Stablecoins have become the backbone of digital asset markets, promising instant settlement and global reach. Yet as of September 2025, regulatory scrutiny is intensifying, with lawmakers and central banks worldwide seeking to address the persistent stablecoin regulatory loopholes that enable cross-border risk migration and arbitrage. The passage of the U. S. GENIUS Act brought long-awaited clarity for dollar-pegged stablecoins, but it also exposed new cracks in the system, especially as states and nonfinancial entities seek to capitalize on regulatory inconsistencies.

How Stablecoin Loopholes Drive Regulatory Arbitrage in 2025

The recent push by U. S. banking associations to close loopholes for nonfinancial stablecoin issuers (source) highlights a growing concern: as federal frameworks tighten, states with more permissive rules become magnets for digital asset businesses. The GENIUS Act, passed in July 2025 (source), set standards for payment stablecoins but left room for state-level exemptions, creating a patchwork that invites regulatory arbitrage.

This is not just a U. S. issue. In Europe, certain stablecoins, such as USDC, can sidestep EU safeguards by leveraging more lenient jurisdictions, shifting risk across borders (source). The result: firms can shop for the most favorable legal environment, undermining both compliance and financial stability.

The Mechanics of Stablecoin Arbitrage: Risks Amplified

Regulatory arbitrage isn’t just a theoretical risk, it’s already shaping market behavior in 2025. DeFi platforms have seen nearly 10% arbitrage returns between leading stablecoins like USDC and USDT this year alone, while over $2 billion has been lost to exploits and post-hack volatility (source). These dynamics underscore how uneven oversight enables sophisticated actors to exploit price discrepancies and jurisdictional gaps.

The Bank for International Settlements has sounded alarms about these risks, warning that unchecked stablecoin growth could erode monetary sovereignty and destabilize payment systems globally (source). Meanwhile, calls from the Bank of Italy and Bank of Canada for coordinated rulemaking reflect a consensus: without harmonized standards, systemic vulnerabilities will persist.

Key Risks and Opportunities from Stablecoin Regulatory Loopholes in 2025

-

Regulatory Arbitrage Across Jurisdictions: Loopholes in the GENIUS Act and varying state laws allow stablecoin issuers to choose the most permissive regulatory environments, potentially undermining federal oversight and enabling risk migration across borders.

-

Entry of Nonfinancial Companies as Issuers: Gaps in federal legislation permit nonfinancial firms to issue payment stablecoins, raising concerns about conflicts of interest, consumer protection, and systemic risk, as highlighted by the American Bankers Association.

-

Exploitation of State-Issued Stablecoins: States with lenient frameworks attract digital asset businesses, creating opportunities for innovation but also regulatory arbitrage, as seen with state-issued stablecoins and exemptions under the GENIUS Act.

-

Cross-Border Risk Shifting: Stablecoins like USDC can bypass EU safeguards via regulatory loopholes, exposing the European Union to risks that originate outside its jurisdiction, as noted by the London Business School.

-

DeFi Exploits and Collateral Arbitrage: In 2025, decentralized finance (DeFi) platforms have seen 9.8% arbitrage returns between USDC and USDT, but also suffered $2B in losses from exploits in Q1 alone, underscoring both profit opportunities and vulnerabilities.

-

Threats to Monetary Sovereignty and Financial Stability: The Bank for International Settlements and the Bank of Italy have warned that unchecked stablecoin growth, facilitated by regulatory loopholes, could erode national monetary control and destabilize payment systems.

Opportunities Amid Compliance Challenges

For crypto industry participants, these gaps present both risks and opportunities. Jurisdictions with lighter-touch regimes can attract innovation, and capital, but also face reputational hazards if exploited by bad actors. Legal professionals must keep pace with shifting requirements across federal, state, and international lines to ensure robust stablecoin compliance. At the same time, well-designed regulation can serve as a competitive advantage by fostering trust among users and counterparties.

The evolving landscape makes it clear: navigating crypto regulation loophole risks demands agility and proactive engagement with regulators at every level. As more countries accelerate efforts to tokenize their own currencies or implement comprehensive frameworks, the window for easy arbitrage is likely to narrow, but until then, the market remains fertile ground for those who understand its complexities.

Ultimately, the interplay between regulatory patchwork and rapid stablecoin innovation is reshaping both compliance strategy and market competition. While the GENIUS Act has set a new federal baseline in the U. S. , its carve-outs for state-sanctioned issuers mean that legal gray zones persist. This fragmentation is mirrored globally, as EU policymakers struggle to close cross-border loopholes and Asian regulators weigh the merits of harmonized oversight.

Legal counsel and compliance teams are increasingly tasked with mapping these shifting boundaries in real time. A minor change in a state or national statute can instantly alter risk profiles for stablecoin projects operating at scale. For example, a project that is fully compliant under Wyoming’s regime may face sudden enforcement action if transacting with users in New York or the EU. The result is a compliance arms race, one that rewards those who invest in continuous monitoring, agile licensing strategies, and robust internal controls.

Best Practices for Navigating Stablecoin Compliance Challenges

To manage exposure to stablecoin regulatory loopholes and reduce arbitrage risk, organizations should take a multi-layered approach:

Best Practices to Mitigate Stablecoin Compliance Risks in 2025

-

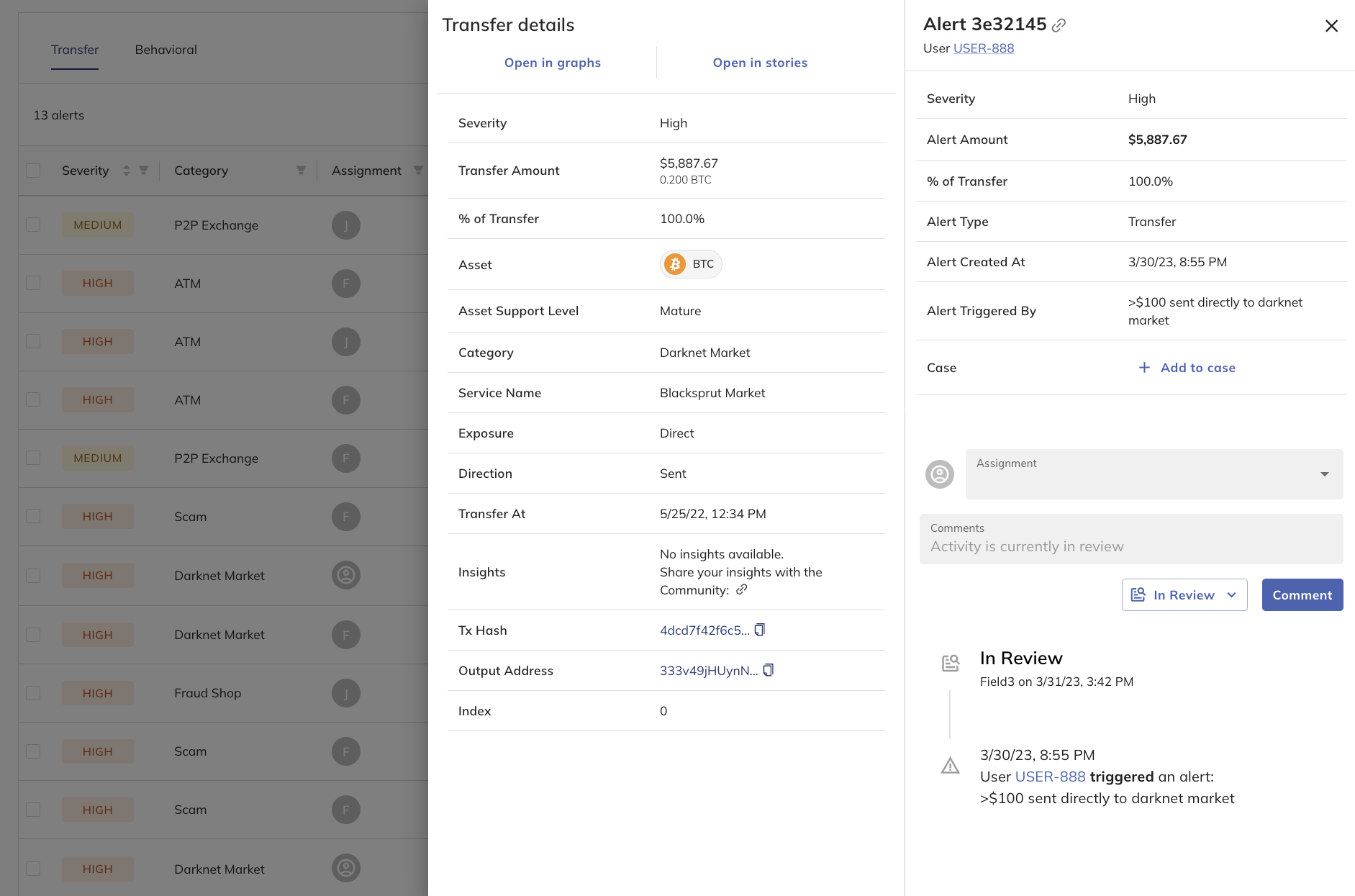

Implement Robust KYC/AML Procedures: Ensure all stablecoin users and counterparties undergo thorough Know Your Customer (KYC) and Anti-Money Laundering (AML) checks, leveraging established providers like Chainalysis and TRM Labs for transaction monitoring.

-

Align with GENIUS Act Requirements: For U.S. operations, ensure stablecoin issuance and reserve management fully comply with the GENIUS Act, including registration, reserve audits, and segregation of client funds.

-

Monitor Regulatory Developments in Key Jurisdictions: Stay updated on evolving rules from authorities like the Bank for International Settlements (BIS), Bank of Canada, and Bank of Italy to ensure cross-border compliance and avoid regulatory arbitrage risks.

-

Adopt Interoperability and Compliance Tools: Use platforms like Fireblocks and MetaMask Institutional that offer compliance modules, transaction monitoring, and policy enforcement for institutional stablecoin operations.

-

Establish Clear Cross-Border Transaction Policies: Define and enforce policies for stablecoin transfers across jurisdictions, referencing guidance from the Financial Action Task Force (FATF) to mitigate risks of regulatory arbitrage and illicit finance.

Given the pace of regulatory change, even well-intentioned firms can stumble into costly pitfalls without proactive guidance. The stakes are high: beyond fines or reputational damage, regulatory missteps can cut off access to banking partners, payment rails, or even entire markets.

The opportunity lies with those who treat regulation as an asset rather than an obstacle. Firms that build transparent reserve models, adopt international best practices ahead of mandates, and engage constructively with regulators will be best positioned to thrive as the rules solidify.

What Comes Next?

With central banks like the Bank of Italy calling for EU-wide standards (source) and Canada advocating for coordinated national regulation (source), momentum is building toward global harmonization. However, until these frameworks are finalized and enforced, expect sophisticated actors to continue exploiting gaps, sometimes at great cost to less prepared market participants.

The lesson for 2025 is clear: stablecoin regulation will remain a moving target. Those who invest now in dynamic compliance infrastructure and cross-jurisdictional intelligence will not only mitigate risk but also unlock new opportunities as digital asset markets mature.