) standards, influencing regulatory frameworks worldwide.

-

Transition Timelines and Global Regulatory Alignment: The Act establishes an 18-month transition period for existing issuers to achieve compliance. By setting clear timelines and standards, the GENIUS Act is promoting cross-border interoperability and encouraging other jurisdictions to harmonize their stablecoin regulations.

The coming months will be pivotal as federal agencies finalize implementing regulations and issuers scramble to adapt legacy systems. For legal teams advising on US market entry or cross-border expansion, the message is clear: proactive compliance planning isn’t optional, it’s existential.

The bottom line? The GENIUS Act stablecoin rules are not just a US story, they’re rapidly becoming the new global baseline for digital asset trustworthiness and regulatory legitimacy. Expect other major economies to follow suit or risk losing ground in shaping tomorrow’s payment rails.

For more detailed analysis on audit obligations and licensing under the new law, visit our resource at GENIUS Act explained: US stablecoin licensing, reserve and audit rules 2025.